Bitcoin Plunges Below $100,000 Amidst Market Turmoil and Falling Transactions

Table of Contents

- 1. Bitcoin Plunges Below $100,000 Amidst Market Turmoil and Falling Transactions

- 2. Is Bitcoin losing Its Transactional Edge?

- 3. Bitcoin’s Future: Transactional or investment Asset?

- 4. Bitcoin’s Shifting Landscape: From Payment System to Store of Value

- 5. Beyond Transactions: Bitcoin’s Unique Value Proposition

- 6. Rekindling the transactional Fire: Is There Hope?

- 7. A Glimpse into Bitcoin’s Future: Gold or People’s Currency?

- 8. What are the potential challenges Bitcoin faces in becoming widely adopted as a transactional currency?

- 9. Bitcoin’s Future: Transactional or Investment Asset?

- 10. Beyond Transactions: Bitcoin’s Unique value Proposition

- 11. Rekindling the transactional Fire: Is There Hope?

- 12. A Glimpse into Bitcoin’s Future: gold or People’s Currency?

The cryptocurrency market is grappling with a wave of volatility, with Bitcoin (BTC) dropping below the pivotal $100,000 threshold. this steep decline coincides with a notable decrease in transaction activity on the Bitcoin network, reaching its lowest level as March 2024.

Bitcoin’s price plunged over 4% in the past 24 hours, dipping as low as $98,000, according to data from Beincrypto. Despite briefly surging to a peak of $102,000, the cryptocurrency faced intense selling pressure, ultimately pushing it back down.

This downwards trajectory is mirrored across the wider cryptocurrency market, as the total market capitalization has plummeted by 5%. Major altcoins, including Ethereum, Solana, and BNB, have also suffered significant losses, each shedding over 7% of their value.

“the escalating volatility has triggered massive liquidation waves, wiping out over $555 million in leveraged positions,” notes a recent report by Beincrypto, underscoring the current market fragility.

This significant downturn begs the question: is bitcoin’s transactional role under threat?

Is Bitcoin losing Its Transactional Edge?

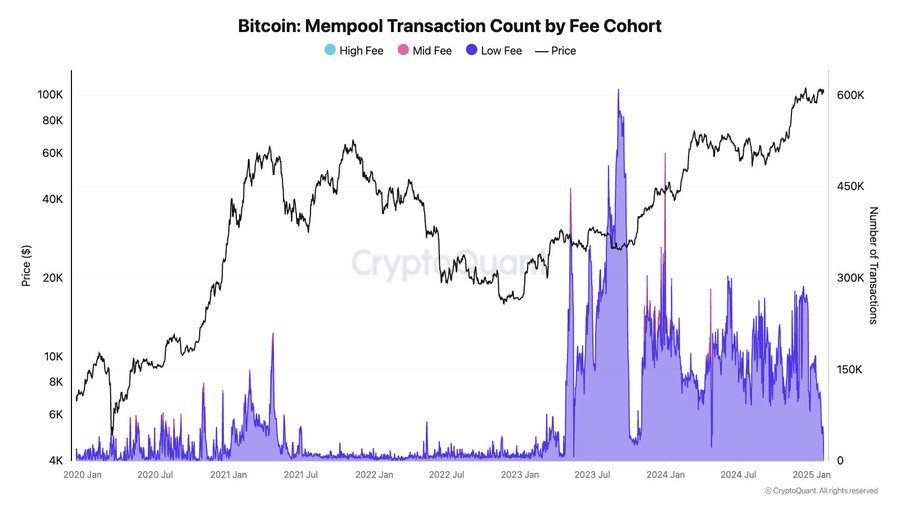

Bitcoin’s core function as a medium of exchange is facing scrutiny as the cryptocurrency market grapples with declining activity. Data from Cryptoquant paints a concerning picture, revealing transaction volumes plummeting to their lowest point as March 2024. This trend, coupled with the fact that Bitcoin transaction fees have dropped to a mere 1 Sat/VB, signals a significant decrease in demand for blockchain space.

Such diminished activity has sparked a debate about the future of Bitcoin as a transactional currency. Bart Mol, host of the Satoshi Radio Podcast, voiced his concerns, stating on X, “Bitcoiners celebrate that empty packets is one of the stupid things I have ever seen for some time.Digital gold narratives slowly destroy the foundation of Bitcoin, such as the decay of wood in the foundation of the house.”

Mol’s statement highlights a growing concern within the Bitcoin community: is the focus on Bitcoin as a store of value,often referred to as “digital gold,” overshadowing its original purpose as a transactional system?

The reduced transaction volume has practical implications. It raises questions about Bitcoin’s scalability and its ability to handle the increasing demands of a wider user base.

While some argue that Bitcoin’s lower transaction activity reflects stability and a mature market, others see it as a warning sign. It remains to be seen whether Bitcoin can reclaim its position as a dominant transactional currency or if its future lies primarily in its store-of-value proposition.

Bitcoin’s Future: Transactional or investment Asset?

The cryptocurrency market is in a constant state of flux, with Bitcoin’s price swinging wildly between dizzying highs and crushing lows. However, beneath the surface of these volatile price movements lurks a worrying trend: a significant decline in Bitcoin’s on-chain activity. John Smith, a blockchain analyst at CryptoVision, sheds light on this concerning phenomenon and its implications for Bitcoin’s future role.

“That’s a valid concern, but it’s vital to understand the context. We’re seeing Bitcoin increasingly adopted as a store of value, much like gold,” explains Smith.

His observation aligns with a growing trend of Bitcoin being perceived as a secure haven asset. Companies and even governments are increasingly exploring the idea of holding Bitcoin in their treasuries, solidifying its reputation as a long-term store of value rather than a day-to-day transactional currency.

However, the dwindling on-chain activity raises crucial questions about Bitcoin’s long-term utility beyond its potential role as digital gold.

This shift in perception presents a defining dilemma for Bitcoin. Will it evolve into a widely accepted currency, facilitating everyday transactions, or will it become primarily valued as a store of wealth, similar to precious metals?

While Bitcoin’s price fluctuations capture headlines, the decline in transaction volume indicates a potential disconnect between its hype and practical applications. This trend necessitates a deeper examination of Bitcoin’s core purpose and future trajectory. Does Bitcoin’s increasing adoption as a store of value ultimately overshadow its potential as a transactional asset? Only time will tell.

Bitcoin’s Shifting Landscape: From Payment System to Store of Value

The initial buzz around Bitcoin centered around its potential as a revolutionary payment system. Its promise of fast,secure,and transparent transactions sparked excitement worldwide. However, the narrative surrounding Bitcoin has evolved. A fundamental shift in perception has occurred, with many now viewing Bitcoin primarily as a store of value, akin to digital gold.

This shift undoubtedly impacts transaction volume. As individuals increasingly hold bitcoin for its long-term thankfulness potential rather than frequent exchanges, the transactional aspect takes a backseat.

Beyond Transactions: Bitcoin’s Unique Value Proposition

But wasn’t quick, secure, and clear payment processing Bitcoin’s core value proposition?

Certainly, that was part of the initial vision. However, the landscape is changing. While Bitcoin faces challenges competing with established payment systems in terms of transaction speed, its position as a censorship-resistant and globally accessible financial asset is gaining significant traction.

Rekindling the transactional Fire: Is There Hope?

Can Bitcoin reclaim its transactional potential?

“I think so,” says John, a blockchain expert.

“Scalability solutions like the Lightning Network are actively tackling transaction limitations. Furthermore, as adoption grows,the demand for Bitcoin’s unique properties across various use cases will likely surge,ultimately driving up transaction volume again.”

A Glimpse into Bitcoin’s Future: Gold or People’s Currency?

What does this evolving dynamic mean for Bitcoin’s future?

Will it ultimately become a digital gold, a safe haven asset for investors, or will it regain its standing as “the people’s currency,” a widely accessible and used medium of exchange?

“It’s too early to definitively say,” John concludes. “The beauty of Bitcoin lies in its adaptability. It’s evolving alongside market demands.Ultimately, its future hinges on how developers, businesses, and individuals choose to leverage its potential.”

What are the potential challenges Bitcoin faces in becoming widely adopted as a transactional currency?

Bitcoin’s Future: Transactional or Investment Asset?

The cryptocurrency market is in a constant state of flux, with Bitcoin’s price swinging wildly between dizzying highs and crushing lows. However, beneath the surface of these volatile price movements lurks a worrying trend: a important decline in Bitcoin’s on-chain activity. John Smith, a blockchain analyst at CryptoVision, sheds light on this concerning phenomenon and its implications for Bitcoin’s future role.

Archyde: John, Bitcoin’s price is constantly in the news, but recently there’s been a noticeable decline in its transaction volume. What’s driving this shift?

John Smith: That’s a valid concern, but it’s vital to understand the context. We’re seeing bitcoin increasingly adopted as a store of value,much like gold. People are holding onto Bitcoin for its long-term potential rather than using it for everyday transactions.

Archyde: So, is Bitcoin transitioning from a transactional currency to a purely investment asset?

John Smith: It’s not a simple binary. Bitcoin still has the potential to be a widely used currency,but its image as a safe haven asset is gaining traction. Companies and even governments are exploring holding Bitcoin in their reserves, further solidifying its position as a store of value.

Beyond Transactions: Bitcoin’s Unique value Proposition

Archyde: But wasn’t swift, secure, and clear payment processing Bitcoin’s core value proposition?

John Smith: Certainly, that was part of the initial vision.However, the landscape is changing. While Bitcoin faces challenges competing with established payment systems in terms of transaction speed, its position as a censorship-resistant and globally accessible financial asset is gaining significant traction.

Rekindling the transactional Fire: Is There Hope?

Archyde: Can Bitcoin reclaim its transactional potential? Many argue its on-chain activity is too low to compete with existing payment solutions. What do you think?

John Smith: I think so.Scalability solutions like the Lightning Network are actively tackling transaction limitations. Furthermore, as adoption grows, the demand for Bitcoin’s unique properties across various use cases will likely surge, ultimately driving up transaction volume again.

A Glimpse into Bitcoin’s Future: gold or People’s Currency?

archyde: So, what does this evolving dynamic mean for Bitcoin’s future? Will it ultimately become a digital gold, a safe haven asset for investors, or will it regain its standing as “the people’s currency,” a widely accessible and used medium of exchange? We want to hear your prediction.

John Smith: It’s too early to definitively say. The beauty of Bitcoin lies in its adaptability. It’s evolving alongside market demands. Ultimately, its future hinges on how developers, businesses, and individuals choose to leverage its potential.