2024-08-10 05:41:37

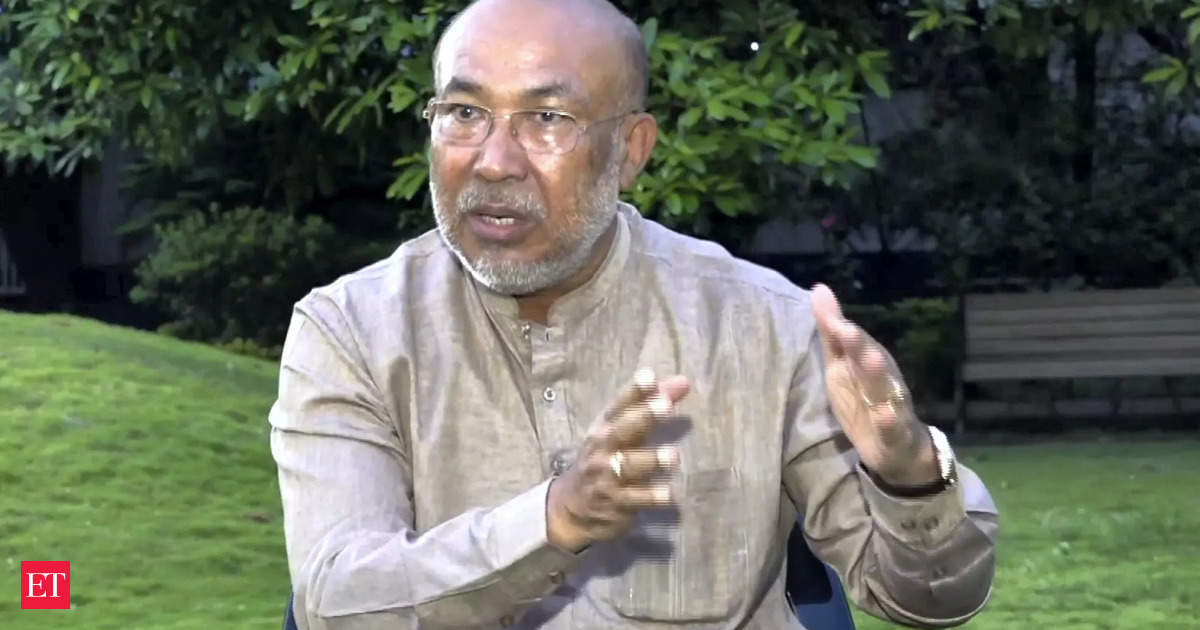

Replying to a question from MP Sheikh Noorul Hassan, the chief minister in charge of finance said about 75% of the state’s total borrowings are from open market borrowings (OMB). The above amount includes a 50-year interest-free loan provided by the Government of India for capital expenditure/investment in the fiscal year 2020-21.

The total liability of the state government for the financial year 2024-25 is Rs 16,988 crore as on March 31, 2024. The total interest paid by the state government on its borrowings every month The interest paid by the state government every month is not fixed. It fluctuates every month during the financial year.

He added that in the fiscal year 2023-24, the state expects to pay Rs 946 crore in interest on the loans taken. In the fiscal year 2022-23, the state will pay Rs 874 crore in interest. In the fiscal year 2021-22, the state government paid Rs 690 crore in interest on the loans taken.

The Ministry of Finance monitors key indicators of the fiscal health of the state and the current credit rating of the state and its impact on the state’s borrowing costs and financial reputation. Currently, the state has no credit rating. In fact, to the knowledge of the State Ministry of Finance, no state in India has a credit rating. The state’s borrowing rates are within the normal range applicable to other Indian states.

The Fiscal Responsibility and Budget Management Act is a mechanism for effective management of public debt. It is the backbone of debt management for state governments. Under Article 293 of the Constitution, the Government of India also monitors the borrowings of state governments. State governments closely monitor their state public debt, taking into account overall outstanding fiscal debt, repayment capacity, funding requirements for development purposes and other debts to meet state government commitments. Details of contingent liabilities of state governments and their potential risks? (i) As on March 31, 2023, the outstanding guarantees provided by the state government were Rs. 12,939.8 crore. Biren said these guarantees were provided under the Manipur Government Guarantee Ceiling Act, 2004. The state government provided budgetary support for debt repayment for most of these guarantees. The state government also makes further investments in the Guarantee Redemption Fund (managed by the Reserve Bank of India) to meet any exigencies. So far, no claims have been made against the fund. The potential risk of contingent liabilities to the fiscal stability of the state is negligible.

1723288836

#March #total #debt #Manipur #government #crore