News hardware Bitcoin: are the whales still in the game?

Published on 07/08/2022 at 17:35

There is a food chain in crypto: the queens of the industry are the whales. With a large amount of cryptocurrency, these “whales” play a key role in the crypto field. Often invisible, what are the whales doing a few months following the fall of Bitcoin?

Summary

- What is a whale in crypto?

- Whales in a few figures

- The Importance of Whales for Bitcoin and Other Cryptocurrencies

- whales during the bear market

- Whales share the reef

What is a whale in crypto?

Whales are part of the legend of cryptocurrencies. Concretely, a whale is defined by a wallet holding a cryptocurrency in an immense proportion. For example, the Tesla company and its thousands of Bitcoins are still a whale, even following the recent sale.

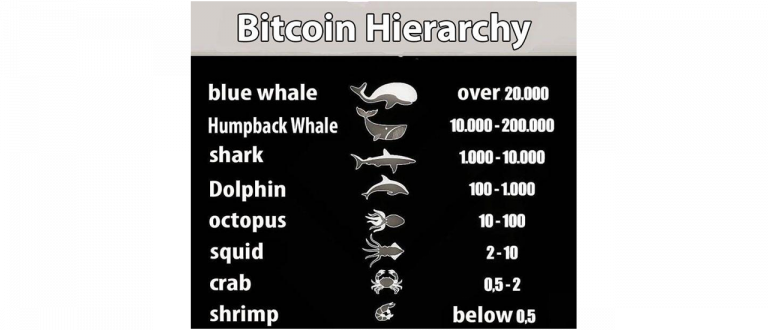

Several hundred, even thousands, of Bitcoins or other currencies are generally necessary to enter the closed circle of whales. Everything depends above all on the value of the cryptocurrency and its “stock” (quantity in circulation). While it is very easy to get 1,000,000 in Shib, it will be significantly harder, if not impossible, to get the same amount in Bitcoin or Ethereum.

The bitcoin threshold needed to get you on the side of the whales constantly varies depending on the price of the cryptocurrency. With the considerable increase in its price, Bitcoin is, therefore, less available in abundance. While it took €6 to hold around 100 bitcoins in 2010, today it takes €2,000,000.

For this reason, there are few wallets considered Whales in any cryptocurrency and even more in the most popular cryptocurrencies like Bitcoin or Ethereum.

Whales in a few figures

Whales alone hold huge amounts of crypto. In the case of Bitcoin, it is known that around 85 wallets hold 15% of the total amount of BTC in circulation. Taking a broader range, nearly 2,200 wallets hold 8 million BTC, or 42% of the amount of BTC in circulation. At current prices, these 2,200 addresses have 185,000,000 billion euros in assets.

If this is cause for concern, it is important to note that Bitcoin or even Ethereum are among the least risky assets in this regard. Indeed, Elon Musk’s favorite cryptocurrency, DOGE is subject to a considerable monopoly… 15 wallets hold around 50% of the tokens. If these whales started selling their entire wallets simultaneously, it would mark the end of DOGE.

Doge – CoinCarp Breakdown

The Importance of Whales for Bitcoin and Other Cryptocurrencies

By holding so many cryptocurrencies in a single wallet, these whales play a key role in the crypto industry. When a whale completes a buy or sell transaction, it immediately affects the price of the asset. Cryptocurrencies are conditioned by the law of supply and demand, so when a large quantity is sold, the price drops and vice versa when it is a purchase. Bitcoin investors have repeatedly paid the price.

Having a significant impact on the rise or fall of prices, the movements of whales are often watched. Most investors see them as signals to buy or sell the cryptos contained in their portfolios. Some Twitter accounts even go so far as to relay every transaction.

Therefore, although Bitcoin allows the anonymity of its owners, it is known that some addresses have started to move since the beginning of the decline.

whales during the bear market

Some whales notably participated in the fall in the value of BTC in June 2022. The price of Bitcoin fell from €28,000 to €18,000 in a few days. These sharp drops may suggest that one or more whales have sent sell orders on their Bitcoin.

Since Bitcoin stagnated around €20,000, whales seem to be giving away their BTC. And that’s not new… Since 2020, the trend has shown that the offer contained in these famous addresses is on the decline. According to Glassnode, whales holding more than 1,000 BTC are shedding a few of them over time, unlike individuals who seem to be hoarding. Indeed, addresses with 0.001 BTC and 1 BTC have tended to buy cryptocurrency in the past two years.

Whales share the reef

The more we advance in the development of these virtual currencies, the less power the whales have. For some time now, whales have had to share the area with other crustaceans and other mammals.

In the absence of control and regulation the crypto market must contend with the rules of whales. Despite sharing the shore with others, the whales continue to steer, evidenced by the recent decline. Only, it would seem that the “fish” do not follow the trend of the whales…. If the trends stay the same, Bitcoin might see a fairer distribution of its coins. For the moment, it’s time for volatility and it’s not to displease some people. Therefore, if some whale buying takes place, the price of bitcoin might rise sharply once more.