- After reaching $61k, BTC experienced a price correction.

- Selling pressure on the currency increased in the last 24 hours.

In the last 24 hours, optimism in the cryptocurrency market rose as Bitcoin [BTC], the leading cryptocurrency, regained the $61k mark. However, this trend was short-lived as the coin underwent a price correction. Let’s take a closer look at the current situation with BTC.

Bitcoin Faces Another Bearish Trend

The leading cryptocurrency gained bullish momentum and managed to surpass $61k on August 20. However, the situation changed swiftly as the bears took charge of the market.

According to CoinMarketCap, the price of BTC declined by more than 2.5% in the past 24 hours. As of this writing, the coin was trading at $59,378.99, with a market cap exceeding $1.17 trillion.

This recent price correction was not surprising.

Ali, a well-known cryptocurrency analyst, tweeted that BTC’s TD sequence had indicated a sell signal. Soon after the signal was noted, the coin’s price underwent a correction.

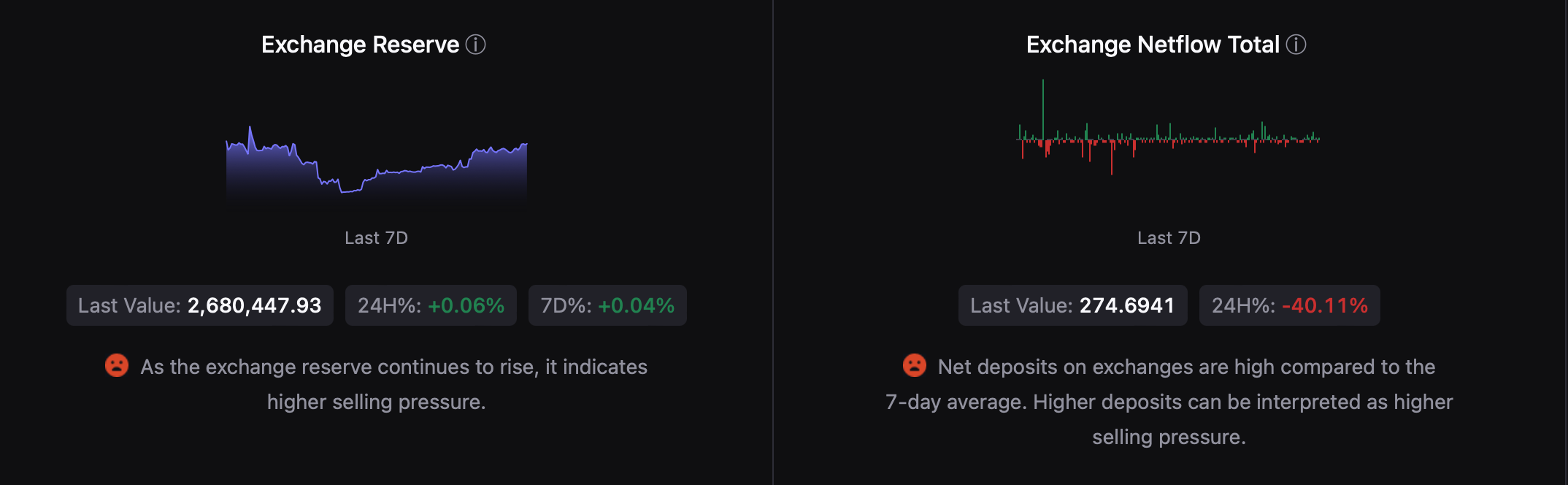

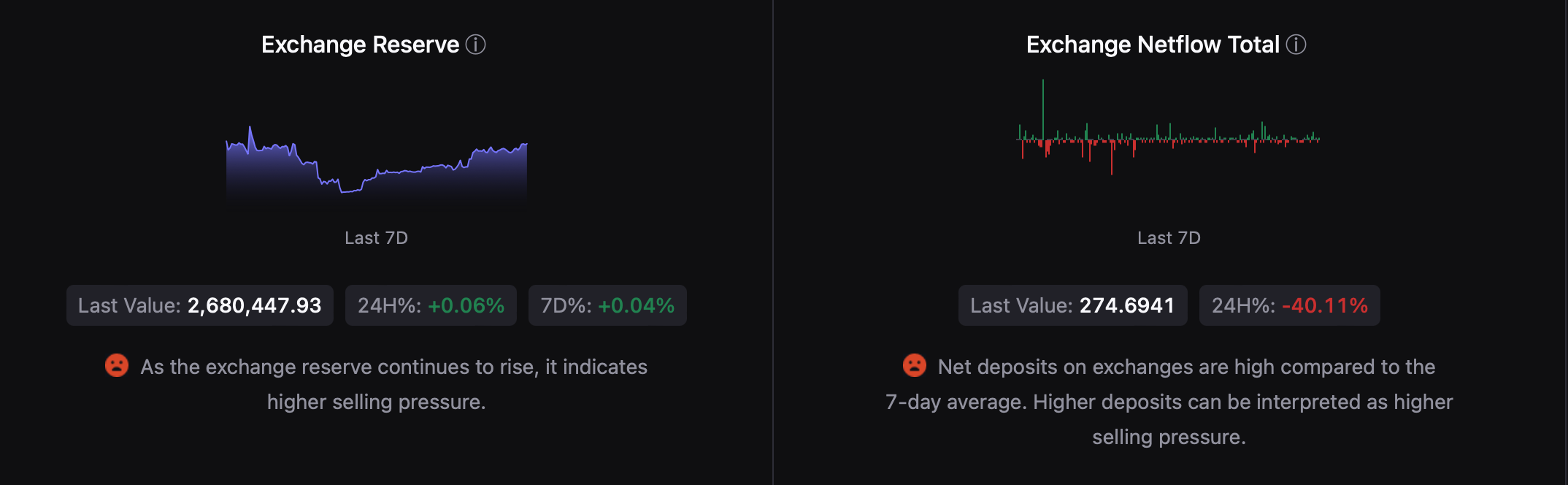

AMBCrypto’s analysis of the data from CryptoQuant identified various factors that may have contributed to the decline in BTC’s price. Our analysis showed that the BTC exchange reserve was rising, suggesting increased selling pressure.

The increase in the net exchange flow further demonstrated that investors were selling Bitcoin.

Specifically, the net BTC deposits on exchanges were significantly higher than the 7-day average. A surge in deposits can be seen as a sign of rising selling pressure. Nonetheless, the Coinbase BTC Premium remained positive, indicating that buying sentiment was still prevalent among U.S. investors.

Source: CryptoQuant

Will This Trend Persist?

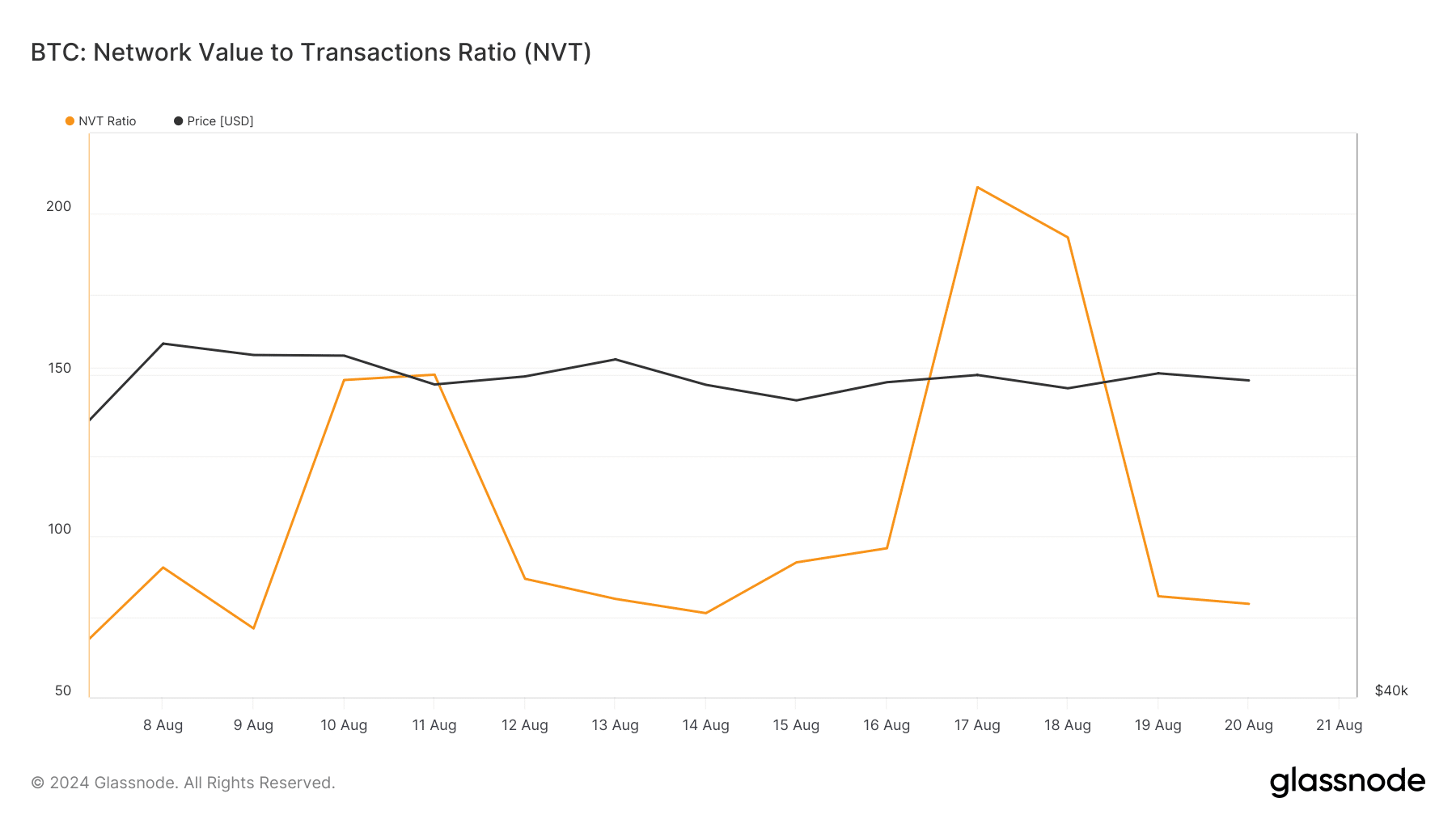

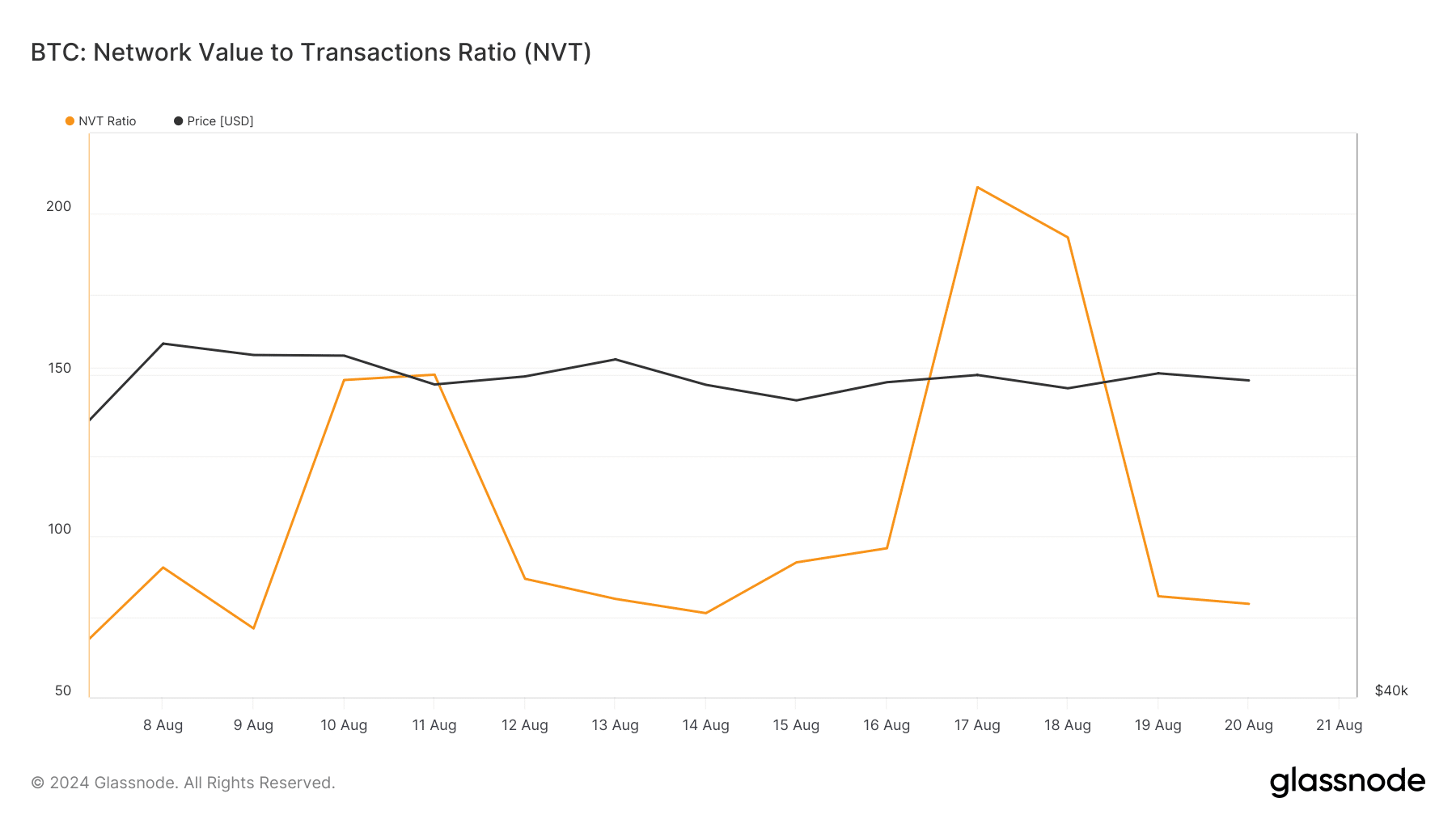

AMBCrypto analyzed data from Glassnode to assess the likelihood of this bearish trend continuing. We found that Bitcoin’s NVT ratio had fallen significantly.

A decline in this metric indicates that an asset might be undervalued, suggesting a potential price increase. The NVT index is calculated by dividing market capitalization by the on-chain transferred volume measured in USD.

Source: Glassnode

However, conditions in the derivatives market did not appear to favor buyers. For instance, the BTC buy/sell ratio turned negative, indicating that selling sentiment was predominant in the futures market.

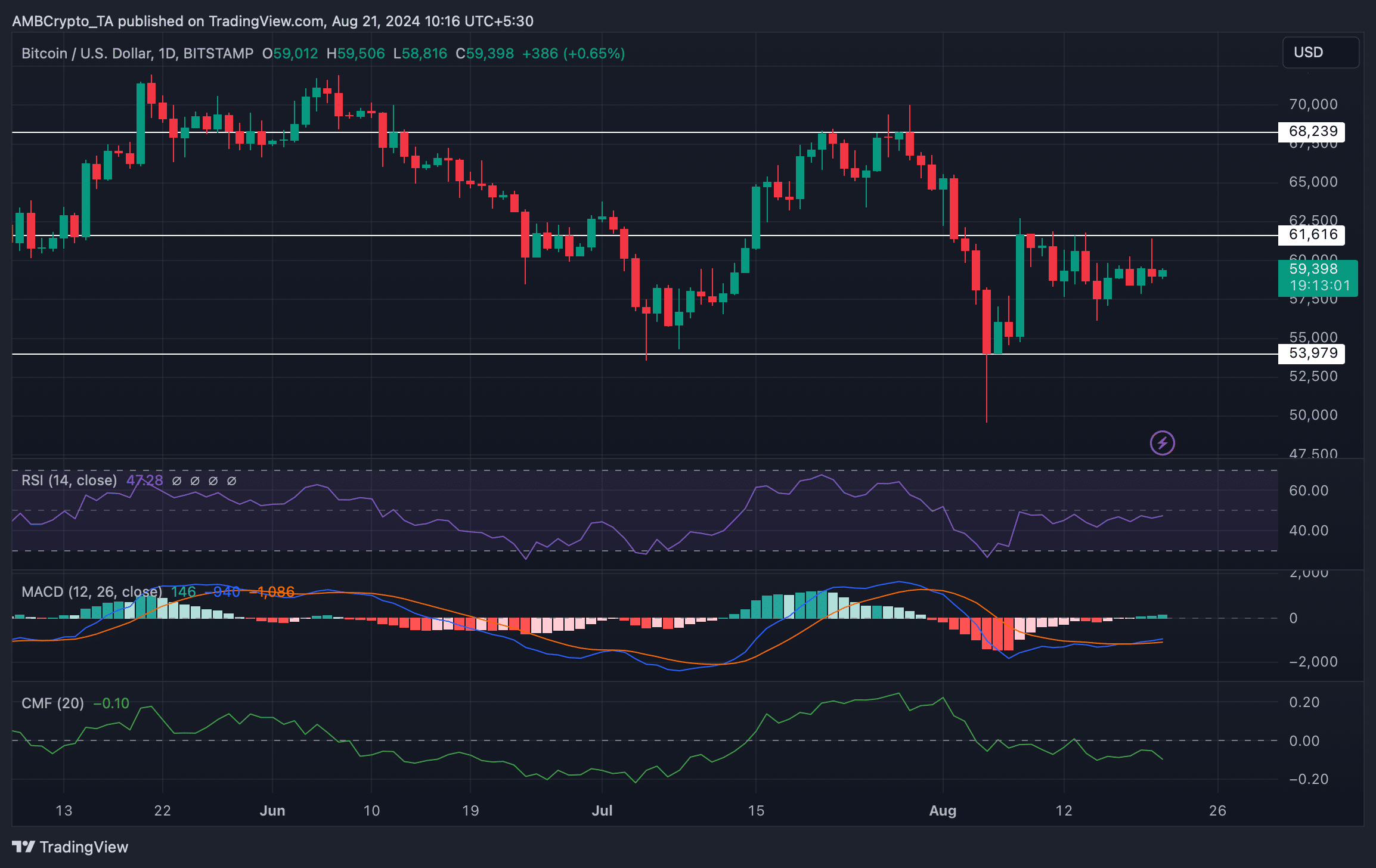

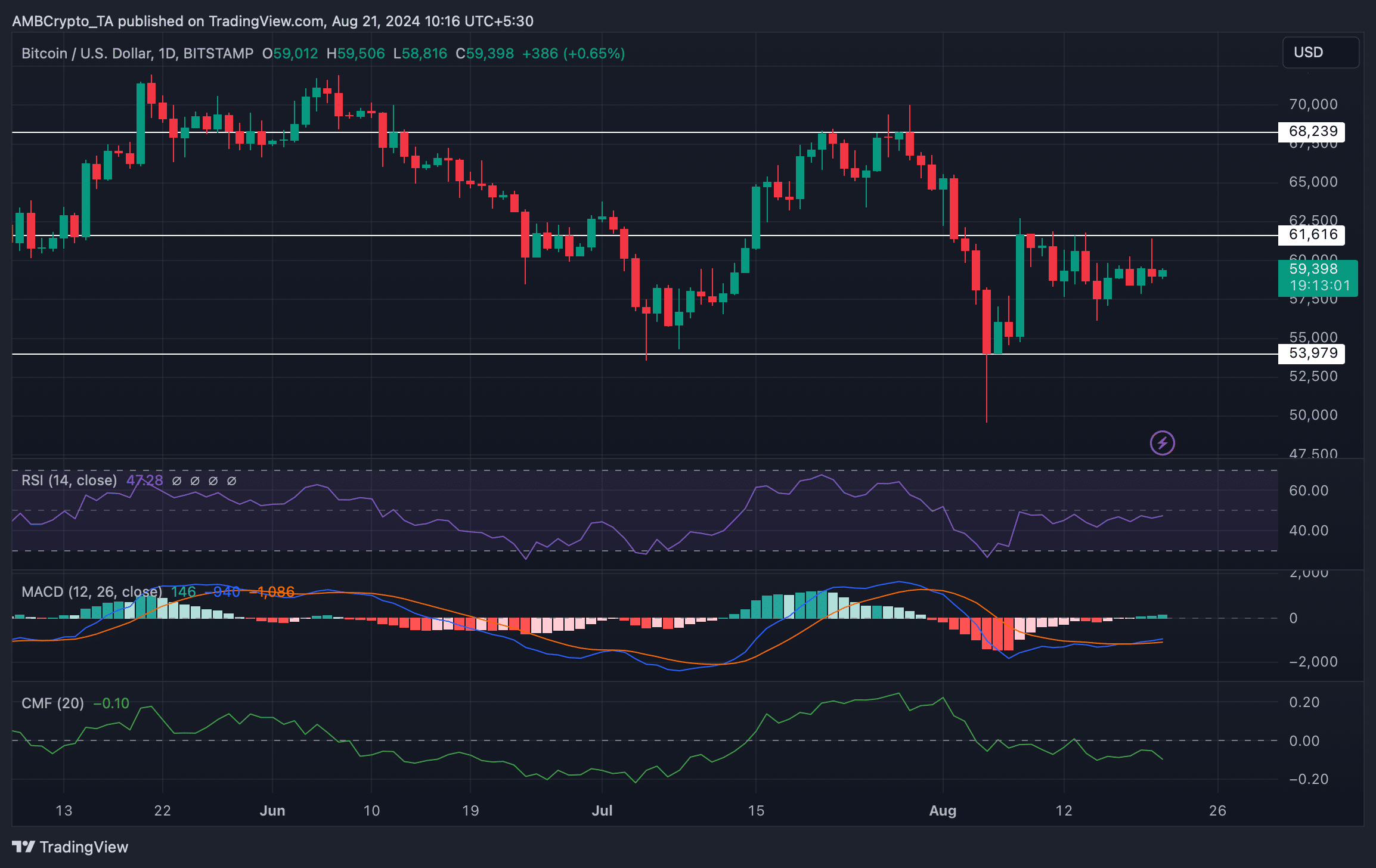

To further understand what to expect, AMBCrypto examined the daily chart of BTC. The MACD technical indicator indicated a bullish crossover.

BTC’s Relative Strength Index (RSI) was gradually nearing the neutral mark, signaling a potential bullish trend.

However, the Chaikin Money Flow (CMF) turned bearish with a recorded decline.

Source: TradingView

This is an automatic translation of our English version.

- After touching $61k, BTC witnessed a price correction.

- Selling pressure on the currency increased over the past 24 hours.

Over the past 24 hours, optimism in the cryptocurrency market soared as Bitcoin [BTC], the king of cryptocurrencies, regained $61k. However, this bullish trend was short-lived as the coin faced a significant correction. Let’s delve deeper into the current situation with BTC.

Bitcoin Experiences a Bearish Shift

Bitcoin exhibited bullish momentum, managing to surpass $61k on August 20. However, the market dynamics shifted swiftly as bearish sentiment gained traction.

As reported by CoinMarketCap, BTC’s price fell over 2.5% in the last 24 hours, trading at $59,378.99 with a market capitalization exceeding $1.17 trillion.

Interestingly, this recent price decline was not entirely unexpected. Cryptocurrency analyst Ali posted a tweet indicating that BTC’s TD sequence had triggered a sell signal. Following this, the coin experienced the anticipated price correction.

Data analysis from CryptoQuant highlighted several factors influencing the BTC price drop. Notably, an increase in BTC exchange reserves indicated growing selling pressure among investors.

Moreover, increased net exchange flow reflected a trend of selling among investors. Specifically, the net deposit of BTC on exchanges surpassed the 7-day average, suggesting a rise in selling pressure. Nonetheless, the Coinbase BTC Premium remained in the green, pointing to a sustained buying sentiment amongst U.S. investors.

Source: CryptoQuant

Will This Bearish Trend Persist?

Following this, AMBCrypto further scrutinized data from Glassnode to assess the potential continuation of this bearish trend. The analysis revealed a significant drop in Bitcoin’s NVT (Network Value to Transactions) ratio.

A decreasing NVT ratio suggests that the asset is undervalued, indicating a possible price increase. The NVT index is calculated by dividing market capitalization by on-chain transferred volume measured in USD.

Source: Glassnode

In the derivatives market, however, signs appeared less favorable for buyers. The BTC buy/sell ratio turned red, indicating a prevailing selling sentiment in the futures market.

To further understand future price movements, AMBCrypto analyzed BTC’s daily chart. The MACD (Moving Average Convergence Divergence) technical indicator exhibited a bullish crossover.

The Relative Strength Index (RSI) was gradually inching towards the neutral zone, signaling potential bullish momentum. In contrast, the Chaikin Money Flow (CMF) displayed a bearish trend, indicating a decline in buying pressure.

Source: TradingView

Practical Tips for Cryptocurrency Investors

- Stay Informed: Regularly check updates and analyses from reliable cryptocurrency news sources.

- Diversify Your Portfolio: Consider a mix of cryptocurrencies to reduce risk exposure.

- Set Stop-Loss Orders: Protect your investments by establishing stop-loss levels to mitigate potential losses.

- Monitor Market Sentiment: Keep an eye on social media trends and market sentiment indicators to gauge investor behavior.

Case Study: Recent BTC Price Trends

In August 2024, Bitcoin demonstrated extreme volatility, with a rapid price increase to $61k before facing a two-day correction. This case showcases the unpredictable nature of cryptocurrency markets, emphasizing the importance of strategic investment and market analysis.

| Date | Price Movement | Market Sentiment |

|---|---|---|

| August 20, 2024 | $61,000 | Bullish |

| August 21, 2024 | $59,378.99 | Bearish |

This is an automatic translation of our English version.