Bitcoin’s Short-Term Holders Turn Bearish, signaling Market Uncertainty

Table of Contents

- 1. Bitcoin’s Short-Term Holders Turn Bearish, signaling Market Uncertainty

- 2. Bitcoin’s Short-Term Holders Feeling the Squeeze: A Potential Turning Point?

- 3. Bitcoin on the Brink: Two possible market Outcomes

- 4. Two Scenarios for Bitcoin’s Future

- 5. History Offers Clues, But No Guarantees

- 6. Dr. Amanda Lee’s Insights: What to Watch for

- 7. Bitcoin’s Dip: Signs of Uncertainty or Chance?

- 8. What are the key on-chain metrics investors should monitor when assessing Bitcoin’s market outlook?

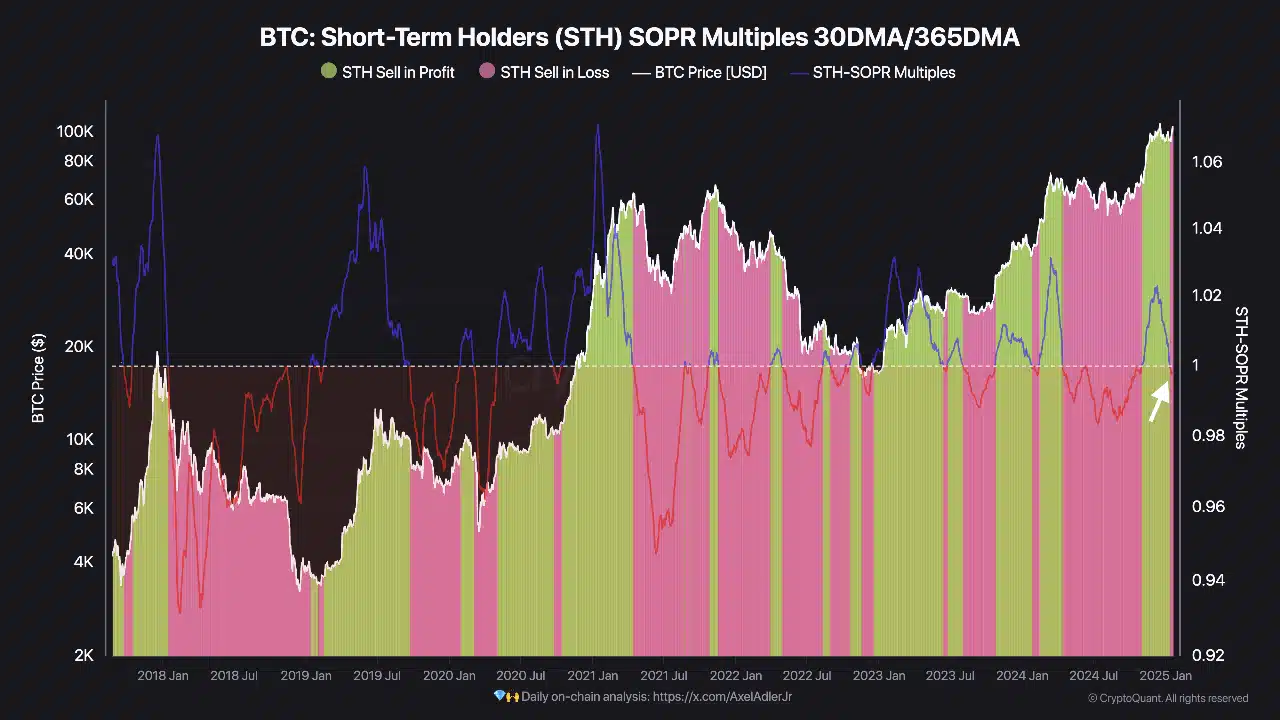

A shift in sentiment among Bitcoin’s short-term holders is painting a picture of uncertainty in the crypto market. Recent data reveals a decline in the Short-Term Holder Spent Output Profit Ratio (STH SOPR), suggesting that these investors are selling their holdings at a loss, a historical indicator ofen associated with turning points in the market.

The STH SOPR is a crucial metric that tracks the overall profitability of short-term Bitcoin holders. It compares the 30-day STH SOPR to its 365-day average, providing a clear snapshot of whether these investors are generally realizing profits or losses. A reading below 1.0 indicates losses, as is currently observed.

“Historically, such dips frequently enough reflect growing market stress but can also present accumulation opportunities for long-term investors,” notes an analyst, highlighting the potential for both risk and reward in this situation.

This bearish trend among short-term holders is raising concerns among investors, as it may foreshadow further price corrections in the short term. The market is now keenly focused on whether this negative sentiment will persist or if a rebound is on the horizon.

These current market dynamics underscore the inherent volatility of cryptocurrencies, emphasizing the crucial need for informed decision-making. While the prevailing trend may signal short-term risks, it’s essential to remember that past dips in the STH SOPR have also presented opportunities for savvy investors to acquire assets at potentially discounted prices.

Bitcoin’s Short-Term Holders Feeling the Squeeze: A Potential Turning Point?

The recent decline in the Spent Transaction Output Ratio (SOPR) for short-term Bitcoin holders (STHs) has ignited a debate about the potential trajectory of the market. This metric,a key indicator of profit/loss for holders who have owned Bitcoin for less than 155 days,shows that STHs are currently selling at a loss,raising questions about whether this trend heralds a significant turning point in the market.

Dr. Amanda Lee, a prominent figure in the cryptocurrency space, is advising investors to closely monitor a range of key indicators to determine whether this negative trend in the STH SOPR will persist or lead to a rebound.

“Understanding the interplay of these factors is crucial for navigating the current market turbulence,” she states.

Bitcoin on the Brink: Two possible market Outcomes

Bitcoin’s recent price plunge, pushing it below the critical $1 threshold, has set the crypto community abuzz with speculation.A key indicator, the Short-Term Holder Spent Output Profit Ratio (STH SOPR), has dipped into negative territory, suggesting widespread selling amongst short-term investors. This development has sparked a crucial question: will this wave of selling deepen the market correction, or will steadfast holders create a price floor, paving the way for a potential rebound?

The answer lies in the behaviour of short-term holders at this moment of market uncertainty. “The chart highlighted this shift, with the recent drop below 1.0 signaling waning confidence among sths,” remarked a prominent crypto analyst.

Two Scenarios for Bitcoin’s Future

Crypto analysts are pointing to two main scenarios that could play out in the coming weeks and months. The first scenario paints a more bullish picture. Here, short-term holders, irrespective of their recent losses, choose to hold onto their Bitcoin. This “buy and hold” strategy could act as a crucial support level, preventing further price drops and potentially establishing a foundation for a recovery.This resolute stance by STHs could signal growing confidence in Bitcoin’s long-term value, even amidst short-term volatility.

However, the second scenario presents a more bearish outlook. If short-term holders continue to sell off their holdings in large numbers, this could amplify downward pressure on the market, leading to a deeper correction. Historically, these periods of capitulation have been marked by heightened volatility and uncertainty, potentially creating a challenging habitat for investors.

History Offers Clues, But No Guarantees

Bitcoin’s history offers valuable lessons about navigating periods of market uncertainty.As an example, during the sharp market crash triggered by the onset of the COVID-19 pandemic in March 2020, the STH SOPR plummeted into negative territory, reflecting widespread capitulation among short-term holders. “This period later proved to be one of the most lucrative entry points, as Bitcoin surged from $4,000 to over $60,000 within the following year,” noted a seasoned crypto analyst.

Similarly, the market downturn in mid-2018, following Bitcoin’s price surge to $20,000, also saw sustained negative STH SOPR readings. This period, though initially signaling capitulation, ultimately became the accumulation phase preceding Bitcoin’s rally to new all-time highs in 2020.

For long-term investors, these historical periods of negative SOPR have often preceded significant recoveries. As selling pressure eases and accumulation begins, the market tends to shift its trajectory upward. However, it’s crucial to remember that past performance is not necessarily indicative of future results.

Dr. Amanda Lee’s Insights: What to Watch for

Dr. Amanda Lee, a renowned crypto analyst, provides crucial insight into navigating this critical juncture. She advises investors to closely monitor several key indicators:

[Insert Dr. lee’s Specific Indicators and Explanations Here]

By understanding these indicators and their potential implications, investors can make more informed decisions about their bitcoin holdings during this period of market uncertainty.

Bitcoin’s Dip: Signs of Uncertainty or Chance?

The cryptocurrency market, known for its volatility, is currently experiencing a period of uncertainty. A key indicator, the Short-Term Holder Spent Output Profit Ratio (STH SOPR), has recently dipped into negative territory, raising concerns among investors. To shed light on this development and its implications, we spoke with Dr. Amanda Lee, a leading expert in cryptocurrency markets.

“The STH SOPR compares the 30-day SOPR with its 365-day average,” explains Dr. Lee. “If it’s below one, it means short-term holders (STHs) are selling Bitcoin at a loss. This recent dip signifies that STHs are experiencing realized losses, essentially selling their Bitcoin for less than they originally paid for it.”

historically, dips in the STH SOPR have been associated with market turning points.”This trend suggests uncertainty and stress,” Dr. Lee notes. “When STHs start selling at a loss, it often reflects a broader sense of market fear or pessimism.” However, she cautions, “these periods of stress can also present opportunities for long-term investors.”

Astute investors often view these dips as potential accumulation opportunities. “When STHs are selling at a loss, the price of Bitcoin tends to go down, making it cheaper to buy,” Dr. Lee explains. “But it’s crucial to have a strong risk management strategy in place, as these periods can also lead to further price corrections.”

Looking ahead, Dr. Lee highlights several key indicators that market participants are closely watching. “We’re monitoring price action closely, looking for signs of support or resistance. Additionally, we’re keeping an eye on other metrics like the Bitcoin Long/Short Ratio and Funding Rates to gauge market sentiment and whether whales are accumulating or distributing their holdings.”

Given Bitcoin’s inherent volatility, Dr. Lee offers this sage advice for investors: “With any investment, it’s significant to do your own research and stay informed. But in Bitcoin,it’s absolutely critical to understand and manage risks. Don’t let short-term market fluctuations dictate your strategy. Always maintain a balanced portfolio and stick to your long-term goals.”

Dr. Lee’s insights provide valuable perspective on the current state of the Bitcoin market. While uncertainty prevails, savvy investors can use these indicators and strategies to navigate the volatile landscape and potentially capitalize on emerging opportunities.

What are the key on-chain metrics investors should monitor when assessing Bitcoin’s market outlook?

Interview: Dr. Amanda Lee Discusses Bitcoin’s Market Uncertainty and Future Prospects

Archyde: Dr. Lee, thank you for joining us today.We’re excited to discuss your insights on the current state of the Bitcoin market and potential outcomes for its future.

Dr. amanda Lee: Thank you for having me. I’m always eager to share my outlook on the Bitcoin market, especially during these uncertain times.

Archyde: Recent data shows a decline in the Short-Term Holder Spent Output Profit Ratio (STH SOPR), indicating that short-term holders are selling at a loss. How notable is this shift, and what does it tell us about the market’s direction?

dr. Lee: This decline in STH SOPR is certainly noteworthy, as it signals a loss of confidence among short-term investors. When this metric dips below 1.0, it suggests that, on average, short-term holders are realizing losses, which can indicate increased selling pressure. However, it’s essential to keep in mind that this is just one indicator among many, and it’s crucial to consider it in conjunction with other key metrics.

Archyde: That leads us to our next question. What other indicators should investors be monitoring to understand the implications of this trend?

Dr. Lee: To gain a comprehensive understanding of the market, investors should keep an eye on several indicators.in addition to the STH SOPR, monitoring long-term holder (LTH) behavior through the LTH SOPR and SOPR Ratio can provide valuable insights. The 30-day and 90-day moving averages, volume profiles, and Bitcoin’s on-chain activity, such as transaction counts and fees, also play significant roles in painting the complete picture.

Archyde: some analysts see two main outcomes for Bitcoin’s future – a deeper correction if STHs continue selling, or a potential rebound if they hold their positions. Which scenario do you think is more likely, based on your analysis?

Dr. Lee: It’s critically important to remember that neither outcome is guaranteed, and the market’s behavior can shift rapidly.That said, I beleive both scenarios are plausible, depending on how short-term holders react to the current market conditions. If STHs capitulate and continue to sell, we coudl indeed see a deeper correction, with heightened volatility and uncertainty. however, if short-term investors hold onto their Bitcoin, setting a price floor and demonstrating confidence in its long-term value, a rebound could be on the horizon.

Archyde: Historically, periods of negative STH SOPR have often preceded market recoveries. How do you think investors should approach these periods, given the risks and potential rewards they present?

Dr. Lee: Past performance isn’t a foolproof indicator of future results, but it does provide valuable context. In times of market stress,it’s crucial for investors to remain informed,disciplined,and patient.They should closely monitor the indicators I mentioned earlier and maintain a long-term perspective. While these periods can present short-term risks, they can also offer opportunities for accumulation at potentially discounted prices. Ultimately, investors should seek to make well-informed decisions that align with their risk tolerance and investment goals.

Archyde: Given the volatile nature of cryptocurrencies, what advice would you give to investors looking to navigate these markets successfully?

Dr. Lee: Above all, I would advise investors to educate themselves about the unique aspects of the crypto market, such as its 24/7 trading nature, decentralized nature, and the role of on-chain metrics. Staying informed about market trends, developments in the broader economy, and regulatory changes is also crucial.Diversification, risk management, and a long-term perspective are essential for triumphant navigation of these highly volatile markets.

Archyde: Thank you, Dr.Lee, for sharing your insights with our audience.Your expertise has provided valuable context for understanding Bitcoin’s current market uncertainty and potential future outcomes.

Dr. Lee: My pleasure. I’m always happy to help investors better understand the crypto markets.