The US dollar is heading for its worst week since early February once morest the major currencies on Friday as it lost some of the momentum it gained from a sudden 10 percent rise in its value.

The Impact of High Inflation and the Russian Invasion of Ukraine

The dollar received a boost from investors’ appetite for it as a safe haven amid turmoil in the markets due to fears of the impact of high inflation and the Russian invasion of Ukraine.

But following rising in the last 14 weeks except for two, the dollar index is heading for a weekly decline of 1.5 percent on Friday.

The index, which measures the dollar’s performance once morest six major currencies, was broadly stable on the day at 102.92. The dollar rose to its highest level since January 2003 at 105.01 last Friday.

Other safe-haven currencies rose this week as global stocks came under pressure.

The euro also benefited from the dollar’s weakness, and is heading for a weekly gain of 1.5 percent. And recorded in its latest trading on Friday, a decrease of 0.1 percent at $ 1.05755.

In the case of cryptocurrencies, the price of Bitcoin settled at just over $30,000, halting the sharp declines it has seen in recent weeks.

Swiss franc achieves weekly gains

The Swiss franc is heading for a weekly gain of regarding three percent once morest the dollar, while the Japanese yen is heading for a weekly gain of regarding one percent.

The Swiss franc finally settled on a broad scale at 0.97350 franc, while the yen fell 0.2 percent to 128.205 yen.

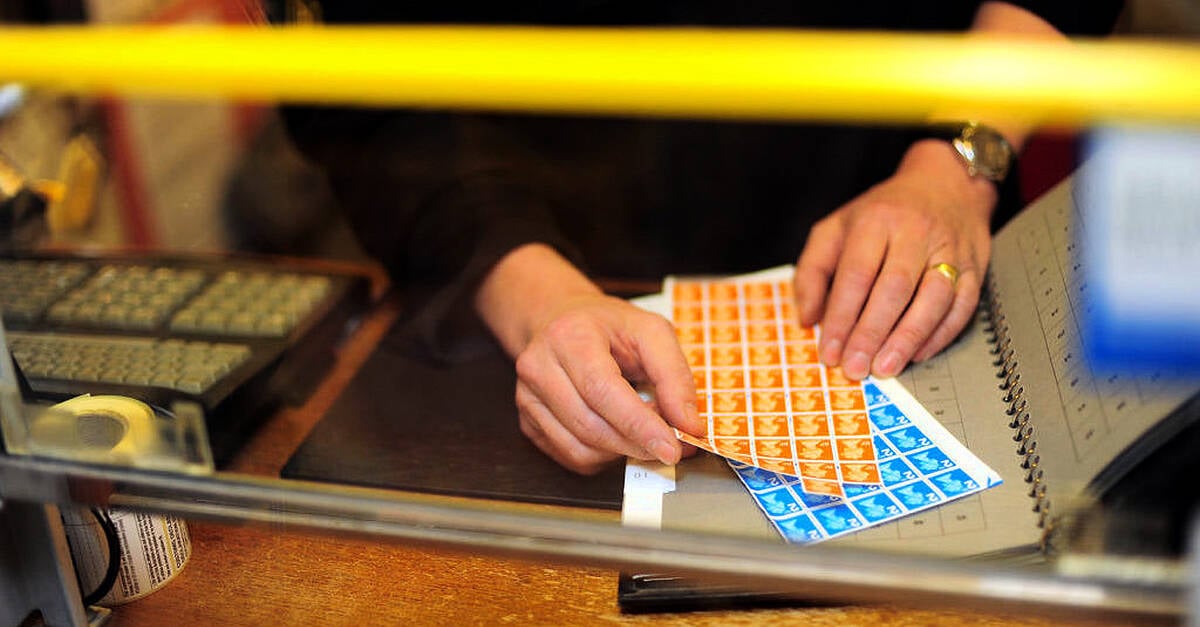

The British pound is preparing for its biggest weekly gain since December 2020, and settled at $1.24805 on the day.