India’s Budget 2025: Tax Relief for the Middle Class

Table of Contents

- 1. India’s Budget 2025: Tax Relief for the Middle Class

- 2. India’s 2025-26 Budget: A Focus on Growth and Business Simplification

- 3. What are the potential implications of raising the tax-free threshold for the middle class on economic growth?

- 4. Interview: Deep Dive into India’s Budget 2025 – Tax Relief and Growth

- 5. Interview with Amit Kumar,Chief Economist at Shardul Amarchand mangaldas & Co.

- 6. Archyde: Mr. Kumar, the budget witnessed a notable shift in emphasis on tax relief, especially for the middle class. what is your assessment of this move and it’s potential impact on the economy?

- 7. Archyde: How will this tax relief compare to the government’s previous approach to fiscal stimulus?

- 8. Archyde: While the government is committed to fiscal duty, it sees a reduction in fiscal deficit target. How might this impact long-term economic stability?

- 9. Archyde: The budget also announced a review of India’s customs duty structure. Could this have an impact on domestic industries and trade relations?

- 10. Archyde: The budget also aims to achieve a debt-to-GDP ratio target. Could you elaborate on the implications of this strategy?

- 11. Archyde: Looking ahead, what are some key questions that the success of this budget will hinge on?

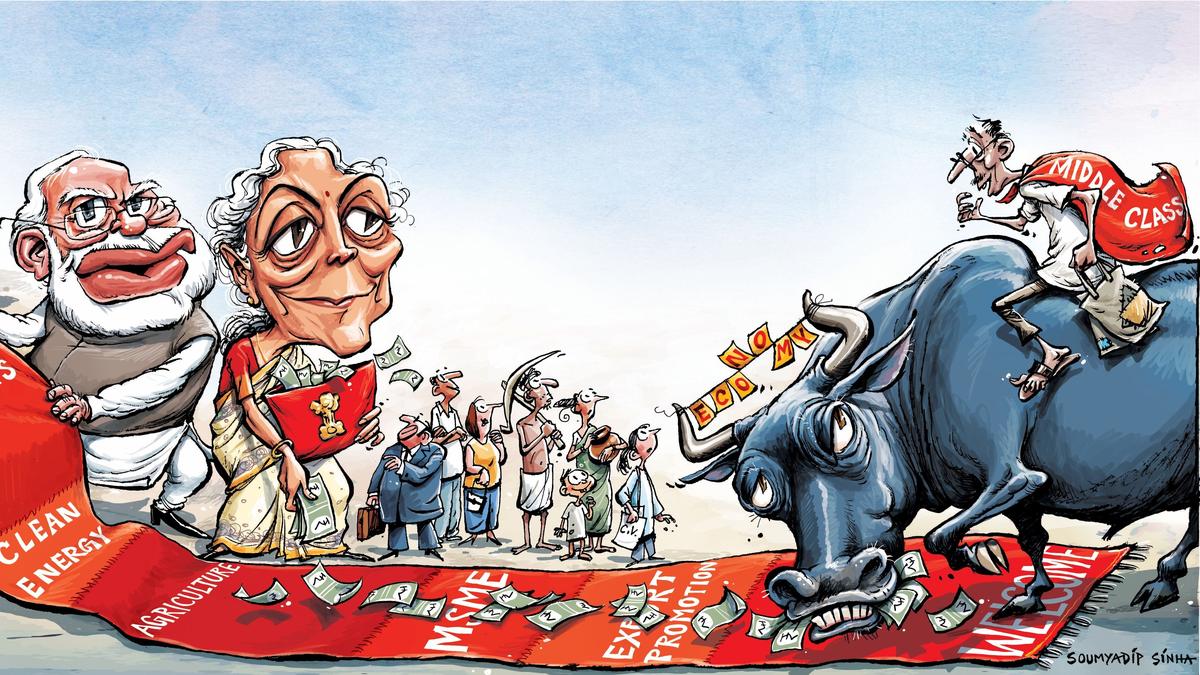

On February 1st, 2025, Finance Minister Nirmala Sitharaman presented the Union Budget for 2025-26, aiming to revitalize India’s sluggish economy. The budget centered around a important tax stimulus of ₹1 lakh crore for households, a move uncharacteristic of the government’s previous approach.

The central focus was on boosting household sentiment and increasing the spending power of India’s burgeoning middle class, a key driver for economic growth. The government believes this tax relief will encourage consumers to spend more, leading to a resurgence in domestic demand.

“Slabs and rates are being changed across the board to benefit all taxpayers. The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment,” said Ms. Sitharaman during her budget speech.

As part of this initiative, no income tax will be payable on incomes up to ₹12 lakh per annum, substantially raising the tax-free threshold from the previous ₹7 lakh limit. This change is projected to benefit approximately one crore taxpayers, alleviating their financial burden and potentially stimulating consumer spending.

While acknowledging the need for public capital expenditure (capex) to drive growth, the government emphasized it’s commitment to tax cuts. Finance Secretary Tuhin Kanta pandey stressed that the changes under the new personal income tax regime are intended to benefit all taxpayers.

The move comes as India faces a confluence of economic challenges. post-pandemic pent-up demand has waned, and prolonged periods of high inflation have dampened consumer confidence. Additionally, the government’s reliance on public capex as a growth engine has shown less impact this year, with growth estimated at 6.4% for the fiscal year.

Economists and central bank officials have been advocating for increased consumer spending to revive economic growth and encourage private investment. The government’s response, though, appears to be a balanced approach, combining both tax relief and sustained investment in infrastructural projects.

Ms. Sitharaman concluded her press conference by assuring the nation that the government remains responsive to the needs of its people.The bold tax cuts and commitment to infrastructure spending are seen as crucial steps towards navigating the current economic landscape and stimulating sustainable growth.

India’s 2025-26 Budget: A Focus on Growth and Business Simplification

India’s Finance Minister Nirmala Sitharaman unveiled a 2025-26 budget prioritizing economic growth, simplifying the tax system, and fostering a more business-kind surroundings.

While the Center’s capital expenditure has been revised downwards to ₹10.18 lakh crore from the original estimate of ₹11.11 lakh crore, it’s projected to jump by 10.1% to ₹11.2 lakh crore in 2025-26. Importantly, the government has maintained its commitment to providing ₹1.5 lakh crore in 50-year interest-free loans to states for infrastructure development.

A key highlight is the overhaul of the Income Tax law, a promise made in the previous year’s budget.This revamp,coupled with a promised review of India’s custom duty structure,aims to attract more investment. The government proposes to eliminate seven of the fifteen existing tariff rates, a move that Ms. Sitharaman emphasized woudl “drastically reduce” and simplify the tariff structure.

“So the usual narrative, which goes on saying ‘Is India being too heavy on tariffs?’ No, you will find that they have been drastically reduced and also simplified,” the Minister stated.These changes coudl be in response to U.S. President Donald Trump, who has frequently criticized India’s tariff policies, grouping it with China.

Economists like DK Srivastava, Chief policy Advisor at EY India, have lauded the budget for its focus on fiscal stimulus. “This stimulus is limited in terms of magnitude and would prove to be effective along with other fiscal and monetary measures aimed at stimulating private investment,” he explained. He further pointed out that the realignment of customs duty tariffs could incentivize domestic manufacturing by reducing the cost of essential inputs.

The budget predicts that the fiscal deficit will shrink from 4.8% of GDP this year to 4.4% in 2025-26, slightly below the 4.5% target set by the government.

A significant shift in fiscal policy is the move from targeting a fiscal deficit to focusing on a debt-to-GDP ratio. The government aims to achieve a debt-to-GDP ratio of 50% (plus or minus 1%),by March 31,2031.

“This approach would provide requisite operational flexibility to the Government to respond to unforeseen developments. at the same time, it is expected to put Central Government debt on a sustainable trajectory in a transparent manner,” Ms. Sitharaman stated in the fiscal policy statement mandated by the Fiscal Responsibility and Budget Management Act, 2003.

Recognizing the importance of a streamlined business environment, the government also announced a series of measures to ease regulations. These measures include the decriminalization of approximately 100 legal provisions across various statutes and a renewed commitment to “trust first, scrutinize later” in the tax department, as announced by Ms. Sitharaman.

What are the potential implications of raising the tax-free threshold for the middle class on economic growth?

Interview: Deep Dive into India’s Budget 2025 – Tax Relief and Growth

Interview with Amit Kumar,Chief Economist at Shardul Amarchand mangaldas & Co.

India’s Finance Minister Nirmala Sitharaman presented the Union Budget 2025-26, focusing on economic growth and business simplification. We spoke with Amit Kumar, Chief economist at Shardul Amarchand Mangaldas & Co., to understand the implications of the budget, particularly the tax relief measures for the middle class.

Archyde: Mr. Kumar, the budget witnessed a notable shift in emphasis on tax relief, especially for the middle class. what is your assessment of this move and it’s potential impact on the economy?

Amit Kumar: This is indeed a bold step by the government. By substantially raising the tax-free threshold from ₹7 lakh to ₹12 lakh, the budget aims to put more money in the hands of consumers, thereby boosting their spending power. With consumer spending being a crucial driver of economic growth, this tax relief could possibly stimulate demand and revitalize the economy.

Archyde: How will this tax relief compare to the government’s previous approach to fiscal stimulus?

amit Kumar: In the past, the government’s focus has been more on large-scale infrastructure projects and public investment. This time, the emphasis seems to be on energizing the private sector through direct tax cuts, aiming to encourage consumer spending and private investment. The government is likely hoping to achieve a more balanced approach to growth this time around.

Archyde: While the government is committed to fiscal duty, it sees a reduction in fiscal deficit target. How might this impact long-term economic stability?

Amit Kumar: ** A lower fiscal deficit target is definitely a positive sign and suggests the government’s commitment to financial discipline. However, its vital to ensure that the deficit reduction measures do not stifle economic growth. The government needs to carefully balance its fiscal goals with the need to support economic activity.

Archyde: The budget also announced a review of India’s customs duty structure. Could this have an impact on domestic industries and trade relations?

Amit Kumar: the simplification and reduction of tariff rates could potentially incentivize domestic manufacturing by making essential inputs cheaper. This could lead to increased competition and potentially lower prices for consumers. However,it’s crucial to ensure that these trade policies don’t negatively impact domestic industries that might be less competitive. The government needs to strike a delicate balance between promoting domestic industries and integrating with the global economy.

Archyde: The budget also aims to achieve a debt-to-GDP ratio target. Could you elaborate on the implications of this strategy?

Amit Kumar: This shift towards a debt-to-GDP ratio target is a significant departure from the previous fiscal deficit focus. It shows the government’s long-term vision for lasting debt management. By setting a concrete target for the debt-to-GDP ratio, the government is signaling its commitment to responsible fiscal practices and aims to build investor confidence.

Archyde: Looking ahead, what are some key questions that the success of this budget will hinge on?

Amit Kumar: Key questions include how effectively the increased consumer spending translates into overall economic growth, whether the tax relief measures benefit a wide cross-section of the middle class, and how the government manages its debt levels while ensuring adequate investment in infrastructure and social programs.The government needs to ensure transparency and accountability in the implementation of these policies for the budget to achieve its desired impact.