2024-04-27 23:08:41

When it seemed that “the sun was rising” for the countryside and the devastating effects of the drought and the productive disaster that it generated in the previous campaign, the appearance of unexpected diseases, the February heat wave, the fall in prices, were left behind international of the commodities granaries, the rise in production costs and the lack of forceful measures in agricultural policy by the national government put the current 2023/24 agricultural cycle in check.

According to the consulting firm specialized in the sector Globaltecnos, The situation of the production of oilseeds and cereals is “from bad to worse” due to “the damage suffered by thermal and water stress that is noticeable in the bulk of the agricultural area” and by the appearance of the plague of leafhopper Dalbulus Maidiswhich spread the bacteria Spiroplasma kunkelii that causes the disease called corn stunting, which is generating “the greatest productive catastrophe in memory for the cereal in the entire central-northern region of the country,” due to its impact on grain yields.

If we add to this the meager or zero net margins on leased fields, which in the case of corn is USD -270 per hectare in the case of corn or USD +10 in the case of soybeans, which leaves a profitability of -26% in the first and +1% in the case of the second, the field is preparing to face “the second consecutive campaign of negative results”, with the aggravating factor that the previous one “was the worst in Argentine history in terms “productive, with generalized losses for all productive areas and regions.”

Authoritarians don’t like this

The practice of professional and critical journalism is a fundamental pillar of democracy. That is why it bothers those who believe they are the owners of the truth.

“Everything indicates that, with international grain prices in the range of minimums, which following export duties are even worse in Argentina, high input prices, added to a challenging economic and political context, generates a combo with no alternatives in sight, putting in check the future of agricultural companies and all actors in the Argentine agricultural chain,” the report said.

Measurements

The truth is that in the face of this complicated panorama “Days and months pass, and the measures expected by producers do not appear, such as a reduction in tax pressure and a single exchange rate”pointed out the work of the consultant.

Although the national government took measures that had a direct impact on agriculture so far in the administration Javier Miley at the head of the Presidency and Luis Caputo managing the designs of the economy as head of the Treasury Palace, such as the correction of the official exchange rate, the increase in the PAIS Tax to 17.5%, the application of another “export dollar” or regulatory issues such as the total opening of the exports or the elimination of SIRAs, in the countryside they expect more forceful tax measures.

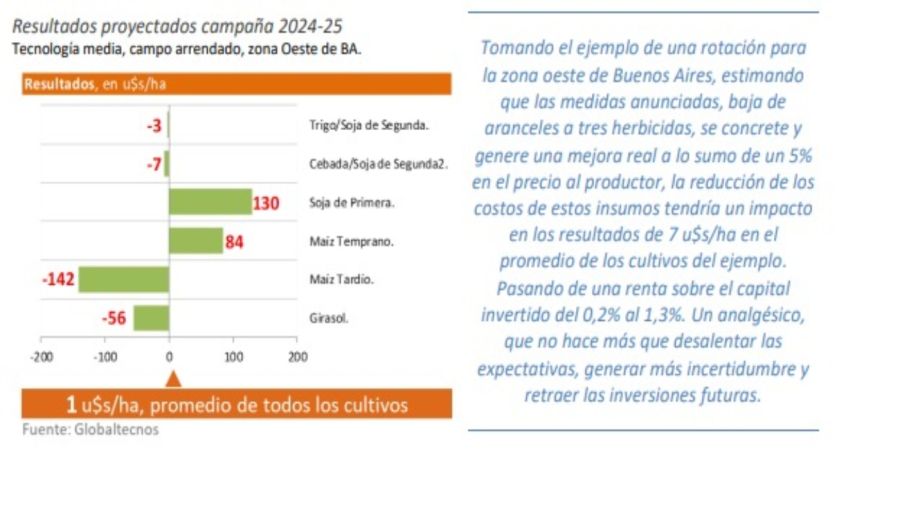

It is worth mentioning that in recent weeks, Caputo, facing the next wheat campaign, announced that import tariffs on three herbicides, atrazine, glyphosate and 2,4D, would soon be lowered, but “beyond the fact that the productive sector celebrates all types of tax reductions, these types of measures do nothing more than add noise to a complex network of commercial relations that end up affecting the entire chain and do not generate a cent of real improvement in the real prices of the economy,” said the job. It should be noted that there is ample evidence of the negative consequences that changes can cause when they do not have a minimum study time in terms of possible collateral damage: Is Argentina prepared to make part of its food production matrix dependent on Chinese and Indian imports? ?

“The price of glyphosate is currently approximately US$5/liter, when back in November/December of last year it was worth regarding US$7.5/liter. The price reduction has already occurred, and not due to the announcements of lower tariffs, but due to a lower international price of the active ingredient and a normalization of the flow of dollars for importers, and it might fall further if it were not for the impact on the cost of the PAIS tax,” the consultancy detailed.

According to the opinion of specialists, all from the renowned CREA Movement, “the expected measures for the sector, regarding the economic policy of the new government, are insufficient for now. A positive and concrete fact is the liberation of export restrictions, and the adaptation of imports of inputs, although it will be necessary to see if the rest arrive later, such as a single exchange rate and a reduction in tax pressure, mainly the really significant such as export duties and the PAIS tax.”

What’s coming

This delicate situation not only generates problems in the current campaign, but might turn the next 2024/25 agricultural cycle black, which is just a few weeks away from starting wheat sowing. For the consulting firm, if “future grain prices, current costs and average production are considered, the next campaign will be, a priori, the third consecutive without positive results for the producer.”

“Consequently, several changes will be generated in the rotation of the 2024/25 campaign, a smaller wheat area”, since “there are no positive results in sight.” However, the big question for specialists is “how far the corn surface will fall in Argentina: everything indicates that it will surely be the most drastic that can be imagined”, since “late corn represents between 70 and 80% of the area.” planted and for the next campaign the expected economic result is not only negative, but it is the worst of all and has on its shoulders the threat of the leafhopper that destroys all possible planting intentions.

With this panorama, the consulting firm assumes that “Argentina will go for more soybeans in the next campaign” and that although “some officials may be happy, because in the short term it will give them more revenue from withholdings, in the long run it will be The entire country will suffer,” because “it is not good for anyone to break the current rotation of grasses and legumes and expose the entire chain to greater risk by concentrating the entire business practically on a single crop.”

On the other hand, the work raises the question of how producers will finance themselves for the 2024/25 cycle, taking into account that they invest close to USD 10 billion per year, of which 30% corresponds to their own capital and the remaining 70%. % from third parties, mostly commercial credit. That is why they wonder “where the necessary capital will come from to face a new campaign. On the producers’ side, their operating capital has been reducing significantly in recent years; The banks, although they offer increasingly lower rates, do not have to show a perspective of negative rates as they had last year, and on the commercial credit side the first objective is to collect past debts and then see very well from whom “They are going to finance the supplies.”

“As long as access to dollars is not fully regularized, the ways and times in which the PAIS Tax will be eliminated and the issue of import tariffs are defined, the input supplier companies will be waiting, seeing in what field and what conditions they have to participate in. In this environment it will not be easy for producers, as they usually did, to access commercial financing under the terms, rates and guarantees generally common in the sector,” the report concludes.

Gi

1714263215

#Agriculture #bad #prices #pests #tariff #reductions #move #needle