2023-05-28 04:18:13

Written by | Tian Xiaomeng

Editor | Li Xinma

Topic picture | IC Photo

On May 24, Lenovo Group announced its full-year and fourth-quarter results for the 2022/23 fiscal year ending March 31, 2023. According to the report data, in the fourth fiscal quarter, Lenovo’s revenue was US$12.635 billion, a year-on-year decrease of 24%, and the net profit attributable to the company’s equity holders was US$114 million, which was US$412 million in the same period last year, a year-on-year decrease of 72%.

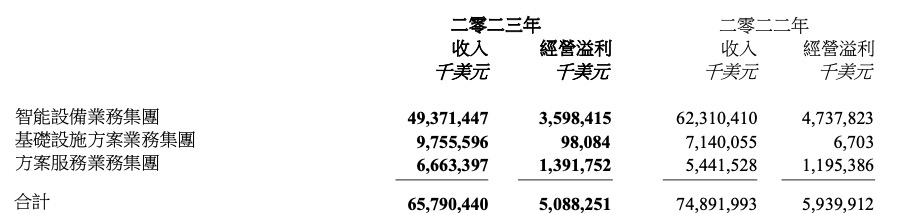

In the 2022/23 fiscal year, Lenovo’s total turnover was US$61.947 billion, a year-on-year decrease of 14%. The net profit attributable to the company’s equity holders was US$1.608 billion, a year-on-year decrease of 21%. The gross profit margin increased by 0.2 percentage points to 17%.

Image source: Lenovo financial report

Image source: Lenovo financial report

The decline in revenue and net profit was also reflected in the capital market. As of the close on May 24, Lenovo Group fell by a minimum of 9.31%, closing at HK$7.24, a drop of 7.65%, and a cumulative drop of 5.36% in the past 5 days.

Image source: Baidu Stock Connect

Image source: Baidu Stock Connect

Although the data is not satisfactory, the performance is still remarkable.

Lenovo has three major businesses including intelligent devices (IDG), infrastructure solutions (ISG) and solution services (SSG). Driven by the solution service business group and infrastructure solution business group, the proportion of business turnover other than personal computers has increased to financial The annual maximum is nearly 40%. This also offset to a certain extent the impact of the 21% year-on-year decline in the revenue of the smart device business group.

Image source: Lenovo financial report

Image source: Lenovo financial report

In addition, Lenovo’s full-year net cash position remained stable, with a year-end balance of US$366 million, exceeding market expectations. At the same time, Lenovo’s net cash outflow from financing activities and investment activities is far less than the net cash inflow from operating activities, and its cash flow is strong. In terms of working capital management, Lenovo’s cash cycle has been shortened to minus 2 days, an improvement of 12 days year-on-year, indicating that the actual cash flow of its main business is much higher than the comprehensive profitability of its income statement.

Yang Yuanqing, chairman and CEO of Lenovo Group, concluded: “In the face of numerous external challenges, Lenovo Group insists on focusing on innovation, and its investment in the field of innovation has not decreased but increased, and it has firmly established a service-oriented transformation.”

01.The PC market will gradually recover

As one of Lenovo’s three major businesses, IDG is not immune to the downward market environment of the global personal computer (PC) industry. The data shows that Lenovo’s personal computer revenue contribution has dropped from 68% in the 2021/22 fiscal year to 61%. IDG’s full fiscal year revenue was US$49.371 billion. Although there has been a decline, it is still higher than the pre-epidemic level.

In response to fluctuations in the PC market, digesting inventory became Lenovo’s main theme last year. However, Lenovo’s sales figures or actual sales figures to end users show a more flat decline in end demand while increasing market share.

At the same time, judging from the annual shipments of global PC suppliers in 2022 according to IDC statistics, Lenovo, HP, Dell, Apple, and ASUS rank in the top five. Lenovo has successfully maintained its position as the champion of the global PC market, with a global market share of 23.3%.

Image source: IDC

Image source: IDC

For the sluggish PC market environment, Yang Yuanqing gave positive feedback in the financial report. He believes that although the PC market has been weak due to channel inventory adjustments in the past few quarters, the adjustment is coming to an end, and the trend of shipments and activations will become more and more consistent. It is expected that the entire smart device market is expected to stabilize in the second half of this year .

It is worth mentioning that Lenovo has precisely aimed at its own positioning in the context of declining shipment demand, currency headwinds, and excess channel inventory.

In IDG’s product portfolio, the proportion of high-end segmented products has further increased to 30%, and the smartphone business has maintained profitability for three consecutive years. The latest market research report shows that Lenovo’s Motorola mobile business grew by 13% in Europe, Latin America by 7%, and Brazil, one of the world’s top five markets, by 5%. The European market share entered the top five for the first time in the past six years. Against the backdrop of an overall downward trend in shipments, Lenovo’s mobile business has achieved contrarian growth in the above-mentioned markets.

At the same time, driven by digitalization and hybrid office models, smart space solutions continue to show huge growth potential. IDC predicts that the intelligent collaboration market is expected to reach US$7.36 billion in 2025, with a compound annual growth rate of 7.0%. The compound annual growth rate of smart home devices will reach 5.9%.

In this regard, Lenovo stated that it will seize the performance growth opportunities brought regarding by the recovery of demand, continue to optimize costs, further improve operational efficiency, continue to invest in innovation in high-end categories and adjacent fields, and create better smart space solutions for mixed working models .

02.The performance of the “second growth curve” is highlighted

The proportion of Lenovo’s non-PC revenue for the whole year has increased to nearly 40%, which is a bright spot in this financial report and further consolidated the “second growth curve”.

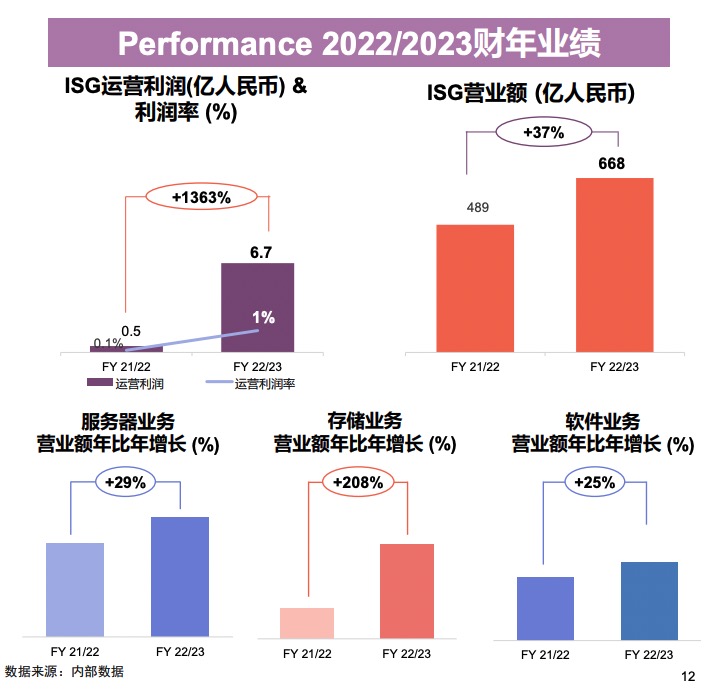

Among them, the annual revenue of the ISG infrastructure solution business group increased by 37% to a record US$9.8 billion, breaking the record for the third consecutive year. Lenovo has also become one of the fastest growing infrastructure solution providers in the world, with operating profit Reached a new milestone of $98 million.

Among the segmented businesses, the turnover of server business increased by 29% year-on-year, ranking third in the world; the turnover of storage business increased by 208% year-on-year, ranking fifth in the world; the turnover of software business increased by 25% year-on-year %.

Image source: Lenovo financial report

Image source: Lenovo financial report

ISG’s performance can achieve sustainable growth, thanks to the demand for computing power detonated by the AIGC revolution. Gartner predicts that in 2025, the global server market will exceed US$132 billion, the storage equipment market will reach US$36 billion, and the edge computing equipment market will reach US$37 billion.

Faced with this trend, Lenovo naturally has its own technology precipitation and development layout.

It is understood that Lenovo has ranked first in the global HPC Top500 list for many years, and its server delivery capabilities and comprehensive performance have been recognized by global customers; Power demand customers to provide more “universal wisdom” computing power products. In addition, Lenovo provides a rich and diverse product portfolio to the global market in the field of AI. So far, Lenovo has released more than 60 products that support artificial intelligence applications, covering artificial intelligence training servers, inference servers, edge artificial intelligence gateways and other products.

Lenovo stated in the financial report that the ISG business is comprehensively strengthening its full-stack product capabilities covering cloud infrastructure and enterprise IT infrastructure, focusing on AI-enabled infrastructure innovation, including AI-enabled edge computing, hybrid cloud and smart computing. Chemical operation and maintenance, etc. At the same time, Lenovo’s independent manufacturing capacity and cost competitiveness have also been continuously improved.

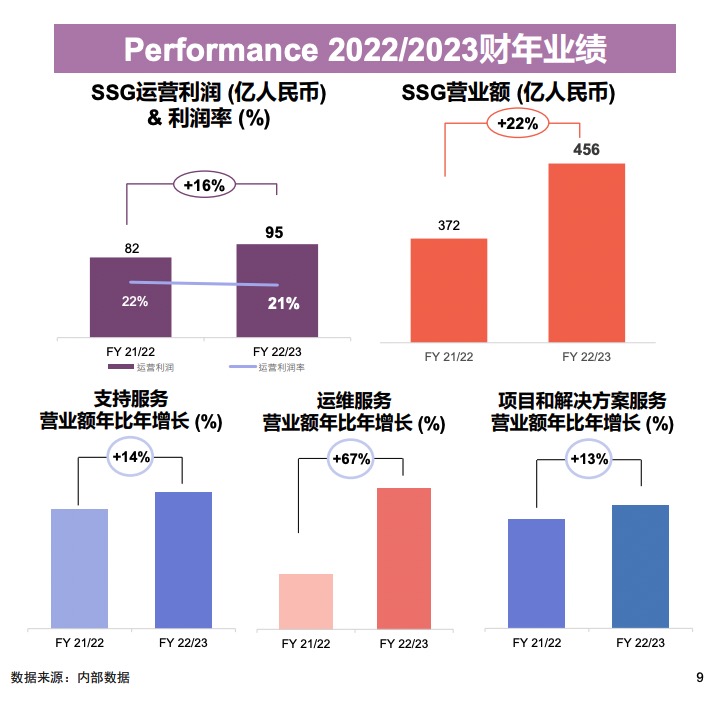

Another major growth engine, the SSG solution service business group, is also very strong and has become an important profit contributor: revenue and operating profit increased by 22% and 16% year-on-year to US$6.7 billion and US$1.4 billion, respectively. The operating profit margin was 20.9%, higher than that of all business groups. Deferred revenue rose 2% year-over-year to a high of $3.0 billion.

Image source: Lenovo financial report

Image source: Lenovo financial report

Overall, the turnover of all subdivided businesses has achieved double-digit growth, of which operation and maintenance services and solution services accounted for 51% of SSG as a whole, an increase of 3 percentage points year-on-year.

It cannot be ignored that in August 2022, Lenovo Group strengthened its service capabilities and expanded the coverage of the solution service business group through the acquisition of Lenovo PCCW Solutions Co., Ltd. (LPS, formerly known as PCCW Lenovo Technology Solutions Limited).

Lenovo said that in the future, the SSG business will continue to expand the service portfolio to increase the penetration rate of hardware support services, and continue to expand the portfolio of digital workspace services (DWS), hybrid cloud services, and sustainable development services to meet the strong market demand for such services .

03.end

Overall, for Lenovo, challenges and opportunities coexisted in the past year.

Facing the pain brought by the common industry down cycle, Lenovo was able to grasp the changes brought regarding by digital education, as well as terminal demands such as high-end smartphones, and was able to gradually realize a full-stack model through continuous “service-oriented transformation”. Transformation of infrastructure and service providers is not easy.

Under the gradual recovery of the PC market and the new opportunities brought by ChatGPT, how Lenovo can achieve double growth in revenue and profit in the new fiscal year is still worth looking forward to.

1685257668

#growth #curve #support #Lenovo #DoNews