Jakarta Stock Market Faces Downturn Amidst Global Economic Uncertainty

Table of Contents

- 1. Jakarta Stock Market Faces Downturn Amidst Global Economic Uncertainty

- 2. Delving Deeper: Factors Behind theJakarta Stock Market Slump

- 3. Navigating the Volatility: Insights into the Indonesian Stock Market

- 4. How does the performance of the technology sector during recent market volatility reflect investor preferences?

- 5. Navigating the Volatility: Insights into the Indonesian Stock Market

- 6. An Interview with Anton Budiman, head of Research at Premier securities Indonesia

- 7. Archyde: Mr. Budiman, the Indonesian stock market experienced a notable decline on Monday. What factors do you believe contributed to this downturn?

Anton Budiman: The Indonesian market, like many others in Asia, is currently feeling the weight of several global and local factors.Rising inflation and interest rates worldwide are creating a risk-averse habitat among investors, leading to a flight to safer assets.This, regrettably, often leaves riskier assets like equities vulnerable.

archyde: How are these global headwinds impacting Indonesian investor sentiment?

Anton Budiman: We’ve also seen a slight slowdown in growth in certain key sectors within Indonesia, which has added to the current bearish sentiment. When combined with the global uncertainty, this creates a perfect storm for a market dip.

Archyde: Despite the general downturn, the technology sector bucked the trend with a modest gain. What does this suggest about investor preferences during times of market turbulence?

Anton Budiman: The technology sector’s relative strength could signal that investors are seeking out sectors perceived as more resilient during economic uncertainty. Technology companies, especially those focusing on innovation and disrupting customary industries, often possess growth potential that can withstand short-term market fluctuations.

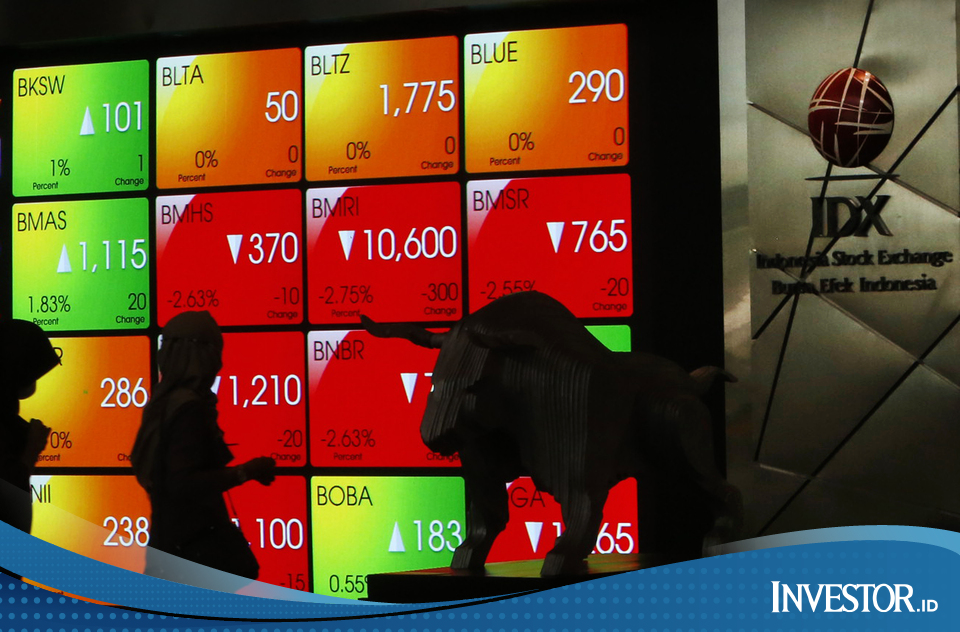

The Jakarta Stock Market closed lower on Monday,February 2nd,2025,mirroring a broader slump across Asian markets. The composite Stock price Index (JCI) dropped 79.13 points,representing a 1.1% decline, and settled at 7,030.

This downturn mirrored a similar trend in other Asian markets.japan’s Nikkei experienced a steep 2.6% fall, while Singapore’s Straits Times dipped 0.7%. Hong Kong’s Hang Seng index also saw a slight decrease of 0.04%. Notably, Shanghai remained closed for Chinese New Year celebrations.

Almost all sectors within the Indonesian stock market witnessed declines. The health sector bore the brunt of the downturn, shedding 2.9%. The raw goods sector followed closely, with a 2.3% drop. Property,infrastructure,and non-primary consumer goods sectors also experienced notable losses,decreasing by 1.9%, 1.8%, and 1.6% respectively.

A glimmer of hope emerged from the technology sector, wich managed to eke out a modest 0.2% gain.

Despite the overall market decline, four stocks bucked the trend and surged to their Auto Rejection Upper (ARA) limits. These four companies topped the list of gainers, registering notable increases of up to 34%,” commented a financial analyst, though the specific names of these outperformers remained undisclosed.

Delving Deeper: Factors Behind theJakarta Stock Market Slump

To gain further insight into the drivers behind this downturn, Archyde spoke with Anton Budiman, Head of Research at Premier Securities Indonesia.

“The Indonesian market, like many others in Asia, is feeling the impact of several factors,” explained Budiman. “Global economic uncertainty stemming from rising inflation and interest rates is creating a risk-averse sentiment among investors. This is leading to a flight to safety, with investors pulling back from riskier assets like equities.”

Budiman also pointed to local concerns surrounding Indonesia’s economic growth outlook. “Data released recently showed a slight slowdown in certain sectors,” he added. “This,coupled with the global headwinds,has contributed to the market’s dip today.”

Navigating the Volatility: Insights into the Indonesian Stock Market

The Indonesian stock market experienced a notable downturn recently, with various sectors feeling the impact. The most heavily affected sectors were raw goods and energy, which each saw declines of 2.9% and 2.3% respectively. These sectors are often particularly sensitive to shifts in the global economy and fluctuations in commodity prices.

Interestingly, amidst this general downward trend, the technology sector bucked the pattern, registering a modest 0.2% gain. This could signal a growing investor preference for sectors perceived as more resilient during periods of economic uncertainty.

Despite the overall market dip,four stocks managed to hit their Auto Rejection Upper (ARA) limits,demonstrating remarkable resilience. While specifics about these outperformers remain under wraps, Anton Budiman, a market analyst, suggests they likely possess strong fundamentals, unique market positions, or high growth potential. “It’s likely investors are recognizing these attributes despite the broader market turbulence,” he commented.

Looking ahead, the outlook for the Indonesian stock market remains somewhat uncertain in the short term. Globally, economic conditions are expected to remain volatile, keeping investors on high alert. However,Budiman remains optimistic about the long-term prospects of the Indonesian economy,citing its strong fundamentals:

“The long-term fundamentals of the Indonesian economy remain strong,supported by a growing population,robust domestic demand,and government initiatives to attract foreign investment. Therefore, we anticipate that the Indonesian stock market will eventually rebound and offer attractive investment opportunities,”

Budiman stated.

The current market dip raises an important question for investors: Is it a temporary setback or a sign of a deeper trend?

How does the performance of the technology sector during recent market volatility reflect investor preferences?

Navigating the Volatility: Insights into the Indonesian Stock Market

An Interview with Anton Budiman, head of Research at Premier securities Indonesia

The Indonesian stock market experienced a notable downturn recently, with various sectors feeling the impact. The most heavily affected sectors were raw goods and energy,which each saw declines of 2.9% and 2.3% respectively. These sectors are often especially sensitive to shifts in the global economy and fluctuations in commodity prices.

Interestingly, amidst this general downward trend, the technology sector bucked the pattern, registering a modest 0.2% gain. This could signal a growing investor preference for sectors perceived as more resilient during periods of economic uncertainty.

Despite the overall market dip,four stocks managed to hit their auto Rejection Upper (ARA) limits,demonstrating remarkable resilience. While specifics about these outperformers remain under wraps, Anton Budiman, a market analyst, suggests they likely possess strong fundamentals, unique market positions, or high growth potential. “It’s likely investors are recognizing these attributes despite the broader market turbulence,” he commented.

To gain further insight into the driving forces behind this recent market volatility, Archyde sat down with Anton Budiman, Head of Research at Premier Securities indonesia.

Archyde: Mr. Budiman, the Indonesian stock market experienced a notable decline on Monday. What factors do you believe contributed to this downturn?

Anton Budiman: The Indonesian market, like many others in Asia, is currently feeling the weight of several global and local factors.Rising inflation and interest rates worldwide are creating a risk-averse habitat among investors, leading to a flight to safer assets.This, regrettably, often leaves riskier assets like equities vulnerable.

archyde: How are these global headwinds impacting Indonesian investor sentiment?

Anton Budiman: We’ve also seen a slight slowdown in growth in certain key sectors within Indonesia, which has added to the current bearish sentiment. When combined with the global uncertainty, this creates a perfect storm for a market dip.

Archyde: Despite the general downturn, the technology sector bucked the trend with a modest gain. What does this suggest about investor preferences during times of market turbulence?

Anton Budiman: The technology sector’s relative strength could signal that investors are seeking out sectors perceived as more resilient during economic uncertainty. Technology companies, especially those focusing on innovation and disrupting customary industries, often possess growth potential that can withstand short-term market fluctuations.

Archyde: Looking ahead, what is your outlook for the Indonesian stock market in the near and long term?

Anton Budiman: While the short-term outlook remains somewhat uncertain due to the prevailing global volatility, we remain optimistic about the long-term prospects of the indonesian economy. Indonesia’s strong fundamentals – a growing population, robust domestic demand, and government initiatives to attract foreign investment – position it well for sustained growth. I believe the Indonesian stock market will eventually rebound and offer attractive investment opportunities for patient long-term investors.

The current market dip prompts an crucial question for investors: Is this a temporary setback or a sign of a deeper trend? Share your thoughts in the comments below!

archyde: How are these global headwinds impacting Indonesian investor sentiment?

Anton Budiman: We’ve also seen a slight slowdown in growth in certain key sectors within Indonesia, which has added to the current bearish sentiment. When combined with the global uncertainty, this creates a perfect storm for a market dip.

Archyde: Despite the general downturn, the technology sector bucked the trend with a modest gain. What does this suggest about investor preferences during times of market turbulence?

Anton Budiman: The technology sector’s relative strength could signal that investors are seeking out sectors perceived as more resilient during economic uncertainty. Technology companies, especially those focusing on innovation and disrupting customary industries, often possess growth potential that can withstand short-term market fluctuations.

Archyde: Looking ahead, what is your outlook for the Indonesian stock market in the near and long term?

Anton Budiman: While the short-term outlook remains somewhat uncertain due to the prevailing global volatility, we remain optimistic about the long-term prospects of the indonesian economy. Indonesia’s strong fundamentals – a growing population, robust domestic demand, and government initiatives to attract foreign investment – position it well for sustained growth. I believe the Indonesian stock market will eventually rebound and offer attractive investment opportunities for patient long-term investors.

The current market dip prompts an crucial question for investors: Is this a temporary setback or a sign of a deeper trend? Share your thoughts in the comments below!