2024-09-26 19:44:00

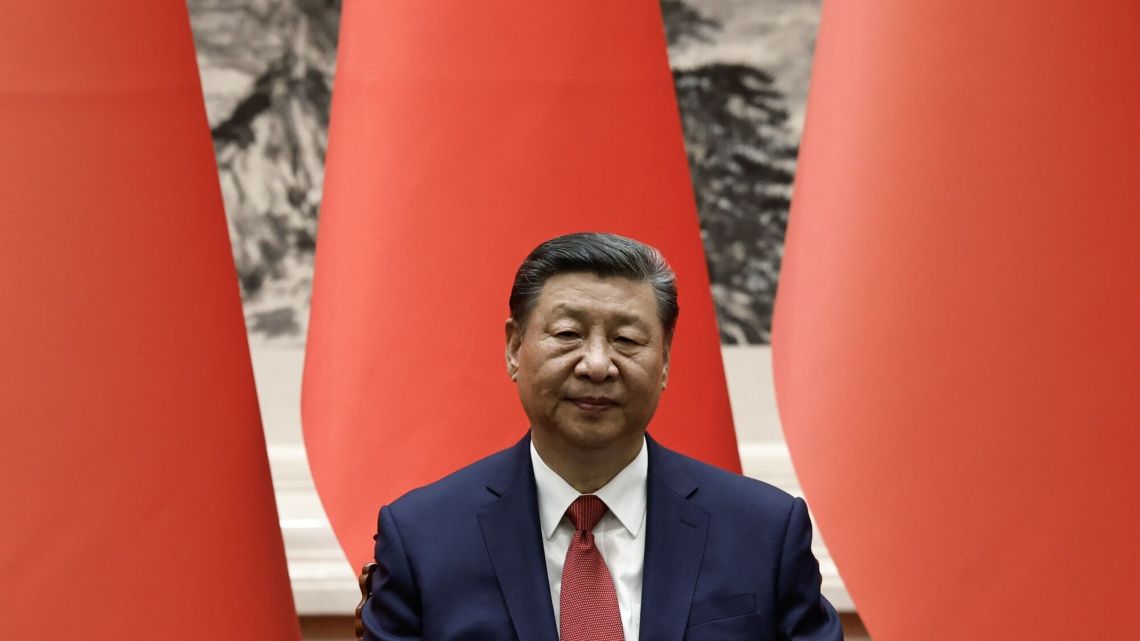

China’s top leader steps up emergency efforts to restore growth and pledges Support fiscal spending and stabilize the struggling real estate sector, providing new impetus to stimulus measures aimed at halting a slowdown in the world’s second-largest economy.

President Xi Jinping pledged to work hard to achieve the country’s annual economic goals during a meeting with 24 members of the Politburo, the official Xinhua News Agency reported on Thursday. official commitment Take measures to stop the real estate market from falling, It was his strongest pledge to date to stabilize key industries after new home prices fell in August at their fastest monthly pace since 2014.

The government will strictly limit the construction of new housing projects as part of efforts to ease an oversupply of housing, the Politburo said. No details were provided on the scale of fiscal spending, The agencies will likely fill out the details in the coming days and weeks.

Dictators don’t like this

The practice of professional and critical journalism is a fundamental pillar of democracy. That’s why it bothers those who think they have the truth.

For example, the Politburo’s statement stood out for its specific language addressing the issue of interest rate cuts, compared with the usual general statements. This change emphasizes the need Talk directly to the market, The move comes just days after the central bank announced a powerful policy offensive that sent benchmark stock indexes surging to their highest levels since 2020.

China is at a crossroads with its aging population

Guidance for the real estate industry “This is the first time since the recession started that Julian Evans-Pritchard, head of China economics at Capital Economics, said in a report that the Politburo has made it clear that the market will rebound.

The news came a few hours earlier than usual, just as the surgery was starting in the afternoon. Post-release gains in the CSI 300 Index, a gauge of mainland Chinese stocks, widened to 4.2%, erasing losses for the year, while an index of real estate developers tracked by Bloomberg rose 15.9%.

performance China’s 10-year bonds rise 3 basis points It rose as much as 2.06% while stocks rebounded. At 4:20 pm local time, the RMB exchange rate rose 0.2% to 7.02 yuan against the US dollar.

This month’s Politburo meeting focused on the economy for the first time since 2018, which was unusual and illustrates Officials hope to ease growing economic anxiety It comes after China’s economic growth slowed to its worst level in five quarters.

Leaders called for a “calm” response to the current economic challenges, but also seemed to realize it was time to change tactics. Officials were given clear instructions to “cope with difficulties, strengthen confidence, and seriously enhance the sense of responsibility and urgency to do a good job in economic work.”

Economists generally viewed the announcement as Change the authorities’ previous piecemeal approach Boosting the economy, although the extent of fiscal stimulus remains unclear.

“The stimulus package supported by today’s Politburo meeting represents a strategic shift in macroeconomic policy,” said Bruce Pang, chief China economist at Jones Lang LaSalle. “If there is more substantial fiscal support and a rebound in public spending, It may be enough to drive improvements in business confidence, market confidence and economic activity.

The Politburo’s commitment to strengthen assistance to people with employment difficulties and low-income groups shows that the government is increasingly concerned about economic difficulties. The day before, the country said it would give One-time cash assistance for struggling residents and promised more subsidies for some unemployed people.

The Politburo also urged officials to “issue and make good use” of ultra-long-term special sovereign bonds and local special tools to promote investment. Local governments speed up bond issuance After maintaining slow growth in the previous months, since August it has been difficult to find high-quality projects for investment while trying to reduce debt risks.

Ding Shuang, chief economist for China and North Asia at Standard Chartered Bank, said the move may further expand the areas where local officials can invest to promote the use of the tool. One effective approach, he said, would be to allow local governments to use funds raised from issuing special bonds to purchase unsold homes.

Typically, policymaking bodies only meet in April, July and December to discuss current economic conditions. According to official records, the last time such a meeting was held outside these months was in March 2020, when China was suffering from the impact of the Covid-19 epidemic. Over the past four years, The September meeting focused first on party discipline Or in internal work.

Interest rates and reserves

The Political Bureau of the CPC Central Committee also demanded strict implementation of Lower interest rates and reserve requirements For banks, China’s central bank announced easing measures this week.

Still, threats to the economy remain. The years-long housing crisis has wiped out an estimated $18 trillion in household wealth, curbed consumer appetite and plunged China into its longest period of deflation since 1999. Trade tensions with the United States and Europe Accusations of overcapacity in China have cast a pall over the manufacturing engine, which remains an unusually positive sector.

A series of stimulus measures recently introduced To a certain extent, this has reduced people’s concerns that China will not be able to achieve its 5% annual growth target. Previously, due to sluggish economic data in August and a general cooling of production, consumption and investment, economists at Wall Street banks including Goldman Sachs Group lowered their full-year GDP forecasts.

“Frequency and amplitude Policy deployment exceeded our expectations”economists at HSBC Holdings PLC wrote in a note. Among them is Liu Jing. “Things have changed; prepare for more proactive steps.

1727380766

#Chinas #Politburo #steps #stimulus #revive #growth