In the Report “Vietnam’s Debt Capital Market Outlook in 2024: Adapting to change”, the FiinRatings expert group made specific comments on the prospects for each industry this year.

Accordingly, industry risk is considered one of the important factors in FiinRatings’ analysis process to evaluate the business risk profile of businesses, in order to make assessments on issuer ratings.

FiinRatings’ assessment of the credit prospects of some economic sectors.

Residential Real Estate Industry: Continues to face difficulties

The report shows that residential real estate developers will continue to face pressures on liquidity, access to capital, interest rate risks, and economic recession affecting demand. people’s demand and ability to pay.

On the positive side, the group of experts believes that important laws such as the Land Law 2024, Real Estate Business Law 2023 and Housing Law 2023 passed by the National Assembly at the end of 2023 – early 2024 will help create premise for market recovery. However, new policies will also have a certain delay and take time to become effective. FiinRatings said that it is expected that the Government will issue 9 decrees and 6 circulars guiding implementation in 2024 to help speed up this process.

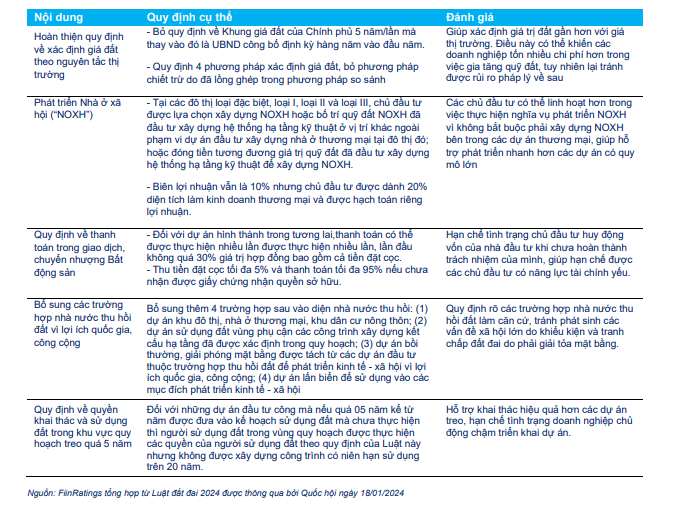

Notable contents in the Land Law, Housing Law and Real Estate Business Law have just been passed and will take effect from January 1, 2025.

In general, with pressure from a large amount of maturing real estate bonds (estimated at ~120 trillion VND – the highest level in the last 5 years), FiinRatings assesses that refinancing risk is still high for with residential real estate developers. However, they believe that there will also be a strong differentiation in the ability of each enterprise in the industry to maintain business operations in the face of general difficult market developments lasting from 2022 until now.

Industrial Park Real Estate Industry: Industry outlook remains stable

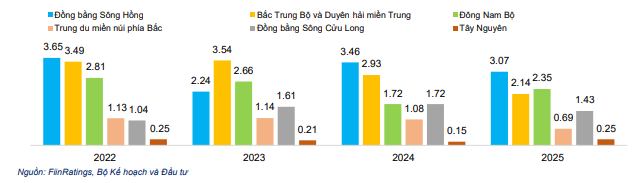

The supply of industrial land in Vietnam is expected to increase by 44,760 hectares in the period 2022 – 2025 to meet the sharply increasing demand for industrial land rental in Vietnam. In which, expansion of new supply sources in the Red River Delta, North Central and Central Coast is accelerated. The delay in approving policies for industrial real estate in Vietnam is a timely issue when many cities have policies to expand new land funds for industrial parks.

New land supply has been drafted for the period 2022 – 2025.

FiinRatings believes that the prospect of Vietnam’s industrial park real estate industry will remain stable through the following factors: (i) high demand thanks to production expansion of both FDI and domestic enterprises ; (ii) supply is encouraged by the Government to meet growing demand; (iii)promote investment in infrastructure. Therefore, FiinRatings expects that the wave of shifting and diversifying production lines from China will continue to boost investment demand from foreign businesses, thereby further improving the operating efficiency of the entire industry.

Energy Industry: EVN’s business situation is a “big question mark”?

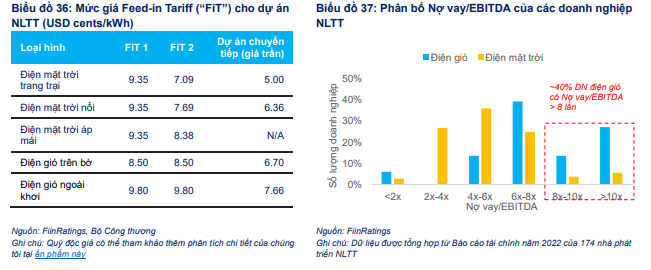

Although the potential for developing renewable energy in Vietnam is huge, there are still certain difficulties and challenges. Among them, policies related to price mechanisms and output offtake are the biggest concerns of investors, greatly affecting the ability of financial institutions to access loans, especially foreign investors.

According to estimates, up to ~40% of wind power developers have Debt/EBITDA > 8 times, while long-term capital (for example, > 10 years) of the entire system is needed to finance projects. This project is still quite limited.

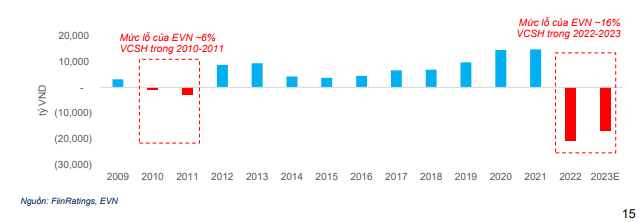

In addition, the business situation of Vietnam Electricity Group (“EVN”) is also one of the big questions of investors, not only from policies related to power purchase contracts (“EVN”) PPA”), but also due to the loss of financial results in the past 2 years. These difficulties stem from EVN’s “dual” obligation to provide electricity at affordable prices to consumers and production facilities, while also investing in electricity transmission and distribution projects. The potential impacts of EVN’s difficult financial situation are worrying because the Vietnamese Government does not have a mechanism to ensure payment to power generation businesses.

EVN’s profit following tax in the period 2009 – 2023.

Regarding prospects, FiinRatings expects the Vietnamese Government and Vietnam Electricity Group to implement reforms, implement restructuring measures, and soon issue specific instructions on price mechanisms, as well as regulations. mechanism to resolve outstanding problems. Currently, there are positive signals, especially for transitional projects (projects that have not yet come into operation within the prescribed time as planned, so there is no specific price yet).

The Ministry of Industry and Trade has issued an electricity price framework for transitional solar and wind power plants in Decision No. 21/QD-BCT dated January 7, 2023 promulgating the electricity price framework for transitional solar and wind power plants. Next, following a long time the projects fell into stagnation. Accumulated to November 2023, there have been 21 transitional renewable energy plants/plant sections with a total capacity of 1,201.4 MW that have completed COD procedures and have generated commercial electricity to the grid.

Financing power projects requires very long-term capital, which is a problem for the Vietnamese banking system. Estimated investment is 135 billion USD in 10 years (equivalent to 13.5 billion USD/year). Currently, outstanding debt for renewable energy projects in the system is only regarding 10 billion USD. This shows that opening up private capital flows and supporting mechanisms for green financial markets to attract foreign capital flows are especially important.

Banking industry: Profitability has improved

Although there is still pressure on asset quality, FiinRatings believes that banks’ profitability will have certain improvements, as the economic situation is expected to recover, along with solutions. , the credit policy implemented by the Government and the State Bank to achieve the goal of promoting economic growth will partly remove difficulties in credit growth.

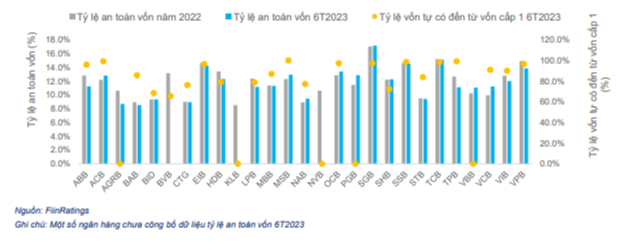

Capital adequacy ratio and contribution ratio of tier 1 capital in equity capital of some banks.

In addition, a trend in the banking industry in 2024 that FiinRatings identifies as likely to affect credit growth and the creditworthiness of banks is the promotion of increasing tier 2 capital to supplement capital sources and support banks. support the achievement of growth goals. With the capital adequacy ratio of domestic banks currently being lower than that of banks in the same region, FiinRatings expects this trend will help banks improve their capital buffers and maintain their sources of capital. Relatively stable capital with reasonable costs, thereby strengthening the credibility of banks.

Securities industry: Relatively positive

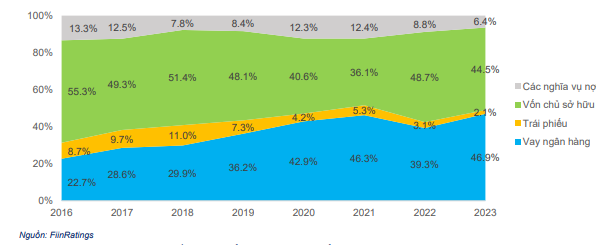

Regarding the capital structure of securities companies, in 2023, bank loan capital has shown an increase to the 2021 level as expected, due to the capital needs of securities companies to finance operations. Margin lending has increased following interest rate cuts. Although this has contributed to increasing the level of financial leverage of the industry, FiinRatings believes that it will not necessarily have a negative impact on the credit quality of securities companies.

On the contrary, in the context of relatively low interest rates and market expectations of economic recovery in 2024, an increase in margin lending activities will likely have positive impacts on the liquidity of banks. market, this will help securities companies consolidate their revenue and profit margins.

Capital mobilization structure of the top 30 securities companies (2016 – 2023).

Regarding the profitability of securities companies, FiinRatings expects that 2024 will be a year with significant differentiation due to differences in business models, reflected in the revenue structure of securities companies. securities, but basically will be relatively positive, with the main driving force being proprietary investment activities and margin lending activities. From FiinRatings’ perspective, the tracking factor for the securities industry will still be activities associated with margin lending and the corporate bond market, which will have a significant impact on positions. liquidity of securities companies.