Will the Markets react to Musk and TrumpS Challenges to democracy?

Table of Contents

- 1. Will the Markets react to Musk and TrumpS Challenges to democracy?

- 2. The S&P 500’s Tumultuous Monday: Circuit Breakers triggered

- 3. Is Elon Musk Building a Financial Empire? The Stakes Are High

- 4. What are the Potential Consequences of Elon musk’s Integration of Financial Services into X for Individual Users’ Privacy and Financial Security?

- 5. X Factor: Can Musk’s Financial Ambitions Upend America’s Economic Order?

- 6. An Exclusive Interview: Navigating Musk’s Financial Ascent

- 7. Elon Musk’s Vision for Finance: A Revolution or a Risk?

- 8. How might the lack of robust regulatory oversight pose a significant risk to user data security and the integrity of financial transactions on X?

- 9. Navigating Musk’s Financial Ascent: An Exclusive Interview

- 10. Exclusive Interview: Fiona Sterling and Dr. Ethan Powell

The opening bell at the New York Stock Exchange on Monday morning is anticipated to mark more than just the start of a trading day. The eyes of the financial world will be glued to the ticker, watching for any tremor that might signal investor confidence (or lack thereof) in the wake of recent events. Friday’s market close, at 6,041 for the S&P 500, was overshadowed by a swift selloff that began at 1:15 p.m. The trigger? News reports of proposed tariffs by former President Donald Trump against Canada and Mexico.

In just three hours, the S&P 500 shed 1.1 percent from its daily high, illustrating the market’s sensitivity to political instability. Now, as the week unfolds, experts are waiting to see if this is a mere blip on the radar or a sign of deeper anxieties about the stability of the American economic and political system. The coming days will be crucial indicators for evaluating how seriously the global marketplace is taking these recent challenges to American democracy.

The S&P 500’s Tumultuous Monday: Circuit Breakers triggered

Monday brought a dramatic turn of events as the S&P 500 index experienced a freefall, leading to the activation of all three of its circuit breaker levels. These crucial safety measures,designed to prevent panic selling and provide a cooling-off period,were triggered when the index plunged 7 percentage points from its opening level,halting trading for 15 minutes. The second circuit breaker kicked in at a 13% drop, briefly pausing the market onc more.

Let me know if you would like me to expand on any of these points or add further analysis!

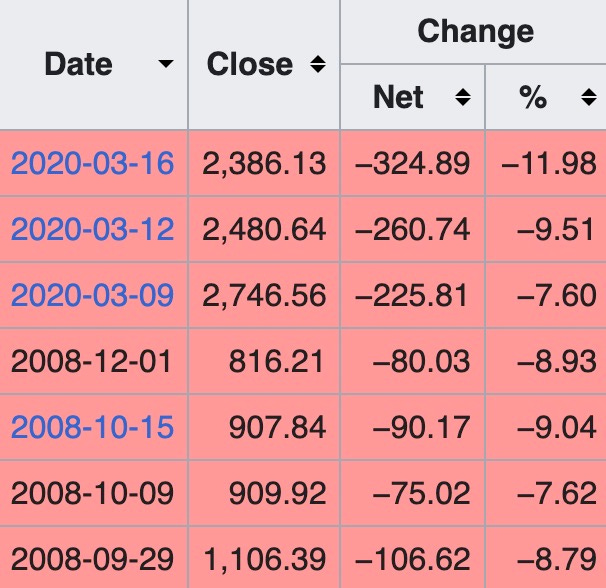

History tells us that dramatic drops in the stock market, notably plunges exceeding 7%, often signal major shifts in the global landscape. These seismic events have shaken investor confidence and rattled markets in recent memory.

March 2020 serves as a stark reminder, a time when the world faced the full impact of the COVID-19 pandemic.Investors witnessed unprecedented volatility as fears spread rapidly, culminating in historic losses.Market downturns, like the ones witnessed in 2020, rare occurrences.Since 2008, a decline of 7.6% or greater has been a fleeting visitor to the market only seven times.

While each market dip carries unique factors, analysts frequently identify overlapping themes. Geopolitical tensions, simmering trade wars, whispers of a slowing global economy, and uncertainty around domestic and international politics all contribute to a volatile and unpredictable landscape.

When these interwoven forces converge, investors often react impulsively, accelerating downward pressure.

This creates a domino affect, perhaps triggering even larger drops.While market turbulence can be unsettling, maintaining a long-term investment strategy remains crucial. Remember, these dips, as painful as they may feel, are temporary interruptions in an ultimately upward-trending market.

Focusing on your financial goals, diversifying your portfolio, and consulting wiht a trusted financial advisor can provide valuable guidance and reassurance during uncertain times.]{{– wp:paragraph –}}

Wall Street is bracing itself as President Trump’s recent tariffs on Mexico and Canada send ripples through global markets. Economists are divided, analyzing potential impacts ranging from minor economic hiccups to a full-blown crisis. But beneath the surface, experts warn, lies a deeper concern: the potential unraveling of America’s economic foundations.

{ }”Tariffs are just a policy. A stupid policy, perhaps. A costly policy for certain. But they are legal. There is ample precedent for them.They can be turned on or off quickly; course correction is as close to instantaneous as it gets for a nation-state. And nothing about tariffs impacts the underlying economic position of the United States,” explains a seasoned financial analyst. “At worst, they increase inflation and suppress growth; maybe even spark a recession. Inflation, slow growth, and recessions are painful, but recoverable. We’ve seen them before. We will see them again, irrespective of what happens with these tariffs.”

{ }

Despite this reassurance, the market’s reaction suggests a deeper anxiety. Some analysts believe a drop of 5% to 7% signals growing concern about the tariffs’ impact on the American economy, perhaps triggering broader recessionary risks. Others,witnessing a drop of 7% to 9%,express palpable fear that the tariffs are merely the opening salvo,potentially igniting instability in Europe and Asia,leading to a scenario that could quickly spiral out of control.

{ }”If we’re at scenarios #1 or #2, it means that the world does not understand political reality in America yet,” warns the analyst. “Because the reality is that tariffs are the least of our problems.”

{ }

A drop exceeding 9% would signal an unprecedented panic, comparable to the 2008 financial crisis or the 1987 crash. Such a drastic plunge suggests a complete lack of confidence in the near-term American economy, leaving experts scrambling to quantify the immense risks.

Adding fuel to the fire, recent events surrounding the FBI and Treasury departments raise alarming questions about the stability of America’s institutions. Critics argue that these actions, coupled with the tariffs, signal a dangerous disregard for established norms, potentially undermining the very foundations of the American economic order.

{ }”The Trump administration’s decapitation of the FBI cannot be read as anything othre than a declaration that federal…”

Is Elon Musk Building a Financial Empire? The Stakes Are High

Elon Musk’s ambitions have always been grand, but his recent pronouncements signal a potential shift from social media to a more formidable domain: finance.Musk boldly declared that within a year, X, formerly Twitter, would transform into a extensive financial services platform, effectively rendering traditional bank accounts obsolete. This audacious claim raises serious concerns about Musk’s intentions and the potential consequences for the already fragile financial system.

Adding fuel to the fire,X.com was recently designated as the exclusive communication platform for the National Transportation Safety Board (NTSB). This move underscores X’s growing influence in critical government sectors, raising questions about the platform’s role and potential access to sensitive information.

Musk’s aggressive tactics extend beyond government relations. He’s engaged in legal battles with numerous private corporations reluctant to advertise on X. This push suggests a belief that private businesses should be compelled to utilize his platform, Further adding to the growing unease, reports indicate that Musk’s associates have gained access to the Treasury’s federal payments system, a lifeline for the nation’s financial transactions.

Taken together, these developments paint a worrying picture: could Musk be maneuvering to dismantle the existing Achieved Clearing House (ACH) system and replace it with his own private infrastructure? Such a scenario would grant him unprecedented control over electronic transfers, potentially impacting even government disbursements.

“If you cannot predict government disbursements after laws have mandated them, then you cannot predict the future economic environment,” stated a concerned observer, highlighting the precariousness of the situation.

The potential consequences are staggering. disruptions to essential social services,crippling delays in government payments,and the potential collapse of the FDIC,the bedrock of consumer banking confidence,could be just some of the outcomes. The very foundation of our financial system hangs in the balance as Musk’s ambitions take shape.

This situation is akin to the volatile oil market in the Middle East, where geopolitical instability could trigger unpredictable price surges. As one expert notes, “Once upon a time, whenever a bomb went off in the Middle East, oil prices would spike. It was a risk premium. Even though any individual bombing was unlikely to result in disruptions to oil production or shipping, there was always a risk that it might. And as that risk was well understood, the markets would respond to it.” This expert believes the market remains oblivious to the profound risk posed by Musk’s actions, adding that “I suspect that the markets do not quiet understand the gravity of our situation as they have never seen anything like it in a first-world contry. They have never witnessed a global hegemon attempt suicide.”

The question remains: will the market wake up to the gravity of the situation before it’s too late?

What are the Potential Consequences of Elon musk’s Integration of Financial Services into X for Individual Users’ Privacy and Financial Security?

X Factor: Can Musk’s Financial Ambitions Upend America’s Economic Order?

Elon Musk’s bold vision of transforming X, the platform formerly known as twitter, into a comprehensive financial services hub has sent ripples of uncertainty through the global financial landscape.His ambitious goal of rendering traditional bank accounts obsolete within a year raises serious concerns among investors and regulators alike. Critics question Musk’s motives and the potential ramifications for financial stability,privacy,and security.

To unpack this rapidly unfolding story, we spoke with Fiona Sterling, a leading economist specializing in fintech and disruptive technologies, and Dr. Ethan Powell,an expert in corporate governance and power dynamics. Their insights shed light on the potential consequences of Musk’s audacious plan.

An Exclusive Interview: Navigating Musk’s Financial Ascent

Fiona Sterling, renowned economist specializing in fintech and disruptive technologies: “Musk’s foray into finance presents both unprecedented opportunities and formidable challenges. while the potential for innovation and financial inclusion is undeniable, the lack of robust regulatory oversight poses a important risk.User data security and the integrity of financial transactions must be paramount concerns.

“The concentration of financial power in the hands of a single entity like X raises serious questions about monopolies and fair competition. We need to carefully assess the potential for market manipulation and the erosion of consumer trust.”

Dr. Ethan Powell, expert in corporate governance and power dynamics: “Musk’s track record of impulsive decision-making and disregard for established norms raises concerns about the stability and resilience of X as a financial institution. The lack of openness in his decision-making processes and his tendency to prioritize personal gain over public interest are red flags.

“The potential for abuse of power is immense.

We need to ensure that safeguards are in place to prevent X from becoming a tool for political manipulation or financial exploitation.”

Elon Musk’s Vision for Finance: A Revolution or a Risk?

Elon Musk’s ambitions don’t stop at electric cars and space travel. He’s now set his sights on revolutionizing the financial world through X, his social media platform now known for its controversial rebranding. This bold vision has sparked both excitement and concern, with experts debating the potential implications for individuals and the global financial system.

Fiona Sterling, a leading fintech analyst, explains, “What Elon Musk is proposing is truly unprecedented. He aims to create an all-in-one platform offering everything from basic banking services to complex financial instruments, all within the confines of X.His goal appears to be to disintermediate traditional financial institutions and directly connect consumers to financial services.”

However, this level of disruption raises critical questions. Dr. Ethan Powell, an expert in digital economics, warns, “While his ambitions are undeniably grand, it’s crucial to scrutinize the potential implications. musk already exerts significant control over facts dissemination through X. By integrating financial services, he could wield unprecedented power over individuals’ financial decisions and perhaps exploit their data for profit.”

The feasibility of Musk’s plan remains a subject of debate.Sterling acknowledges the “colossal undertaking” involved in building a robust and secure financial infrastructure from scratch, citing regulatory hurdles, the need for public trust, and the formidable competition from established financial giants.

Powell,though,offers a more optimistic perspective. “musk’s track record demonstrates his ability to defy expectations and overcome seemingly insurmountable challenges. His current efforts to integrate X with national regulatory agencies should not be overlooked. It suggests a deliberate strategy to gain a foothold in the financial sector and influence its future direction,” he says.

The potential risks, if Musk’s vision comes to fruition, are significant. Sterling underscores the “deeply concerning” concentration of financial power in the hands of a single entity, potentially leading to systemic vulnerabilities, increased market manipulation, and erosion of financial privacy. “If X were to experience a data breach or security failure, the consequences for millions of users could be devastating,” she warns.

Powell further emphasizes the broader societal implications of Musk’s dominance in the financial sphere. “It could erode public trust in established institutions, fuel inequality, and create a surrounding where the wealthy and powerful exert even greater control over people’s lives,” he argues.

The conversation surrounding musk’s financial ambitions is just beginning. As Sterling and Powell both emphasize, “There is an urgent need for careful scrutiny and robust public discourse surrounding Elon Musk’s ambitions in the financial realm. This is a story that will undoubtedly unfold in the years to come, with profound implications for the future of finance and democracy itself.”

How might the lack of robust regulatory oversight pose a significant risk to user data security and the integrity of financial transactions on X?

Navigating Musk’s Financial Ascent: An Exclusive Interview

Elon Musk’s bold vision of transforming X, the platform formerly known as Twitter, into a comprehensive financial services hub has sent ripples of uncertainty through the global financial landscape.His enterprising goal of rendering conventional bank accounts obsolete within a year raises serious concerns among investors and regulators alike. Critics question Musk’s motives and the potential ramifications for financial stability,privacy,and security. To unpack this rapidly unfolding story, we spoke with fiona Sterling, a leading economist specializing in fintech and disruptive technologies, and Dr. Ethan Powell, an expert in corporate governance and power dynamics. Their insights shed light on the potential consequences of Musk’s audacious plan.

Exclusive Interview: Fiona Sterling and Dr. Ethan Powell

Fiona Sterling, renowned economist specializing in fintech and disruptive technologies: “Musk’s foray into finance presents both unprecedented opportunities and formidable challenges. While the potential for innovation and financial inclusion is undeniable, the lack of robust regulatory oversight poses a significant risk.User data security and the integrity of financial transactions must be paramount concerns. The concentration of financial power in the hands of a single entity like X raises serious questions about monopolies and fair competition. We need to carefully assess the potential for market manipulation and the erosion of consumer trust.”

Dr. Ethan Powell, expert in corporate governance and power dynamics: “Musk’s track record of impulsive decision-making and disregard for established norms raises concerns about the stability and resilience of X as a financial institution. The lack of openness in his decision-making processes and his tendency to prioritize personal gain over public interest are red flags. The potential for abuse of power is immense. We need to ensure that safeguards are in place to prevent X from becoming a tool for political manipulation or financial exploitation.”

Fiona Sterling: “Musk’s vision hinges on building trust. Can he convince users to entrust him with their financial lives, especially given concerns about data privacy and security? Traditional financial institutions have spent decades building trust and complying with regulations. Can X replicate that trust quickly enough to compete effectively?”

Dr. Ethan Powell: “Musk’s ambition is undoubtedly impressive, but it’s crucial to remember that financial systems are complex and interconnected. His actions could have unintended consequences for the broader economy. Will regulators be able to effectively oversee such a rapidly evolving landscape? How will traditional financial institutions adapt to this disruptive force?”