[비즈한국] The ‘Amendment to the Enforcement Decree of the Housing Act’, which eases the period of restriction on the resale of apartment lot rights, is effective from the 7th, and the restrictions on the resale of apartment lot rights have been eased. Previously, the resale restriction period was up to 10 years, but with this amendment, it is reduced to up to 3 years in the metropolitan area and up to 1 year in the non-metropolitan area. To be more specific, in the metropolitan area, public housing and regulated areas are relieved to 3 years, overconcentration control areas to 1 year, and other areas to 6 months. In non-metropolitan areas, the period was shortened, such as 1 year for public housing and regulated areas, 6 months for metropolitan cities, and complete abolition of other areas, or regulations were eliminated altogether.

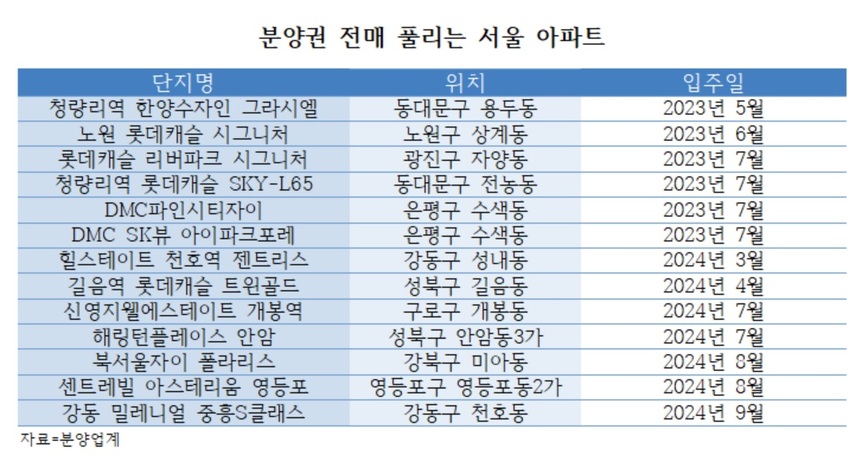

#13 complexes in Seoul receiving benefits from easing restrictions on resale of pre-sale rights

This measure is retroactively applied to apartments that have been sold prior to the revision of the Enforcement Decree. For example, the Dunchon Jugong Apartment (Olympic Park Foreon), which was sold in December last year, had a resale restriction period of 8 years under the enforcement ordinance at the time. However, with the revision of the Enforcement Decree, the period of restriction on resale is reduced to one year, and sales of pre-sale rights are possible from December of this year. In regulated areas such as Gangnam 3-gu and Yongsan-gu, the resale restriction period is applied for 3 years. Considering that it takes around 30 months for the construction following the sale, it is expected that the transaction will be possible before and following the registration of the transfer of ownership.

The area that has received the most attention due to the relaxation of restrictions on the resale of lot rights is Seoul. In Seoul, since Mokdong Central IPark Weave in early 2020, there has been no sale right transaction itself. Therefore, it is necessary to check the complexes in Seoul, which are subject to this mitigation measure, where resale of lot rights is restricted. There are 13 complexes in total. Among the apartments that announced the winners of the subscription before April 7, 2022, the apartment complexes that have not yet started moving in can sell the right to sell.

There are Graciel, Hanyang Sujain at Cheongnyangni Station, which will move in in May 2023, Nowon Lotte Castle Signature, which will move in in June, and SKY-L65, Lotte Castle at Cheongnyangni Station, which will move in in July. In the same month, DMC Pine City Xi in Susaek-dong, Eunpyeong-gu, DMC SK View I-Park Foret, and Lotte Castle River Park Signature in Gwangjin-gu are also available for sale.

There is also a complex that is scheduled to move in next year. Gangdong-gu Hillstate Cheonho Station Gentress (March 2024), Seongbuk-gu Gireum Station Lotte Castle Twin Gold (April 2024), Seongbuk-gu Harrington Place Anam Guro-gu Sinyeongji Well Estate Gaebong Station (July 2024), Gangbuk-gu Bukseoul Xi Polaris Yeongdeungpo-gu Centerville Asterium Yeongdeungpo (August 2024), Gangdong-gu Gangdong Millennial Jungheung S Class (September 2024), etc.

#Regulations on actual residence and transfer tax remain the same, be careful of ‘don’t ask investment’

Since the second half of 2022, real estate transactions have decreased and the market has cooled, so the government has introduced a series of deregulation policies. The easing of resale restrictions is also part of the 1·3 measures introduced earlier this year. It was regarding reducing the regulated area, easing resale restrictions, and abolishing the actual residence obligation.

The residency requirement has not yet been abolished. This is because, unlike the resale restriction, in which the government revises the enforcement ordinance through the cabinet meeting, the regulation of the actual residence obligation is a matter that needs to be revised by the National Assembly. As the mandatory residency regulation remains, there is confusion in the market.

At the end of this year, Olympic Park Foreon will be available for resale. However, there is a duty of residence. Even if the resale restriction is lifted, the residency obligation remains, which inevitably puts a burden on the buyer.

Nonetheless, it might be good news for the market. For end-users, the range of choices is broadened. You can either resell the lot and buy it, or you can make a subscription. In particular, purchasing an existing house requires a lot of money at once, whereas purchasing a subscription or sale right requires only 10% of the sale price as a down payment and loans for interim payments are allowed, so you can secure time to raise funds.

But investors should beware. There are often cases in which a down payment is put in forcibly with the intention of selling when a premium is added later, but the sale is not successful, resulting in problems. In the past, there have been many examples of negative premiums.

It is okay for end-users who are thinking regarding buying their own house and have the money, but caution is needed when purchasing multiple units to make premium profits for investment purposes. It is essential to study location, product, and price. There is a burden of high interest rates, and there are many places where there is resistance to prices because market prices have risen very high over the past few years.

Even if it becomes possible to invest in the resale of lot ownership, capital gains tax must be considered. Previously, the transfer tax rate was 70% when holding for less than one year, 60% between 1 and 2 years, and 6-45% for more than 2 years. However, through measures 1 and 3, it was decided to change the transfer tax rate of lot ownership to 45% if the holding period is less than one year, and to the basic tax rate for others. However, this is also a part of the law that needs revision, so it is pending in the National Assembly. Although restrictions on resale of lot rights have been eased, transfer tax and heavy taxation for short-term holdings are still applied.

There is also a concern that if the sale rights are released in the market, the price of existing apartments will decrease as the number of sales increases. Whether it is construction, new construction, or pre-sale rights, it means that you must decide whether to buy or not by considering the location, product, and price. In particular, keep in mind that if there is no criterion for determining the appropriate price, you will always be a ‘hogu’ in the real estate market.

Famous for the pen name Pachon Hakryeol Kim The head of the Smart Tube Real Estate Research Institute served as the team leader of the Real Estate Research Division of the Korea Gallup Research Institute. He is running and running Naver’s blog ‘Exploring the World of Pachon’ and YouTube ‘Smart Tube TV’. His books include ‘Seoul Real Estate Absolute Principles (2023), ‘The Future of Incheon Real Estate (2022),’ Kim Hak-ryeol’s Absolute Real Estate Investment Principles (2022), ‘South Korea Real Estate Future Map’ (2021), ‘From now on, only places to climb will rise’ ( 2020), ‘Real Estate User Guide in Korea’ (2020), ‘Exploring real estate in the metropolitan area’ (2019), ‘There are places to climb even if it is not in Seoul’ (2018), ‘There are still apartments to buy’ (2018), etc. There is.

Kim Hak-ryeol, director of the Smart Tube Real Estate Research Institute, writer@bizhankook.com

[핫클릭]

·

[부동산 인사이트] Is it the highest in 10 years? Looking at unsold statistics

·

[부동산 인사이트] Finding clues for investment in the plunge in published prices

·

[부동산 인사이트] Announcement of 15 national industrial complexes nationwide… can i invest

·

[부동산 인사이트] How much will the value of Seoul increase with the ‘Great Han River Project’?

·

[부동산 인사이트] Two things you need to know before buying your own home

<저작권자 ⓒ 비즈한국 무단전재 및 재배포 금지>