Supermarket Sales Plummet in Argentina: A Sign of Economic Distress?

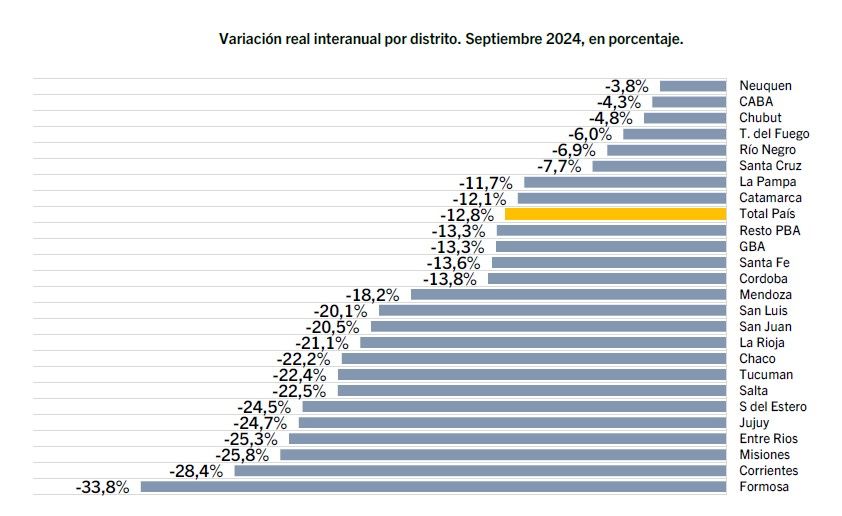

Argentina is facing a grim economic reality as supermarket sales data reveals a persistent decline in consumer spending. Across the nation, sales contracted 12.8% in September, mirroring a worrying trend that has plagued the retail sector for 11 consecutive months.

Córdoba: A Microcosm of National Challenges

Córdoba province suffered even steeper losses, with sales down 13.8% compared to the same period last year. This places Córdoba in the middle of the regional rankings, mirroring a broader economic downturn affecting provinces across the country. While Neuquen (-3.8%), CABA (-4.3%), and Chubut (-4.8%) experienced the smallest sales dips, the impact was more pronounced in Formosa (-33.8%), Corrientes (-28.4%), and Misiones (-25.8%).

Shifting Consumer Priorities: Spending Habits Under Scrutiny

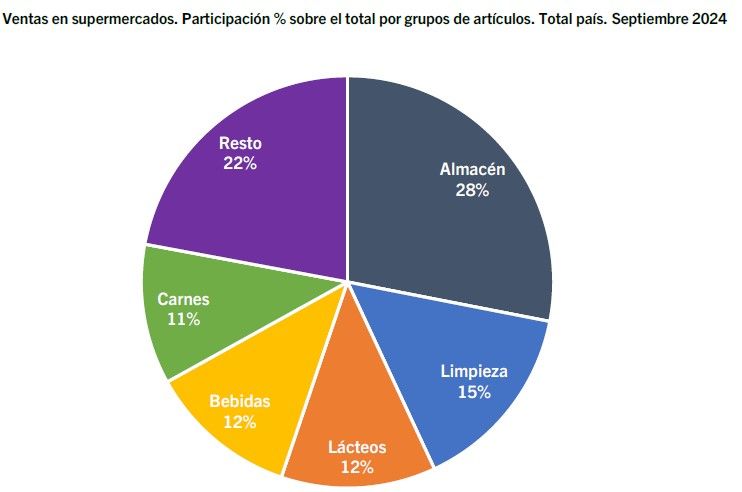

Analysts attribute the decline in sales to stagnant wages, leaving consumers with less disposable income. People are increasingly prioritizing essential goods over discretionary items. Shop items remain the most popular category, accounting for 28% of September sales. Cleaning and fragrance products secured a 15% share, followed by dairy products at 12%.

On the other end of the spectrum were bakeries (4%), clothing, footwear, and home textiles (2%), and prepared food and kebab shops, with a meager 1% of total sales. These figures paint a clear picture of where consumers choose to prioritize their household budgets.

A Glimmer of Hope?: Cleaning Products See Growth

Bucking the downward trend, cleaning and fragrance products unusually saw a 1% rise in sales nationwide and a 5.1% increase in Córdoba. This suggests consumers might be prioritizing hygiene and cleanliness amidst economic uncertainty.

Meat Consumption Declines Sharply in Response to Inflation

Costlier groceries are heavily impacting Argentinians’ diets. In Córdoba, meat consumption shrunk by a substantial 21.6%. The sharp decline reflects scarce household budgets, forcing families to cut back on protein sources like beef. Beverage consumption also experienced a significant drop of 24.3%, while warehouse product sales dipped by 16.3%, and barbecue restaurant consumption fell by 16.6%.

A Struggle to Keep Food on the Table: Essential Items Remain Costly

While overall sales in Córdoba registered negative figures, declines were less pronounced in certain essential food categories. Vegetables and fruits faced a decrease of only 1.7%, dairy products dropped by 3.4%, and bakeries experienced a 4.5% decline. These figures indicate that while affordability is a major concern for many, consumers are making strenuous efforts to ensure access to basic staples.

Cautious Optimism or Empty Promises?

“Salary increase” has become a mantra for the government, attempting to reassure the public amidst rising costs. Chief of Staff Guillermo Francos highlighted an average salary increase of 119.2%, exceeding the cumulative inflation rate by 17.6 percentage points. However, alongside the somber sales data, these figures raise questions about whether these salary gains are sufficient to match the reality of soaring prices.

What specific regional disparities in supermarket sales are mentioned, and what factors might contribute to these differences?

## Supermarket Sales Slump: A canary in Argentina’s economic coal mine?

**Host:** Welcome back to the show. Today, we’re diving into the latest economic data out of Argentina, and it’s not looking good. Supermarket sales have plummeted for the eleventh consecutive month, painting a worrying picture of the nation’s financial health. Joining us to dissect these numbers is leading economist Dr. Maria Sanchez. Dr. Sanchez, thanks for being here.

**Dr. Sanchez:** Thanks for having me.

**Host:** Let’s get right to it. These numbers are stark. A 12.8% nationwide drop in supermarket sales in September alone. What’s driving this precipitous decline?

**Dr. Sanchez:** Several factors are converging to create this perfect storm for the Argentinian consumer. Stagnant wages are a key culprit. People simply aren’t seeing their incomes keep pace with rising costs of living. This leaves less and less disposable income, forcing people to prioritize essential items like food and cleaning supplies, and cut back on discretionary spending.

**Host:** The article mentions that sales of cleaning products actually went up slightly. Is that a sign of people trying to keep things tidy during tough times, or is there something else at play?

**Dr. Sanchez:** It’s fascinating, isn’t it? It could be a combination of factors. People may indeed be spending more on cleaning products as a way to cope with stress and maintain a sense of control during uncertain times. It’s also possible that this reflects a shift towards value-oriented products, perhaps as consumers are looking for ways to stretch their budgets further.

**Host:** The article also highlights the disparities in regional sales figures. Some provinces, like Formosa, Corrientes, and Misiones, seem to be hit particularly hard. What can you tell us about that?

**Dr. Sanchez:** Argentina, despite being a relatively homogenous country, experiences regional economic disparities. Provinces reliant on specific industries that are struggling, or those with higher unemployment rates, tend to suffer more pronounced dips in consumer spending.

**Host:** So, what does this all mean for the future of the Argentinian economy? Is there a light at the end of the tunnel?

**Dr. Sanchez:** These numbers are undoubtedly concerning. They point to a possible recessionary spiral, where declining consumer spending further contracts the economy. To reverse this trend, the government needs to address underlying issues like wage stagnation, inflation, and unemployment. It’s a complex problem with no easy solutions, but targeted policies aimed at revitalizing the economy and putting more money back in people’s pockets are crucial.

**Host:** Dr. Sanchez, thank you for shedding light on this important issue. We appreciate your time and insights.

**Dr. Sanchez:** My pleasure.

**(End of Interview)**