A ‘red light’ has been turned on for the soundness of real estate-secured loans in the financial sector. This is because the auction successful bid rate, which refers to the value of real estate collateral, has fallen below 80% in most regions of the country except Seoul. Analysts say that the loss of principal from financial companies for home-mortgage loans and non-home-mortgage loans of businesses with a loan-to-mortgage recognition ratio (LTV) of 80% or more is within the scope of assessment. As the real estate economic downturn continues, there is great concern that the insolvency will spread to the entire financial sector, starting with the second financial sector.

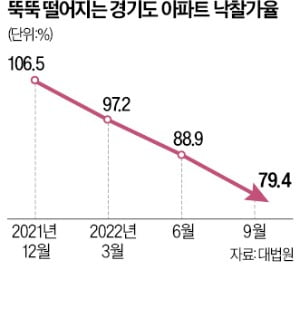

According to the Supreme Court auction information site on the 5th, the successful bid rate for apartments in Gyeonggi Province last month was 79.4%. It is the first time in nine years since September 2013 that the successful bid rate for apartments in Gyeonggi-do fell below 80%. Until December of last year, it was 106.5% higher than the appraised value, but it is declining every month. In major cities such as Daejeon (69.4%), Daegu (79.5%) and Busan (78.9%), the winning bid rates were all below 80%. Auction items more than doubled in Seoul and other parts of the country. Conversely, the successful bid rate is expected to decrease further, with the bid rate halved from 42% to 20.4% in the same period in Seoul.

In the financial sector, the winning bid rate means the possibility of recovering the principal and interest. This is because if the winning bid rate falls below the LTV, it will lead to losses even if the collateral is disposed of in the event of delinquency of principal and interest. Mortgage loans are loan products that can provide up to 80% of LTV for living stabilization funds, business mortgage loans, and non-home mortgage loans.

If the winning bid rate falls below 80% due to arrears of principal and interest following paying up to 80% of these loan products, even if a financial company disposes of the house held as collateral to get the principal and interest back, 100% of the principal cannot be returned.

A bank official said, “The balance of the principal loan that cannot be repaid with only the house taken as collateral will depend on the borrower’s ‘credit’. said When buying a house, there is an opinion that it is necessary to look at the loss section more conservatively, since both a mortgage loan and a credit loan are received at the same time.

Ahn Dong-hyeon, a professor of economics at Seoul National University, pointed out, “The borrowers who borrowed with high LTV are likely to be marginal borrowers with multiple debts.

Is Real Estate Recession Transferred to Financial Industry Risks?

“Loss to financial companies even if collateral is disposed of”… Successful bid rate = Possibility of recovering principal and interest

As the successful bid rate at real estate auctions has fallen below 80%, there is growing concern that the risk of a real estate recession will shift to the financial sector. If the borrower fails to repay the loan, the financial company collects the principal by selling the real estate held as collateral. However, if the auction successful bid rate falls below the loan limit of the financial company, the LTV, the difference leads to a loss to the financial company. A bank official said, “Loans given out following evaluating the past collateral value of 100% or higher will become insolvent.”

○Auction winning bids drop, financial loss is ↑

Mortgage loans from two financial institutions, including savings banks, are identified as the weakest link. Unlike household loans, business loans are not subject to regulations from financial authorities. For this reason, in the second financial sector, there are not many companies with LTV of 80% or more. According to the Financial Supervisory Service, the average LTV of savings banks for business operators is 75%. Of the 12.4 trillion won paid by all savings banks, 6 trillion won exceeds 80% of the LTV. This means that even if the auction successful bid rate falls below 80%, a loss can occur.

Recently, the auction price has been dropping. The successful bid rate at apartment auctions in Gyeonggi-do fell from 106.5% in December last year to 79.4% last month. There are also observations that insurance companies, which have operated business subsidies more conservatively than savings banks, cannot be relieved. In 2012, when the housing economy continued to stagnate, the successful bid rate at apartment auctions fell to the low 70% level. Woo Byung-tak, head of Shinhan Bank’s Real Estate Investment Advisory Center, said, “Since the successful bid rate lags behind the real estate market, it will continue to fall unless the market rebounds significantly.”

The rate of successful bids for non-housing mortgage loans such as land, officetel, etc., which had no regulation ratio, is also on the decline. The successful bid rate for land, forest, and field in Gyeonggi-do was 78.5% and 63.5% for shopping malls and officetels, which is significantly lower than that of general housing. Financial companies apply the real estate collateral recovery rate instead of LTV for business loans or non-home mortgage loans, except for the real estate rental business, which has an LTV regulation ratio. Depending on the region, the most conservative banks have a real estate collateral recovery rate of up to 70-80% of the winning bid price. This means that up to 70-80% of the winning bid will be loaned out. Last year alone, the successful bid rate at apartment auctions was over 100%. This is the basis for the expectation that significant losses will occur in non-mortgage loans.

Another problem is that the number of non-home mortgage loans that have already been implemented is large due to the lack of a regulatory ratio. As of the end of June last year, the balance of non-credit loans in mutual financial institutions such as the Nonghyup, the fisheries cooperative, and the credit union, which has the second largest assets following banks, reached 278 trillion won. This is equivalent to 64% of the total loan amount in the mutual financial sector.

○ The actual LTV of ‘Young Kleuk’ seems to be higher

There is also an opinion that LTV should be viewed more conservatively compared to the successful bid rate. According to the Bank of Korea’s Financial Stability Report in the first half of the year, the average LTV for loans given by banks to households is 38.7%, and for mutual finance is 61%. Among them, the proportion of loans exceeding 70% of LTV in mutual finance accounts for regarding 15%. However, the industry points out that there are many cases of real estate purchases by adding credit or expedient business loans to real estate collateralized loans. This means that even if 80% of the LTV regulation is applied, the actual LTV that one borrower pays can exceed 80%.

Gap investment is also considered a potential risk to loan soundness. When purchasing an apartment with cheonsei, the borrower’s real LTV will far exceed the jeonse rate if the original house has a cheonsei loan and borrows a credit loan to buy the house. Ahn Dong-hyun, a professor of economics at Seoul National University, said, “Considering the jeonse rate, if you take a jeonse loan to make a gap investment, you can estimate the LTV to be around 70%. not,” he pointed out.

Seo Ji-yong, a professor at Sangmyung University, said, “Saving banks have relatively little capital, so if a loss occurs, the capital buffer effect is small, so there is a greater possibility of insolvency.”

By Park Jin-woo/Bin Nan-sae, staff reporter [email protected]