Original title: A-share sector said | Salt Lake Lithium extraction sector is favored by the market once more, nearing the peak season of liquor consumption, Maotai’s share price has returned to below 2,000 yuan

Cover news reporter Zhu Ning

On January 6, affected by the decline in the external market, the Shanghai Index opened lower and continued its weak adjustment trend. It once fell by nearly 1% during the intraday session, and then rebounded, but failed to turn red; the Shenzhen Component Index and the ChiNext Index both fell sharply during the intraday market. After the dip, the decline narrowed; the turnover of the two cities exceeded 1.1 trillion yuan, the northbound capital inflows were substantial, and net sales exceeded 6.6 billion yuan throughout the day. As of today, the three major stock indexes have fallen for three consecutive days since 2022.

As of the close, the Shanghai Composite Index fell 0.25% to 3,586.08 points, the Shenzhen Component Index fell 0.66% to 14429.51 points, and the ChiNext Index fell 1.08% to 3,127.48 points; the total turnover of the two cities was 1,136.7 billion yuan, and the net sales of northbound funds were 6.638 billion yuan.

On the disk, track stocks rebounded, and the salt lake lithium extraction sector rose sharply. The overall performance of low-value blue-chip stocks was stable, with construction, steel, and building materials sectors leading the way.

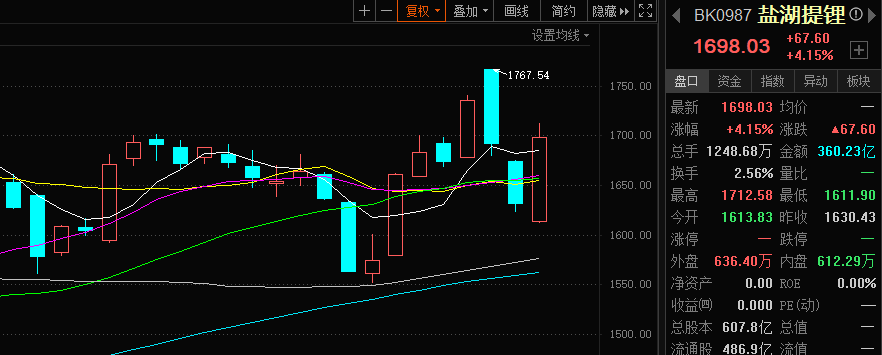

Lithium extraction in salt lake returns to the upward trend

The salt lake lithium extraction concept is one of the branches of new energy. After nearly half a month of adjustments, under the stimulus of the news, it gradually recovered the decline and emerged suddenly, and successfully led the sector to return to the market spotlight and accept the renewal of market funds. Scrutinize.

After two days of substantial adjustment, it rebounded today. After the opening of the market, the concept of lithium extraction in Salt Lake fluctuated slightly and continued to rise. As of the close, the plate rose by 4.15%.

Prior to this, CCTV Finance released the 2021 industry new power list, and Salt Lake promoted lithium on the list. In 2021, the lithium battery industry will explode, and the supply of lithium raw materials will cause concern. The Salton Sea Salt Lake Geothermal Salt Lake Lithium Mine in California, USA, attracted US$20 million from the venture capital of Bill Gates. More than 80% of my country’s lithium resources are concentrated in salt lake brines. It is expected that the development of domestic salt lake lithium resources will accelerate, and it is expected to account for more than 20% of global lithium supply in the future.

According to data released by the Shanghai Iron and Steel Federation, the third round of lithium salt price increases continue to heat up. The latest lithium hydroxide rises by 2000-3000 yuan/ton, lithium carbonate rises by 4000-4500 yuan/ton, and lithium cobalt oxide rises by 7,500 yuan/ton. Lithium manganate will rise by 1,000-4,000 yuan/ton. The agency predicts that the supply and demand pattern of lithium will continue to be tense in 2022, and the price will remain high.

Regarding the reasons for the rebound in the lithium extraction sector in the salt lake today, a researcher from Huafu Securities told reporters that at the beginning of the year, due to the continuous decline, the market’s confidence in the new energy sector has declined significantly, but in fact the fundamentals have not changed. The contradiction has not been effectively resolved, so following the decline, there will still be a rise in the sector.

China Everbright Bank analyst Zhou Maohua also told reporters that the relevant sectors showed signs of rebounding today, and market sentiment has stabilized, mainly because the market’s positive expectations for stabilizing growth policies have boosted market sentiment.

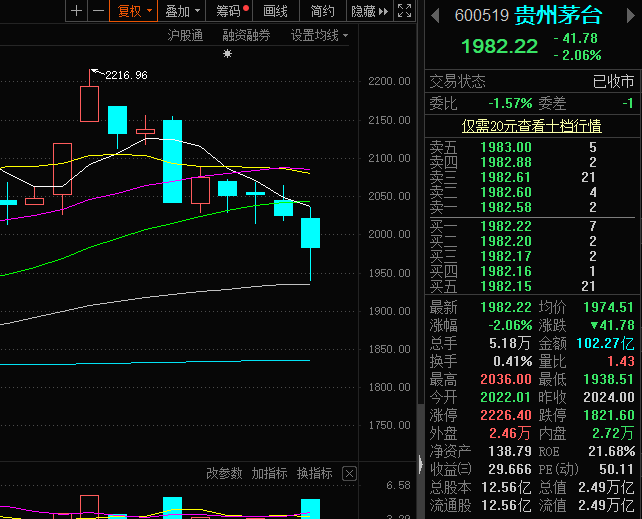

Lower profit growth rate Moutai fell below 2000

Kweichow Moutai fell below the 2,000 yuan mark during the intraday trading, and closed down 2.06% to 1982.22 yuan per share. The liquor sector was green, and stocks such as Luzhou Laojiao, Wuliangye, and Kouzijiao fell one following another.

On the news, on the morning of January 6, CITIC Securities issued a research report saying that it lowered the forecast of Kweichow Moutai’s 2021 net profit growth rate to 11.4%, compared with the original forecast growth rate of 13%. At the same time, maintain Kweichow Moutai’s 2022-2023 net profit growth forecast of 11%, corresponding to the 2021-2023 earnings per share forecasts of 41.42 yuan, 45.95 yuan, and 50.87 yuan, respectively. The original forecasted earnings per share are 41.92 yuan, 46.56 yuan, and 46.56 yuan, respectively. 51.87 yuan.

What needs to be noticed is that from 2017 to 2020, Kweichow Moutai achieved revenues of 61.063 billion yuan, 77.199 billion yuan, 88.854 billion yuan, and 97.993 billion yuan, respectively, an increase of 52.07%, 26.43%, 15.1%, and 10.29% year-on-year; The net profits attributable to the parent were 27.079 billion yuan, 35.204 billion yuan, 41.206 billion yuan, and 46.697 billion yuan, up 61.97%, 30%, 17.05%, and 13.33% year-on-year, respectively, and the growth rate continued to slow down.

Regarding the three consecutive declines in the A-share market since the beginning of the year, China Everbright Bank analyst Zhou Maohua said that at present, due to changes in macroeconomic policies at home and abroad, such inter-sector valuation revaluation and fluctuations are normal. The overall valuation of the domestic stock market and the capital market are normal. The medium and long-term development potential is great, and the market is generally optimistic.

Zhou Maohua concluded: “The market fell successively in the beginning of the year, mainly due to the continuous adjustment of sectors that have been sought following by the market before. Funds have turned to the defensive sector. Although the market sector has adjusted and rotated in recent days, the overall market sentiment has been relatively stable, and the trading volume has been increasing. Staying at around one trillion yuan, the current macro and policy aspects continue to be beneficial to the stock market.”Return to Sohu to see more

Editor:

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.