2023-06-06 05:00:00

Chart of the week from DWS. The European sector has been resilient since the rescue of Credit Suisse, but AT1s have yet to recover, making them attractive.

In March, banks’ AT1 bonds gained unexpected notoriety thanks to the innovative rescue of Credit Suisse (CS). At the time, investors and issuers feared that the Swiss model would set a precedent, meaning that AT1 capital would once more be used to cover losses sooner than expected. But this has not happened so far, first of all because it was indeed a Swiss peculiarity, which the ECB immediately qualified as inapplicable to banks in the euro zone. Moreover, the CS imbroglio did not trigger a conflict in the European banking sector(1).

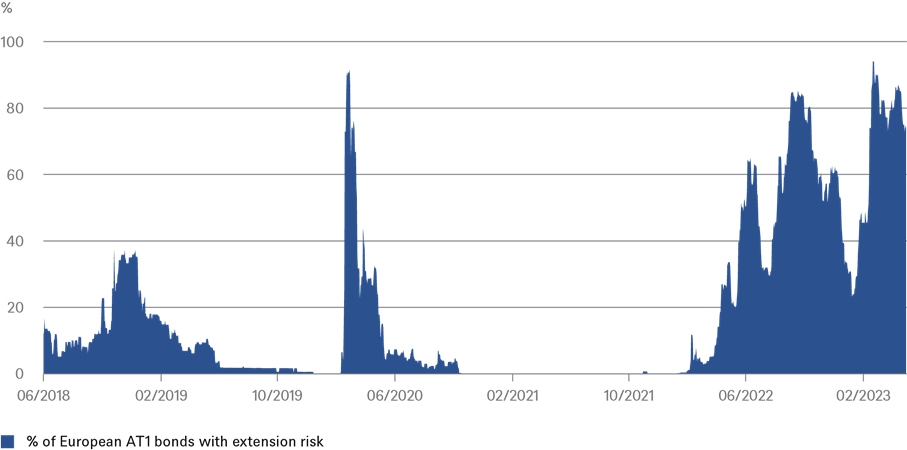

Nevertheless, the CS episode did not spare the AT1 bond market, as our chart of the week shows. This chart can be considered a stress indicator, as it shows how many outstanding AT1 bonds are priced as if they were perpetual, that is, as if the issuers would never exercise their right to call them back. There may be reasons why a bank does not redeem its outstanding AT1 bonds, but it is more than common market practice for banks to redeem their bonds and issue new ones.

AT1 bonds are too risky, which can only be because whole groups of investors have abandoned this segment since the CS incident.

Our chart nevertheless reveals a remarkable anomaly, since it is at regarding the same high stress level as during the March crisis. This situation does not correspond to our view of the state of the European banking sector, which we consider to be well capitalized and with sufficient liquidity. Nor is it what stock prices or the prices of insurance once morest default on the payment of obligations by financial institutions indicate. And above all, it does not correspond to what is currently observed on the market. With the exception of six bond issues – which represent only around 1% of the AT1 market – all AT1 bonds were called as soon as possible. Even when it was not optimal for economic reasons. Banks therefore still seem to fear a reputational risk. From our point of view, AT1 bonds are too risky, which can only be because whole groups of investors have abandoned this segment since the CS incident. In our opinion, this makes this segment even more attractive today.

Percentage of AT1 bonds priced as if held in perpetuity

Sources: Bloomberg Finance L.P., DWS Investment GmbH au 31/05/2023

1686032869

#European #bank #bonds #show #surprising #concern