Could Cardano (ADA) Be Poised for a 40% Surge?

Table of Contents

- 1. Could Cardano (ADA) Be Poised for a 40% Surge?

- 2. Deciphering the Symmetrical Triangle

- 3. Whale Activity and Market Sentiment: The X-Factors

- 4. The Potential Impact of a Breakout

- 5. Cardano (ADA) teeters on the brink: Will the Triangle Break?

- 6. Whale Activity and the Broader Crypto Landscape: Key Factors to Watch

- 7. Cardano’s Price Outlook: A Delicate Balance Between Bulls and Bears

- 8. Cardano’s Price Outlook: Decoding the Patterns

- 9. Cardano’s Future: A Beacon of Hope?

- 10. What is the significance of the symmetrical triangle pattern observed in Cardano’s price action?

- 11. Cardano’s Price Outlook: Decoding the Patterns

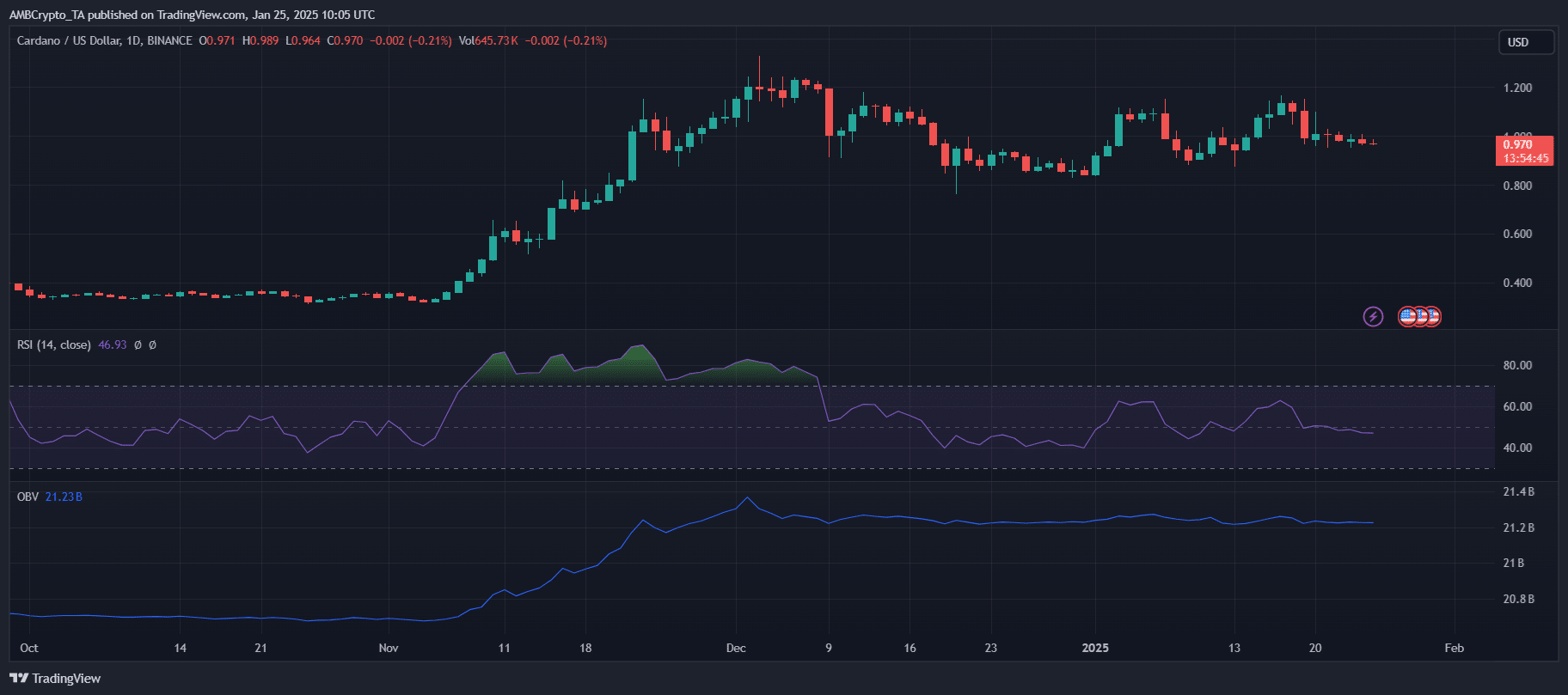

Cardano (ADA) is currently dancing on the edge of a breakthrough.Its price action is trapped within a symmetrical triangle pattern, a technical formation that frequently enough precedes meaningful price movements. analysts are eagerly watching, predicting a potential 40% surge if the momentum swings in favor of the bulls. However, the tight price range suggests a looming volatility explosion, making every move a potential turning point.

Deciphering the Symmetrical Triangle

A symmetrical triangle forms when an asset’s price oscillates between converging support and resistance levels. it’s like a pressure cooker, where the tug-of-war between buyers and sellers intensifies as the price consolidates. This period of consolidation can last for varying lengths of time, adding to the suspense.While not inherently directional, symmetrical triangles are known to signal a significant breakout event. This break can propel the price upwards or downwards, often with extraordinary speed and force.

Whale Activity and Market Sentiment: The X-Factors

Alongside the technical indicators, the actions of large investors, frequently enough dubbed “whales,” can provide valuable insight into ADA’s potential trajectory.

Keeping a close eye on whale activity can reveal if these influential players are accumulating ADA, suggesting a bullish outlook, or if they’re offloading their holdings, potentially indicating a bearish trend.

Another crucial factor to watch is the broader cryptocurrency market sentiment. If the overall market is experiencing a bullish wave, ADA could benefit from the increased buying pressure. Conversely,if the market turns bearish,ADA could be dragged down despite its bullish technical setup.

The Potential Impact of a Breakout

A breakout from the symmetrical triangle could trigger a significant price surge for ADA. Analysts are anticipating a potential 40% move if the price manages to break above the resistance level of the triangle. However, it’s important to remember that technical analysis is not foolproof, and the actual price movement could differ from these predictions.

The coming days and weeks will be crucial for ADA’s price action. The convergence of the technical setup, whale activity, and market sentiment will ultimately determine whether this tezos contender can break free from its confines and unleash its 40% potential.

Cardano (ADA) teeters on the brink: Will the Triangle Break?

January 25th, 2025, saw Cardano (ADA) caught in a tight squeeze, trading around $0.97. This position between the critical support level of $0.83 and the resistance at $1.06 suggests a brewing volatility storm.

Renowned analyst Ali Martinez highlighted this dynamic, noting that ADA’s movement mirrored the symmetrical triangle pattern.Renowned crypto analyst, ali Martinez, observed this pattern, predicting,”Historically, breakouts from symmetrical triangles tend to follow the prevailing market trend. Considering ADA’s current position, the market eagerly awaits a decisive move above or below these key levels, which could trigger a 40% price swing in either direction.”

Whale Activity and the Broader Crypto Landscape: Key Factors to Watch

The price of ADA is heavily influenced by the actions of ‘whales,’ large investors who can dramatically sway market sentiment with their buy or sell orders.

Beyond whale activity, the broader cryptocurrency market plays a critical role in ADA’s performance. Positive news, regulatory clarity, or advancements in blockchain technology can fuel a bullish sentiment, while negative events or market downturns can dampen ADA’s progress.

Investing in cryptocurrencies carries inherent risks. It is crucial to conduct thorough research, understand market dynamics, and only invest what you can afford to loose.

Cardano’s Price Outlook: A Delicate Balance Between Bulls and Bears

Cardano’s price action has been a captivating dance between bullish and bearish forces in recent weeks. While the cryptocurrency flirted with the $1.06 mark, a surge of selling pressure from large investors, known as “whales,” dampened its advance.

“Whale activity has been pivotal,” a recent report highlighted, noting the sale of over 180 million ADA by major holders in the past week. This significant outflow exerted downward pressure on ADA, stalling its upward momentum. Consistent outflows from wallets holding over $1 million further suggest a waning confidence among these large investors.Analysts are closely watching this trend. If whale sell-offs persist, the situation could spiral into a bearish breakdown below the critical $0.83 support level. However, a halt in these selling activities could ignite a renewed bullish sentiment, propelling ADA above the $1.06 resistance level.

Cardano’s future price trajectory hangs in the balance, intricately linked to the outcome of its current symmetrical triangle pattern.

A breakout above the $1.06 resistance could spark a major rally, potentially lifting the price by as much as 40%. This scenario would likely be fueled by reduced whale activity, increased on-chain transactions, and a favorable overall market sentiment.

conversely,a break below the $0.83 support level could trigger a cascade of selling pressure, driving ADA towards lower levels. Persistent whale outflows, coupled with a weak market habitat and lingering macroeconomic uncertainties, could exacerbate this decline.

Furthermore, the price movements of Bitcoin, the dominant cryptocurrency, will undoubtedly play a significant role in shaping Cardano’s future price.

Cardano’s Price Outlook: Decoding the Patterns

the cryptocurrency market is a constantly shifting landscape, with analysts and traders always seeking clues to predict future price movements.Today, we’ll delve into the world of technical analysis to explore Cardano’s current price action and potential future trajectory. To guide us through this analysis, we have two experts: Amanda Coin, a seasoned cryptocurrency analyst with a keen eye for market trends, and David Ledger, a blockchain developer with deep expertise in Cardano’s technology and ecosystem.

Amanda Coin: “We’re currently observing a symmetrical triangle pattern in Cardano’s price action,” she explains. “This suggests a brewing storm of volatility,with the bulls and bears locked in a tense tug-of-war,waiting for a decisive breakout.”

David Ledger: “I agree,” Ledger adds. “This pattern often signals a significant price move in the direction of the prevailing trend. Considering Cardano’s recent performance, this breakout could potentially lead to a 40% swing in either direction.”

Amanda Coin: “One crucial factor to watch is the activity of whales—major investors holding significant amounts of ADA. Recent data shows a notable increase in sell-offs from these whales,which has exerted downward pressure on the price.”

David Ledger: “That’s a key point,” Ledger emphasizes. “Whale activity can strongly influence market sentiment and drive price movements.If these large holders continue to sell, it could trigger a bearish breakdown below the crucial $0.83 support level.”

Amanda coin: “Conversely,” she continues, “if we see a halt in these sell-offs and some buying activity from whales, it could bolster bullish sentiment and propel ADA above the .06 resistance level.”

david Ledger: “absolutely. A sustained breakout above this resistance could ignite a significant rally for Cardano, driven by renewed confidence in the project and its potential.”

Amanda Coin: “Ultimately,” she concludes, “the success or failure of this breakout depends on the interplay of several factors, including whale activity, overall market sentiment, and broader cryptocurrency market trends.”

Cardano’s Future: A Beacon of Hope?

The world of cryptocurrency is constantly evolving, with new projects emerging and existing ones vying for dominance. Amidst this dynamic landscape, Cardano has emerged as a significant player, drawing attention for its innovative approach to blockchain technology.Its unique features and ambitious goals have sparked both excitement and skepticism within the crypto community.

Recently, industry experts have shared their perspectives on Cardano’s long-term trajectory. When asked about his view on Cardano’s future, David Ledger posed a compelling question to Amanda Coin: “What are your thoughts on the overall trajectory of Cardano in the longer term, Amanda?” Coin’s response reflects a confident outlook:

“I remain bullish on Cardano’s long-term prospects. The project’s focus on scalability, security, and sustainability, coupled with its growing ecosystem of decentralized applications, positions it well for future growth.”

Coin’s optimism stems from Cardano’s core principles. The platform prioritizes scalability, aiming to handle a vast number of transactions efficiently. Security is another paramount concern,with Cardano implementing robust consensus mechanisms to safeguard the network from vulnerabilities. Moreover, Cardano is committed to sustainability, striving to minimize its environmental impact through energy-efficient operations.

The growing ecosystem of decentralized applications (dApps) built on Cardano is a testament to its potential.These applications are transforming various sectors, from finance and gaming to supply chain management and healthcare. As the dApp ecosystem expands, Cardano is poised to become a more integral part of the decentralized future.

Cardan’s future is a story still being written, but with its dedication to innovation and its growing influence, it appears to be a promising chapter in the evolution of blockchain technology.

What is the significance of the symmetrical triangle pattern observed in Cardano’s price action?

Cardano’s Price Outlook: Decoding the Patterns

Amanda Coin: “We’re currently observing a symmetrical triangle pattern in Cardano’s price action,” she explains. “This suggests a brewing storm of volatility,with the bulls and bears locked in a tense tug-of-war,waiting for a decisive breakout.”

David Ledger: “I agree,” Ledger adds. “This pattern often signals a notable price move in the direction of the prevailing trend. Considering Cardano’s recent performance, this breakout could potentially lead to a 40% swing in either direction.”

Amanda Coin: “One crucial factor to watch is the activity of whales—major investors holding significant amounts of ADA. Recent data shows a notable increase in sell-offs from these whales,which has exerted downward pressure on the price.”

David Ledger: “That’s a key point,” Ledger emphasizes. “Whale activity can strongly influence market sentiment and drive price movements.If these large holders continue to sell,it could trigger a bearish breakdown below the crucial $0.83 support level.”

Amanda coin: “Conversely,” she continues, “if we see a halt in these sell-offs and some buying activity from whales, it could bolster bullish sentiment and propel ADA above the $1.06 resistance level.”

david Ledger: “absolutely. A sustained breakout above this resistance could ignite a significant rally for Cardano, driven by renewed confidence in the project and its potential.”

Amanda Coin: “Ultimately,” she concludes, “the success or failure of this breakout depends on the interplay of several factors, including whale activity, overall market sentiment, and broader cryptocurrency market trends.”