In the midst of the catastrophic collapse experienced by the ecosystem Terra Over the last couple of weeks, the question investors have been asking is can the price of LUNA go back to $1?

the earth project was developed in 2018 by Daniel Chin and Do Kwon together with Alliance Terra, a conglomerate of Asian companies dedicated to online commerce.

In addition to having the native LUNA token, His goal was to offer stablecoins more decentralized compared to the more traditional ones, how Tether (USDT), USD Coin (USDC) and Binance USD (BUSD).

Despite its short existence, LUNA acquired great prominence and ranked among the top-earning cryptocurrencies During the past year.

MOON started the year 2021 trading at 0.64 dollars and, in 12 months, experienced a growth of 15,100%. Before the end of the year, LUNA was trading close to $100.

History of a crisis: the Terra ecosystem collapses

The Earth ecosystem started to wobble beginnings of May when TerraUSD (UST) lost its peg and LUNA prices plummeted.

To present a perspective, the operation of the stablecoins decentralized TerraUSD (UST) was next: If the price of TerraUSD (UST) exceeded the value of the dollar, to mint more UST users had to burn the equivalent dollar amount of the LUNA tokenwhich allowed the supply to be reduced and thus allowed the parity of UST with the American currency.

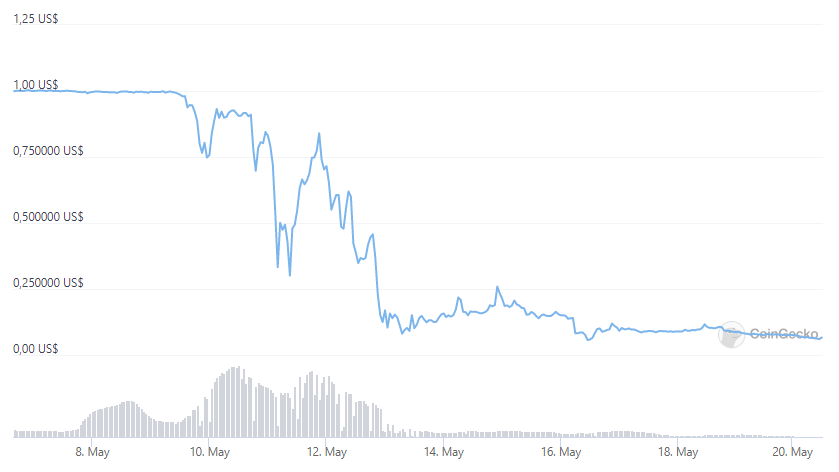

However, on May 8, UST lost its peg to the US dollar. The changes occurred in the context of the withdrawal of 2.2 billion UST from the anchor protocol.

After becoming one of the whales of Bitcoin bigger, the developers of UST decided to provide the traders OTC a loan of 1,500 million dollars ($750 million in Bitcoin and $750 million in UST) to stabilize the rate of stablecoinsbut it was not enough to recover the price.

On May 10, the stablecoins fell to $0.68following which it entered a correction but, since then, UST has posted a significant drop.

At press time, UST is trading at $0.066, a drop of 15% in the last 24 hours and more than 90% in the last 15 daysaccording to the data de CoinGecko.

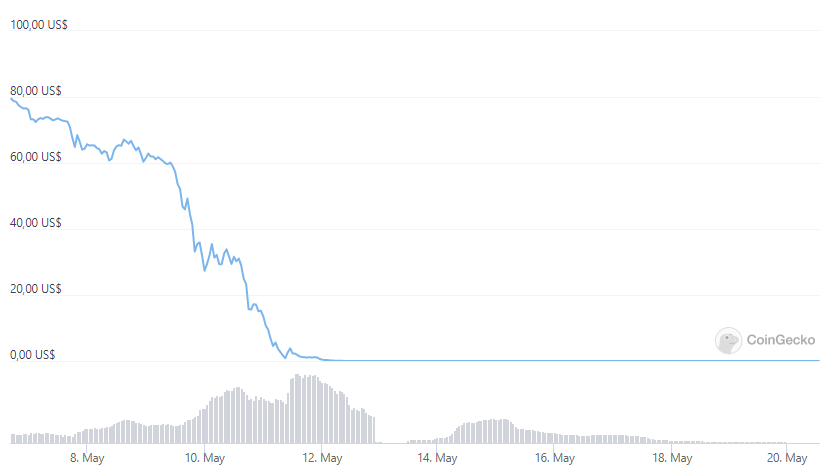

For its part, the LUNA token experienced a more dramatic crash. After reaching a historical maximum of 119 dollars last April, during the beginning of the crisis it fell almost 50%.

Since then, the LUNA catastrophe was absolute and lost practically all its value. At the time of publication, LUNA quote in $0.00013.

Can the price of LUNA return to 1 dollar?

Currently, the CEO of Terraform Labs, Do Kwon, has submitted the vote a proposal for a Terra Recovery Plan, which began on Wednesday, May 18, and has not been without controversy.

Amidst this gloomy scenario, investors are wondering Can the price of LUNA return to 1 dollar?

To try to answer this question, it is necessary to make an important observation: in less than two weeks, LUNA’s circulating supply grew from just over 300 million tokens to almost 6.5 billion tokens.

In this way, for the price of LUNA to return to 1 dollar, would mean the market capitalization would have to touch $6.7 trillionand that is if the current supply remains stable.

This digit represents 5 times more than the current total capitalization of the cryptocurrency marketwhich stands at 1.3 trillion dollars.

On the other hand, to make the comparison more visible. For LUNA price you can go back to 1 dollar with your current circulating supply, would need 13 times the total capitalization of Bitcoin and more than 20 times that of Ethereum, which are located at 558 billion dollars and 237 billion dollars, respectively.

Another element to note is that when the LUNA supply was still above 300 million tokens, the price was trending towards $100. Thus, its market cap at the time averaged around $33 billion.

In this sense, in order for LUNA to reach the market capitalization prior to the crash, the token would have to be trading at approximately $0.005.

Therefore, in the midst of the current scenario, a price of LUNA at $1 seems unlikely.

Evena price of 0.005 might be unrealistic, considering that its market capitalization is 860 million dollars.

LUNA, the sensation token that managed to enter the top 10 of the ranking of the cryptocurrencies now he is in position 71 and struggling to survive. Only the time and decisions of the development team and the community will have the last word.

Disclaimer

All information contained on our website is published in good faith and for general information purposes only. Any action that the reader takes on the information found on our website is strictly at their own risk.