With the European Central Bank (ECB) starting a cycle of cutting base rates this year, there is growing talk of a further decline in the popularity of deposits. Is it still possible to catch up on this investment opportunity for an attractive return?

Since 2015 until 2022 EURIBOR was zero, but with the start of the Russian war in Ukraine, due to the energy crisis and a strong increase in inflation, the ECB started to raise the base interest rates – in 2023. EURIBOR peak was also fixed in October: 4.1 percent. Such interest greatly increased the price of household loans, but at the same time shook the time deposit market – depending on the period and type of deposit, residents could earn up to 4% on the deposit. interest.

After managing the record inflation, in 2024 In the summer, the ECB started the interest rate reduction cycle and this year it has already reduced the base interest rate twice by 0.25% each. point. Market participants predict that the 3-month EURIBOR will increase from the current 3.3%. will decrease to 2.38 percent. in 2025 at the end of the first quarter, and in 2025 in June, the 3-month EURIBOR should reach 2 percent.

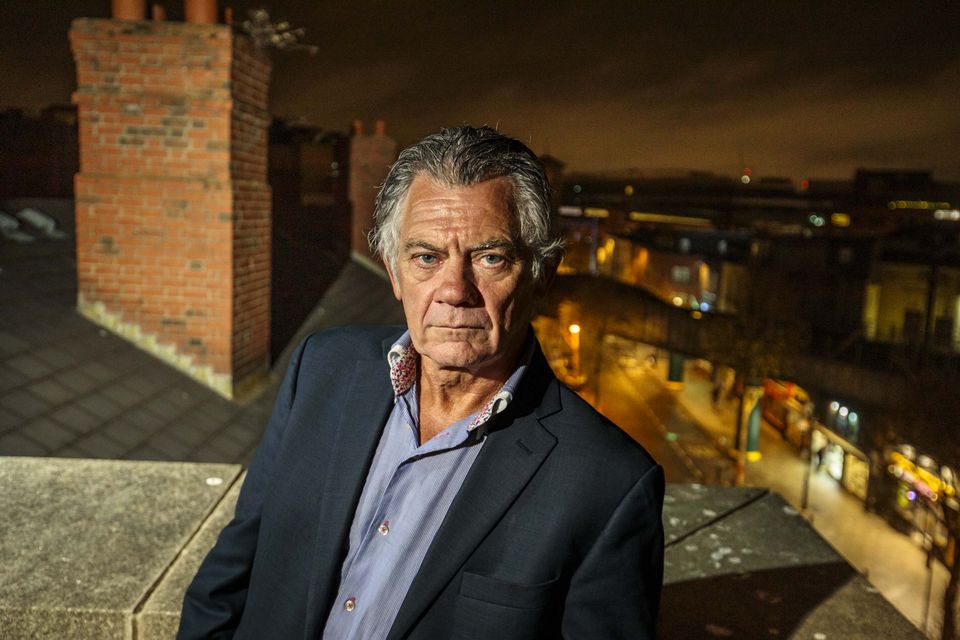

According to Darius Burdaitis, head of the Lithuanian branch of Citadele Bank, in the near future this will also affect deposit interest rates, but it will not be a sudden change.

“The ECB is reducing the base interest rates gradually, and the EURIBOR is also gradually decreasing – it should not return to the zero zone in the near future. Therefore, deposit interest rates will remain more attractive for some time than in 2019, when they were also close to zero,” says D. Burdaitis.

Despite the slight decrease in interest rates, the September data of the Bank of Lithuania show that the opportunity to invest in deposits remains attractive: deposits of Lithuanian households and non-financial companies increased by 247.4 million, respectively. and 169.7 million euros.

“In September, annual inflation was 0.4 percent. Citadele bank for 12 months. a person can currently receive a term deposit from 2.96 to 3.15 percent. interest. Thus, it still remains an effective way for residents to protect their savings from inflation with the lowest risk,” observes Darius Burdaitis.

According to him, it is usually best to invest in a medium-term deposit of 6-12 months. Also, when deciding on the duration of the deposit, it would be worthwhile to evaluate inflation forecasts.

“A considerable part of the population is worried about the fact that if they keep their savings in a deposit, it will not be possible to withdraw this money for a certain period of time. However, if it is necessary to withdraw money before the term ends, it can be done quite quickly – in this case, the accrued interest will be deducted from the deposit amount. Another solution is to keep savings in several deposits of different duration”, advises D. Burdaitis.

#interest #rates #fall #popularity #deposits #wane #Business

2024-10-01 19:13:33