2024-11-19 23:49:00

AMEX Corporate no Apple Pay” style=”margin: auto;margin-bottom: 5px;max-width: 100%” />

AMEX Corporate no Apple Pay” style=”margin: auto;margin-bottom: 5px;max-width: 100%” />

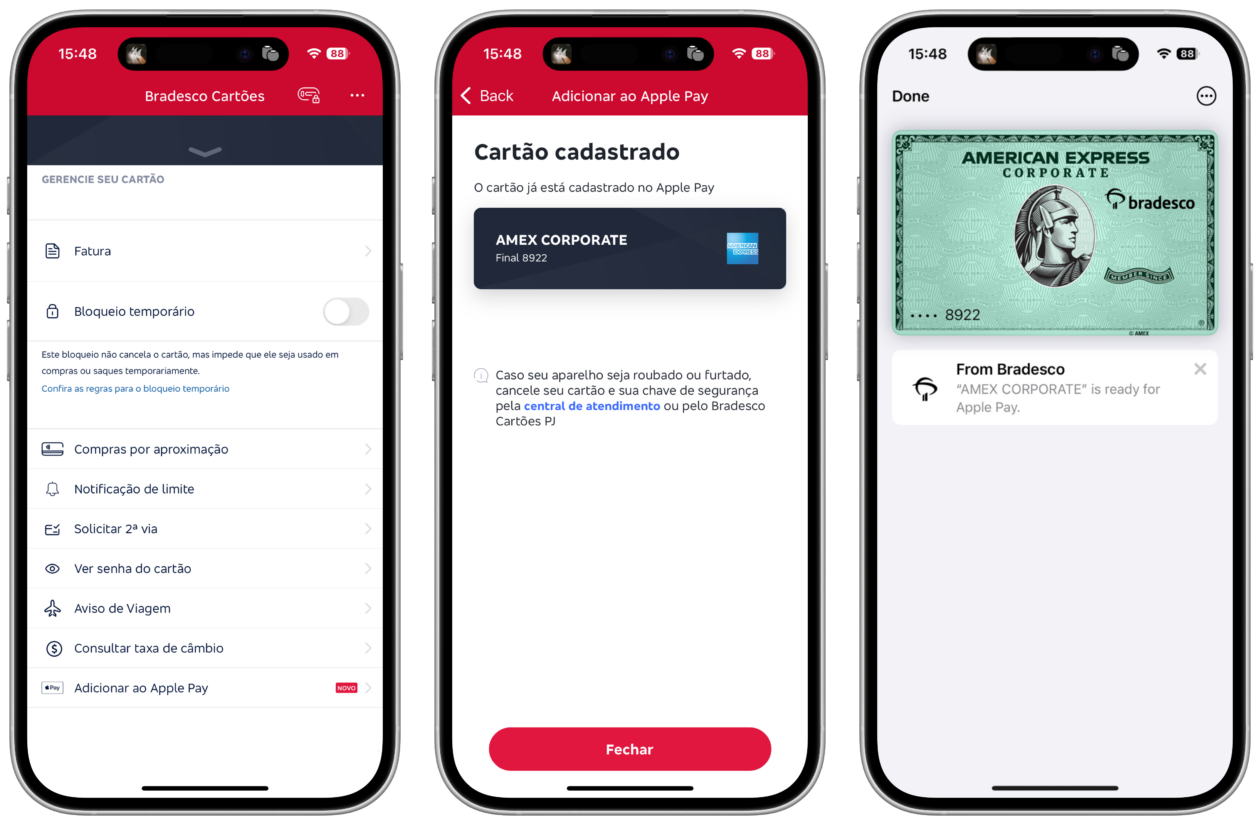

After — literally — more than a year of saga, in November 2022 the cards American Express (issued by Bradesco) gained compatibility with the Apple Pay. Now, about two years later, it’s time for the cards AMEX Corporate gain support for Apple’s digital wallet!

As the reader Cow Baiza Macedo informed us, cards can now be added via the application Bradesco PJ Cards — obviously, it is also possible to register them manually in the Wallet app (Wallet) and confirm via the app later.

Complete guide: all cards accepted by Apple Pay in Brazil

Recently, Lanistar, Zoop, iFood Benefícios, Santander Select Global account, Flash, Caixa and Sicoob cards also gained support for Apple’s contactless payments solution.

1732060289

#AMEX #Corporate #cards #gain #support #Apple #Pay

How can users add their AMEX Corporate cards to Apple Pay?

**Interview with Tech Expert on Apple Pay’s New Features**

**Host:** Welcome to our segment on the latest in digital payment technology. Today, we have with us Alex Müller, a tech expert who is well-versed in mobile payment systems. Thanks for joining us, Alex!

**Alex Müller:** Thanks for having me! I’m excited to discuss the recent updates regarding Apple Pay.

**Host:** To kick things off, could you tell us about the recent announcement regarding American Express Corporate cards and their integration into Apple Pay?

**Alex Müller:** Absolutely! After a lengthy wait, American Express Corporate cards issued by Bradesco are now compatible with Apple Pay. This marks a significant step in expanding the options for users in Brazil, especially for those who rely on corporate expenses.

**Host:** That’s great news for professionals. How exactly can users add their AMEX Corporate cards to Apple Pay?

**Alex Müller:** Users can add their cards via the Bradesco PJ Cards app, which is designed specifically for managing PJ (Pessoa Jurídica) accounts. Alternatively, they can manually input their card information into the Wallet app and confirm it through the app later, making the process quite flexible.

**Host:** Flexibility is key in digital payments. For those who might be wondering, what age requirements exist for using Apple Pay, particularly for younger users like teenagers?

**Alex Müller:** Generally, users must be at least 13 years old to use Apple Pay, but the exact age can vary depending on the country and the bank’s policies. It’s always best to check with the bank for specific requirements.

**Host:** That’s a useful point. As Apple Pay continues to grow, what other features or partnerships do you foresee in the near future?

**Alex Müller:** We’re likely to see more partnerships with various financial institutions and increased support for international cards. Additionally, as businesses increasingly adopt digital payments, we can expect enhanced security features and possibly integrations with reward programs to maximize user benefits.

**Host:** Exciting developments ahead! Thank you for sharing your insights, Alex.

**Alex Müller:** My pleasure! Digital payment technology is evolving rapidly, and I look forward to seeing how it shapes our financial transactions.

**Host:** Stay tuned for more updates on tech trends, and thanks for watching!