2023-09-27 18:03:05

Published on Sep 27, 2023 at 2:26 p.m.Updated September 27, 2023 at 8:03 p.m.

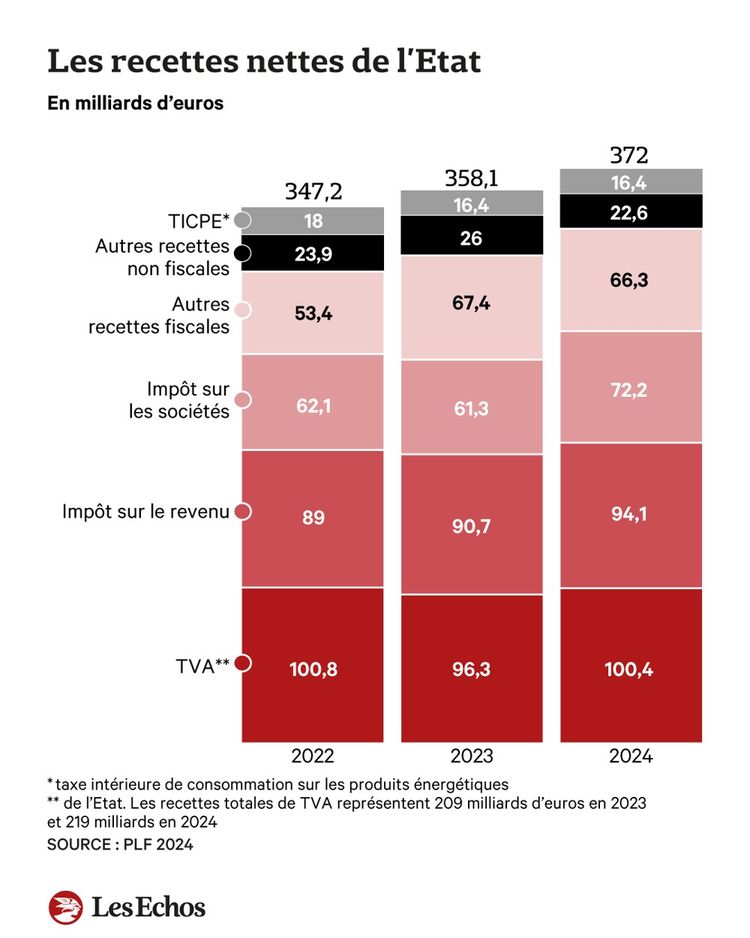

The finance bill (PLF) for 2024 marks a major fiscal turning point: it is an end to the massive tax cuts, which had characterized Emmanuel Macron’s policy since his accession to the Elysée in 2017. Constrained by the necessary return to control of public accounts, the government no longer allows itself to give gifts to businesses or households.

There remains, of course, a major tax measure which will take effect in 2024: the continued reduction in the contribution on business added value (CVAE). This production tax will decrease by a quarter next year. Its maximum rate (concerning companies with more than 50 million turnover) increases to 0.28% compared to 0.375% in 2023. This represents 1 billion euros of shortfall for the State in 2024.

A zero-sum game

The sum is significant, but pales in comparison to the CVAE reductions already implemented in 2021 and 2023. In three years, the government had given up 10 billion in revenue and had committed to abandoning the remaining 4 billion by 2024. . It ultimately only goes a quarter of the way and spreads the decline until the end of the five-year term.

The PLF for 2024 also includes some tax innovations which should partially offset this drop in revenue. To finance the ecological transition, it will tax motorway concessions and large airports – to the tune of 600 million euros. The increase in taxes on diesel from farmers and public works companies will also bring in 170 million euros next year. Overall, the amount of taxes paid by companies will change very little.

“Swallowed cake no longer has flavor”

This observation is even more true for individuals. The reduction in taxes for the middle classes, promised by Emmanuel Macron last spring, will wait for better days. “We will lower household taxes by 2 billion euros in the 2025 PLF,” assured Finance Minister Bruno Le Maire. Until then, nothing will change apart from the indexation of the income tax scale which will deprive the State of 6 billion euros.

The brakes are marked when we compare this fiscal stability with the massive reductions of recent years. Since 2017, the State has given up on 50 billion euros in revenue, distributed equally between households and businesses. Reduction in corporate tax and CVAE, transformation of the ISF into an IFI, implementation of the “flat tax”, elimination of the housing tax and the audiovisual royalty… “I recall all these reductions tax because, as the President of the Republic often says: “Swallowed cake no longer has any flavor,” insisted Bruno Le Maire during the presentation of the PLF for 2024 on Wednesday.

10 billion more VAT

The executive deplores not being paid in return, but the explanation is simple. On the one hand, the recent surge in property taxes confuses the message. The government may argue that the latter depends on the municipalities, the taxpayer only sees the invoice and not the sender. On the other hand, the French are too badly affected by inflation to give it credit for past efforts.

Fueled by the opposition, criticism is increasing over the state’s tax revenues which are jumping with the rise in prices, particularly for fuel. “It’s false,” reacted Bruno Le Maire. VAT revenue will increase from 209 to 219 billion euros between 2023 and 2024, or 10 billion euros more. On the other hand, the sole cost of indexing [des prestations sociales, des retraites et du barème de l’impôt sur le revenu , NDLR] represents more than double. There is no need to take out the calculators to see that inflation costs the State dearly! »

Uncertainty following 2024

Despite this tax break, Bruno Le Maire reiterated his credo: “We must remain faithful to this promise of lower taxes, in a country which maintains a compulsory tax rate among the highest of all developed countries. » The minister insists on the role of past declines in the good performance of the French economy: 2 million jobs created since 2017, 300 factories opened, 1% growth in 2023.

Despite this conviction, he was forced to give up continuing in 2024. What will happen followingwards? The government is targeting 12 billion euros in savings per year from 2025 and is committed to bringing the public deficit below 3% in 2027. If it wants to meet this objective, considered ambitious, the tax break of 2024 might well turn into a long plateau, or even lead, according to some experts, to a sharp turnaround between now and the end of the five-year term.

1695866149

#Budget #government #suspends #tax #cuts