Netflix lowered earnings-per-share and sales estimates for the second half of the year

“The effect of introducing the package with advertisements will not appear until 2023”

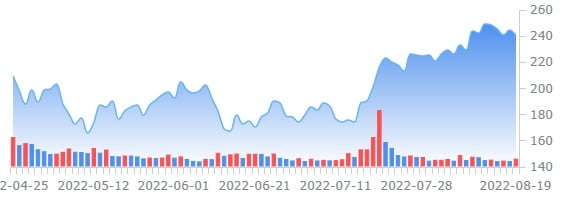

CFRA surged regarding 40% in one month since mid-July. Netflix(241.16 -1.64%)(NFLX) downgraded its investment rating to ‘sell’, saying it’s time to take a break.

According to CNBC on the 22nd (local time), CFRA NetflixIt has lowered its investment rating from ‘Hold’ to this. The target price was also reduced slightly from $245 to $238. It is lower than last Friday’s closing price of $241.16.

Kenneth Leon, analyst at the company, said: Netflixis no longer a growth stock. He blamed the slowdown in operating and free cash flow. NetflixWe lowered our earnings-per-share and sales estimates for the second half of the year.

This analyst NetflixHe said that the effect of the introduction of the subscription package with advertisements, which is a key catalyst for the company, is expected to increase the number of subscribers (220.7 million as of the end of June), which had been flat throughout this year. However, he said the effect would not be visible until 2023.

Facing the headwinds of inflation and consumer spending on non-essentials NetflixHe noted that it is a factor that hinders the growth of

Netflixexpects to add regarding 1 million more subscribers in the third quarter of this year, reaching 221.6 million subscribers.

By Kim Jung-ah, staff reporter [email protected]