Indonesian Stocks See Continued Foreign Selling Pressure

Table of Contents

Table of Contents

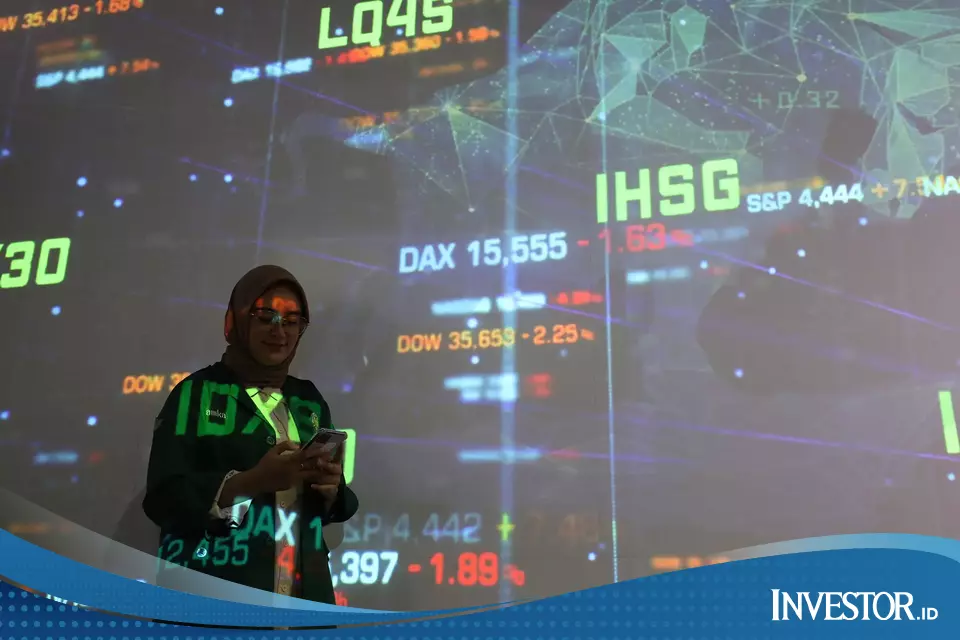

IHSG Falls Amidst Global Uncertainty

The composite stock price index (IHSG) continued its downward trend, falling 66.15 points (0.9%) to close at 7,258.6, marking its third consecutive day of decline. Market sentiment remains cautious as investors await interest rate decisions from major central banks, including the Federal Reserve (Fed) and Bank Indonesia (BI). Trading activity remained robust, with 159 shares rising, 442 shares falling, and 193 shares remaining unchanged. The total transaction value reached IDR 11.18 trillion, reflecting a trading volume of 27.99 billion shares across 1,075,794 transactions.Sector Performance and Market Outlook

All sectors of the Indonesian stock market closed lower on Monday. the property sector was the weakest performer, declining by 2.9%, followed by the technology sector (down 2.3%), transportation (down 1.9%), raw goods (down 1.6%), and non-primary consumer goods (down 1.5%).For the latest data and analysis on the indonesian economy and market, look no further than Investor.id.

The online publication provides a wealth of resources, including in-depth articles, expert insights, and live streaming events. keep up with the latest market trends and developments by tuning into IDTV for insightful shows and analysis on all aspects of the Indonesian economy and financial landscape.

Stay informed by checking out Investor.id’s coverage on Google News

And don’t miss out on live events – join Investor.id’s livestreams for in-depth discussions on key topics.

I can help you create a structured outline for this interview. As we’re basing this on a past interview with LeVar Burton, we can adapt it to fit Archyde’s style and focus on a specific angle.

Hear’s a possible structure:

**Archyde Interview: LeVar Burton**

**Introduction:**

* Begin by introducing LeVar Burton and highlighting his multifaceted career, mentioning his iconic roles (Kunta Kinte in “Roots,” Geordi La Forge in “Star Trek: The Next Generation,” and host of “Reading Rainbow”).[[1](https://www.emmys.com/news/interviews-archive)]

**Focus:**

* Since this is for Archyde,we need a specific angle. Consider these options:

* **Championing Literacy:** Focus on LeVar’s lasting impact on literacy through “Reading Rainbow” and his current work advocating for reading.

* **Depiction and Inclusivity:** Discuss LeVar’s groundbreaking roles and his outlook on representation in Hollywood, then and now.

* **The Power of Storytelling:** Explore LeVar’s views on the importance of storytelling across different mediums – television, film, books.

**interview Questions:**

* **Opening:**

* “You’ve had an incredibly impactful career, touching on generations with iconic roles and inspiring a love of reading in countless children. Looking back, what are some of the defining moments that have shaped your journey?”

* **Focus-Specific Questions (Examples):**

* **Literacy:** “Reading Rainbow remains a beloved program. What makes it so enduring, and what do you see as the biggest challenges to promoting literacy today?”

* **Representation:** “As one of the few Black actors in prominent roles during your early career, how did you navigate those challenges? What progress do you see in Hollywood’s representation landscape, and what more needs to be done?”

* **Storytelling:** “You’ve masterfully acted, narrated, and hosted. What draws you to storytelling in its various forms,and what power do you believe stories hold?”

* **Closing:**

* Ask levar about any upcoming projects he’s excited about.

* ”What advice would you give to aspiring actors or storytellers today?”

**Tone:**

* Archyde is known for its thoughtful and in-depth approach.keep the tone conversational but respectful and insightful.

**Additional Notes:**

* Research levar Burton’s recent activities and opinions.

* tailor the questions based on the specific focus you choose.

## Investor Confidence SHAKEN as Foreign Selling pressure Continues in Indonesian Stocks

**Archyde Interviews Reza Priandana**,Head of Research at NH Korindo Sekuritas

**Poppy: ** Welcome,Reza,thanks for joining us today.indonesian stocks don’t seem to be catching a break lately. We’re seeing another day of strong foreign selling. Can you shed some light on what’s driving this trend?

**Reza:** Poppy, good to be here. Yes, unfortunately, yesterday continued the trend we’ve seen for a while now: ample net selling by foreign investors. There are several contributing factors:

**First:** Global market jitters are always a concern.Uncertainties surrounding interest rate hikes from major central banks like the Fed and our own Bank Indonesia are making investors cautious.

**Second:** Locally, there are concerns about the Indonesian rupiah‘s performance against the US dollar. A weakening rupiah can make indonesian assets less attractive to foreign investors.

**Third:** Specifically, we’re seeing some profit-taking in heavyweight bank stocks like BBRI, TLKM, and BBNI, which were performing quite well earlier. This is adding to the selling pressure.

**Poppy: ** It’s unsettling to see such heavyweights being hit. But it’s engaging that GOTO bucked the trend, actually seeing a net buy from foreign investors.

**Reza:** Exactly.GOTO’s performance is a bit of a shining spot in all this. It shows some investors are still bullish on Indonesia’s digital economy and GOTO’s potential for growth.

**Poppy:** The IHSG has now fallen for three consecutive days. Are we headed for a deeper correction?

**Reza:** It’s tough to say for sure. The downward pressure is certainly there, driven by the global and domestic factors we discussed. Though, Indonesia’s economic fundamentals remain solid, and many sectors still offer attractive investment opportunities.A lot will depend on how the global economic landscape evolves and what decisions the central banks make regarding interest rates.

**Poppy:** What advice would you give to retail investors wading through this uncertainty?

**Reza:**

* **Stay informed.** Follow reputable sources like Investor.id for reliable market data and analysis. Tune in to IDTV for insightful discussions on the Indonesian economy and financial trends.

* **Diversify your portfolio.** Don’t put all your eggs in one basket. Diversification helps mitigate risk.

* **Be patient and disciplined.** Emotional decisions often lead to poor investments. Stick to your long-term investment strategy and don’t panic sell.

**poppy:** Excellent advice, Reza.Thank you for sharing your expertise and insights with our viewers today.

**Reza:** My pleasure, Poppy.