- Bitcoin miners have been accumulating the coin for over a month.

- BTC gained bullish momentum over the past 24 hours as its value increased by 4%.

Bitcoin halving events have been one of the most significant occurrences in the history of cryptocurrencies, as they are vital in determining BTC’s future. Following each halving, BTC has historically taken time to build bullish momentum and reach new peaks.

With the last halving occurring a few months back, AMBCrypto decided to investigate whether BTC is adhering to its previous trends.

What are Bitcoin miners doing?

Ali, a well-known cryptocurrency analyst, recently posted a tweet highlighting intriguing information regarding BTC halving cycles.

According to the tweet, 119 days have passed since the 2024 Bitcoin halving. In the last two cycles, BTC reached a market peak about 530 days after the halving. If BTC follows a similar pattern, we may be looking at the early stages of a BTC bull cycle.

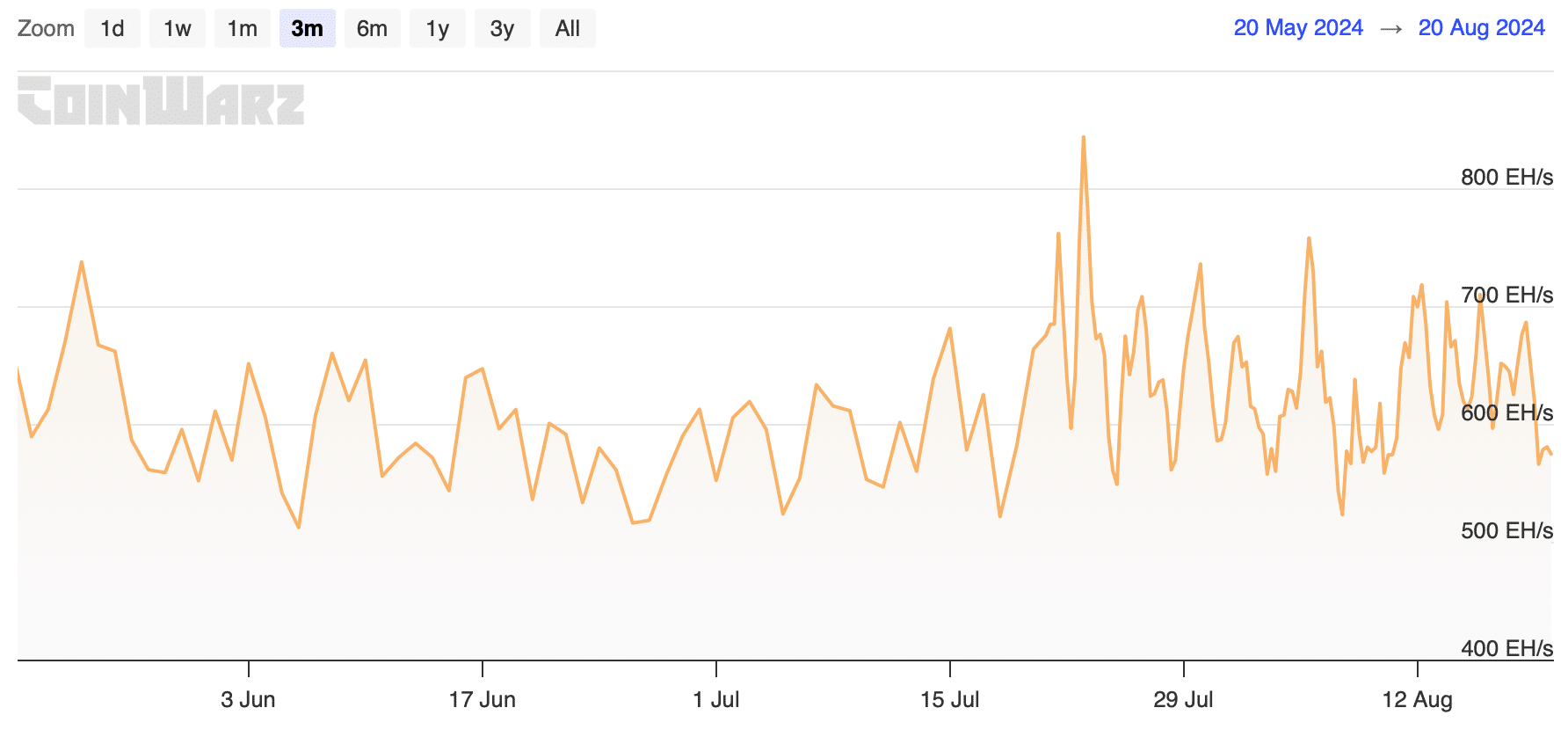

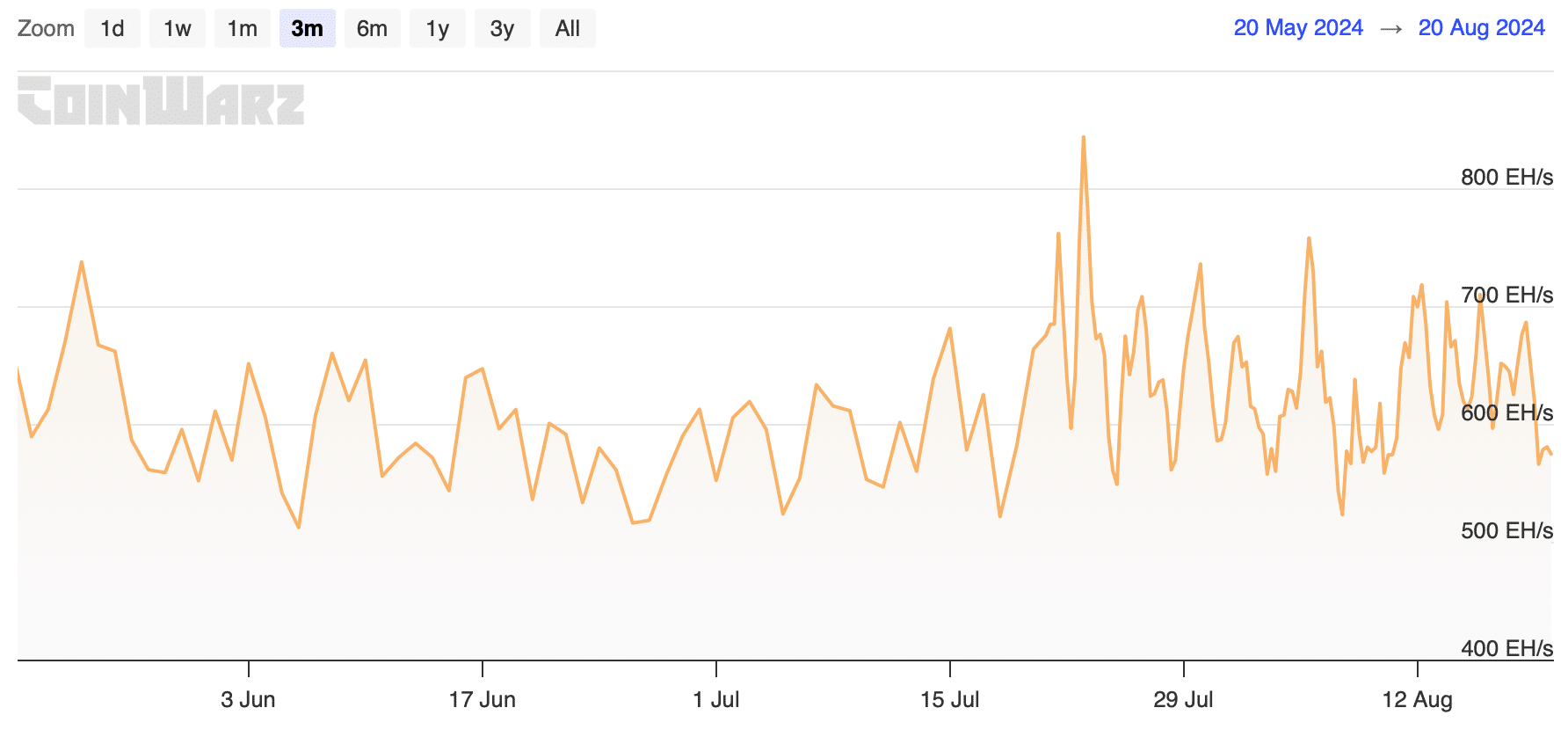

Since the halving, BTC’s hashrate has remained relatively stable, indicating that miners have continued their operations consistently. At the time of this writing, the BTC hashrate stood at 602.28 EH/s.

Source: CoinWarz

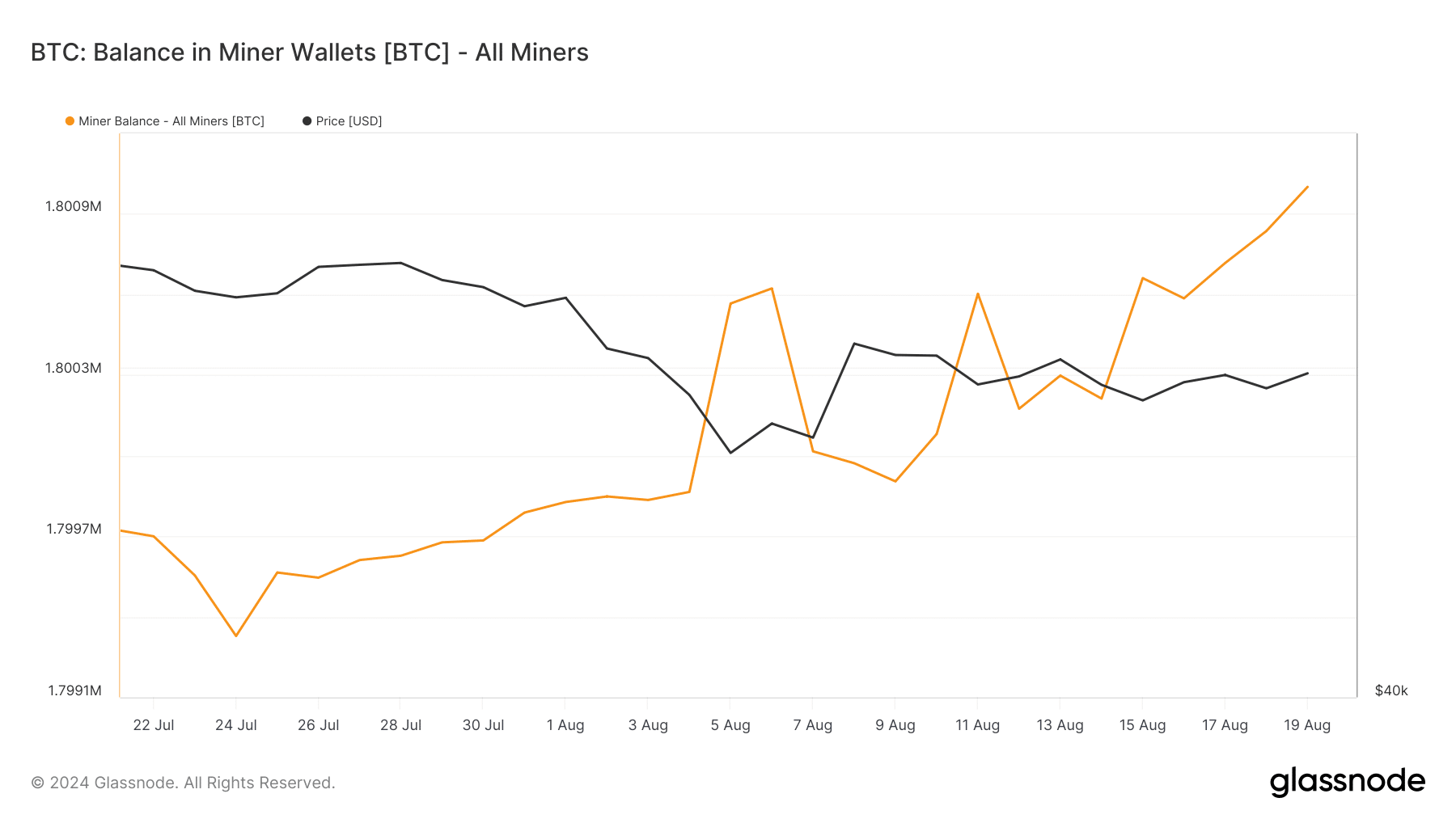

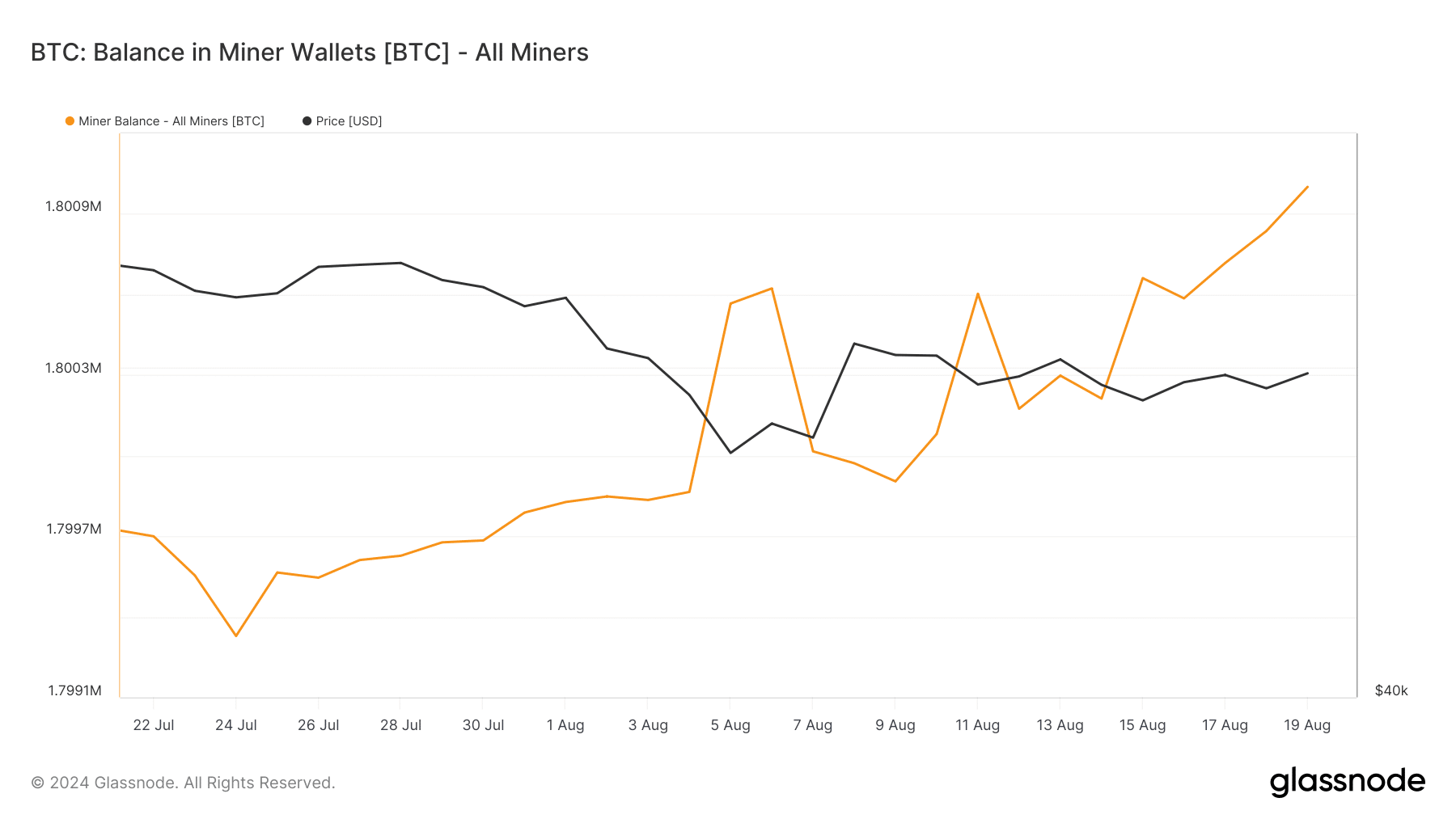

AMBCrypto also examined Glassnode data to evaluate the performance of BTC miners. Our findings indicated that BTC miners’ revenue has been on a downward trend over the past 30 days.

However, it was surprising to observe a notable increase in miners’ balances during the same timeframe, clearly indicating that miners were accumulating BTC while anticipating a price rise.

Furthermore, data from CryptoQuant revealed that the BTC Miners Position Index was in the green, suggesting that miners have been selling fewer holdings compared to their one-year average.

Source: Glassnode

The reason behind the miners’ accumulation

As miners continued to accumulate BTC, AMBCrypto explored other datasets to uncover the potential reasons behind this strategy.

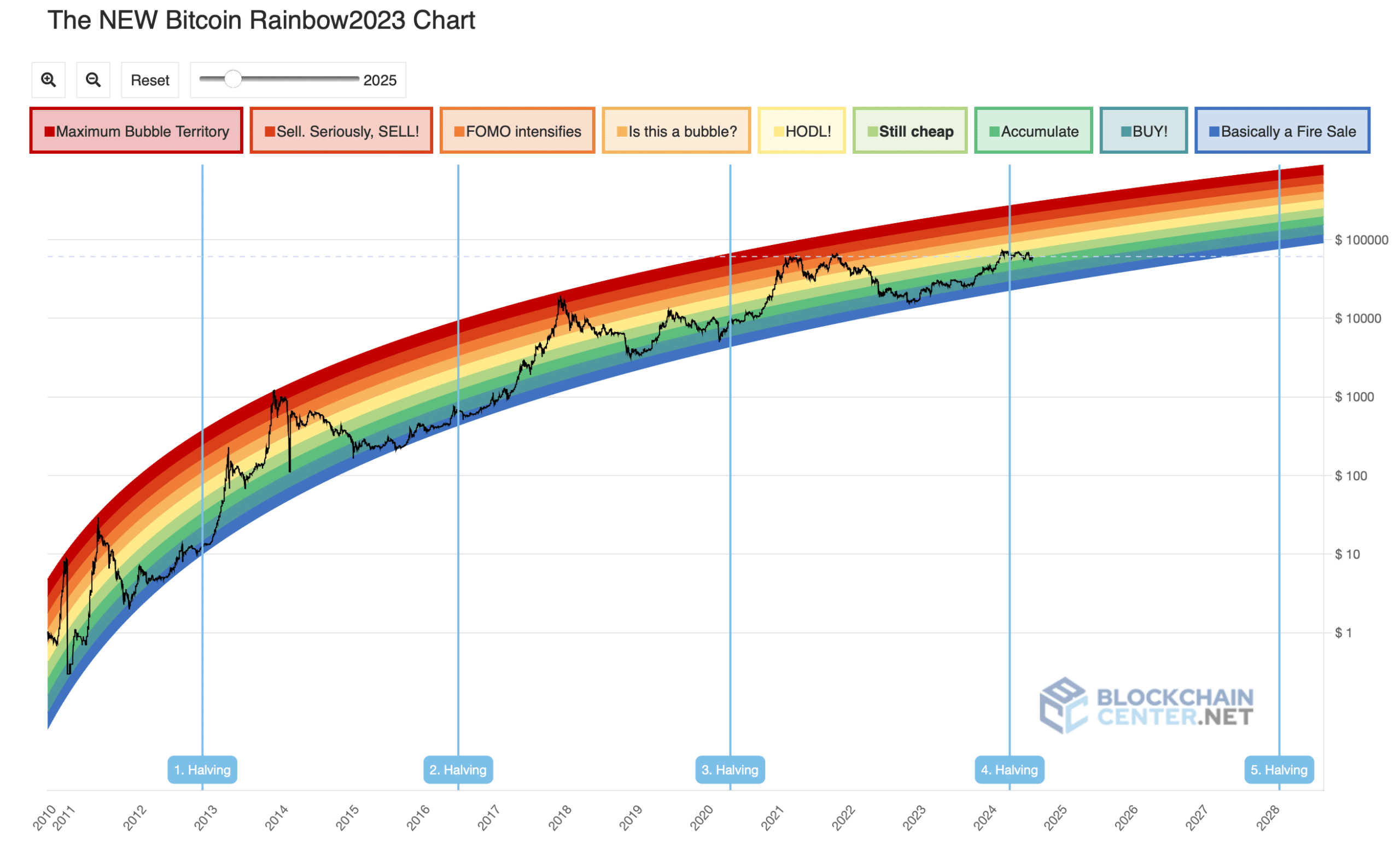

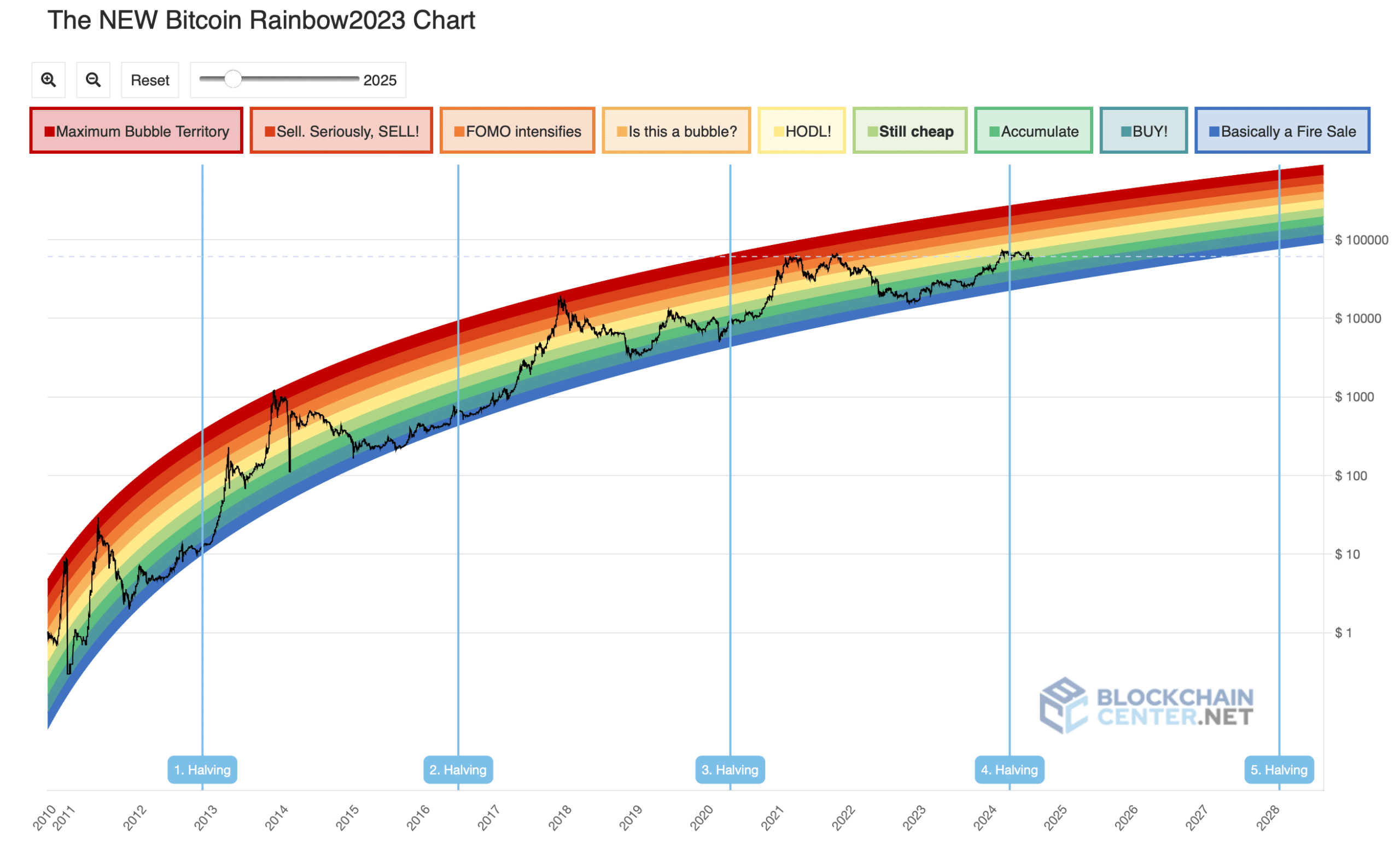

Bitcoin’s rainbow chart, an indicator that reveals BTC’s status in relation to its price, indicated that BTC was in the “accumulation” phase.

This suggests that it is an opportune time to purchase more before the coin’s price gains bullish momentum.

Source: Blockchaincenter

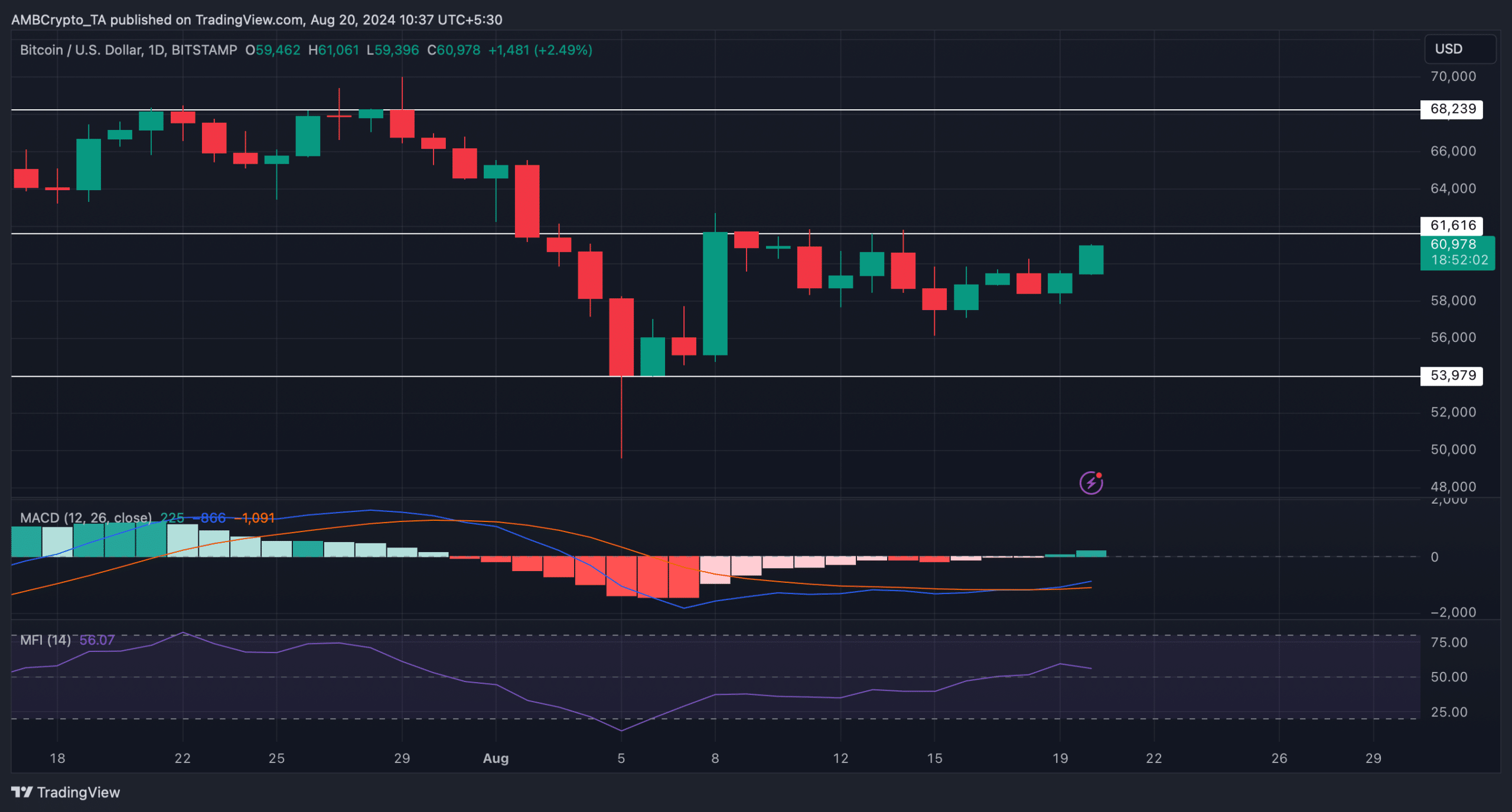

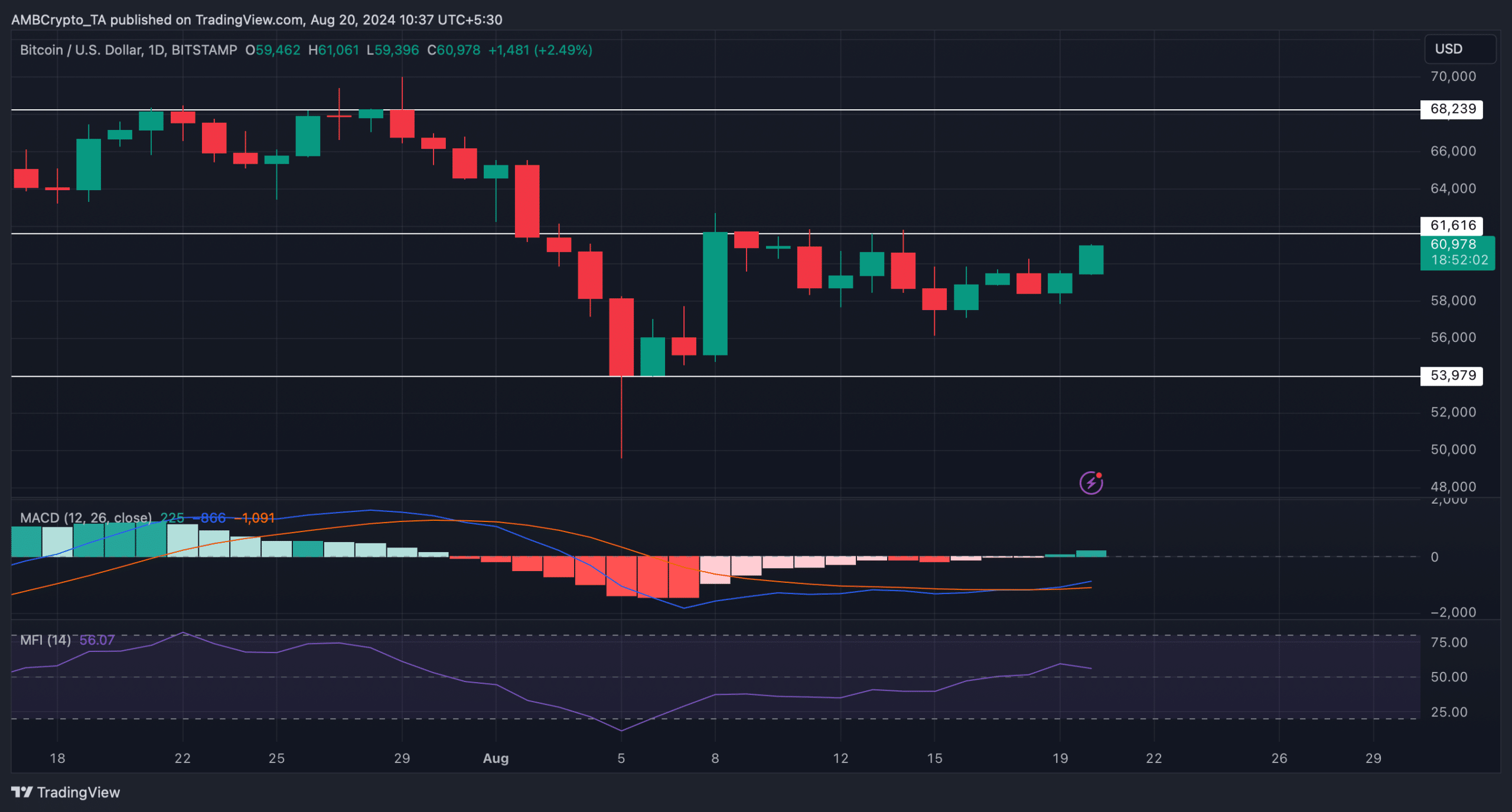

The data from CoinMarketCap indicates that BTC bulls have entered the market, as the coin’s price surged by 4% over the past 24 hours. At the time of this writing, BTC was trading at $60,930.84, with a market cap exceeding $1.2 trillion.

AMBCrypto then analyzed the coin’s daily chart to evaluate whether this upward trend would persist.

The MACD technical indicator displayed a clear bullish crossover, suggesting a high likelihood of continued price increases. However, the Money Flow Index (MFI) showed a decline.

This indicates that investors might experience a few days of stagnant movement.

Source: TradingView

This is an automatic translation of our English version.

- Bitcoin miners have been accumulating the coin for over a month.

- BTC gained bullish momentum over the past 24 hours as its value increased by 4%.

The halvings of Bitcoin (BTC) have been one of the most notable events in the history of cryptocurrencies as they play a crucial role in shaping the future of BTC. After each halving, BTC took its time to gain bullish momentum and reach new highs. Since the last halving occurred a few months ago, AMBCrypto planned to check if BTC has been following its past trend.

What are Bitcoin Miners Doing?

Ali, a popular cryptocurrency analyst, recently published a tweet mentioning interesting information related to BTC halving cycles. According to the tweet, it has been 119 days since the 2024 Bitcoin halving. In the last two cycles, BTC reached a market high around 530 days after the halving. If BTC follows a similar trend, then these could be the early stages of the BTC bull cycle.

Since the halving, BTC’s hashrate has been fairly stable, indicating that miners continued their operations at a steady pace. As of now, the hashrate for BTC was at 602.28 EH/s.

Fuente: CoinWarz

AMBCrypto looked into Glassnode data to find out how BTC miners were performing. Our analysis revealed that BTC miners’ revenue has been on a downward trend for the past 30 days. Surprisingly, there has been a significant increase in miners’ balance over the same period, indicating that miners were accumulating BTC while waiting for a price increase.

Additionally, data from CryptoQuant indicated that the BTC Miners Position Index was green, showing that miners were selling fewer holdings compared to their one-year average.

Fuente: Glassnode

The Reason Behind the Accumulation of Miners

As miners were accumulating BTC, AMBCrypto explored additional data sets to uncover the possible reasons behind this strategy. Bitcoin’s rainbow chart, an indicator that reveals the state of BTC in regards to its price, suggested that BTC was in the “accumulation” phase. This essentially implies that now is the right time to buy more before the price gains bullish momentum.

Fuente: Blockchaincenter

The data from CoinMarketCap shows that BTC bulls have entered the market over the past 24 hours, as the coin’s price surged by 4%. At present, BTC was trading at $60,930.84 with a market cap exceeding $1.2 trillion.

AMBCrypto then evaluated the coin’s daily chart using technical analysis indicators to determine whether the uptrend would be sustained. The MACD indicator displayed a clear bullish crossover, indicating a high probability of continued price increases. However, the Money Flow Index (MFI) recorded a decline, suggesting that investors might experience a few days of slow movement.

Source: TradingView

Benefits of BTC Mining Accumulation

The practice of accumulation by Bitcoin miners has various benefits:

- Strategic Advantage: Miners can sell their accumulated assets at higher prices in future bullish cycles.

- Market Influence: Large accumulations can impact BTC’s market price positively; a confident sign for retail investors.

- Long-Term Stability: Focused accumulation may lead to sustained growth for the BTC ecosystem.

Case Studies: Historical Miners’ Accumulation Patterns

Historical data indicates that after significant halving events, mining operations have consistently followed accumulation phases before bullish runs. For instance, in 2020 post-halving, BTC miners began holding onto their reserves instead of selling, leading to a substantial increase in BTC prices. Such patterns can offer predictive insights into current and future miner behaviors.

Practical Tips for Investors

If you’re looking to gain insights into BTC mining and investing strategies, consider the following tips:

- Monitor Market Sentiment: Use tools like the Fear and Greed Index to gauge investor emotions and trends.

- Analyze Hashrate Recovery: Pay close attention to changes in hashrate as it can indicate miner confidence.

- Keep Up with Technical Indicators: Regularly review MACD and MFI indicators for potential market signals.

Understanding these interconnected factors can help make informed decisions in the volatile cryptocurrency market.