The BoJ in the footsteps of the Fed ? The Bitcoin (BTC) price take a dip above $17,000, boosted by an unexpected move from the Japanese central bank. Nevertheless, the cryptocurrency fails to really regain key levels.

Bank of Japan Hikes Rates: Green Hiding Reds Ahead for Bitcoin Price?

Bitcoin price goes up up to $17,057 on Bitfinex today, December 20, 2022. The cryptocurrency is trading at $16,881 at the time of writing. Its price is currently registering a daily gain of 2.63%.

Bitcoin benefits from weaker dollar (DXY), as the Bank of Japan (BoJ) surprised markets, increasing the rate of its bond yields.

Although Bitcoin benefited from this move by the Japanese central bank in the immediate term, traders and analysts suggest that this rate hike will hurt all markets, especially those in risky assets, in the coming days or so. the next weeks.

The trader Christian H. Cooper has thus noted that a minor change in Bank of Japan policy “has huge implications that will take weeks to show up”. The trader foresees in particular a decline in stocks for weeks, as well as “chaos”.

Resistant averages, thicker red cloud and on a downward trajectory

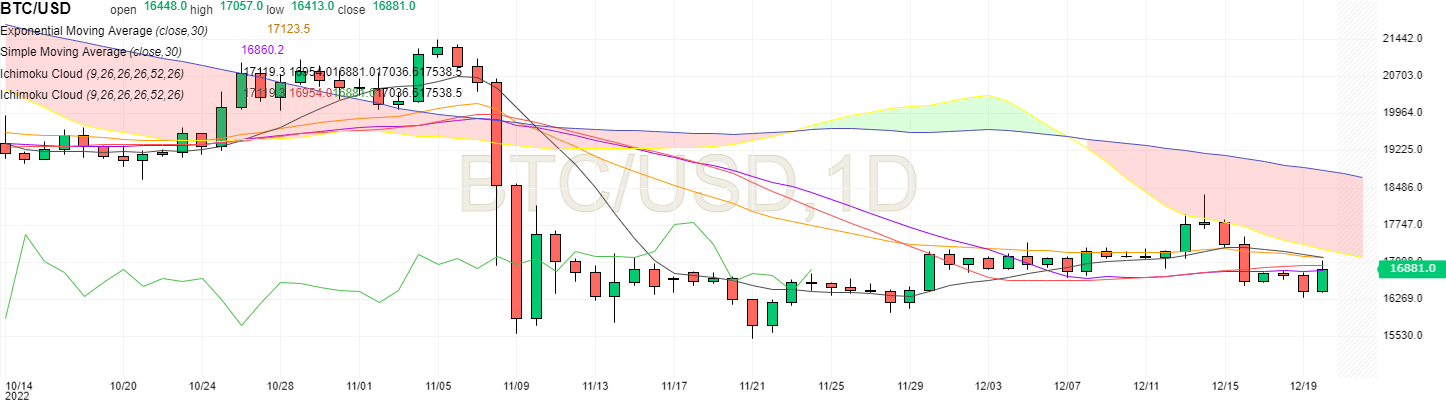

Despite this bullish momentum from Bitcoin boosted by dollar weakness, the cryptocurrency failed to touch the 30-day exponential moving average – in orange in the graph below – which stands at $17,123.

After crossing this level on December 13, Bitcoin rose above $18,000. He lost it on December 16, to come back later to around $16,300.

And while Bitcoin admittedly managed to break through the 30-day simple moving average at $16,860 – ligne violette – at the moment, the cryptocurrency does not show no conclusive signs of a lasting reconquest of this level, which has been acting as a resistance for several days.

Given these moves, can Bitcoin still sustainably return above $17,000 in the very near term, or will bear pressure increase and further complicate such a climb? ?

The Bitcoin price chart above in daily units shows that the Ichimoku Cloud, which is currently a major resistance area for the cryptocurrency, thickens and might go down to $17,000 in the next few days.

At this stage, a reconquest of $17,000 thus seems difficult without an exogenous factor that would have a strong enough impact, to allow Bitcoin to cross the resistance lines at the simple and exponential moving averages of the 30 days, as well as this red cloud.

The $14,000 scenario currently looks more believable, than a sustained rally above $17,000. And even if the cryptocurrency manages to get back above this level, a bullish continuation seems even more complicated.

In crypto, do not economize on caution! So, to keep your crypto assets safe, the best solution is still a personal hardware wallet. At Ledger, there is something for all profiles and all cryptos. Do not wait to put your capital in safety (commercial link)