Recently, Bitcoin has shown significantly more strength than Ethereum

The price of Bitcoin has recently reached levels close to the highs from around four weeks ago, effectively recovering nearly all losses incurred since that time. In contrast, Ethereum’s price remains about halfway to its recent peak set on August 24, 2024. A key factor in this disparity has been the recent purchase of over 7,000 Bitcoins by Microstrategy, as announced by Michael Saylor on X.

Since yesterday, the tide appears to be turning, with Ethereum gaining more dominance

While Bitcoin is seeing a slowdown in its upward movement, Ethereum has been experiencing more dynamic growth since yesterday, and it has been notably stronger than Bitcoin since Thursday of this week. This potential shift in dominance warrants close observation, as several fundamental aspects may evolve from it.

If Ethereum takes control, it will benefit the Altcoin sector

At this early stage, it might be somewhat premature to discuss an altcoin rally or the beginning of the long-anticipated altcoin season, but who knows what will become of this currently fragile crypto landscape? Discover more in the video!

This video is already available today on my YouTube channel and has been published here on Finanzmarktwelt with a direct link.

The YouTube channel is currently undergoing renovation, and I welcome comments, likes, and of course, new subscribers—so please subscribe!

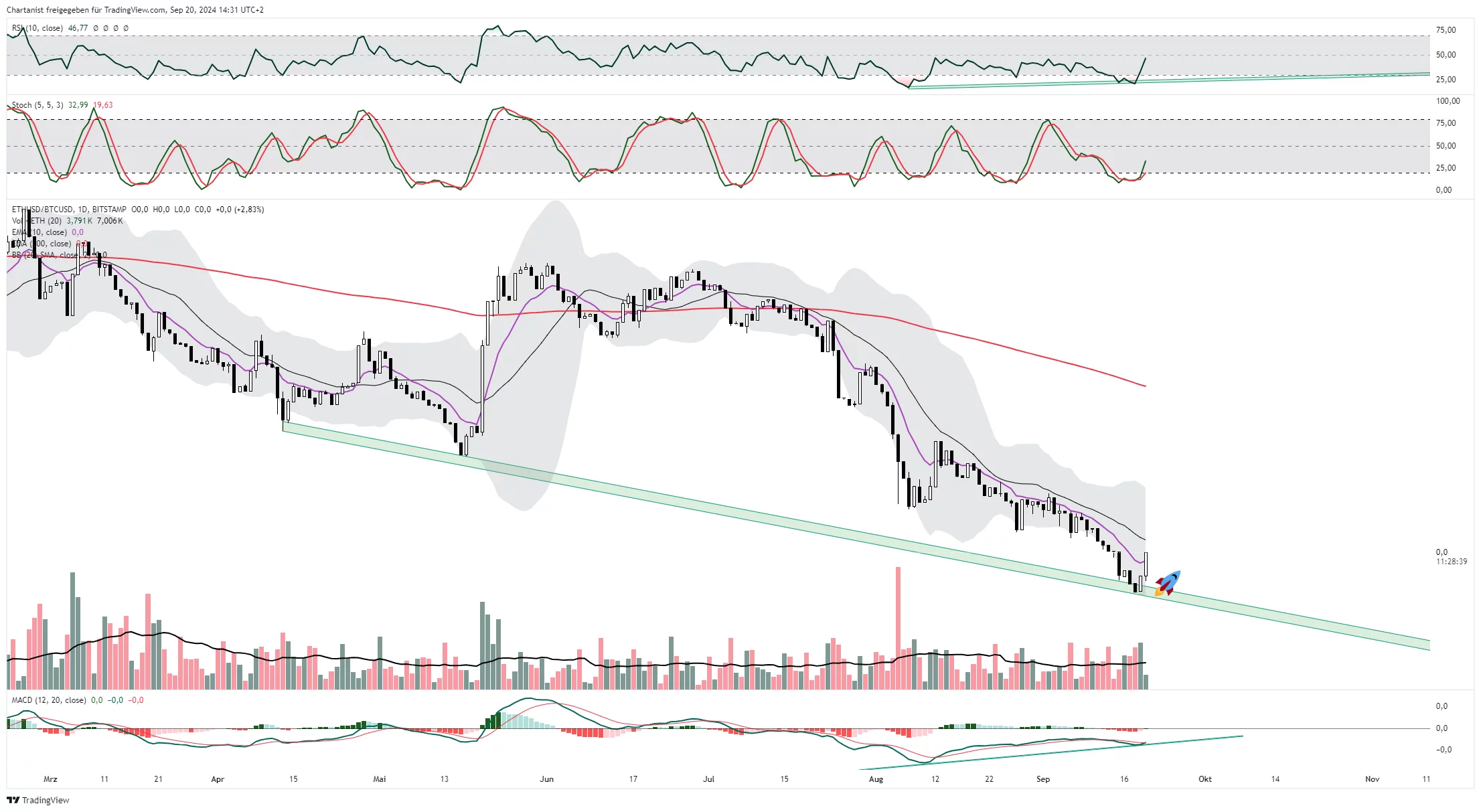

The chart(s) discussed in the video(s) were/are made available via Tradingview!

More articles from me can be found on Finanzmarktwelt here!

Michael Borgmann – Technical Analyst

Risk warning: Trading in securities and financial instruments can expose your capital to significant risks, potentially exceeding the invested capital. Trading is not suitable for everyone. Past performance does not guarantee future results. The analyses presented here do not constitute investment advice and should not be seen as a recommendation to buy or sell a security, futures contract, or any other financial instrument. The analyses provided are for informational purposes only and cannot replace individualized consultation. Liability for direct or indirect consequences of these suggestions is, therefore, excluded.

Bitcoin vs Ethereum: The Current Market Dynamics

The cryptocurrency market has been buzzing with activity lately, particularly regarding the performance of Bitcoin and Ethereum. Bitcoin has demonstrated significant strength, nearing its recent highs from four weeks ago. In fact, Bitcoin’s recovery has been so robust that it has almost completely negated the losses experienced during that timeframe. In contrast, Ethereum’s price is lagging behind, sitting at approximately halfway between its current value and the interim highs reached on August 24, 2024. This disparity in performance can be partially attributed to Microstrategy’s recent announcement of additional Bitcoin purchases, which saw the company acquire over 7,000 Bitcoin, as stated by Michael Saylor on X.

The Shift in Market Sentiment: Ethereum’s Growing Dominance

As of yesterday, signs indicate a possible shift in market dynamics. Ethereum has started to show more strength compared to Bitcoin. This trend is especially noteworthy since Thursday, when Ethereum’s growth outpaced Bitcoin’s gains. Such shifts in market sentiment and asset dominance warrant close observation, as they may herald broader changes in the cryptocurrency landscape.

The Implications of Increased Ethereum Dominance

While it may be too early to declare the onset of an altcoin rally or an “altcoin season,” Ethereum’s resurgence could potentially fuel growth in the broader altcoin sector. If Ethereum continues its upward trajectory, it may pave the way for other cryptocurrencies to follow suit, essentially invigorating the entire market. Investors should keep a close eye on Ethereum’s movements to capitalize on potential market shifts.

Factors Influencing Ethereum Growth

- Network Upgrades: Ethereum has constantly been evolving, with significant upgrades such as Ethereum 2.0 aimed at improving scalability and reducing transaction fees.

- Increased Adoption: As more decentralized applications (dApps) and smart contracts are built on Ethereum’s platform, the demand for ETH increases.

- Investments and Institutional Interest: Institutional investments in Ethereum have been growing, enhancing its credibility and stability as a digital asset.

Monitoring the Market: Tips for Investors

For crypto investors looking to navigate this shifting landscape, here are some practical tips to consider:

- Diversification: Consider holding both Bitcoin and Ethereum to balance out your portfolio. This can help mitigate risks associated with volatility.

- Stay Informed: Keep abreast of market news, trends, and analysis to make informed decisions. Utilize platforms like Twitter and specialized news outlets.

- Utilize Technical Analysis: Leverage tools like TradingView for charting and market analysis. Understanding support and resistance levels can be crucial.

- Set Clear Goals: Define your investment strategy by setting clear entry and exit points. This discipline can help manage emotions during market fluctuations.

Case Studies: Successful Ethereum Investments

To illustrate the potential of Ethereum investment, let’s look at some notable cases:

| Investor | Date of Investment | Investment Amount (ETH) | Value at Peak (USD) | Percentage Gain |

|---|---|---|---|---|

| Investor A | January 2021 | 10 ETH | $40,000 | 300% |

| Investor B | March 2021 | 5 ETH | $20,000 | 200% |

| Investor C | July 2021 | 15 ETH | $60,000 | 400% |

Upcoming Features and News

This changing tide in Ethereum’s favor could be bolstered by upcoming features and news, which may further enhance investor sentiment. Some of the anticipated developments include:

- Layer 2 Scaling Solutions: The implementation of technologies such as Optimistic Rollups may increase transaction speeds and decrease costs.

- Partnerships and Collaborations: As Ethereum partners with more companies, it solidifies its position within the decentralized finance (DeFi) ecosystem.

- Regulation Clarity: As regulatory frameworks around cryptocurrencies evolve, clearer laws can attract more institutional investors to legitimize and bolster Ethereum and other digital currencies.

For further insights, you can explore detailed video analysis on my YouTube channel. There, I delve deeply into the fluctuating dynamics of Ethereum and market predictions. Don’t forget to subscribe for more analysis and up-to-date information.

The charts and visuals referenced in this article have been generated using TradingView, a vital tool for traders and analysts alike.

For more articles and analyses from me on Finanzmarktwelt, visit my author page for plenty of valuable information.

Author: Michael Borgmann – Technical Analyst

Risk warning: Trading in securities and financial instruments can expose your capital to considerable risks, possibly even beyond the capital invested. Trading is not suitable for everyone. Past performance is no guarantee of future performance. The analyses shown here do not constitute investment advice and are therefore not a recommendation to buy or sell a security, a futures contract or any other financial instrument. The analyses provided are intended for information purposes only and cannot replace an individual consultation. Liability for direct or indirect consequences of these suggestions is therefore excluded.

Read and write comments, click here