SAQ customers will have to pay a little more for their alcohol, while the federal excise tax will increase by 2%.

• Read also: Strong opposition to new liquor tax hike coming April 1

The measure was announced in the Freeland 2023 budget, tabled this week.

The increase was to reach 6.3%, but the federal government decided otherwise. On a bottle, the average increase is $0.01, now reaching 5 cents.

Although the amount of the tax is low, this increase is added to the amount of other taxes that Quebecers already pay.

Here is the breakdown of taxes, fees and purchase cost for a bottle of wine:

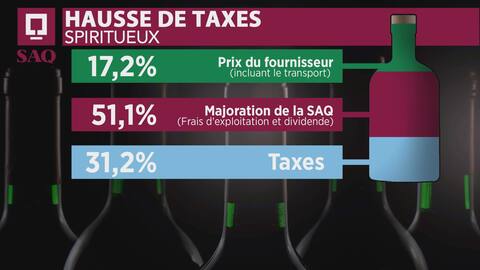

Here is the portrait for spirits:

All consumers bear these exorbitant fees, including entrepreneurs who buy in large quantities.

The Canadian Federation of Independent Businesses (CFIB) denounces this new increase in the price of alcoholic beverages.

CFIB vice-president François Vincent believes that these costs take up too much of the budget of entrepreneurs.

“SMEs are affected threefold by inflation,” he says, referring to the challenges faced by entrepreneurs.

In addition, higher taxes might lead to lower consumption, he says.

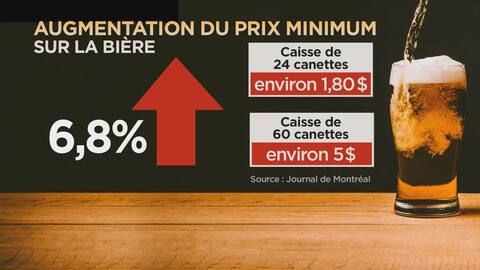

Beer will not be spared from soaring prices. On average, the case of 24 cans will increase by $1.80, while that of 60 cans will see its price jump by $5.

Resigned customers

Met by TVA Nouvelles, taxpayers are not surprised by these repetitive increases in taxes on alcoholic products.

“It discourages me more or less […] I’m the one paying the price,” said a customer.

“It seems that everyone is rushing to increase everything,” observes a man.