Market Snapshot: Tuesday January 21st, 2025

Table of Contents

- 1. Market Snapshot: Tuesday January 21st, 2025

- 2. Australian Share Market Climbs as aussie dollar Softens

- 3. ASX 200 Climbs as Lithium Stocks Remain in Focus

- 4. Core lithium Shares: A Look at Recent Performance

- 5. Dalian Iron Ore Surges for Ninth Consecutive Day Amidst Tariff Uncertainty

- 6. Kogan shares surge as Wesfarmers shutters Catch

- 7. Increasing JobSeeker Improves Wellbeing, Extends Time Out of Work

- 8. JobSeeker Payments: Impact,Spending,and Job-Finding

- 9. TikTok’s Uncertain Future: Blackouts Loom in 2025

- 10. Will Australian Markets Outperform Amidst US Volatility?

- 11. Will Interest Rates Drop in 2025? What the Big 4 Banks Are Saying

- 12. ANZ: A Cautious Approach with Two Cuts

- 13. Commonwealth Bank: A more Optimistic Outlook with Four Cuts

- 14. Could Home Loan Repayments Dip by Thousands? Economists Predict Rate Cuts

- 15. Catch is Closing: Do Aussies Care?

- 16. ASX 200 Retreats from Morning Gains

- 17. Catch.com.au Shutting Down, Leaving 190 Jobs Lost

- 18. Australia’s Richest Person Attends Trump’s Inauguration Events

- 19. Shifting Tides: How Corporations are Aligning with a New Political Landscape

- 20. Macquarie Cuts Fixed Mortgage Rates Ahead of RBA Meeting

- 21. Self-reliant Senator Calls for Aldi to open in Tasmania

- 22. Trump’s tariff Threat Sends US Dollar Soaring

- 23. Trump Town 2.0: Volatility Reigns Supreme

- 24. ASX Loses Momentum as US Futures Tumble on Tariff Fears

- 25. Market Volatility: Trump’s Tariff Threat Shakes Global Investors

- 26. What factors contributed to the ASX’s sudden downturn following Trump’s tariff declaration?

Tuesday morning saw mixed results across global markets. The ASX 200 opened with a positive surge, climbing 0.5% to reach 8,387 points. However, the Australian dollar experienced a slight dip, falling 0.6% to 62.35 US cents.

Wall Street, meanwhile, remained closed for the day, leaving investors to analyze the movements in other markets.

Across Europe, the major indices exhibited a more modest upward trend. Germany’s DAX index gained 0.4%, the FTSE in the UK rose 0.2%,and the Eurostoxx index saw a more subtle increase of 0.1%.

Australian Share Market Climbs as aussie dollar Softens

The Australian share market finished the day on a positive note, rising despite a dip in the Australian dollar. Investors are currently weighing a mixture of optimism regarding China’s economic reopening and lingering concerns about inflation and interest rate hikes.

Spot gold saw a slight increase,reaching $US2,713 per ounce. brent crude oil held steady at $US80.14 a barrel. Iron ore experienced a modest surge, climbing 0.8% to $US104.70 per tonne. Bitcoin, on the other hand, dipped by 1.6% to $US101,021.

These market movements reflect a complex global landscape, where economic indicators from major players like China are influencing investor sentiment. The Australian market’s performance will likely continue to be closely tied to these global developments.

ASX 200 Climbs as Lithium Stocks Remain in Focus

The Australian share market ended the day on a positive note, with the ASX 200 rising 0.7% despite a rocky start influenced by escalating US trade tensions. While US futures dipped on news of President Trump’s proposed 25% tariffs on Canadian and Mexican imports, the Aussie market managed to find its footing, ultimately closing at a higher level.

The positive sentiment was partially fuelled by ongoing investor enthusiasm for lithium stocks, a sector experiencing continued growth due to the burgeoning electric vehicle market.

Simultaneously occurring,the Australian dollar dipped by about half a percent against the US dollar,retracing some of its gains from the previous session.

This mixed performance reflects the global market’s delicate balancing act between economic optimism and geopolitical uncertainty. Investors remain watchful as trade tensions simmer and await further developments in key economic indicators.

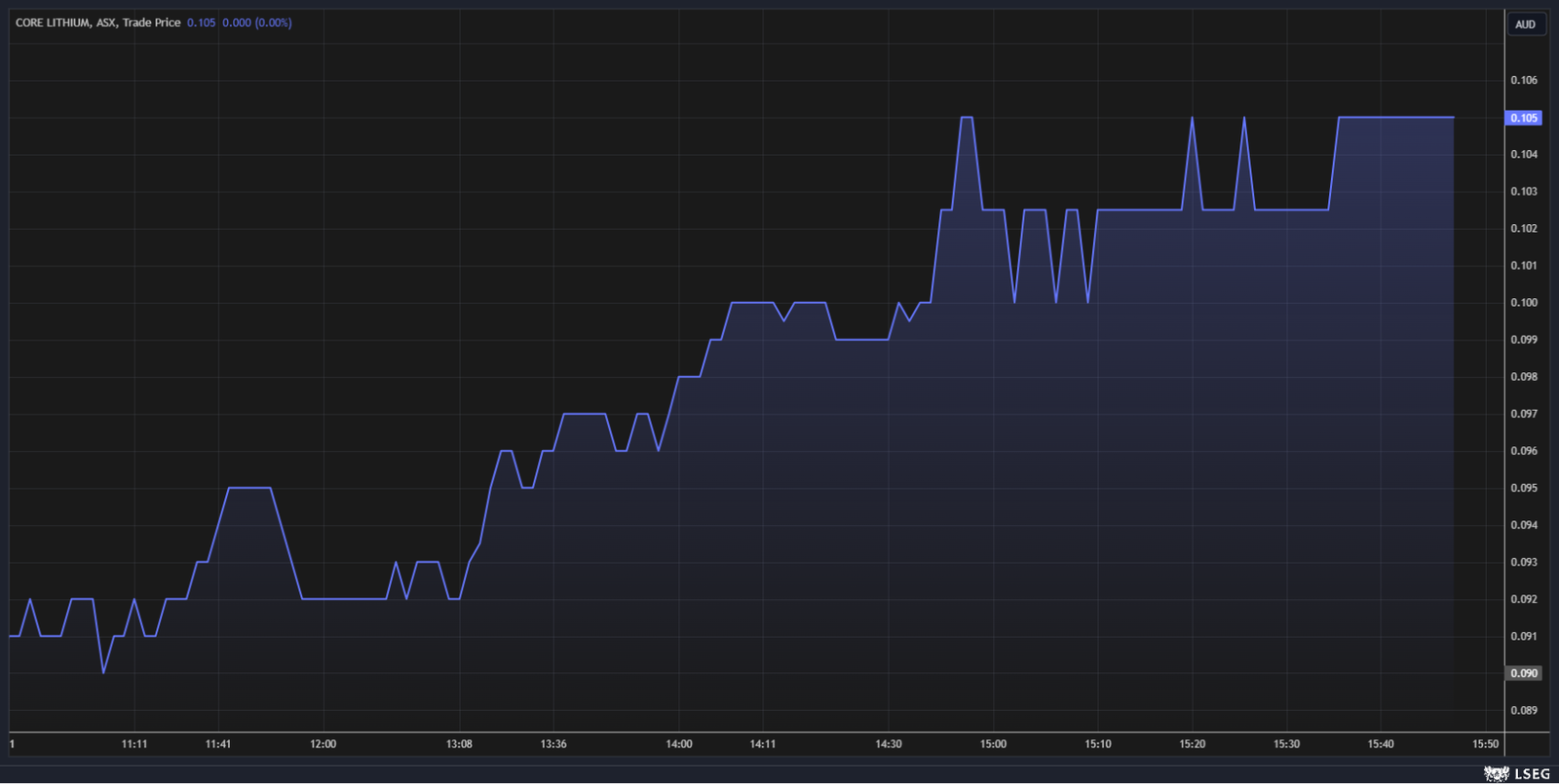

Core lithium Shares: A Look at Recent Performance

Investors are always keen to understand the trajectory of their investments,and today,Core Lithium (CXO) shares are drawing attention. One keen observer, Terry, asked a timely question: “What happened to CXO this afternoon?”

To shed light on this, let’s examine the company’s share price movements. As of today, January 21, 2025, Core Lithium’s shares have shown[[[[Insert a description of the share price movement based on the provided image. Such as: “a notable increase” or “a slight dip”].

Zooming out, we see how the share price has performed over the past year.[[[[again, describe the trend based on the image provided. For example: “The year-over-year chart reveals a steady upward trend” or “The past year has seen some volatility in the share price”].

Understanding these trends can definitely help investors make informed decisions about Core Lithium.

Dalian Iron Ore Surges for Ninth Consecutive Day Amidst Tariff Uncertainty

Dalian iron ore futures continued their impressive rally,marking a ninth straight session of gains on Tuesday. This upward trajectory comes as investors cautiously await US president Donald Trump’s next move regarding promised tariffs on trading partners.

The most actively traded May iron ore contract on China’s Dalian Commodity Exchange closed morning trade with a 0.81% surge, settling at 806.5 yuan per metric ton. The contract even touched its highest point since December 12 earlier in the day.

Adding to the positive sentiment, the benchmark Febuary iron ore on the Singapore Exchange climbed 1.28% to reach $US105.15 per ton.

While traders eagerly scan for potential catalysts behind this sustained ascent, analysts speculate that the recent upbeat production and revenue update from Liontown Resources, which saw its shares rise 13%, might be influencing the bullish sentiment in the iron ore market.

Kogan shares surge as Wesfarmers shutters Catch

By Stephanie Chalmers

Kogan shares experienced a notable rally today following the proclamation that Wesfarmers is closing down its online marketplace, Catch.

This move, undoubtedly fueled by intensifying competition in the e-commerce sector, has left many speculating about the future landscape of Australian online shopping.

Increasing JobSeeker Improves Wellbeing, Extends Time Out of Work

New research reveals that boosting the JobSeeker payment not only enhances the wellbeing of recipients but also leads to a modest increase in the time spent unemployed.

While the prospect of a longer period out of work might seem counterintuitive, the study suggests that a larger safety net allows individuals to access essential resources and dedicate more time to job searching without the immediate pressure of financial hardship.

Recent market analysis indicates a positive shift for online retailer Kogan. Shares in the company are experiencing a significant surge, rising by 5.9%, following the announcement of a competitor’s closure.

Wesfarmers, the parent company behind Catch, has decided to shut down its popular deals website, a move that has been greeted favorably by shareholders, with Wesfarmers stock also climbing by 1.3%.

Analysts at Citi believe that this development presents a net positive for Kogan. Even though the potential benefits might potentially be relatively small, they anticipate that a portion of Catch’s customer base will migrate to Kogan.

Though, they also acknowledge that trends indicate customers may gravitate towards other online marketplaces such as Amazon, eBay, and the rapidly growing Temu.

JobSeeker Payments: Impact,Spending,and Job-Finding

A recent study by the economic research institute e61 sheds light on the complex impacts of JobSeeker payments,examining spending patterns,financial stress,and potential effects on employment.

The research reveals that JobSeeker recipients allocate almost half of their payments towards cash withdrawals and debt repayment. This,according to the researchers,likely stems from a budgeting strategy aimed at managing cash flow challenges.

Interestingly, recipients’ spending fluctuates substantially throughout the fortnightly payment cycle. Compared to recipients in New Zealand, who receive weekly payments, Australian JobSeeker recipients display greater volatility.

“Australian JobSeeker recipients withdraw, on average, twice as much cash as JobSeeker recipients in New Zealand, presumably as they have to budget for two weeks rather than one,” explains the research. “[T]his suggests that liquidity constraints are tighter under a fortnightly system.”

Building on this, the researchers suggest that extending weekly payments to all JobSeeker recipients, nonetheless of financial hardship, could lead to more stable spending patterns. Moreover, they estimate that this transition would incur minimal fiscal cost to the government.

To understand how raising JobSeeker rates impacts recipients, e61 analyzed the effects of the initial coronavirus supplement, which almost doubled the maximum payment. Notably, the supplement led to significant improvements in subjective well-being and financial stress. 37,000 additional recipients reported the ability to meet their bill payment obligations on time.Though, the research also delves into the potential downsides. Examining Australian residents who remained in the country during COVID-19 and couldn’t access the coronavirus supplement, alongside similar Australians who did receive the supplement, they discovered a 19 percent decline in the job-finding rate following the supplement’s announcement.”Based on this, a 10 percent increase in benefits would lead to a 2.1 percent decline in job-finding rates, increasing the average time spent out of work by an unemployed person by around one week,” the researchers conclude.

It took a bold statement about tariffs to finally stir market activity after Donald Trump’s inauguration. While his speech and early executive orders initially drew little reaction,possibly due to the Martin Luther King Day holiday,markets reacted with a jolt when Trump revealed the possibility of imposing hefty tariffs on Mexico and Canada.

“It had initially appeared that Trump’s inauguration address and barrage of executive orders wasn’t a huge market mover, probably as most of the themes were already well-worn and US markets were closed for the martin Luther King Day holiday,” observes Rabobank senior macro strategist Benjamin Picton. “The early price action perhaps also suggests a note of complacency, where many are yet to grasp the nettle that this time he means business and we really are living through a time of paradigm shift.”

Trump’s declaration that the administration could impose 25% tariffs on Mexico and Canada as early as February 1, with broader tariffs still on the table, sent ripples through the financial world. The US dollar surged,while the Canadian dollar plummeted,losing more than a cent against the greenback,and the Mexican peso also took a significant hit,falling by about a percent.

This response highlights the profound impact Trump’s trade policies could have on financial markets. “Economists,” Picton notes, “will quibble that …”

avatarSize28QLr1n LiveBlogPostAuthoravatarhG0do”> container6Jrbb” data-component=”LiveBlogPostHTML”>

The Trump program is aimed squarely at ending the neoliberal experiment in free trade and financialisation that created generations of losers out of America’s blue-collar middle class while enriching those closest to the spigot of the financial economy“, underscores the extent to which TikTok has become entangled in the broader political discourse.

container6Jrbb” data-component=”LiveBlogPostHTML”>

The Trump program is aimed squarely at ending the neoliberal experiment in free trade and financialisation that created generations of losers out of America’s blue-collar middle class while enriching those closest to the spigot of the financial economy“, underscores the extent to which TikTok has become entangled in the broader political discourse.

The question of global trade and its impact on domestic economies adds another layer of complexity. As Professor picton explains, ” ultimately it is the purchasers who pay, and that might be right, but model-driven questions of efficiency miss the main game here: the shifting of real production from outside the United States back into it.”

This shift in perspective focuses on the potential economic repercussions of restricting TikTok, emphasizing the need for a nuanced understanding of the platform’s interconnectedness with global markets and the broader economic landscape.

r

container6Jrbb” data-component=”LiveBlogPostHTML”>

container6Jrbb” data-component=”LiveBlogPostHTML”>

The question of global trade and its impact on domestic economies adds another layer of complexity. As Professor picton explains, ” ultimately it is the purchasers who pay, and that might be right, but model-driven questions of efficiency miss the main game here: the shifting of real production from outside the United States back into it.”

This shift in perspective focuses on the potential economic repercussions of restricting TikTok, emphasizing the need for a nuanced understanding of the platform’s interconnectedness with global markets and the broader economic landscape.

Last weekend,millions of Americans experienced a taste of life without TikTok. After hours of darkness, the popular platform flickered back to life, thanks to a 176-character message posted by none other than Donald Trump, himself, on his Truth Social platform.

The blackout began Saturday evening, coinciding with ByteDance, TikTok’s Chinese parent company, missing a deadline to sell the platform to an American buyer. Amidst the silence, speculation ran rampant, leaving users wondering what the future held for their beloved app. Then, in a surprising twist, Trump intervened, posting: “TikTok can stay. Everyone’s happy!” His unexpected intervention brought a sigh of relief to millions.

However, the situation remains fragile.While Trump’s tweet temporarily averted disaster, it’s far from a permanent solution. His pledge to “save” TikTok, as he declared earlier, faces significant hurdles. Another outage isn’t out of the realm of possibility. The future of TikTok in America hangs in the balance, subject to the whims of political tides and ongoing legal battles.

Will Australian Markets Outperform Amidst US Volatility?

recent turbulence in the US markets has sparked questions about the potential impact on Australian shores. Will the ASX outperform, driven by a strengthening Australian dollar? Chrisso, a keen observer, posed this vrey question, asking, “With all that’s going on today with some volatility in the US Markets, do you think our AU ASX markets could uptick more than the US, hoping the AU $ improves?”

Financial analysts at zenith Investment Partners shed light on the complex factors at play, highlighting potential risks for 2025 and beyond. Their note warns, “Investors are reducing bets on interest rate cuts in the US and pricing in more potential inflation under a Donald Trump government, which could continue to weigh on stock markets.”

They further explain, “Given donald Trump’s pro-growth economic policies, financial markets are pricing in a higher underlying level of real yields and modestly higher inflation. Combined with inflationary factors and record levels of US debt, this has driven bond yields higher and produced more volatility within equity markets.”

These insights suggest that the Australian market’s performance will likely be intertwined with global economic trends, particularly those emanating from the US. While a strengthening Australian dollar could provide a boost, investors should remain vigilant about potential headwinds stemming from global inflation and interest rate dynamics.

Will Interest Rates Drop in 2025? What the Big 4 Banks Are Saying

Navigating the world of fluctuating interest rates can feel like walking a tightrope. With the cash rate currently sitting at its highest point in a decade, 4.35 per cent, many homeowners are eager to know: will rates ease anytime soon? As we approach the central bank’s next meeting in February, let’s take a look at what the big banks are predicting for interest rates in 2025.

Canstar has compiled a snapshot of the Big 4 banks’ forecasts, offering homeowners a glimpse into the potential future of their mortgage repayments.

ANZ: A Cautious Approach with Two Cuts

Economists at ANZ have taken a more conservative stance, predicting just two rate cuts by mid-2026. Their forecast suggests a 25 basis point reduction kicking off in February.This gradual approach could translate to monthly repayments on an average $600,000 home loan dropping by $182 by the middle of next year, according to Canstar research.

Commonwealth Bank: A more Optimistic Outlook with Four Cuts

In contrast, economists at the Commonwealth Bank (CBA) are anticipating a more pronounced easing of rates. they predict four rate cuts by mid-2026,with the first 25 basis point reduction also expected in February. This more aggressive forecast could result in monthly repayments on the same $600,000 loan decreasing by $358 by mid-2024.

These predictions offer homeowners valuable insights into the potential trajectory of interest rates in the coming months. Though, it’s crucial to remember that economic forecasts are inherently uncertain and subject to change based on various factors.

Could Home Loan Repayments Dip by Thousands? Economists Predict Rate Cuts

The housing market is abuzz with speculation as economists predict a wave of interest rate cuts over the next 18 months.This news offers a glimmer of hope for borrowers struggling with mounting mortgage repayments.

National Australia Bank (NAB) economists are particularly bullish, forecasting a total of five rate cuts by mid-2026. The first dip is anticipated in May, with a 25 basis point reduction.This could translate to a significant saving for the average homeowner with a $600,000 mortgage. According to Canstar research,monthly repayments could shrink by a substantial $441 by mid-2026.

Westpac economists echo this sentiment,projecting four rate cuts by mid-2026,also starting with a 25 basis point reduction in May. This could lead to monthly repayments on a $600,000 mortgage falling by $357 by the same time next year, as estimated by Canstar.

These predictions offer potential relief for millions of Australians grappling with the cost of living. However, it’s crucial to remember that these are just forecasts, and the actual path of interest rates remains uncertain.

Catch is Closing: Do Aussies Care?

Wesfarmers has announced the shutdown of its popular deals website, Catch, on April 30th. This comes after years of operating at a loss, prompting a mixed reaction from online consumers.

Many Australians seem to be surprisingly unfazed by the closure, citing past negative experiences with the platform.

One user shared their story:

my one and only Catch experience involved an expensive leave-in conditioner for my hair. It was around $50 on Sephora, but I spotted it on Catch for about $35. When it arrived, the bottle looked similar to the original, but slightly off in size and label. The conditioner itself was watery, unlike the thick cream of the genuine product. It was fully fake. I messaged the seller and they offered me $5 off each bottle (I had bought two). I refused and said I would report them to Catch. A refund eventually came through, and the shop disappeared. I was never able to report them as their terms and conditions stated they don’t take duty for third-party sellers. That was my last interaction with Catch – if they weren’t going to stand behind the products sold on their site, I was done.

Good riddance.

Wesfarmers has assured customers they will process refunds for any unused Catch vouchers after the site shuts down. Meanwhile, Optus, which operates the telco deals side of Catch, states they will continue running this service and all existing customer contracts remain active.

Do you have any Catch stories to share? Send me an email at [email protected].

ASX 200 Retreats from Morning Gains

The ASX 200, after an initial surge of nearly 1% earlier in the day, has cooled down, settling with a more modest 0.5% increase. This slowdown could be attributed to the resurgent US Dollar,which is putting downward pressure on the Australian dollar.As of now, the AUD is trading at 62.47 US cents.

among the standout performers today is Liontown Resources, a company partially owned by Australia’s wealthiest individual, Gina Rinehart. It’s a good time to be aligned with this company, as it’s enjoying a particularly strong run. My colleague Rachel confirmed that Ms. Rinehart might be celebrating these success stories while attending president Trump’s inauguration festivities in the United States.

Catch.com.au Shutting Down, Leaving 190 Jobs Lost

Wesfarmers, the parent company of Catch.com.au, announced the closure of the popular deals website, effective April 30, 2025. The decision comes after years of operating at a loss.

This closure will unfortunately result in the loss of 190 jobs, according to sources.

Wesfarmers assures customers that any unused Catch vouchers will be refunded once the website ceases operations.

While Catch.com.au is closing its doors, Optus, which partnered with Wesfarmers to offer telco deals, plans to continue operating its dedicated deals platform, ensuring existing customers’ contracts remain unaffected.

Australia’s Richest Person Attends Trump’s Inauguration Events

The world is witnessing a flurry of activity as prominent figures from various industries flock to President Trump’s inauguration events.Among them is Gina rinehart, Australia’s wealthiest individual and a prominent figure in the mining sector.

The ABC has confirmed Rinehart’s presence at multiple inauguration gatherings, including the highly anticipated Liberty Ball. This event, currently underway, serves as a platform for prominent individuals to celebrate and connect during this historic occasion.

Shifting Tides: How Corporations are Aligning with a New Political Landscape

Even before Donald Trump took office, a surprising shift began to ripple through the corporate world. Some of America’s most influential companies, seemingly in anticipation of the new administration, started aligning their stances with Trump’s views. This wasn’t a silent acquiescence; it was a calculated realignment with a new political reality, a dance now playing out across the globe.

Insights from business commentator Ian Verrender reveal the depth of this transformation.

“it’s just a jump to the left … and then a step to the right.”

under the Trump administration,stances on issues like diversity,workplace inclusion,and climate change,once widely condemned by corporate America,were met with a surprising lack of resistance. Major American companies, instead of launching into a vocal protest, pivoted their approaches, a move that’s already making waves in Australia.

Macquarie Cuts Fixed Mortgage Rates Ahead of RBA Meeting

australia’s fifth-largest bank, Macquarie, has made a significant move by slashing rates on its one- to three-year fixed-term home loans. This strategic decision comes just four weeks before the Reserve Bank of Australia’s crucial meeting in February,setting the stage for potential ripple effects throughout the mortgage market.

According to home loan tracking website Canstar, Macquarie’s reduced rates bring its two-year fixed rate to a mere 0.06 percentage points above the lowest rate currently offered in the Canstar database. The bank’s one-year fixed rate is only 0.10 percentage points shy of the lowest in the database.

“Today’s cuts from Macquarie Bank bring its 2-year fixed rate at 5.55% to within just 0.06 percentage points of the lowest 2-year rate in the Canstar database, at 5.49% and 0.10 percentage points shy of the lowest 1-year fixed rate in the database.

The move comes exactly four weeks ahead of the Reserve Bank of Australia’s next cash rate decision, scheduled for February 18, and could spark further competition in the fixed rate market.

This proactive move by Macquarie raises anticipation for potential rate adjustments by the RBA.While some economists predict a rate cut at the upcoming meeting, others believe the board might hold off until May. currently, the cash rate stands at 4.35 percent, its highest point in over a decade.

Self-reliant Senator Calls for Aldi to open in Tasmania

Tasmanian residents are hoping a new petition will finally bring the popular German supermarket chain, Aldi, to their shores.

Independent Senator Tammy Tyrrell has launched a petition addressed to Aldi, aiming to address the lack of supermarket competition in Tasmania. Residents have long expressed frustration over the dominance of Coles and Woolies, calling for more affordable and diverse options.

Senator Tyrrell’s petition comes just as the Australian Competition and Consumer Commission (ACCC) is finalizing a report on supermarket competition in Australia. this report, expected by February, will likely shed light on the challenges faced by consumers and the need for greater choice in the market.

Aldi has previously dismissed calls to open stores in Tasmania and the Northern Territory, citing logistical challenges and the feasibility of their central distribution model in these remote regions. However, the increasing public pressure and the ACCC’s ongoing inquiry may force the company to reconsider its stance.

Trump’s tariff Threat Sends US Dollar Soaring

Donald Trump reignited concerns about trade tensions on Tuesday, asserting his intention to impose 25% tariffs on goods coming from Canada and Mexico. Adding fuel to the fire, he hinted that February could mark the beginning of these new import taxes.

The market reacted swiftly to this news, with the US dollar experiencing a notable surge, particularly against the Canadian and Mexican currencies.

While specific details about the proposed tariffs remain unclear, Trump’s pronouncements have undoubtedly created a wave of uncertainty within the global economic landscape.Investors and businesses are anxiously awaiting further clarification on the potential scope and timeline of these tariffs, as their implementation could have significant ramifications for cross-border trade and financial markets.

Trump Town 2.0: Volatility Reigns Supreme

The ASX kicked off the day with a sense of optimism, but that quickly dissipated, leaving investors scrambling to understand the sudden downturn.Comments on social media reflected the widespread unease:

“What’s just happened on the ASX??”

– David

“Share market seems to have taken a sudden down turn, anything we should be aware of?

”

– Laika

By early afternoon, the market was noticeably subdued, with a clear shift in sentiment. A sharp decline in key indices underscored the day’s volatility.

As the day wears on, investors will be looking for answers. The sudden shift in the market suggests underlying forces at play, and understanding those forces is crucial for navigating the turbulent waters ahead.

ASX Loses Momentum as US Futures Tumble on Tariff Fears

the Australian share market is experiencing a slowdown today, mirroring a decline in US futures sparked by renewed trade tensions.

President Donald Trump’s recent statements, reaffirming his intention to impose tariffs on Canada and Mexico, have sent shockwaves through global markets.

“We are thinking in terms of 25% [tariffs] on mexico and Canada,” Trump declared, causing a sharp drop in the Canadian dollar and the Mexican peso against the US dollar.

This escalation in trade tensions follows reports that tariffs might have been delayed, leading to a brief period of optimism for the US greenback.However, Trump’s resolute stance quickly reversed the trend, pushing the US dollar higher and dragging down Wall Street futures.

adding fuel to the fire, Trump boldly stated, “Tariffs are going to make us rich as hell,” further solidifying his commitment to protectionist policies.

Market Volatility: Trump’s Tariff Threat Shakes Global Investors

The Australian Share Market, while still in positive territory, has shown signs of wavering. The ASX 200, after touching new highs earlier, is currently only 0.3 percent higher.

This dip coincides with escalating trade tensions fueled by President Donald Trump’s latest pronouncements on tariffs. as reported by Reuters, Trump stated, “US President Donald Trump said he was thinking of imposing 25% tariffs on imports from Canada and Mexico because they were allowing many people to cross the border and also fentanyl.”

Adding to the unease, the President hinted at a potential February 1st implementation date for these tariffs. Trump further disclosed that he had engaged in a conversation with Canadian Prime minister Justin Trudeau on Monday regarding the matter.

“He said the action could come on Feb. 1.

He said he had spoken on Monday with Canadian Prime Minister Justin Trudeau.

These developments have reverberated across global markets, with nasdaq and S&P 500 futures experiencing significant declines. This downward movement suggests a potential for a sharp drop in Wall Street when trading resumes overnight.

The uncertainty surrounding potential tariffs has sparked anxiety among investors, highlighting the critical role that trade relations play in shaping global economic stability. The coming week will undoubtedly be a period of heightened scrutiny as markets grapple with the implications of Trump’s actions.

What factors contributed to the ASX’s sudden downturn following Trump’s tariff declaration?

It seems like there was an issue with the formatting and some parts of the text are missing. Here’s the restored version:

Trump’s Tariff Threat Sends US Dollar Soaring

Donald Trump reignited concerns about trade tensions on tuesday, asserting his intention to impose 25% tariffs on goods coming from Canada and Mexico. Adding fuel to the fire, he hinted that February could mark the beginning of these new import taxes.

The market reacted swiftly to this news, with the US dollar experiencing a notable surge, particularly against the Canadian and Mexican currencies.

While specific details about the proposed tariffs remain unclear,Trump’s pronouncements have undoubtedly created a wave of uncertainty within the global economic landscape. Investors and businesses are anxiously awaiting further clarification on the potential scope and timeline of these tariffs, as their implementation could have critically important ramifications for cross-border trade and financial markets.

Trump Town 2.0: Volatility Reigns Supreme

the ASX kicked off the day with a sense of optimism, but that quickly dissipated, leaving investors scrambling to understand the sudden downturn. Comments on social media reflected the widespread unease:

markdown

"What's just happened on the ASX??"

- David

"Share market seems to have taken a sudden down turn, anything we should be aware of?"

- Laika

By early afternoon, the market was noticeably subdued, with a clear shift in sentiment. A sharp decline in key indices underscored the day’s volatility.