May 400 billion ↑… Judamdae 800 billion won↑ Credit loan 500 billion won↓

The total household loans in the financial sector also increased by 1.8 trillion won… Credit loan growth shifted due to household demand

Banking corporate loans surged by 13.1 trillion won… 2nd place in history as of May

[연합뉴스 자료사진]

(Seoul = Yonhap News) Reporter Shin Shin-kyung and Oh Joo-hyun = Household loans in the banking sector increased last month for the second month in a row, following April.

According to the Bank of Korea analysis, this is because banks have recently lowered the loan threshold by lowering interest rates and increasing the limit to make up for the sluggish household loans since the end of last year.

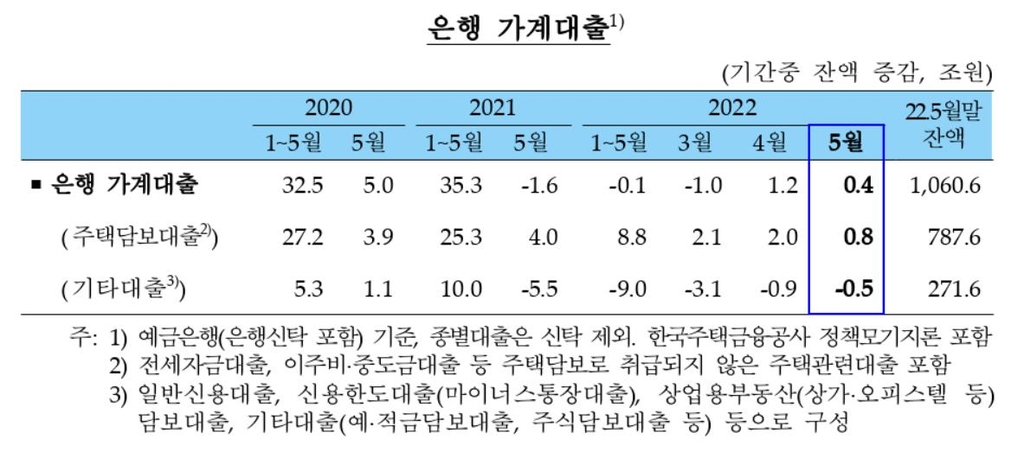

According to the ‘Financial Market Trends’ announced by the BOK on the 10th, the balance of household loans at deposit banks as of the end of May this year stood at 160.6 trillion won, an increase of 400 billion won from the end of April.

[한국은행 제공.재판매 및 DB 금지]

Bank household loans fell behind for four months in a row in December (200 billion won), January (500 billion won), February (200 billion won), and March (-1 trillion won) of last year, and then in April (+1 trillion won) 100 billion), and maintained the upward trend for the second month following rebounding. However, the increase was 800 billion won less than in April.

Looking at the increase and decrease in household loans by type, mortgage loans (balance of 787.6 trillion won) surged 800 billion won in one month. The increase fell to less than half of April (2 trillion won).

Among the mortgage loans, Jeonse loans increased by 1.1 trillion won, but the remaining individual mortgage loans decreased slightly.

Other loans including credit loans (balance of 271.6 trillion won) fell by another 500 billion won in one month. It is the sixth consecutive month of decline since December last year.

Hwang Young-woong, Deputy Head of Market Team at the Financial Markets Bureau of the Bank of Korea, said regarding the background and outlook for household loan growth, “We believe that the effect of strengthening household loan business by banks since March is showing to some extent.” “The increase in housing-related loans is likely to continue, and the If the strengthening of loan business continues, I think that the overall household loan recovery will continue.”

According to the ‘Household Loan Trend’ by the Financial Services Commission and the Financial Supervisory Service, household loans in the entire financial sector, including banks and secondary financial institutions, also increased by 1.8 trillion won last month. Housing mortgage loans surged 1.6 trillion won, and other loans such as credit loans surged 200 billion won.

In particular, in the case of other loans, it continued to decrease this year, but then returned to an increase for the first time last month.

An official from the financial authorities explained, “In May, as the demand for household funds related to Family Month increases, other loans such as credit loans tend to increase.”

By industry, household loans increased by 400 billion won in the banking sector and 1.4 trillion won in the second financial sector.

[한국은행 제공.재판매 및 DB 금지]

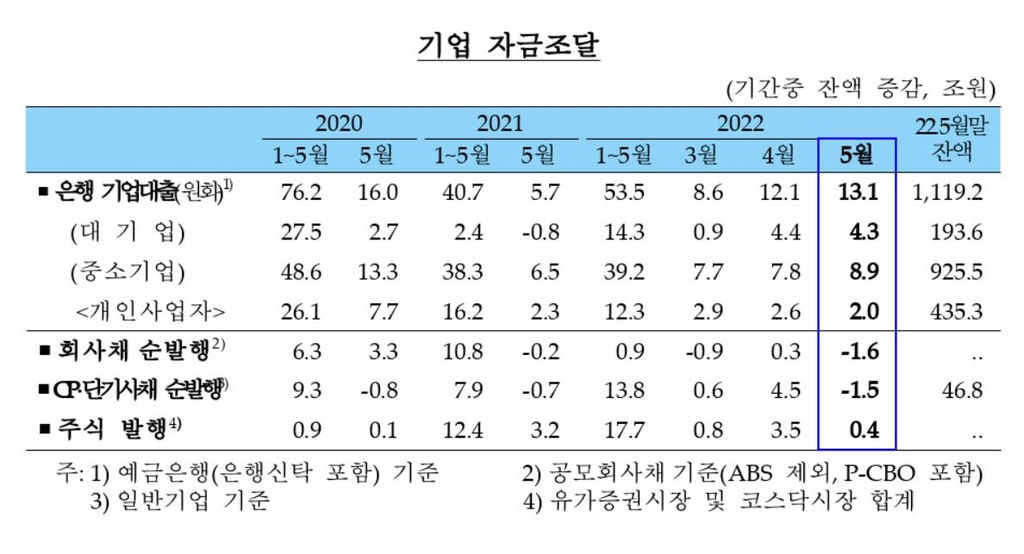

In the case of companies, loan growth continued for the fifth month in a row.

As of the end of May, the balance of loans in Korean won by companies stood at 119.2 trillion won, up 13.1 trillion won in a month. As of May, this is the second largest increase since statistics began in June 2009.

Loans to SMEs increased by 8.9 trillion won, including 2 trillion won in loans to individual businesses, and loans to large companies increased by 4.3 trillion won. In particular, the increase in loans to SMEs (8.9 trillion won) was the second highest on record as of May.

Deputy Manager Hwang explained, “Corporate loans increased significantly in May due to continued financial support for COVID-19, the demand for facility funds and the efforts of banks to handle corporate loans.”

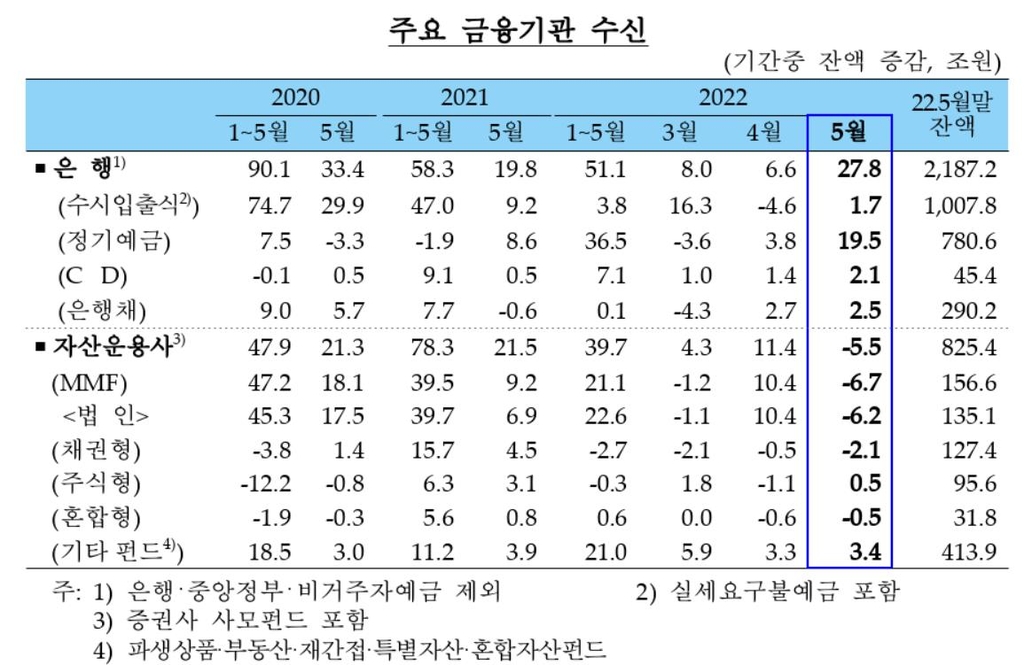

As of the end of May, the balance of payments received by non-loan banks was 2187 trillion won, an increase of 27.8 trillion won from the end of April.

By type of receipt, frequent deposits and withdrawals increased by 1.7 trillion won due to the inflow of funds from local governments related to the execution of loss compensation for small business owners.

Term deposits also increased by 19.5 trillion won as funds from individuals and local governments flowed in due to rising interest rates.

However, receipts from asset management companies decreased by 5.5 trillion won in May.

Money market funds (MMF) decreased by 6.7 trillion won due to the outflow of government funds, and 2.1 trillion won from bond-type funds went out.

Equity-type funds and other funds increased by KRW 500 billion and KRW 3.4 trillion.

[email protected], [email protected]

Report on Kakao Talk okjebo

<저작권자(c) 연합뉴스,

Unauthorized reproduction-redistribution prohibited>

2022/06/10 12:00 Send