On Wednesday, September 21, the US Federal Reserve System (FRS) raised the key rate range by 75 basis points at once, to 3-3.25%. The cryptocurrency market reacted with a fall.

“The central bank aims to achieve maximum employment and inflation at 2% in the long term,” the Fed said in a statement.

The department will also continue to reduce the holdings of treasury and mortgage-backed securities, as well as agency debt. The Fed once once more noted the global economic difficulties.

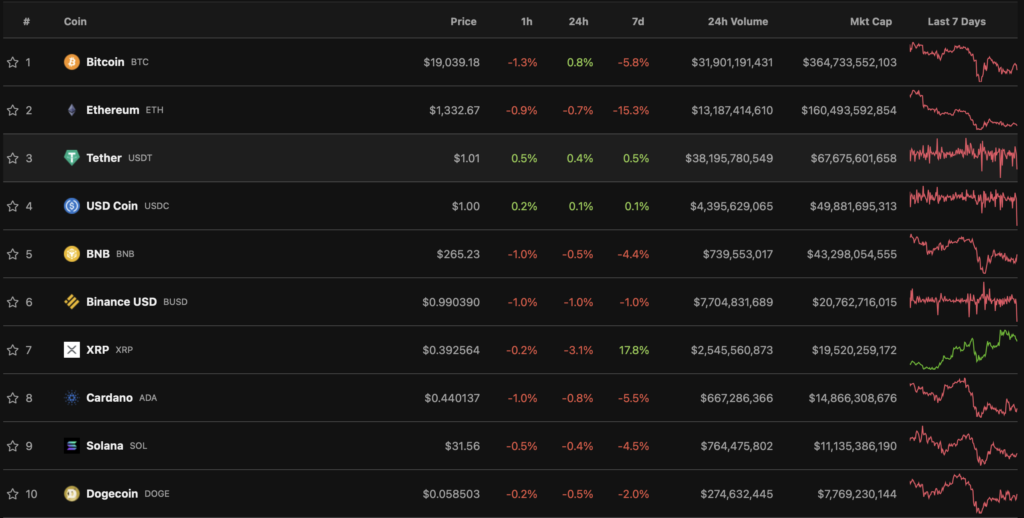

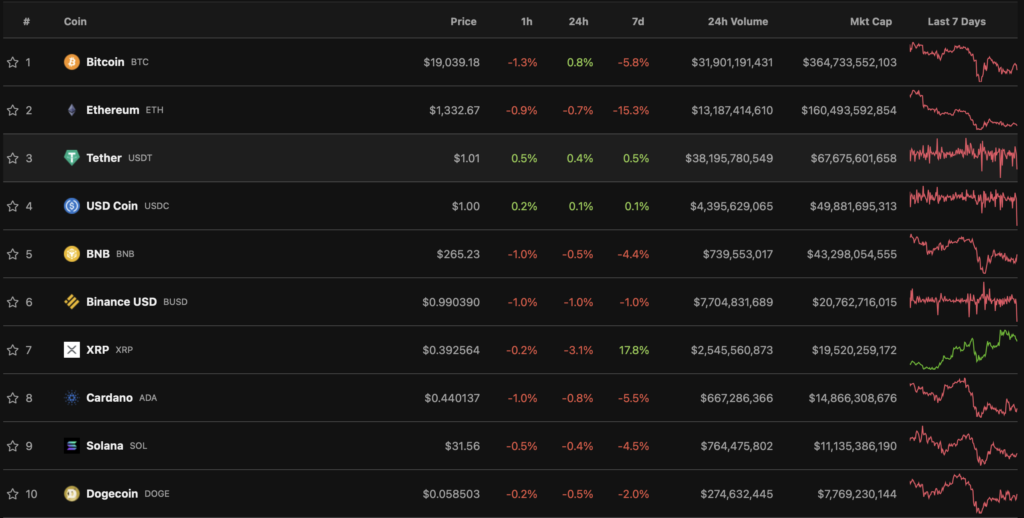

Against the backdrop of the news, the price of bitcoin fell below $19,000. At the moment, digital gold quotes dropped to $18,666.

Most of the top 10 cryptocurrencies by capitalization were in the red zone. XRP (-3.1%), Cardano (-0.8%) and Ethereum (-0.7%) lost more than others in the last 24 hours.

According to CoinMarketCapthe total market capitalization of cryptocurrencies is regarding $920 billion.

In March, the Fed for the first time since 2018 raised the key rate up to 0.25–0.5%. The local rally of cryptocurrencies continued until April – Bitcoin and Ethereum reached annual highs.

B has the Fed raised the stake once more – by 50 b. p. On the background of the news, bitcoin crossed the $40,000 mark, but on the same day failed the $36,000 levelwhich was the beginning of a protracted correction.

In June the Fed raised the key rate immediately at 75 b. n. for the first time since 1994. The indicator reached the level of 1.5–1.75%, to which bitcoin reacted with a short-term increase to $22,000, and then crashed below $18,000.

Remember, July rate increase up to 2.25-2.5% led to the growth of the cryptocurrency market. Bitcoin then crossed the $22,000 mark, and Ethereum – $1,500.

At the end of the summer, digital gold reacted to the speech of the head of the Fed, Jerome Powell falling below $21,000.

Read ForkLog bitcoin news in our Telegram – Cryptocurrency news, courses and analytics.

Found a mistake in the text? Select it and press CTRL+ENTER