- AI16Z might see further declines before surging to $2.6, according to market analysts

- Seasoned traders on Binance and OKX are accumulating the token, signaling confidence in its future

AI16Z has experienced a turbulent week, shedding 19.05% of its value. The downward trend continued with a 4.59% drop in the last 24 hours, suggesting more potential losses ahead. Despite this, experienced traders on major platforms like Binance and OKX appear to be betting on a turnaround, diverging from the broader market pessimism.

Is AI16Z poised for a rebound?

Over the past month, AI16Z has been moving within an ascending channel on the daily chart, marked by higher highs and higher lows. Though, recent activity shows the token retreating from its resistance level, forming a lower low as it edges downward.

technical analysis suggests the decline may halt at the 0.618 Fibonacci retracement level, aligning with the ascending channel’s base around $0.80. This level is viewed as a critical support zone. From here, AI16Z could potentially rebound and rally to $2.60, offering significant gains of 325%.

Why are top traders doubling down on AI16Z?

despite the bearish outlook, prominent traders on Binance and OKX are placing meaningful buy orders for AI16Z. This counterintuitive move highlights their confidence in the token’s long-term potential, even as the broader market signals caution.

This accumulation by top traders could indicate a strategic play, anticipating a reversal in AI16Z’s fortunes. Their actions suggest that the token’s current dip might be a buying prospect rather than a signal to exit the market.

Bullish Sentiment Dominates Crypto Markets: What Traders Are Saying

In the ever-volatile world of cryptocurrency, market sentiment can shift in an instant. Right now, the scales are tipping sharply in favor of the bulls. Data from leading exchanges like Binance and OKX reveals a surge in long-to-short ratios, signaling that top traders are placing their bets on upward momentum.

At the time of writing, the long-to-short ratio for Binance top traders stood at an impressive 3.3497, while OKX traders recorded an even higher 4.15. These figures are more than just numbers—they’re a window into the mindset of high-level market participants. A ratio above 1 indicates that buyers are outnumbering sellers,and the current values suggest a robust bullish outlook. This optimism could very well spill over into the broader market, potentially sparking a rally.

Visual portrayal of current market trends.

Spot trading data further reinforces this positive sentiment. The supply of AI16Z, a key cryptocurrency, has been steadily declining on exchanges. This drop is often interpreted as a sign of accumulation by long-term holders, who are likely betting on future price appreciation.When traders hold onto their assets rather than selling them, it suggests confidence in the market’s potential for growth.

“The long-to-short ratio is a critical indicator of market sentiment,” explains one analyst. “When top traders are leaning heavily toward long positions, it’s a strong signal that they expect prices to rise.” This sentiment is echoed across the crypto community, where discussions of an impending bull run are gaining traction.

Though, while the current outlook is undeniably optimistic, it’s worth noting that cryptocurrency markets are notoriously unpredictable. External factors like regulatory changes, macroeconomic shifts, or sudden market shocks can quickly alter the landscape. For now, though, the data paints a compelling picture of a market poised for growth.

For traders and investors, these trends offer valuable insights. Staying informed about key metrics like the long-to-short ratio can definitely help navigate the turbulent waters of crypto trading. As always, a balanced approach—combining data analysis with a cautious strategy—remains the best course of action.

So, what’s next for the crypto market? If the current sentiment holds, we could be on the brink of a significant upward movement. But as any seasoned trader will tell you,in the world of cryptocurrency,the only constant is change.

AI16Z Investors Show Confidence as Tokens Move Off Exchanges

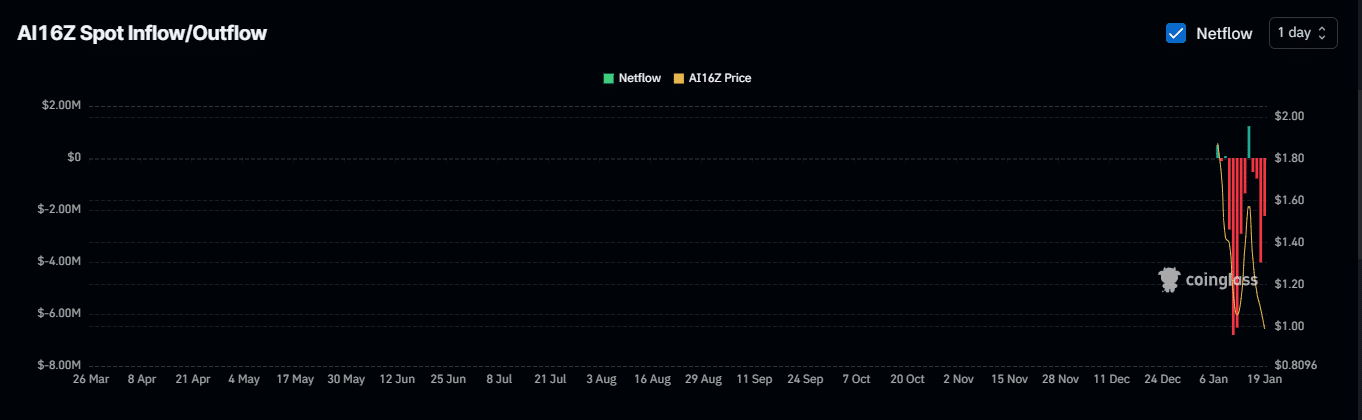

Over the past 24 hours, a notable shift in AI16Z’s exchange netflows has caught the attention of market observers. A total of $2.74 million worth of AI16Z tokens were moved from exchanges into private wallets, signaling a trend of long-term holding. This negative netflow has now extended for five consecutive days, with a cumulative withdrawal of $8.24 million during this period.Such sustained activity underscores growing investor confidence in AI16Z’s future potential.

Bullish Sentiment gains Traction in Derivatives Market

The derivatives market for AI16Z is reflecting a strong bullish sentiment. Key metrics such as the funding rate and Open Interest have been on an upward trajectory. the funding rate, which indicates whether buyers or sellers are dominating the market, reached 0.0440%—its highest level as January 13. This figure highlights the dominance of long traders, who are currently paying the premium, further emphasizing the positive outlook for AI16Z.

What This means for AI16Z’s Future

The movement of tokens off exchanges and the bullish indicators in the derivatives market suggest that investors are increasingly optimistic about AI16Z’s long-term prospects. This trend not only reflects confidence in the token’s value but also indicates a strategic shift toward holding rather than trading. As the market continues to evolve, these developments could pave the way for a more stable and promising future for AI16Z enthusiasts.

In the ever-evolving world of cryptocurrency, understanding the underlying factors that drive market trends is crucial. Take AI16Z, as a notable example. Recently, this asset has shown a notable uptick in Open Interest, a metric that gauges the total value of unsettled derivative contracts. A surge of 5.43% brought its Open Interest to a staggering $206.52 million, signaling a growing wave of confidence among traders.

This isn’t just a random spike. When Open Interest climbs alongside the funding rate, it’s a clear indicator of heightened optimism in the derivatives market. Such optimism doesn’t just stay confined to derivatives—it frequently enough spills over, propelling the broader market upward.

For AI16Z to shatter its previous records and reach new heights, a significant shift in these key metrics might be necessary. Until then, the asset is expected to either maintain its current range or continue its gradual upward trajectory.”When both open Interest and the funding rate increase, it is a sign of strong optimism among derivative market participants,” experts note, emphasizing the interconnectedness of these indicators.

As traders and investors keep a close eye on AI16Z, the broader crypto market remains a dynamic playground. Understanding these trends isn’t just about numbers—it’s about deciphering the collective sentiment that drives the market. Whether you’re a seasoned investor or a curious newcomer, staying informed is your best strategy in this fast-paced world.