VN-Index increased more than 7 points in the weekend session.

Cash flow “runs” from the banking stocks group to the real estate group

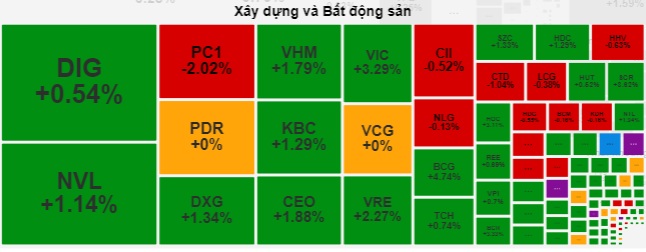

Overview during the weekend trading session, cash flow showed signs of withdrawing from banking stocks. On the contrary, real estate codes suddenly maintained a green color, some codes even closed at the ceiling price.

Specifically, the “king stocks” group today saw quite strong profit taking. Among the 10 codes that negatively affected the VN-Index, there were 7 stocks in this group, including: BID, VCB, HDB, STB, MBB, LPB and OCB. On the contrary, there were two codes of this group that traded quite actively throughout the session: ACB and CTG.

Cash flow shifted to real estate group today (February 16).

A stock code that also attracted attention today was HVN of Vietnam Airlines Corporation (Vietnam Airlines; HoSE: HVN) when this code closed the session at 12,850 VND/share, up 2.39% compared to the previous session. .

The reason this code had a positive session is due to the information that the Prime Minister recently assigned the State Capital Management Committee in February to submit a master plan to overcome difficulties for Vietnam Airlines due to the impact of Covid-19. 19.

GVR stock had a quite positive trading session today (February 16).

Another stock code that also attracted attention today is GVR of Vietnam Rubber Industry Group (HoSE: GVR) as this code has increased to the ceiling with relatively large liquidity. The upward momentum of GVR shares occurs in the context of the company’s financial situation improving as well as the prospects of the industrial park real estate group being evaluated relatively brightly in 2024.

In addition, as of December 31, 2023, the group had 5,677 billion VND in cash equivalents (of which only 155 billion VND was in cash, the rest were demand bank deposits), an increase of nearly 30% compared to with the beginning of the period. The group has more than VND 11,225 billion in short-term deposits at the bank.

Thanks to these amounts, the Group recorded nearly 259 billion VND in deposit interest in the last quarter of the year, an increase of 70 billion VND over the same period last year and contributed largely to financial revenue.

In the public investment group, stock codes under the VIETUR joint venture including CC1, VCG, HAN… have improved somewhat with an increase of over 2%. In the same direction, other stocks in the same industry such as HHV, KSB, FCN, LCG… also increased quite significantly.

Moving in the same direction, the public investment group and the steel stocks group somewhat kept pace. The trio of stocks HPG, HSG, NKG recorded an increase of around 1%.

Vietnam Airlines’ HVN shares are also quite positive.

In the securities group, cash flow showed signs of a significant decline as red continued to cover the entire industry.

In the oil and gas group, the movements of oil prices yesterday partly affected the movements of energy stocks. Closing the followingnoon session, PVD, PVS, BSR, PVC differentiated in green and red mixed with relative liquidity.

In particular, from the beginning of the followingnoon session, buying pressure continued to increase gradually in the real estate group when stocks such as DIG, CEO, HDC, DXG… diverged in the green, fluctuating from 1% – 3%. Worth mentioning, FIR is the most active stock in the group as it maintained its ceiling price increase for 2 consecutive sessions.

Closing the session, VN-Index increased 7.2 points (0.6%) to 1,209.7 points. Meanwhile, HNX-Index increased slightly by 0.29 points (0.13%) to 233.04 points; while UPCoM-Index fluctuated insignificantly, increasing only 0.01 points (0.01%) to 90.06 points.

On HNX, the number of red codes still dominates. Liquidity on the HNX also recorded a significant decrease, equivalent to 67 million units, worth more than 1,200 billion VND.

As for UPCoM, at the end of the session, UPCoM-Index recorded not too large fluctuations. The total matched volume reached over 46 million units, valued at over 495 billion VND.

The total trading value on all 3 exchanges today reached more than 19,979 billion VND.