An investment envelope of 1.8 billion dirhams, some 766 jobs in prospect, 10 million cast aluminum components to be produced… The foreign direct investment (FDI) counter for the year 2022 has just started with the groundbreaking ceremony for a new industrial unit of the Citic Dicastal group.

The Chinese supplier specializing in the molding and production of aluminum auto parts, including rims and chassis components, is already at its third factory in the country, with 5.3 billion dirhams of cumulative investment in three years.

“It is indicative of the dynamism experienced by the automotive sector, which has risen to the top of the Moroccan industry and which has shown all its resilience in the face of the health crisis”, explains this industrialist, according to whom “the sector must face many challenges to stay in the circuit and avoid returning to the starting point”. It is because this sector, which has become heavy, both in the balance of payments and in the job market, has come a long way…

The Renault turning point

Reverse, until the dawn of the XXIe century. The automotive industry in Morocco was then mainly limited to the historic Somaca factory (created in 1959), with, year following year, an assembly capacity of nearly 30,000 vehicles. Since then, the sector has fueled to experience phenomenal growth, under the effect of various acceleration plans.

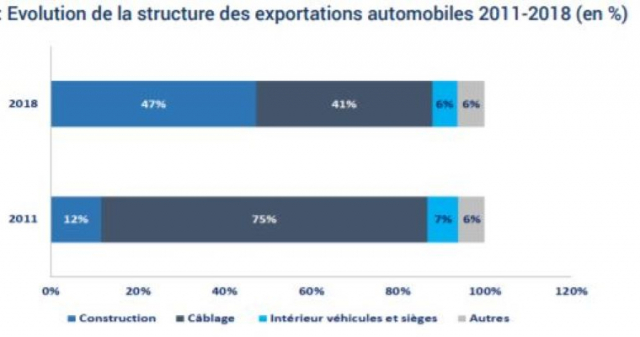

© : Source: DEPF

From the low-cost manufacture of subcontracted components for European assembly sites, launched in the wake of the Emergence Plan, to the establishment of major manufacturers with the Industrial Acceleration Plan (PAI), the sector s is completely transformed. And it is inevitably the shift in Renault’s establishment at the level of the Tangier Med port complex which has been decisive for the fabric of automotive suppliers.

“While rolling out the red carpet to the French manufacturer in this free zone, the Kingdom has favored the installation of international brands enjoying the confidence of global manufacturers. This ended up convincing a new manufacturer, in particular Stellantis (ex-PSA), to establish itself a dozen years later in Kenitra”, sums up a veteran of the Moroccan Association for Industry and Commerce of the car (AMICA).

Performance and Resilience

Since 2012, the sector’s indicators have gone into overdrive, whether in terms of job creation, vehicles produced, or even export earnings. Already in 2014, the sector has become the leading export sector, exceeding foreign exchange earnings from phosphates. Better still, the 40 billion dirhams of export turnover achieved at the time more than doubled to exceed 83 billion dirhams in 2021. Because even the health crisis, which has undermined so many sectors , represented only a slight jolt for the automobile industry: following the brake on exports to 72 billion dirhams, in 2020, these regained momentum to exceed their pre-pandemic level.

© : DR

The sector is also one of the rare components of the PAI to have exceeded its initial objectives. While Moulay Hafid Elalamy was counting on the creation of 90,000 jobs, the automobile industry was able to generate 148,000 at the end of 2019. “After the confinement, all the jobs were maintained and the sector was able to restart with growth”, affirms our source from AMICA. Morocco has thus become the leading automobile manufacturer in the Middle East and North Africa region and the second on the African continent.

It is also the first construction hub on the continent with the establishment of around 250 national and international players. FDI accumulated by the sector is around 26 billion dirhams between 2012 and 2018. As for its added value, it exceeds 30 billion dirhams, a colossal level which represents one and a half times the added value of OCP. And the potential remains enormous, knowing that the local integration rate is still at 60%, with the objective of raising it to 80% over the next few years.

Challenges to overcome

Further developing local integration remains the main challenge for the sector. “The wealth created is still too often captured by foreign investors and the impact on the local fabric is not sufficient. In-depth integration will encourage Moroccan entrepreneurship and increase the integration rate of young graduates,” says our source.

Upgrading skills is another lever for development, but also another challenge to be met. Labor should not be dedicated solely to the assembly of parts, connectors or other components. “Orienting young people towards innovative professions, training the workforce in the technological skills of tomorrow or even creating bridges between the academic world and the professional world are all priority objectives for gaining in competitiveness and added value” , explain the authors of a study by the Ministry of Finance.

Another major challenge lies in the diversification of export markets towards other developing countries, particularly in Africa. The country’s exports still only rank 27e world level and face strong competition, particularly from Eastern European countries and Turkey. Indeed, “Morocco’s dependence on European export markets increases its vulnerability to international changes,” say experts from the International Finance Corporation (IFC), adding that the European market was tending to slow down and that the competition was particularly tough.

Morocco must capitalize on its position as a strategic hub towards Africa to conquer emerging markets where demand is strong. But, it is also necessary to take shelter from the risk of industrial relocation which might encourage manufacturers and equipment manufacturers to pack up. Considering a 100% Made in Morocco automobile must start today.

“An economical electric vehicle designed and manufactured in the Kingdom to be exported to Africa, and why not to Europe, should be the objective to be set for this sector if we really want to take advantage of all the investments we are making today. today,” says our professional. This is obviously the way to excellence…