The quantity of the social insurance coverage pension will depend on the variety of individuals working and paying social insurance coverage contributions, their wages and the social insurance coverage charge. Leaving apart the problem of the tariff, the principle elements that decide the quantity of pensions are the variety of working individuals, their wages and the pension indexation rule.

The only and most secure technique of indexation of pensions is predicated on growing pensions on the similar charge as the typical wage has elevated. By growing pensions on this method, in intervals when the expansion charge of employment exceeds the expansion charge of pensioners, a reserve begins to kind within the social insurance coverage system. Because the financial system grows, as companies create an growing variety of jobs, the reserve additionally grows within the social insurance coverage system.

When the financial system strikes from a progress part to a recession part, when companies cease hiring new workers, following they begin shedding outdated ones, when wage progress stops, the reserve within the social insurance coverage system stops accumulating and begins to lower. Ideally, the excess constructed up within the system throughout an financial upswing is totally depleted throughout a downturn, when wages cease rising, fall, and the system has to pay unreduced pensions, present an analogous quantity of illness and maternity advantages, and a a lot bigger quantity of unemployment advantages.

Since 2017, indexation in accordance with the expansion charge of the wage fund has been formally utilized in Lithuania. In comparison with wage-only indexation, wage indexation will increase pensions at a quicker charge as employment grows, barely will increase the substitute charge, and lowers reserve formation charges. Such indexation will increase pensions at a slower charge and lowers the substitute charge as employment declines. The latter statutory choice is a considerably safer different to the system, though not in all circumstances.

Not one of the indexing choices can assure the monetary stability of the system at a quicker charge when the variety of pensioners grows than the variety of working folks, that’s, they can not shield in opposition to the getting old of the inhabitants and it shouldn’t be anticipated of them. There is no such thing as a method of indexing pensions that protects the system in opposition to an getting old inhabitants, however all indexation choices present safety in opposition to the same old recessions that hit the financial system.

By indexing pensions on the similar charge as wages have grown, a extra, much less fixed, relationship between common pension and common wages is maintained. By indexing pensions to the expansion charge of the payroll, the substitute charge tends to rise barely because the payroll grows. The latter choice is safer for the system provided that the variety of employed individuals tends to lower. In different circumstances, the primary choice is preferable for the social insurance coverage system.

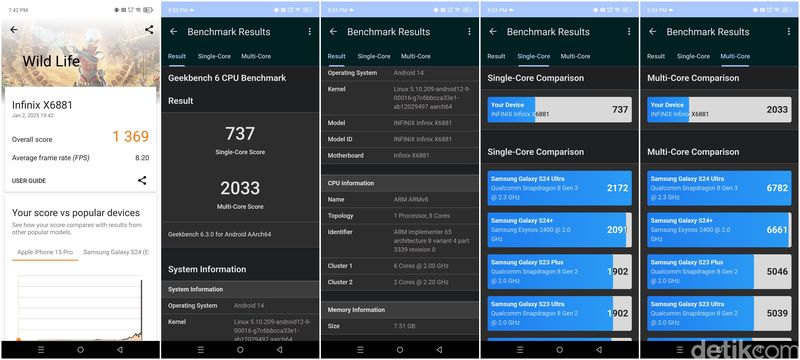

The primary determine exhibits the dynamics of old-age pension, wages and their ratio, the so-called substitute charge, from the primary quarter of 2008 to the primary quarter of 2024. The very best charge of change was in 2009. Such a excessive substitute charge was decided not by the effectivity of the social insurance coverage system, however by the truth that old-age pensions had been elevated, whereas wages fell in parallel because of the monetary disaster.

The social insurance coverage system was unable to assist such excessive substitute charges and paid advantages past the system’s capability – the lacking funds had been borrowed. The sharp improve within the substitute charge throughout this era was not an indication of the elevated consumption alternatives of senior residents, however somewhat an indication of the declining consumption alternatives of working folks and the growing debt burden of the social insurance coverage system.

VU picture/Retirement pension for these with the required size of service, web wage and substitute charge from 2008. I quarter till 2024 I quarter

The substitute charge all the time will increase firstly of the yr, when pensions are elevated, following which progressively decreases later within the yr as wages improve. in 2024 Within the first quarter, the old-age pension substitute charge for these with the required size of service is 47.7 %. Over the last month of the elections, a substantial variety of politicians holding numerous positions or the staff of the ministries underneath their command managed to familiarize the general public with what the pension substitute charge needs to be. Of their opinion, it needs to be increased than it’s now, and as methods to lift it, they indicated a change within the pension formulation and a unique indexation than is at the moment legitimate.

Undoubtedly, the pension calculation formulation might be modified, however this is not going to change the quantity of contributions transferred to the social insurance coverage finances. The appliance of quicker indexation will forestall the formation of a enough reserve stage and can cut back the monetary sustainability of the social insurance coverage system. The one sustainable method to elevate the substitute charge is to have stronger than earlier employment progress.

This place might give the impression that the important thing to increased pensions lies within the enterprise and funding local weather. The next substitute charge is assured by the accelerating creation of recent jobs, so the principle focus needs to be on the elements influencing choices to open new factories, develop operations in Lithuania or transfer them to Lithuania from different nations. Tax surroundings and stability are solely a number of the standards which can be necessary for buyers.

The state of contemporary economies is decided by the labor power of those economies and its capabilities. It will likely be potential to draw buyers if the nation can supply extremely certified and comparatively cheap labor power. If the required expert labor is just not out there within the nation, buyers is not going to go, even when they’re exempted from all taxes, as a result of there merely is not going to be employees in that nation who can carry out the required features.

So, in truth, the important thing to a better substitute charge doesn’t lie within the funding local weather, however within the schooling of the inhabitants. With the intention to create a welfare state, the principle focus have to be on schooling and information. It’s not the truth that an individual has an schooling, however what sort of schooling an individual has, that’s the most important determinant of a rustic’s manufacturing construction. Every little thing else: manufactured items, their portions, paid taxes and contributions, pensions allotted from them, funds for constructed roads, and many others. are the results of the fundamental issue – schooling, and particularly increased schooling.

The important thing to financial success, increased charges of substitute and prosperity for all lies proper right here. Higher schooling determines a unique high quality of labor provide available in the market and offers a foundation for attracting investments. A well-educated workforce is a prerequisite for creating new jobs, accelerating payroll progress and elevating the substitute charge.

Even though focusing extra on increased schooling and making it a prime precedence is the one path to prosperity, politicians keep away from it for a number of causes. Prioritizing the sector of upper schooling, which employs a small a part of the inhabitants, doesn’t look like a great way for them to earn voters’ votes, since universities and schools have solely regarding 10.5 thousand folks working as most important and part-time jobs. employees.

This can be a very small citizens in comparison with 620 thousand. recipients of old-age pensions. The second purpose is that the optimistic results of schooling on the financial system have to attend. Optimistic structural modifications within the increased schooling system might be achieved in two or three years, however for politicians, such a wait and such a time period is just too lengthy, they need a assured and noticeable end in one political time period.

With the intention to rapidly show the fruits of their initiative and drive, a couple of politician thought that it will be worthwhile to regulate the pension formulation in order that reserves would cease accumulating within the system, and pensions would develop at a quicker tempo. Additionally, not one in all them proposed to make use of the gathered reserve already now to extend the welfare of pensioners. Each proposals are well-intentioned however result in poor outcomes. The reserve of the social insurance coverage system offers a chance to build up further funds throughout the progress part, that are used to satisfy obligations throughout the recession.

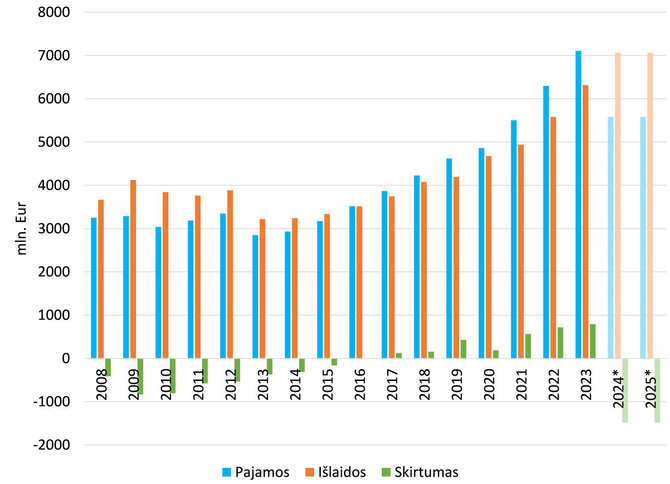

VU picture/State social insurance coverage fund’s revenue, bills and their distinction from 2008 to 2023.

The second determine presents the dynamics of social insurance coverage system revenue, bills and their distinction from 2008 to 2023. If the Lithuanian financial system had been hit by the identical disaster as in 2008 and the revenue of the social insurance coverage system can be 21%. lower than the necessity for spending (see the 2 hypothetical final units of dashed bars simulating a supposed extreme recession in 2024 and 2025), this gathered reserve of practically three billion can be dissolved inside two years.

Thus, the social insurance coverage system with the present reserve would face up to a reasonable recession, however it will not deal with a extreme disaster – it must borrow to satisfy its obligations.

Within the social insurance coverage system, bills exceeded revenue yearly from 2008 to 2015. Throughout this troublesome eight-year interval, expenditures within the social insurance coverage system exceeded revenues by 4 billion. euros. Later, starting in 2016, revenues exceed expenditures, and through this simpler eight-year interval, the Social Safety system generates $3 billion. euro reserve.

The social insurance coverage system receives particular consideration throughout this era: the financing of the fundamental pension is transferred from the social insurance coverage finances to the state finances, and the money owed of the social insurance coverage system, which have been rising for eight years, are additionally transferred from the social insurance coverage system. If the social insurance coverage system had needed to cowl the money owed itself from the excess that began to build up since 2016, it will not have 3 billion in it as we speak. reserve, and 1 billion of unpaid loans (excluding curiosity).

If the fundamental pension was financed from social insurance coverage contributions, and never from transfers from the state finances, old-age pensions would have grown at rather more modest charges than they did, the substitute charge would have persistently decreased, and the quantity of money owed would have been a lot increased than 1 billion. euros.

I’ll finish this text with a query and reply session.

The query: at whose expense did the substitute charge talked regarding by many politicians handle to be maintained and the social safety system saved from debt? Reply: account of wants financed with the assistance of the state finances, account of future consumption, account of private revenue, account of the remainder of the nation’s life. The switch of a part of the financing of social insurance coverage must the state finances created the necessity to borrow for the wants of the state finances, led to the emergence of recent taxes and the necessity to implement tax reform.

Query: Why did this occur? Reply: The Social Safety system entered the recession in 2008 with out massive reserves and with very massive will increase in advantages. Query: Have politicians and civil servants realized something from this? Reply: sure, they’ve realized that pensions can’t be raised at a charge that the system can not maintain in the long run and that budgets will need to have satisfactory reserves for contingencies akin to crises. So far, 3 billion has been gathered within the social insurance coverage system. euro reserve is enough to beat a reasonable recession.

#Algirdas #Bartkus #oldage #pension #change #charges #social #insurance coverage #system #reserve #Enterprise

2024-06-09 19:08:30