2024-03-11 21:01:37

Reporter Lee Yeon-ju of The Vivid

At 6 a.m. on the 12th, the tax-saving counseling program ‘Setech Square’ was released through Chosun Ilbo’s economic YouTube channel ‘Chosun Ilbo Money’ and Chosun.com. Tax Tech is a time to listen to tax experts on tax-saving know-how based on the real stories of viewers who are worried regarding complex tax issues. Hae-rim Eom, a tax accountant from Dasol Tax Corporation, joined us. Tax accountant Eom, a former broadcast journalist, is an expert in the field of gifts and inheritance.

We had a discussion with tax accountant Eom on the topic of ‘low price transfer and burdensome gifting.’ We covered the same topic three months ago, and we received many stories from viewers and readers expressing similar concerns, so we decided to take the time to do it once more.

This time, it is a case where a grandfather is considering transferring the property to his granddaughter at a low price. The person who sent the story is the daughter-in-law. A 90-year-old father-in-law is regarding to pass on an apartment to his 28-year-old daughter. The price of apartments in non-adjusted areas in Seoul is 880 million won based on the recent actual transaction price of the same size. It is being leased for 450 million won. The acquisition price is 200 million won and the holding period is 15 years. The storyteller said, “My daughter has an annual income of 50 million won as of year-end tax settlement, and I have raised 40 million won as seed money,” and requested consulting, saying, “Please determine whether a low-cost transfer from a special relationship or a burdensome gift is better.”

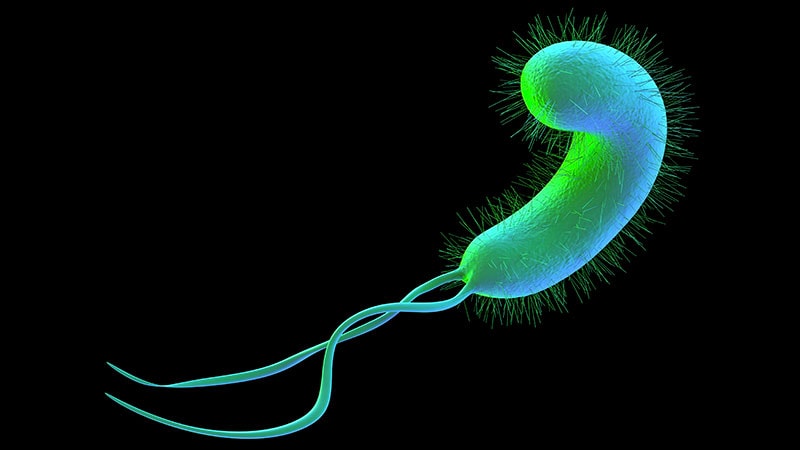

Hae-rim Eom, a tax accountant, explains low-cost transfers and gifts with burden. /Chosun Ilbo Money Capture

The determined tax amount varies depending on the asset status of the person who wants to pass on the apartment and the person who wants to inherit it. The situation becomes complicated if the grandfather owns multiple homes, or if the daughter lives with her parents and the parents already own a home. However, in this video, to aid understanding, we assume that the grandfather owns one home and the daughter lives separately from her parents.

This is a case where grandparents want to skip their children and pass on their property to their grandchildren. Tax accountant Eom said, “If you gift it to her grandchildren, there is only a 5-year period for it to be included in the inheritance tax, so there is an inheritance tax savings effect.” She continued, “If the value of the apartment is expected to increase in the future due to redevelopment, etc., it is better to pass it on as soon as possible.”

The key is how to pass it on. You can check the video for more detailed information regarding how much tax you have to pay when making a low-cost transfer or burdensome gift, and which is the best strategy for saving taxes.

➡️To view the ‘Seteqq’ video on portal sites such as Naver, copy the following link and access it.

1710195363

#grandfather #pass #apartment #worth #million #won #granddaughter