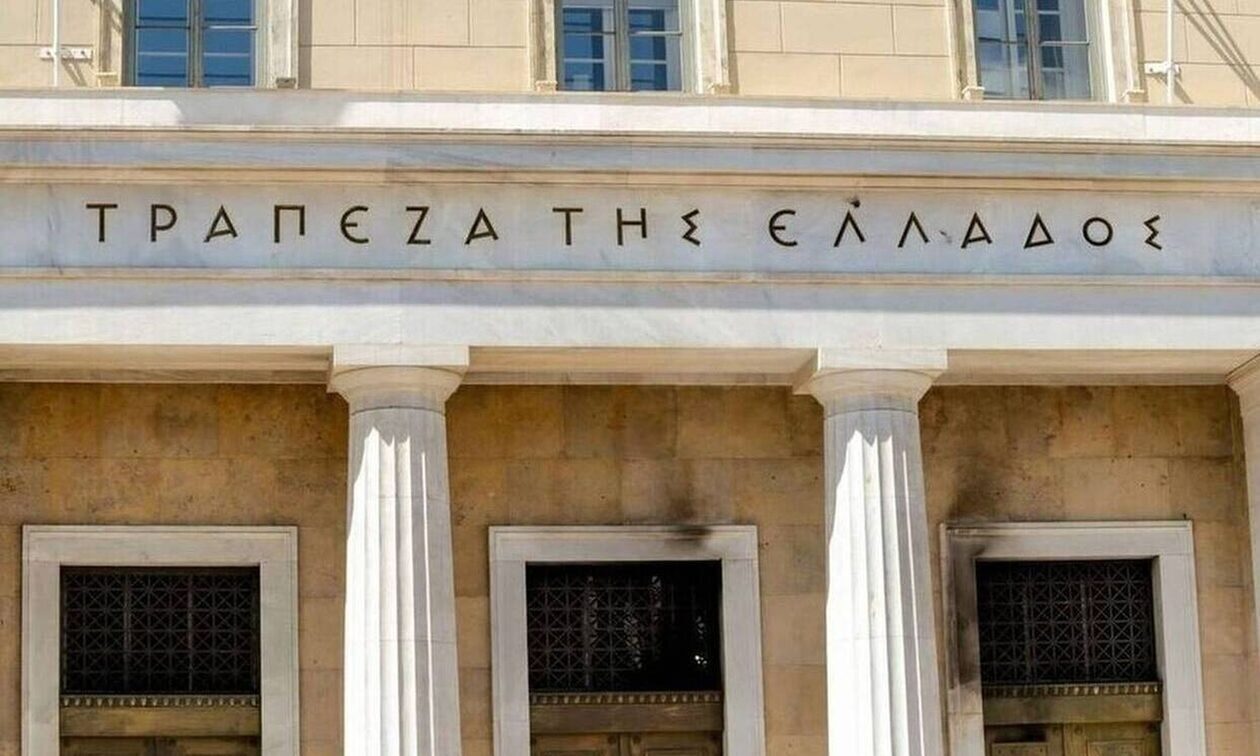

The Bank of Greece revised down the growth rate of the Greek economy for 2024.

According to her data ELSTATthe growth rate in 2023 fell to 2%, from 2.3% originally forecast.

THE TtE now estimates that the GDP of the country will grow by 2.3% in 2024, once morest an initial forecast of 2.5%.

However, the BoE is keeping its forecast for growth of 2.5% in 2025 and 2.3% in 2026 unchanged.

The BoE insists that the risk of a further slippage in the rate of economic growth exists (downside risk according to current terminology) due to a possible worsening of the geopolitical crisis in Ukraine and the Middle East with the consequent consequences for the global economic environment – ( ii) a lower than expected rate of absorption and use of the structural funds of the Recovery Fund and the EU- (iii) in possible delays in the implementation of the reforms, which will brake the process of improving the productivity of the economy and the competitiveness of businesses.

On the other hand, positive surprises on the tourism front as well as the effects of the upgrading of the economy, will contribute positively to the growth rates of the economy.

Regarding developments in the financial sector, the BoE points out that the results announcements for 2023 from the four systemic banks showed a strengthening of net interest income, which was, however, more than offset by a decrease in net trading and other income, resulting in lead to a modest reduction in net profits.

According to the announced results, the ratio of bad NPE loans of the four banks is, on average, at around 4%. At the same time, the yields of the highly secured bonds, issued by the Greek banks, decreased in the period under review.

Withdrawal of deposits

The BoE finds that since the fourth quarter of 2021, private sector deposit growth has slowed overall.

Businesses, as stated in the analysis, are using their liquidity reserves in the face of higher interest rates. Household deposits have been adversely affected by increased consumer spending, high inflation and, more recently, the high opportunity cost of bank deposits.

According to newsbeast, the growth of bank loans to businesses has slowed since the last quarter of 2022 amid higher interest rates and weakening economic growth. Bank loans to households continue to decline due to mortgage deleveraging.

Bank lending rates have seen significant increases, especially for business loans, following the tightening of single monetary policy.

Read also:

Rio Hospital: What is the condition of the 35-day-old baby – What are the next steps of the doctors

Igoumenitsa: Policemen transported 100 kg of drugs in an official vehicle – Three arrests following a traffic accident

Anna Michele Asimakopoulou: Apart from the ND Euro-ballot – The statement

Patras: A 48-year-old woman was found dead in her home – Her partner found her

Pyrgos: A cruel game of fate for a 14-year-old – After her parents, she also “lost” the only person who cared for her

#Bank #Greece #Revises #growth