As it is predicted that banks will enter the virtual asset industry, the virtual asset industry also expressed expectations. It is expected that public trust in the industry will increase as more reliable operators enter the market.

In particular, it is explained that the virtual asset custody (custody) service that banks are preparing not only maximizes this effect, but can also promote the revitalization of the entire virtual asset industry.

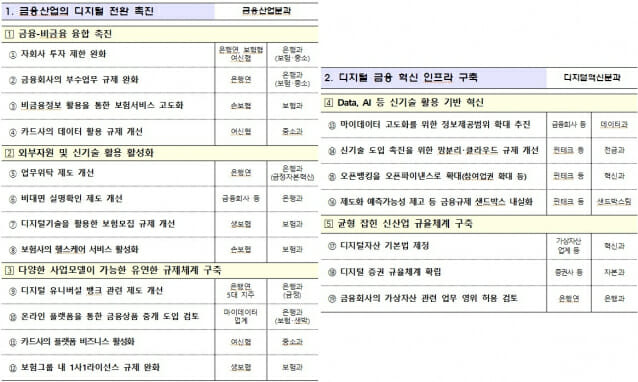

Suggestion of easing regulations on separation of finance and industry… Bank ‘allowing virtual asset business’ innovation task included

The Financial Services Commission announced the ‘Finance Regulation Innovation Promotion Direction’ at the 1st Financial Regulation Innovation Conference held on the 19th. Acceptance review’ included.

This reflects the recommendations of the National Federation of Banks, and virtual assets are selected as one of the industries that want to expand ancillary business.

In addition, the Federal Reserve Bank of Korea also proposed to allow investment within 1% of equity capital without industry restrictions, including virtual assets, in order to promote the digital transformation of the financial industry. Currently, under the Banking Act, non-financial companies are only allowed to invest within 15% of their shares.

In the remarks at the meeting, Chairman Kim Joo-hyun of the Financial Services Commission said that he would first consider ways to improve the scope of business of financial companies and restrictions on investment in subsidiaries in order to ease regulations on separation of finance and industry.

As the FSC announced this policy direction, the possibility that banks’ entry into the virtual asset industry will become a reality has increased.

■Virtual asset exchange “Entry of banks, promotion of institutional investment”

The virtual asset industry predicted that this direction of regulatory innovation will contribute to the growth of the industry. In a situation where consumers with negative perceptions of virtual assets are still significant, it is expected that positive perceptions of the industry will expand if banks, which are socially reliable business operators, are incorporated as players.

An official from the virtual asset exchange said, “The goal of banks is to provide virtual asset custody services directly without going through subsidiaries by taking advantage of their advantages. It will become stronger as you acquire it.”

When banks start the virtual asset business in earnest, it will reduce concerns regarding legal risks and promote the creation of an environment where institutions can invest in virtual assets.

Another exchange official said, “It is positive for the market that virtual asset custody services are active overseas, and that traditional financial institutions have a legal basis to handle virtual assets. An environment is created where this can be done, and there is nothing wrong with considering the bank’s social position.”

Related articles

However, he predicted that if securities companies enter the virtual asset market in the future, they are likely to face direct competition with banks, unlike banks.

An official from the virtual asset exchange said, “If we add simple development to the stock trading service, we will be able to support virtual assets.”