In a familiar turn of events, prominent headlines have once again surfaced surrounding Apple.

According to the latest earnings report released on Saturday, Berkshire Hathaway, under the stewardship of Warren Buffett, has offloaded a significant portion of its stake in Apple, further fueling the ongoing speculation in the financial markets.

The Omaha-based conglomerate has reduced its ownership by approximately 25% during the third quarter, a move that has caught the attention of investors and analysts alike.

Despite this sale, Berkshire Hathaway still retains an impressive portfolio with around $69.9 billion worth of Apple shares as of the end of September, solidifying Apple’s status as the cornerstone of Berkshire’s investments.

Additionally, Berkshire Hathaway is also scaling back its position in Bank of America, leading to an increase in its cash reserves, which have now surpassed a staggering $300 billion.

The reasons behind Berkshire’s decision to sell a portion of its Apple shares remain unclear, yet the market response indicates that investors are largely unfazed by this development.

In Monday’s trading, Apple stock saw a slight dip, falling 1% as Wall Street adjusted to the fresh news, marking the first opportunity for market analysts to react.

As of the previous Friday’s close at approximately $223 per share, Apple’s stock had decreased by 5.5% from its all-time high of just above $236 achieved on October 21, highlighting the volatility surrounding the tech giant in the wake of earnings announcements.

This latest Berkshire disclosure comes on the heels of Apple’s quarterly earnings report, which, while better than anticipated, has left Wall Street ambivalent about the iPhone maker’s long-term prospects.

Loop Capital has adjusted its price target for Apple downward, now predicting a valuation of $275 per share, a decrease from the previous target of $300, yet this still suggests a potential upside of nearly 24% from Friday’s closing price.

On a more optimistic note, analysts at Morgan Stanley praised Apple for achieving its highest operating margins in a decade, showcasing the company’s resilience and operational efficiency.

Meanwhile, Bank of America analysts have highlighted an uptick in global App Store revenue and download figures for October, providing a silver lining for Apple’s growth prospects.

For Apple investors, enduring a constant stream of news headlines is par for the course.

Amidst the fluctuations, Jim Cramer has advised members of the CNBC Investing Club to remain focused and refrain from getting swept up in the noise surrounding Apple’s stock movements.

His mantra, “own it, don’t trade it,” emphasizes that Berkshire’s recent sales should not be interpreted as a sign of distress for Apple but rather a strategic move to realize profits amidst a rising stock price.

“Who am I to challenge the ‘Oracle of Omaha?'” remarked Cramer, indicating his belief that Buffett’s motivations are likely driven by a desire to capitalize on Apple’s recent strong performance.

If you’re a subscriber to the CNBC Investing Club with Jim Cramer, you’re afforded the advantage of receiving a trade alert prior to Jim executing any trades.

After dispatching a trade alert, Jim allows a 45-minute window before making any stock transactions in his charitable trust’s portfolio.

For stocks he discusses on CNBC TV, Jim enforces a longer wait, pausing for 72 hours post-alert before acting on his trading strategies.

THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, TOGETHER WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

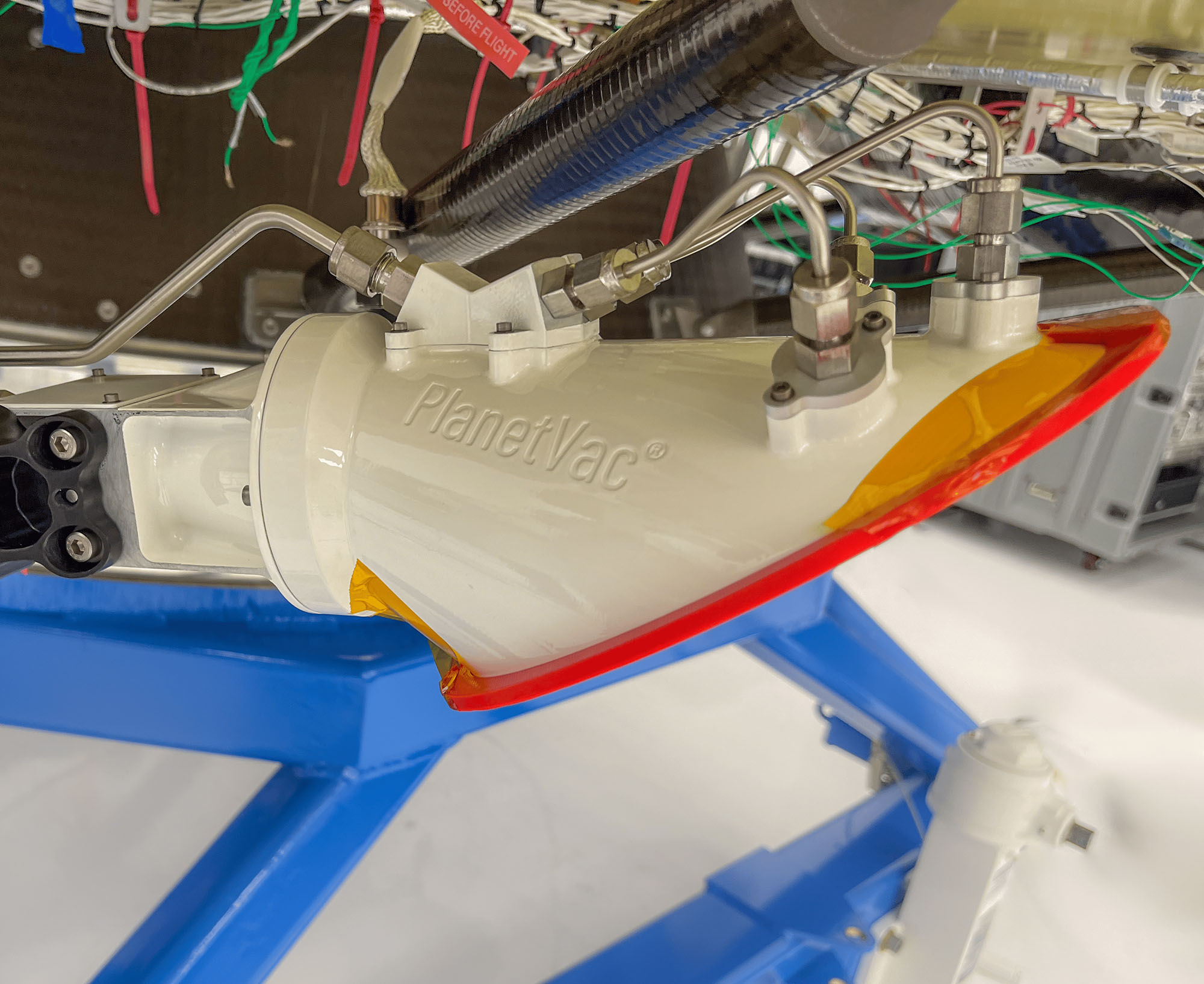

An Apple store in Manhattan, New York, on July 5, 2024.

Nurphoto | Nurphoto | Getty Images

**Interview with Financial Analyst Jane Doe**

**Host:** Welcome back to Market Insights. Today, we’re diving into some intriguing developments surrounding Warren Buffett’s Berkshire Hathaway and its recent moves with Apple stock. Joining us today is financial analyst Jane Doe, who specializes in tech stocks and investment strategies. Jane, thank you for being here.

**Jane Doe:** Thank you for having me! It’s great to discuss the latest market trends with you.

**Host:** Warren Buffett has trimmed his stake in Apple by about 25% recently. What do you think prompted this decision, especially given Apple’s strong performance?

**Jane Doe:** That’s a great question. Berkshire Hathaway still has a substantial $69.9 billion in Apple shares, so it’s clear that Buffett still believes in the long-term potential of the company. However, selling part of the stake could indicate a strategic move to lock in profits, especially considering the volatility we’ve seen in tech stocks. Options like diversifying into other assets or increasing cash reserves are always on the table for a savvy investor like Buffett.

**Host:** Speaking of cash, Berkshire’s reserves have surpassed $300 billion. What do you think they might do with that cash?

**Jane Doe:** With such a large cash reserve, Berkshire has a safety net for future acquisitions or investments. This could mean that they’re looking for undervalued opportunities in the market. Many analysts speculate that an economic downturn could be on the horizon, so having liquidity can help them seize opportunities when prices drop.

**Host:** Apple’s stock did see a slight dip of 1% after the news broke. How should investors interpret such short-term fluctuations?

**Jane Doe:** Short-term volatility, especially after earnings announcements, is common in the stock market. Investors often react emotionally to news, but the fundamental value of Apple hasn’t changed dramatically. Even with the price target adjustments from analysts like Loop Capital, there’s still a significant upside potential. It’s important for investors to focus on the long-term outlook rather than reacting to immediate market shifts.

**Host:** You mentioned analysts being ambivalent about Apple’s long-term prospects despite the company’s record-high operating margins. What does that tell us about market sentiment?

**Jane Doe:** It shows a mixed bag. While Apple is undeniably performing well operationally, some analysts may be cautious due to broader economic factors, competition, or concerns over future product lines. The market often prices in both current performance and future expectations. As we see greater scrutiny on tech giants, it’s crucial for investors to weigh both sentiment and fundamental data when making decisions.

**Host:** what’s your overall takeaway for investors watching these developments?

**Jane Doe:** I would advise investors to remain calm and not to panic over short-term fluctuations. Look at the fundamentals—Apple continues to innovate and maintain high margins. Long-term holders might see this as a buying opportunity rather than a red flag. And keeping an eye on Berkshire’s strategic moves can provide additional insights into potential trends in the market.

**Host:** Thank you for sharing your insights, Jane. It looks like there’s a lot to consider for investors as they navigate these changing tides.

**Jane Doe:** My pleasure! Always happy to help clarify these market dynamics.

**Host:** That’s all for today’s segment on Market Insights. Stay tuned for our next episode as we delve deeper into the evolution of technology stocks.