Hello.

We recently had a conversation with a senior manager from a prominent electronics manufacturer about a new generation of smartwatches. As I held the latest products in my hands, our discussion turned to the market, and a question that has always intrigued me arose: what is your perspective on budget factories that frequently replicate the designs of your watches and sell them for $10 to $20? This issue affects all companies, as the market is saturated with imitations of Apple Watches, Samsung Galaxy Watches, Huawei watches, and others. These replicas are sold at much lower prices than the originals, even though, visually, they are nearly indistinguishable. The differences only become apparent when you hold them, but since watches are such personal items, it’s unlikely that one would borrow a friend’s watch to compare.

The response was so nuanced that it sparked further discussion, and I felt it was necessary to share some of these insights with you.

Comparing inexpensive watches that mimic design elements or completely replicate well-known models to the originals is almost impossible. They belong to different categories; fakes are priced at a few dozen dollars while originals can cost significantly more. The target audiences differ as well; an Apple Watch buyer would never consider a fake, as they do not offer the required level of functionality, and purchasing a counterfeit might raise questions about one’s ability to afford the real deal. It’s akin to a taxi driver supposedly sporting an expensive Swiss watch—a near-impossible scenario that clearly suggests a fake is present. Although distinguishing electronic watches is not as straightforward, this aspect remains a crucial factor in choosing the original. Furthermore, a copy does not come close to delivering the same quality. Thus, for consumers who opt for an iPhone, buying a fake or a lookalike watch is generally pointless. I will highlight one distinction a bit later.

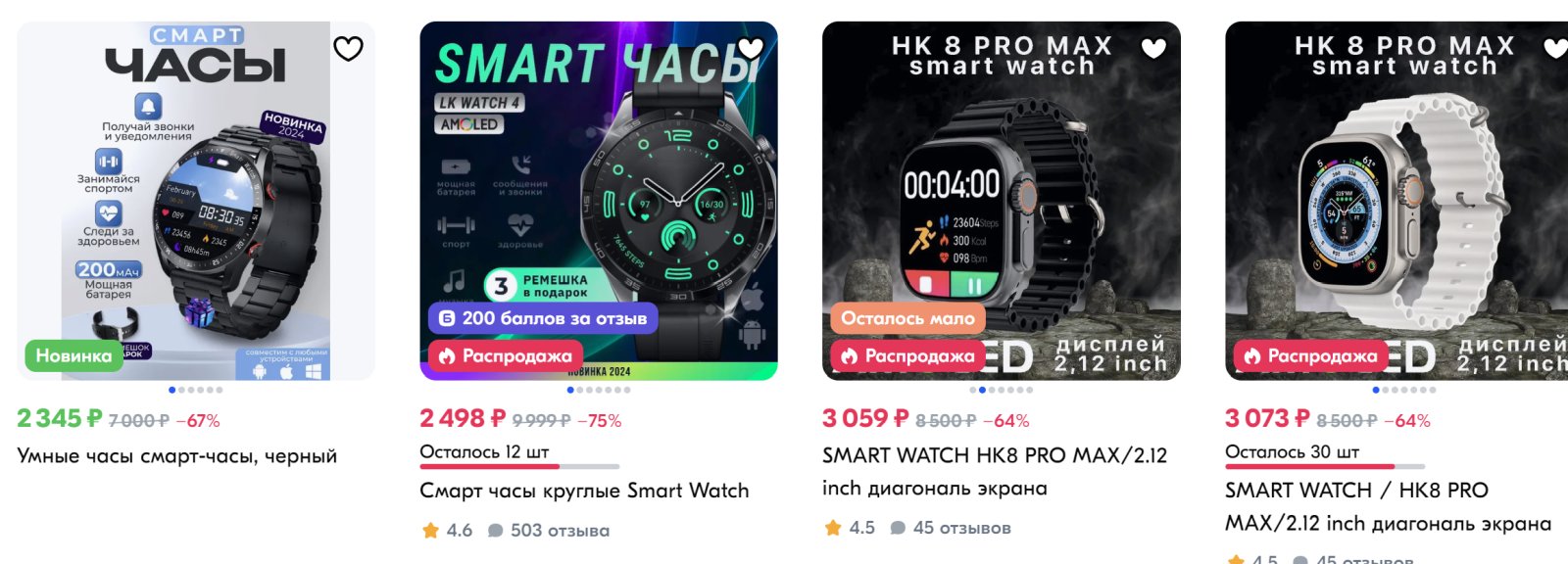

According to my conversation partner, the smartwatch market is still relatively narrow. The penetration of such devices, compared to smartphones, does not exceed 10%—in some European countries, it reaches 15%. Many people around me wear smartwatches, making it seem like a prevalent trend, as I often spot various models on people’s wrists. However, the actual penetration of smartwatches is quite low, and while it is gradually increasing, there is no indication of explosive growth. Russia is an outlier in this regard: last year, 5.8 million smartwatches from all manufacturers were sold in the market (according to MTS data), amounting to 45.8 billion rubles. Considering that the smartphone market comprised 32.5 million units, the penetration rate for smartwatches is approximately 18% of current sales, which is substantial. About a third of these sales involve inexpensive watches from unknown brands, which attract attention primarily due to their low prices.

A paradoxical statement emerged: cheap watches do not compete with premium products, as the audiences are too different. However, they play a vital role in familiarizing consumers with this type of device and increasing penetration. In essence, low-cost watches from obscure brands are viewed as products that help cultivate a habit among consumers, ultimately filling their sales funnels. Initially, one might purchase a fake or a replica, and later, perhaps, opt for the original. My interlocutor illustrated the typical journey of a user. They buy an unknown watch that appeals to them aesthetically, likely not realizing it is a copy of a specific model; they might simply know that it is a knockoff from a certain manufacturer. The quality aligns with the price point, and after some time, the watch may break, leading to another purchasing decision. They can either repeat the experience, spend a little more money, or abandon the idea of a smartwatch altogether. The percentage of those opting out is minimal; typically, people begin searching for a new model. Amazfit was mentioned as an example of an intermediary brand that bridges the gap between obscure brands and more recognizable watches. It offers original models that borrow designs from prominent brands, with prices lower than those of large corporations but still significantly higher than those of unknown manufacturers. My interlocutor noted that Amazfit’s positioning is due to its lack of robust marketing; they cater solely to rational buyers seeking value.

Another factor is the absence of integration into the manufacturer’s ecosystem. Corporations develop watches as devices integrated into a lifestyle. For instance, Garmin is tailored for athletes, sailors, and aviators. Unlike other devices outside their primary function, Garmin offers a distinctive ecosystem supported by strong marketing that adds brand value. Amazfit lacks this aspect, and in the long run, the company will either need to adapt or exit the market.

Consumers don’t necessarily have to transition from obscure brands to Amazfit or similar names; they can also select models from larger corporations. For instance, the Huawei Watch Fit 3 closely resembles the Apple Watch SE model.

These models are nearly indistinguishable, including their color options. In certain aspects, the Huawei version is simpler, while in others, it is superior—particularly regarding battery life, as it does not require daily charging. Additionally, its price is significantly lower than that of the Apple Watch, and it is compatible with both iPhone and Android devices. This means the choice of such watches appeals to cost-conscious consumers and Android users, for whom the Apple Watch is not an option. These products exist and effectively address specific needs; sales of these watches in Russia are very robust.

Corporations have little incentive to combat low-cost watches; they play an essential role in familiarizing consumers with a new product category during a time of low smartwatch penetration in the market (any penetration below 40-50% can be deemed minimal). The costs associated with combating these budget watches and replicas are high, with minimal return on investment. Moreover, this struggle can adversely affect the sales funnel, hindering conversions to the corporations’ own sales.

We observe a similar strategy for many new product categories, such as TWS headphones. However, the penetration for these headphones is higher than that of smartwatches, and companies will soon intensify efforts to combat counterfeits and copies.

In certain markets, corporations are making attempts to reduce the prevalence of low-quality knockoffs. The underlying reason is that the widespread availability of fakes discourages consumers from opting for the original product, as seen with AirPods and previously with Beats headphones. Efforts are primarily focused on markets where there is sufficient demand, as the widespread presence of fakes can lead to decreased sales of the genuine product. Even then, measuring this decline is challenging, as the buyer demographics differ significantly.

In another organization and under different circumstances, I heard an intriguing remark: counterfeits are advantageous because they do not last long, ultimately driving consumers back to the original product. The notion is that every product holds a value reflective of its price; saving money by purchasing lower-quality items often results in compromised quality and capabilities. On the other hand, the justification for a branded product’s price is not always clear-cut.

I believe that the narrative surrounding how fakes or replicas of products contribute to the sales funnel and acclimatize consumers to a new category of merchandise is noteworthy as it enhances our understanding of the market landscape. It illuminates the positioning of each product within the market, revealing that these devices are not direct competitors. Instead, they facilitate market expansion. Premium devices capture consumer attention but may not always be accessible. Thereafter, suppliers of budget solutions emerge, familiarizing consumers with the product category and contributing to market growth. This symbiotic relationship fosters an upward spiral of increasing sales, showcasing the interesting interplay between these diverse products and companies.

The Dynamics of the Smartwatch Market: How Cheap Counterfeits Influence Consumer Behavior

Hello.

During a recent conversation with a top manager from a major electronics manufacturer, we explored the evolving landscape of smartwatches. My curiosity was piqued regarding the increasing prevalence of inexpensive knock-offs that mimic the design and functionality of high-end models like the Apple Watch and Samsung Galaxy Watch. The market is flooded with these alternatives, often retailing between $10 and $20. Although they may appear nearly identical at first glance, significant differences exist beneath the surface. So how does this affect brand loyalty and consumer behavior?

The Reality of Smartwatch Imitations

Counterfeit smartwatches exist in a distinct market category compared to their authentic counterparts. The price discrepancy—high-end models often costing an order of magnitude more—means they serve dramatically different audiences. Consumers who invest in an Apple or Samsung smartwatch typically have specific expectations for functionality and quality that low-cost imitations simply cannot fulfill. A look at a lavish model on the wrist of someone who may not afford it only raises questions about authenticity.

The Market Penetration of Smartwatches

As of now, the penetration of smartwatches in markets globally remains relatively low—hovering around 10%, and even reaching 15% in certain European markets. In Russia, for example, approximately 5.8 million smartwatches were sold last year, indicating a penetration of about 18% in comparison to smartphone sales. Notably, around one-third of these sales consist of affordably priced brands that leverage their low prices to capture consumer interest.

The Role of Cheap Counterfeits in Market Growth

Interestingly, low-cost smartwatches do not directly compete with established brands. Instead, they serve a vital role in introducing consumers to the smartwatch ecosystem. The process typically unfolds as follows: consumers might begin with a low-cost imitation, which can gradually lead them to consider upgrading to more reputable models. A brand like Amazfit often steps in as an intermediary, offering original designs at a price point that is more accessible than the flagship options from major corporations.

Consumer Journey: From Fake to Authentic

- Purchase of an Imitation: Consumers often begin by purchasing a low-cost imitation based on aesthetic similarities.

- Experience Stage: The quality and features are consistent with the lower price, and eventually, the device may break or underperform.

- Consumer Decision: Once they recognize the product limitations, many opt to explore reputable models, thus entering the sales funnel of higher-end brands.

Brand Ecosystem Integration

Leading corporations, such as Garmin, have developed robust ecosystems around their products. They position their watches not merely as stand-alone devices but as key components of a broader lifestyle geared toward specific demographics, such as athletes or outdoor enthusiasts. This ecosystem concept is often lacking in cheaper alternatives, making them less appealing to rational consumers seeking value.

Market Dynamics: The Impacts of Competition

The smartphone market, for instance, exhibits a different dynamic, as companies actively work to combat cheap fakes that could dilute their brand value. However, in the smartwatch market, the strategy is to not engage in a price war but rather to acknowledge the role of low-cost options in fostering awareness. This observation could lead to an interesting evolution within the entire tech accessory industry.

Case Study: Huawei vs. Apple

Consider the Huawei Watch Fit 3, which draws design inspiration from the Apple Watch SE. Despite their similarities, Huawei’s models tend to offer extended battery life and are compatible across both iOS and Android platforms, making them an appealing choice for price-sensitive consumers. This strategic positioning results in rapid sales growth, especially within the Russian market.

Conclusion: The Positive Impact of Counterfeit Watches

Ultimately, the presence of inexpensive smartwatches introduces a valuable entry point into tech adoption, facilitating consumer familiarity with smartwatches as a category. Although they may not compete directly with premium products, their existence can boost overall sales and awareness.

The recognition that purchasing a cheap version can often lead back to original brands clarifies the cyclical nature of consumer habits. Therefore, rather than viewing these lower-cost brands as threats, top manufacturers may find advantages in understanding their role in a growing market.

Practical Tips for Consumers

- Research Before You Buy: Always read reviews to distinguish brands that offer quality products.

- Test Compatibility: Ensure that the device you choose works well with your smartphone and other tech.

- Consider Brand Ecosystems: Evaluate whether the smartwatch you are considering integrates well into your lifestyle or existing devices.

Future Trends and Projections

The smartwatch market will continue to grow, supported by the dual roles of budget imitation devices and premium products. As consumer awareness rises and technology advances, expect more innovative features and integrations to emerge.