On Monday, May 9, bitcoin quotes updated at least since the summer of 2021. The price of the first cryptocurrency fell below $31,600.

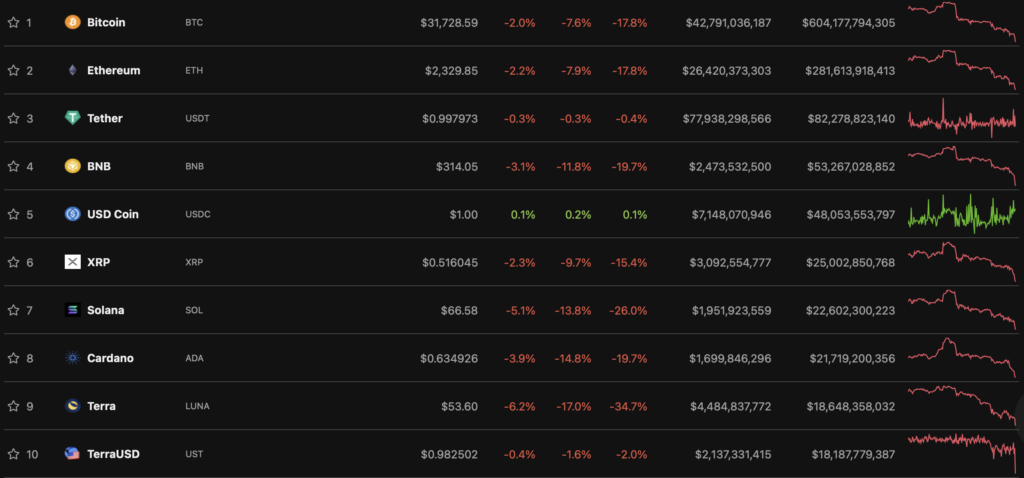

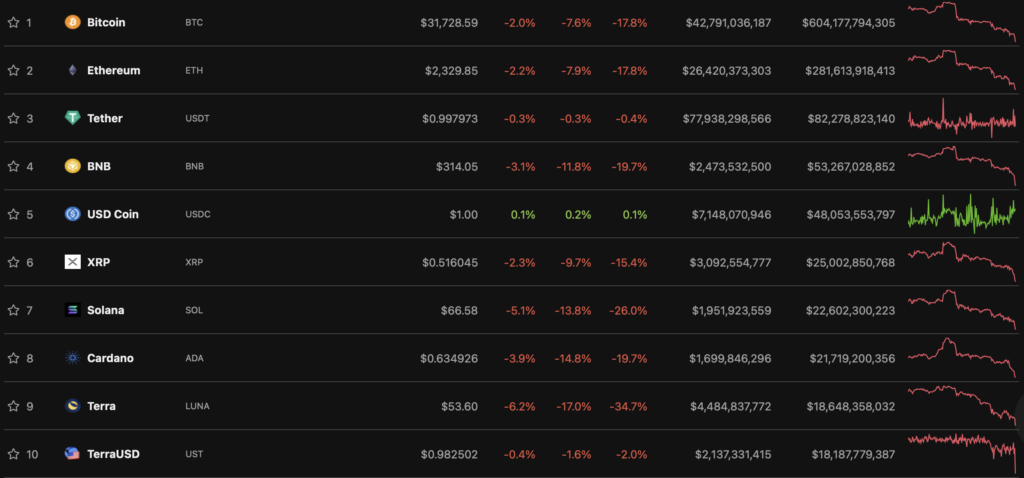

According to CoinGecko, over the past day, BTC has fallen in price by 7.6%, over the week – by 17.8%. Following the flagship, all crypto assets from the top 10 by capitalization were in the red zone.

Ethereum is trading at $2,329, losing 7.9% in a day. BTC dominance index – 39.4%, ETH – 18.2%.

According to Coinglassthe daily volume of liquidations in the futures market exceeded $270 million.

Unfavorable market prospects have led to a drop in the index of fear and greed to 11 points (“extreme fear”).

Bitcoin Fear and Greed Index is 11 — Extreme Fear

Current price: $34,041 pic.twitter.com/PQK3x6YMok— Bitcoin Fear and Greed Index (@BitcoinFear) May 9, 2022

On May 8, Glassnode’s lead analyst, Checkmate, noted that “many are waiting for the fuse of bitcoin capitulation.” The latter is usually characterized by a relatively long, sudden and catastrophic price drop, like collapse in March 2020.

Many of you are waiting for the #Bitcoin ‘capitulation wick’.

If it happens, and it really is THE capitulation wick, the majority of folks won’t step in a buy it because the fear will be too great.

This is the way it always is, and always will be.

Tip: have a plan, stick to it

— _Checkmate ????⚡???????? (@_Checkmatey_) May 8, 2022

“If this happens, and this is really a capitulation, most people will not buy [биткоин]because the fear is too great. It has always been and always will be, ”Checkmate emphasized.

Analyst Caleb Franzen noted the downward trend and did not rule out that “more pain is to be expected.”

Seems worthwhile to expect more pain. Those who embrace it will be best-off in the long-term.https://t.co/oCQfBkDDQa

— Caleb Franzen (@CalebFranzen) May 8, 2022

May 5, following a short surge in quotes once morest the background of raise Fed key rate price of the first cryptocurrency began to fall rapidlyclose to $35,000.

In April, former BitMEX CEO and co-founder Arthur Hayes predicted the fall of bitcoin to $30,000 at the end of the first half. He attributed this to a possible decline in the Nasdaq 100 (NDX), with which digital gold is highly correlated.

Analysts at Arcane Research have confirmed that the statistical relationship between Bitcoin and the Nasdaq index peaked from July 2020.

Recall, trader and head of Factor LLC Peter Brandt allowed the price to fall digital gold to $28,000.

Subscribe to the ForkLog channel at YouTube!

Found a mistake in the text? Select it and press CTRL+ENTER