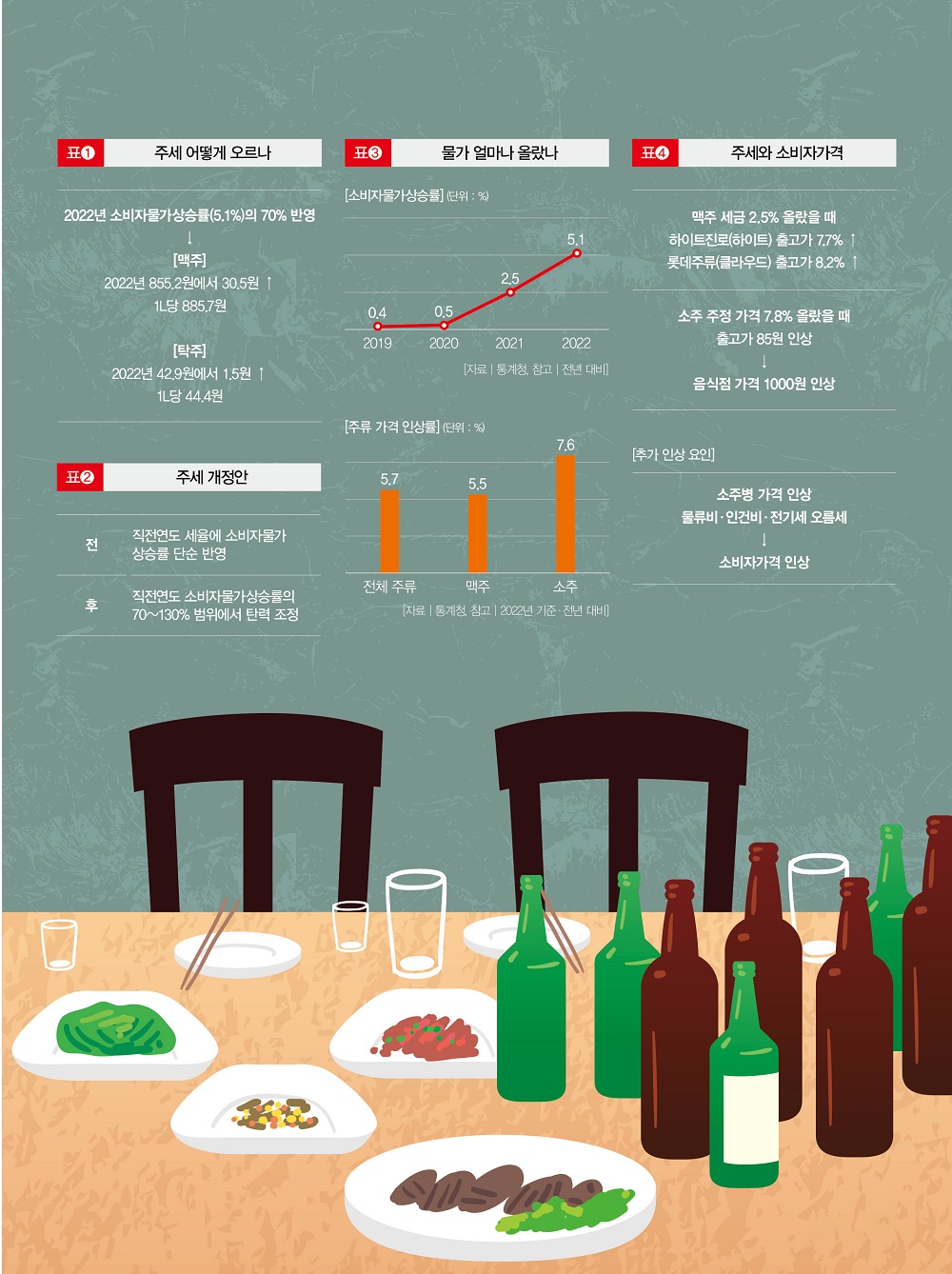

Alcohol prices are likely to rise once more this spring. In January, the Ministry of Strategy and Finance decided on the tax on alcoholic beverages (beer and rice wine) according to the price indexation system. From April, beer is subject to a tax of 885.7 won per 1 liter. This is an increase of 30.5 won from the previous year (855.2 won). In the same way, the tax on rice wine rises by 1.5 won, from 42.9 won to 44.4 won per liter (Table ❶). This is the result of reflecting 70% of last year’s consumer price inflation of 5.1%.

The Liquor Tax Act has been changed to an inflation-linked system that simply reflects the consumer price increase rate in the tax rate of the year immediately preceding 2020. In January, the Ministry of Strategy and Finance once once more revised the Enforcement Decree of the Liquor Tax Act. It was decided to adjust the elasticity of beer and rice wine exported from April this year within the range of 70-130% of the consumer price inflation rate, taking into account taxation equity with other alcoholic beverages, factory price fluctuations, and alcoholic beverage price stability (Table ❷).

This year’s state tax rate is higher than in 2021 (0.5%) and 2022 (2.5%). The steep increase in consumer prices was reflected in the liquor tax (Table ❸). The problem is that when the liquor tax rises, the liquor industry raises the factory price, and when the factory price rises, the price of liquor sold at retail stores and restaurants also jumps. Moreover, the width is several times greater than the rate of increase in the liquor tax. This is because various factors such as grain prices, logistics costs, and labor costs are additionally applied to the tax increase.

Let’s take beer as an example. When taxes rose 2.5 percent last year, Hite Jinro and Lotte Chilsung raised the factory prices of Hite and Cloud by 7.7 percent and 8.2 percent, respectively. This year, it is expected to rise more than this, so the prospect that the factory price will also rise significantly than before is pouring in. This is why the price of beer currently sold at restaurants for 4,000 to 5,000 won will rise to 6,000 to 7,000 won.

It’s not just beer and takju that are raising taxes. The price of soju rises when the price of alcohol, the raw material, rises. The increased shipping price rises to a greater extent at the point of arrival to the consumer. Just as when the factory price of soju increased by 85 won last year, the price at restaurants and other places went up by regarding 1,000 won (Table ❹).

However, when production costs are rising, it cannot be said that the price hike should be suppressed. This is because the burden of self-employed workers, such as raw materials and labor costs, is heavy. If so, can’t we reverse the situation and adjust the liquor tax that causes the factory price to rise?

An official from the liquor industry said, “The rate of tax increase was not large at 0.5% and 2.5% over the past two years, but as prices have risen so much, this year’s tax has also risen a lot.” Wouldn’t it be difficult to touch?” he said.

Lee Joo-hyeon (pseudonym), an office worker who relieves daily stress with a glass of soju, said, “It is strange that taxes go up every year according to the inflation rate.” . Also, only the common people of Amen saw the bitter taste.

Reporter Kim Mi-ran The Scoop

[email protected]