2024-01-30 17:07:40

Is it worth investing in Alibaba Group using asset code BABA34? We have already said before that investing in China can be a great option. Precisely because it is an emerging market, and the second largest economy in the world.

And there are several possibilities for you such as BDRs, ETFs and other variable income options. For example the BDR BABA34. With opening in B3 in 2019, this asset is the code for the China-based Alibaba Group.

In today’s article, we will explore a little more regarding this asset and understand whether this is a good investment or not.

What is Alibaba Group?

Alibaba Group is a conglomerate of companies in the retail segment. Founded in 1999 by Jack Ma in Hangzhou, China, with the aim of creating an e-commerce platform that connects Chinese companies. There are several sales channels, each with a different approach.

The Alibaba Group itself aims to connect Chinese companies with international buyers. However, its business model was B2B – Business to Business, that is, for companies to buy from companies. Therefore, in this channel, wholesale purchases are very common.

In the 2000s, Taobao emerged, a C2C platform similar to Mercado Livre, where individuals sell to other individuals. However, this platform was only available for the Chinese market.

In 2008, it was time for the launch of Tmall and Alipay. Tmall has a model more similar to Amazon, which is B2C – bussiness to customer, where companies sell to end customers. However, this is an internal China website only.

Alipay on the other hand, is not a retail business. It’s a business for retail. Alipay is an online payment method. Therefore, all transactions within the Alibaba Group are now made through Alipay.

Assuming that China and the USA are the largest economies in the world. What happens there affects the rest of the world. Before, Alibaba Group was only for China. In 2010, they launched Aliexpress, allowing Chinese companies to ship products to people all over the world.

The Global Expansion of Alibaba BABA34

In 2014, Alibaba Group held its IPO in September 2014 on the New York Stock Exchange. At the time, the group raised 25 billion dollars and is still the largest IPO in the world. The IPO coordinating banks were Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, JPMorgan Chase & Co and Morgan Stanley.

Since then, Alibaba Group has been constantly expanding. And Brazil has become an important hub for the company. This happens precisely because Brazil is a strong consumer of Aliexpress, to the point of opening an office here in Brazil.

Furthermore, China is a major trading partner for Brazil. Therefore, it makes perfect sense to maintain close commercial relationships. And that’s when BDR BABA34 comes in.

As you already know, BDR is the acronym for Brazilian Depositary Receipt or securities deposit certificate. In practice, these are variable income certificates, issued in Brazil and traded on B3, and here they are called BABA34.

BDRs are backed by foreign investments, such as shares, index funds (ETFs) or international debt securities (bonds). Therefore, BDRs allow access to the results of these external investments.

However, it is important to highlight that BDRs do not grant direct participation in the underlying investments. In other words, when you acquire them, you gain exposure to the international market, but you do not become a direct shareholder of a foreign company. Instead, you gain exposure to the performance of companies abroad without directly purchasing their shares.

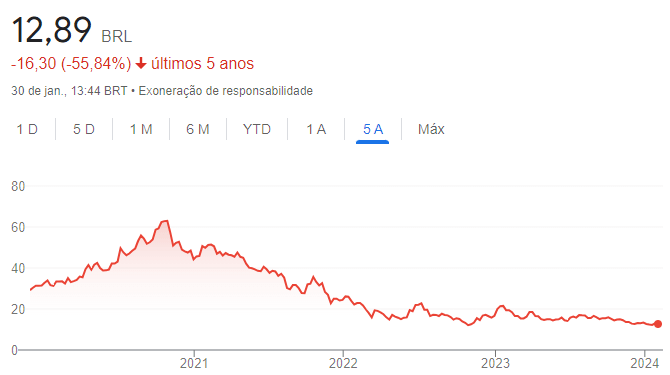

BABA34 asset performance over the last 5 years

World macroeconomic scenario

To talk regarding this subject, guests João Vitor Cardoso, Variable Income Specialist here at Renova Invest.

“Firstly, let’s start from the following principle: China and the United States as the largest economies in the world, everything and anything that happens there will affect the rest of the world. That said, thinking regarding a scenario during and following the pandemic, we have a situation that puts both countries in the eye of the storm. China as the first focal point of the virus and the American economy was damaged.

Therefore, both countries went through an inflationary peak, so the natural movement is: raising interest rates to control inflation. When interest rates are higher, you have an economic brake, precisely because everything becomes more expensive, and this really harms retail.

However, the market as a whole cannot handle high interest rates for long, so at a certain point it is essential to lower interest rates. And this movement is happening in Brazil and will soon begin in the United States. And low interest rates benefit the retail sector, which is where Alibaba Group finds itself.”

About the Asset

Therefore, thinking regarding an ecommerce business model, as is the case with Alibaba Group, there are advantages and disadvantages. For example:

Benefits:

- Anyone can access it;

- Low cost;

- Greater variety;

- No product production costs.

Disadvantages:

- Security in payment methods;

- Technology dependence;

- Profit sharing with suppliers.

Still according to the assessment of specialist João Vitor, “looking from the side of the company itself, it is a good company to invest in, because in addition to being solid, looking at its history – where there was a drop of more than 50%. In this scenario, we have two paths: the first looking from the side of opportunity, following all there is a decline and, as a strong and significant company, it will tend to recover.

But, on the other hand, it is a company that continues to expand, and the decline is much more related to the economic situation the world has gone through, than actually to the company.

And using shallow logic, the big problem for retail companies is always the inflationary period. And this explains why Brazilians have some resistance to purchasing assets from the retail sector. Historically speaking, we have several moments in which our economy was severely affected by high interest rates and inflation. Which is bad for the economy as a whole, but it’s common for an emerging country.

Therefore, if we look at this asset as a whole, the trend is for improvement, following all, more than 90% of the drop occurred in a period of global economic instability, and, therefore, the reestablishment of these shares will come. And this is proven by the company’s results from the last half of the year.”

Is it worth investing in BABA34?

As always, everything depends on your investment strategy and also your investor profile. Therefore, be sure to talk to an investment advisor to make your decision regarding purchasing BABA34. You, as an investor, can and should better understand your objectives within the financial market. Therefore, it is necessary to evaluate other assets that make more sense over time.

To have a healthy portfolio, long-term and short-term assets need to be part of your investments. In addition to retail class assets, goods and services. Remembering that any and all investments in shares are mostly considered risky investments.

But if we had to qualify a type of investor for this role, it would be for the bold profile. However, for those investors who have a well-diversified portfolio and want to take some risks, it may make sense.

What we need to keep in mind, therefore, is that every asset that is sensitive to interest, such as retail, construction, services and others, brings a certain sensitivity to the investor. Therefore, it is very important to follow your investment advisor’s strategy.

Renova Invest advisors are ready to assist you and outline a strategy that makes sense for you and your objectives in relation to your assets, explaining whether or not it makes sense to buy assets like BABA34. Click here and talk to an advisor now.

1707698326

#BABA34 #Alibaba #Group #worth #investing