- Bitcoin is showing indications of improved market sentiment, though short-term challenges remain and are impacting its performance.

- Can Bitcoin gain sufficient momentum in light of declining dominance?

The investment landscape for Bitcoin [BTC] is witnessing a resurgence of confidence, even as it struggles to maintain a value above $60,000. This is evident from the activity of retail investors as well as Bitcoin miners.

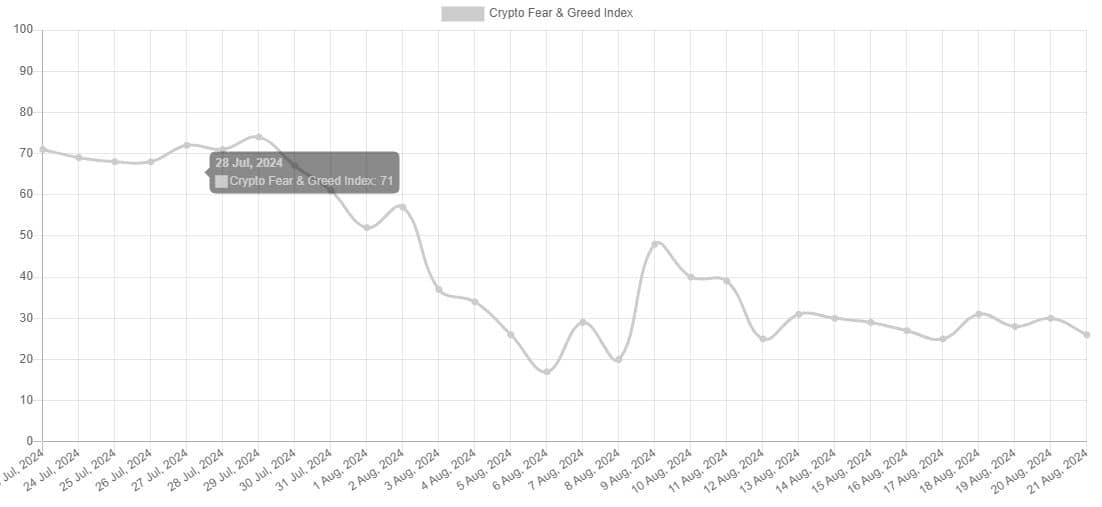

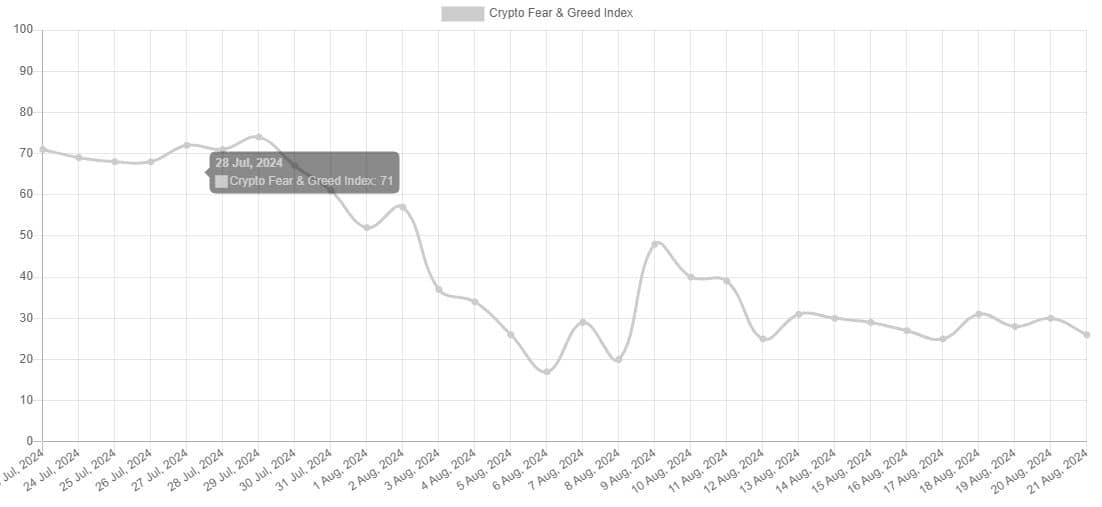

Currently, Bitcoin and the broader cryptocurrency market are experiencing a revival of confidence, in contrast to the situation at the beginning of the month. The fear and greed index is at 26 now, having peaked at 30 during Tuesday’s trading session.

Source: Alternative.me

The Fear and Greed Index indicates that confidence in Bitcoin is currently greater than at the beginning of the year. However, this does not provide a complete picture of confidence, given a recent drop to 26 in the last 24 hours.

The potential reason for this shift could be that the BTC price has dipped back below $60,000, which has become quite common recently.

The selling pressure that is pushing BTC below $60,000 this time may be linked to the news that Mt. Gox has just transferred over 12,000 BTC valued at over $700 million.

Are Miners Hoarding Bitcoin?

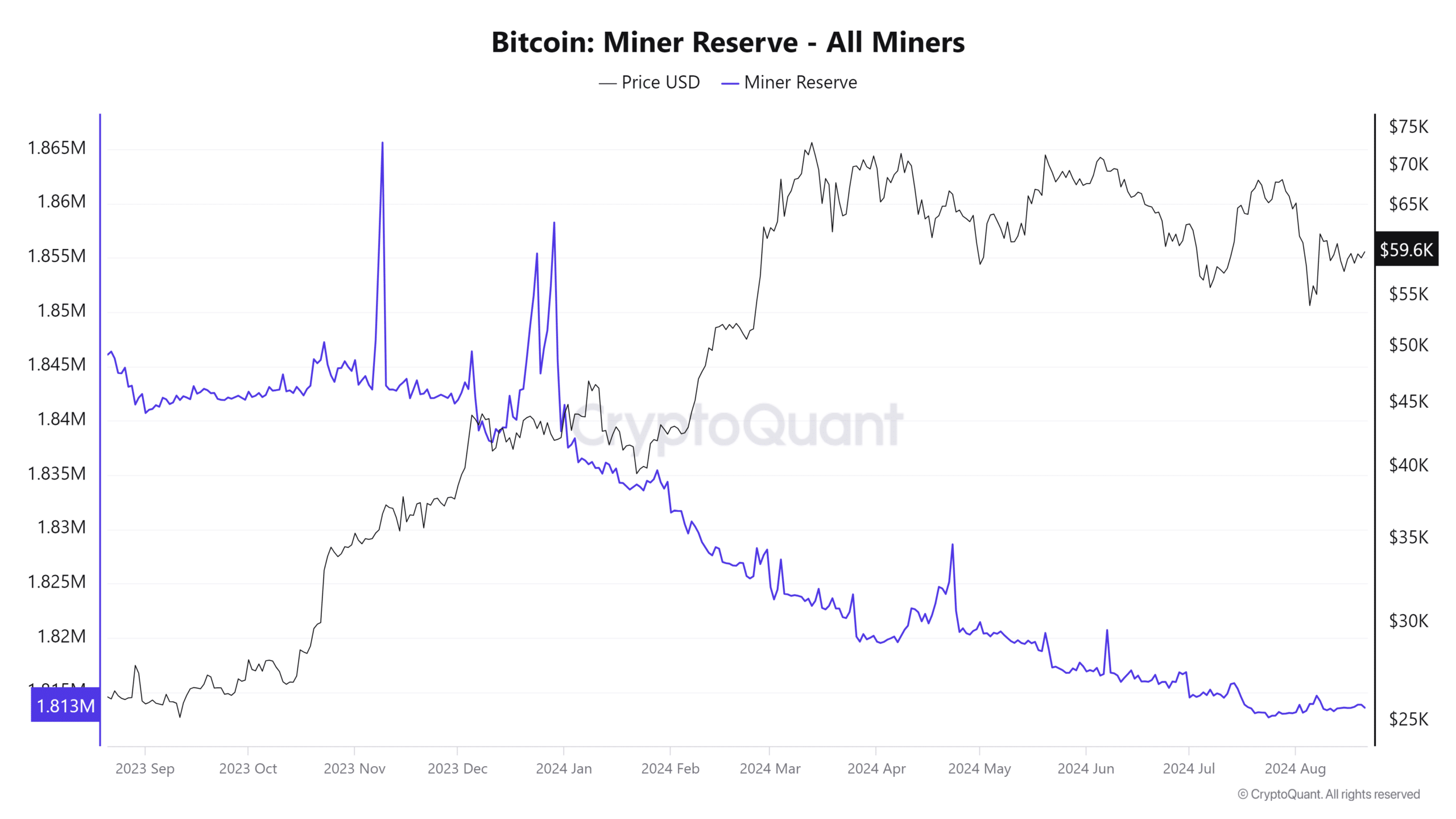

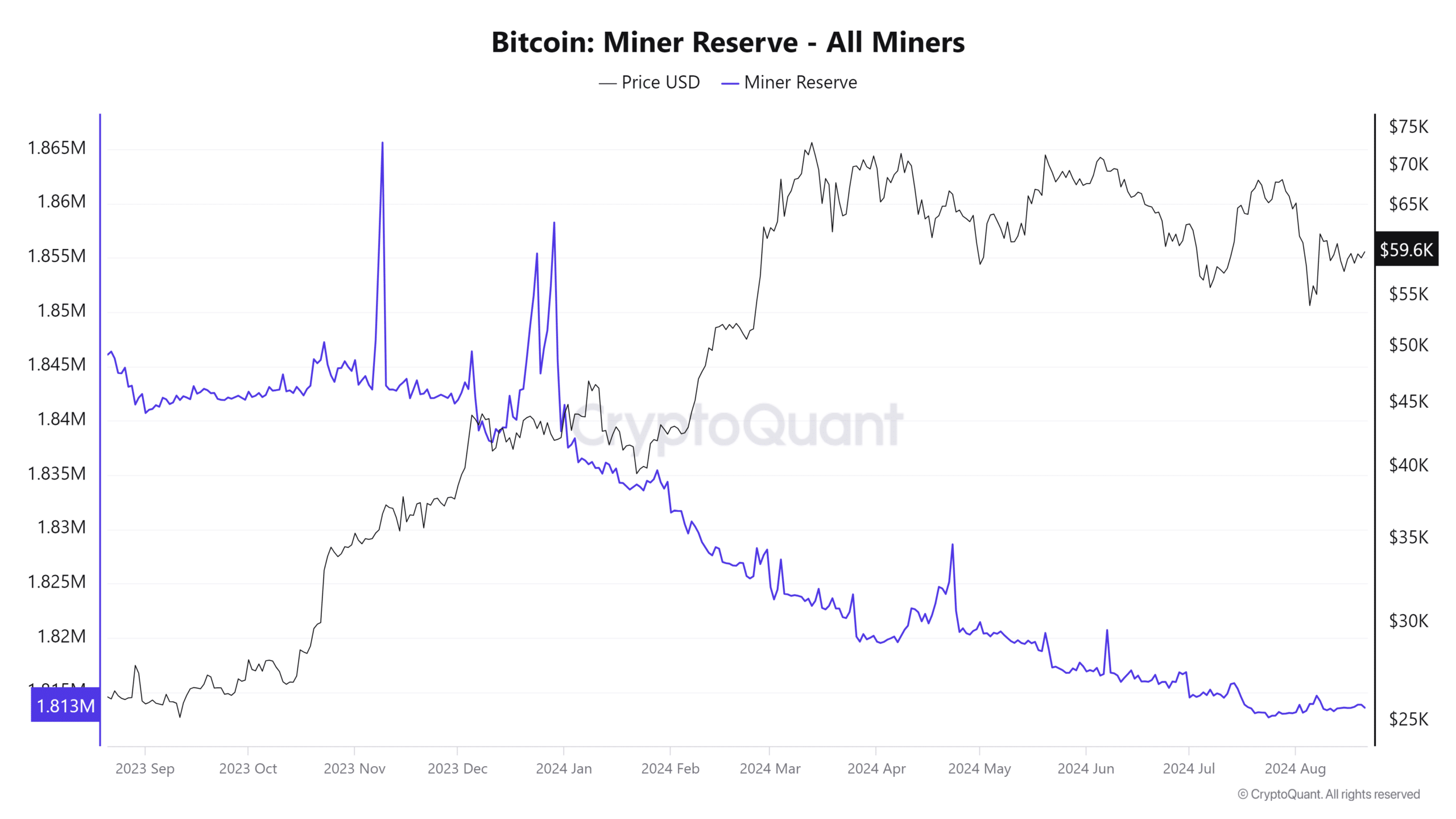

Over the past 12 months, Bitcoin miner reserves have generally been declining, reflecting the pressure to sell as bars became the predominant force.

Nonetheless, data on miner reserves shows an upward trend so far this month compared to the recent lows in July. This indicates that more miners are choosing to hold on to their BTC.

Source: Cryptoquant

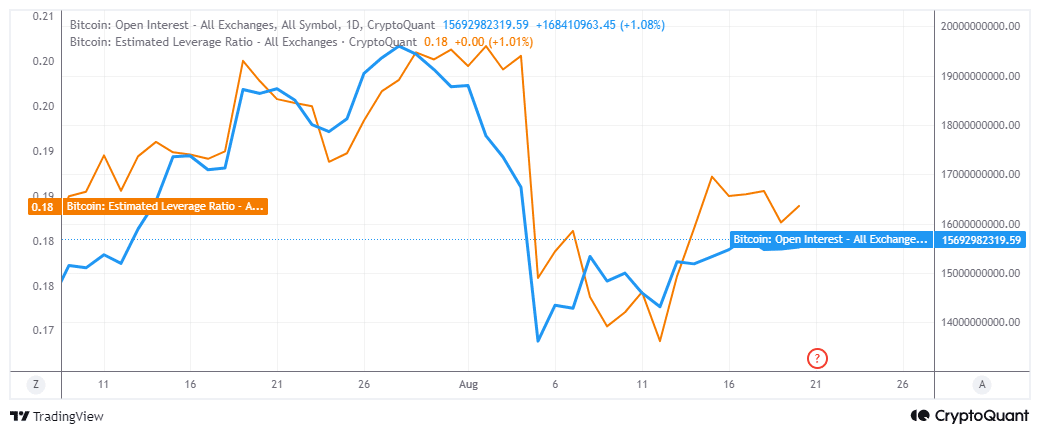

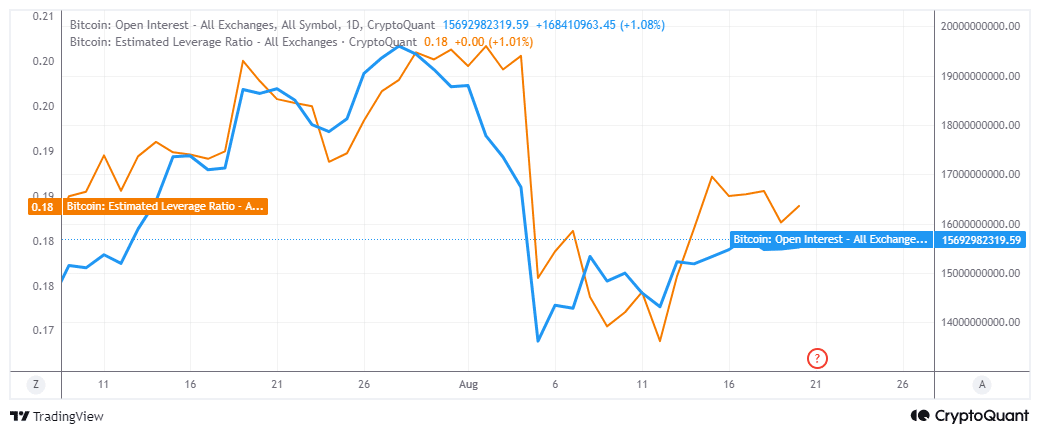

Demand for Bitcoin in the derivatives market is also increasing. This was evidenced by a rise in open interest following a rocky start earlier this month. Similarly, we have noticed a growing demand for leverage and a revival of interest.

Source: CryptoQuant

Despite the increase in open interest and leverage, it is clear that the market is still cautious. Recent sell-offs have left many traders feeling anxious, particularly with ongoing directional uncertainty.

While the current market conditions suggest an uptick in overall sentiment, Bitcoin remains vulnerable to both identifiable and uncertain risks. The selling pressure associated with Mt. Gox is one such risk.

There is also a less prominent risk: BTC dominance has been on a decline since August 10.

Source: TradingView

A minor pullback is expected given that Bitcoin dominance observed a strong surge since July 13. However, this could signal the beginning of a more pronounced downtrend moving forward.

If this is the case, liquidity may begin shifting in favor of altcoins, thereby limiting Bitcoin’s potential for growth.

Meanwhile, the demand for Bitcoin from major institutions signifies increasing competition. For instance, Microstrategy has been the main institutional investor, but that is no longer the case.

Recent figures indicate that BlackRock has been aggressively acquiring Bitcoin, and its BTC holdings are now nearly double those of Microstrategy.

This is an automatic translation of our English version.

- Bitcoin is showing signs of improving market sentiment, but short-term headwinds are still present and affecting its performance.

- Can Bitcoin gain enough momentum amid signs of declining dominance?

The investment landscape not Bitcoin [BTC] is experiencing a resurgence of confidence despite struggling to stay above $60,000. Retail activity and Bitcoin miners indicate positive sentiment.

Bitcoin and the broader cryptocurrency market are experiencing a return of confidence, contrary to earlier this month’s conditions. The fear and greed index currently stands at 26, having touched a high of 30 recently.

Source: Alternative.me

The Fear and Greed Index indicates that confidence in Bitcoin is currently higher than at the beginning of the year. However, this does not necessarily reflect complete market assurance, considering that it fell back to 26 in recent hours.

The possible reason for the recent downward pressure on BTC could be linked to a significant movement of 12,000 BTC, worth more than $700 million, associated with Mt. Gox.

Are Miners Hoarding Bitcoin?

Bitcoin miner reserves have shown a general decline over the past year, reflecting significant selling pressure within the market. However, miner reserve data shows a reversal trend in August when compared to July’s lows.

Source: Cryptoquant

Increasing demand for Bitcoin in the derivatives market has become evident, as reflected in rising open interest and a resurgence of leverage trading.

Source: CryptoQuant

Despite the uptick in open interest and trader engagement, a cautious sentiment prevails within the market as recent sell-offs have left many participants unsure about their positions.

While current market conditions suggest a recovery in overall sentiment, Bitcoin remains vulnerable to several risks, including the aforementioned Mt. Gox-related pressures.

Insights into Bitcoin’s Market Dynamics

Bitcoin’s dominance has been on a downward trajectory since August 10, a typical occurrence after a strong rally. However, a persistent decline could indicate a shift in investment towards altcoins, thereby limiting Bitcoin’s potential for further gains.

Source: TradingView

Additionally, institutional interest in Bitcoin is on the rise, leading to heightened competition in the market. For instance, Microstrategy was previously the leading institutional investor but has seen its position challenged. Recent reports indicate that Blackrock has aggressively ramped up its Bitcoin acquisitions, potentially overshadowing Microstrategy’s holdings.

Benefits of Investing in Bitcoin

- Decentralization: Bitcoin operates independently of centralized authorities, providing users with greater control over their financial assets.

- Blockchain Security: The underlying technology ensures a high level of security through cryptographic techniques.

- Potential for Growth: With increasing institutional adoption, Bitcoin’s value may continue to rise, presenting lucrative investment opportunities.

Practical Tips for Investors

- Do Your Research: Before investing in Bitcoin, ensure you understand its market dynamics, risks, and potential rewards.

- Diverse Portfolio: Consider diversifying your investments across different cryptocurrencies and asset classes.

- Long-term Perspective: Be prepared for market volatility. A long-term approach can often yield better results than day trading.

Case Studies: Successful Bitcoin Investments

Looking back at investors who bought Bitcoin during its early days serves as a reminder of its potential. Many individuals who purchased Bitcoin when it was valued at a few hundred dollars have seen returns exceeding thousands of percent. The lesson here is the importance of timing and foresight in investment strategies.

As Bitcoin’s ecosystem matures and market dynamics evolve, keeping an eye on its trends can provide insightful guidance for both novice and seasoned investors.