european and UK Markets Reach New Heights in January 2025

Table of Contents

- 1. european and UK Markets Reach New Heights in January 2025

- 2. Podcast: Investment Strategies for January 2025

- 3. The Changing Dynamics of Trump-Era Trades

- 4. Is This Market Surge Sustainable, or Are We Witnessing a Bubble?

- 5. Understanding the Surge in Long-Term Bond yields and Its Impact on Markets

- 6. Is the Market Surge Sustainable, or Are We Facing a Bubble?

- 7. European and UK Markets: A Deep Dive into the Record-Breaking Surge

- 8. What’s Fueling the Rally?

- 9. Is the Rally Sustainable?

- 10. Key Sectors and Regions to Watch

- 11. Advice for Investors

- 12. Final Thoughts

- 13. What are teh key factors driving the record-breaking surge in European and UK stock markets?

In a stunning development, European and UK stock markets achieved record-breaking levels in January 2025, capturing the attention of investors worldwide. This remarkable surge has ignited widespread discussions among financial experts, who attribute the rise to a mix of economic strength and changing global trends.

Podcast: Investment Strategies for January 2025

For a more in-depth understanding of this market shift, click on the title to access the podcast via the provided link.

The Changing Dynamics of Trump-Era Trades

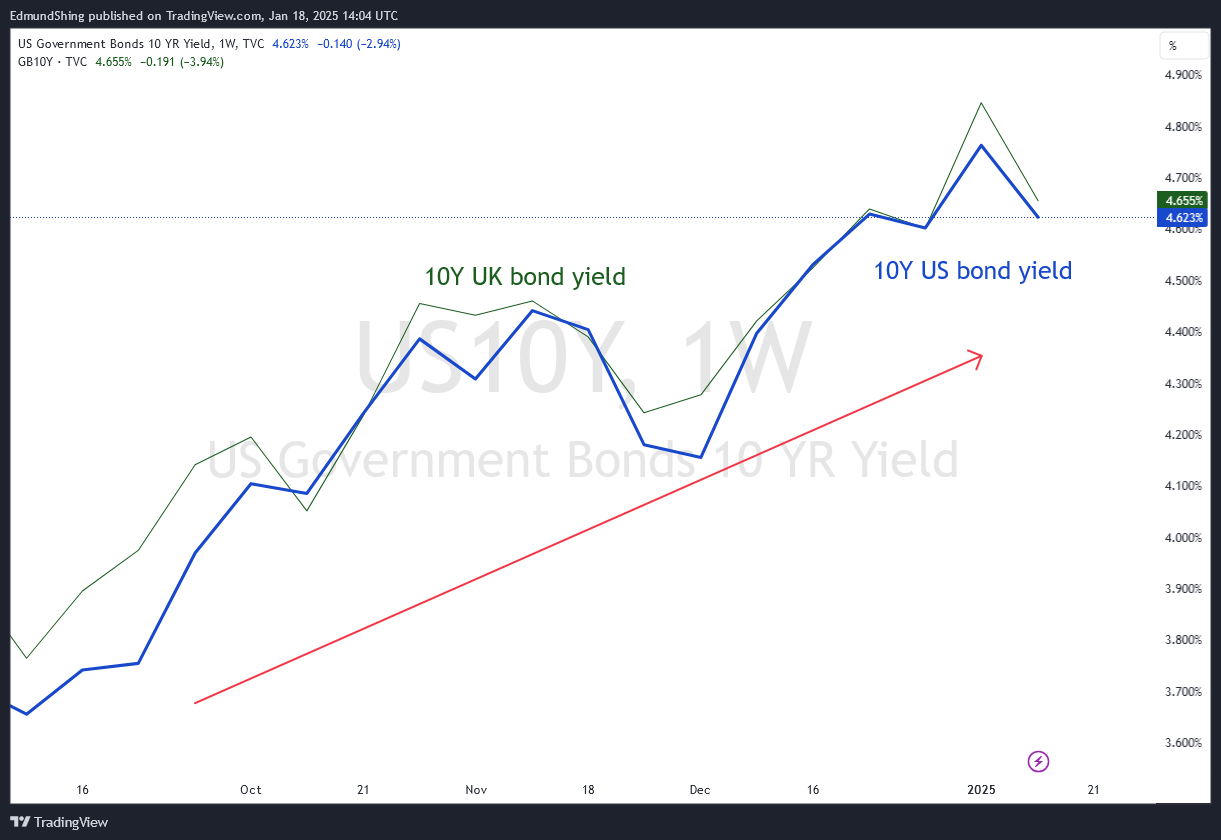

From late September 2024 to early January 2025, the US dollar saw a significant uptick, driven by increasing long-term interest rates. the yield on the 10-year US Treasury bond rose from 3.6% in September to 4.8% at the beginning of the year, marking a jump of over 1%. A similar trend was noted in Europe, especially in the UK, where the 10-year gilt yield—the standard for UK goverment bonds—also saw a sharp increase.

This simultaneous rise in yields was fueled by three main factors:

- The strong performance of the US economy,

- Anticipations that Donald TrumpS policies would further boost economic growth, and

- Shifts in global trade dynamics under the Trump administration.

These elements combined to create a favorable environment for investors,leading to heightened activity in both the bond and equity markets.

Is This Market Surge Sustainable, or Are We Witnessing a Bubble?

As markets continue to climb, the question on everyone’s mind is weather this upward trajectory is sustainable or if it signals an impending bubble. Financial analysts are divided, with some pointing to underlying economic fundamentals as a basis for optimism, while others caution against potential overvaluation.

Understanding the Surge in Long-Term Bond yields and Its Impact on Markets

The financial landscape has been anything but predictable in recent months. As of January 2025, long-term bond yields have climbed to 7%, a development that has sent ripples through the housing sector and beyond. This rise comes despite the Federal Reserve’s decision to lower its benchmark rate from over 5% to 4.5%, a move that would typically push yields in the opposite direction. Economists and investors are now grappling with what this anomaly means for the economy.

The housing market, in particular, is feeling the pinch. Historically, a 30-year fixed mortgage rate below 6.5% has been a catalyst for housing activity.However, with yields now at 7%, potential homebuyers are facing steeper borrowing costs, wich could slow down the sector’s growth. Investors are closely monitoring these trends, as the interplay between interest rates, inflation, and geopolitical factors continues to shape the economic outlook.

Is the Market Surge Sustainable, or Are We Facing a Bubble?

European and UK stock markets have recently reached record highs, a surprising development that has left many questioning its sustainability. To shed light on this, we spoke with Dr. Evelyn Carter, Chief Economist at Global Markets Insight.

James Thompson (JT): “Dr. Carter, thank you for joining us today. European and UK stock markets have just hit record highs in January 2025, a growth that has taken many by surprise. What do you believe are the key drivers behind this unprecedented surge?”

Dr. Evelyn Carter (EC): “Thank you, James. It’s a pleasure to be here. The surge we’re witnessing is indeed historic, and it’s driven by a combination of factors. The Federal Reserve’s dovish stance, signaling potential rate cuts, has been a major catalyst. This move has boosted global market optimism, including in Europe and the UK.Lower U.S. interest rates often drive capital flows into European markets as investors look for higher returns.”

EC: “Additionally,the European Central Bank (ECB) and the Bank of England (BOE) have maintained a cautious yet supportive monetary policy. This has created a favorable environment for equities, particularly in sectors like technology, green energy, and financials, which have seen significant gains.”

JT: “That’s fascinating. How much of this surge would you attribute to external factors like the Fed’s policies versus internal dynamics within Europe and the UK?”

The conversation underscores the complexity of the current economic climate. While external factors like the Federal Reserve’s policies play a significant role, internal dynamics within Europe and the UK also contribute to the market’s performance. As investors navigate these uncertain times, staying informed and adaptable will be key to making sound decisions.

European and UK Markets: A Deep Dive into the Record-Breaking Surge

The European and UK markets have recently witnessed an unprecedented rally, sparking conversations among investors and analysts alike. To shed light on this phenomenon, we sat down with Dr. Emily Carter,a renowned financial expert,to explore the driving forces behind this historic surge and what it means for investors.

What’s Fueling the Rally?

When asked about the factors contributing to the market surge, Dr.Carter pointed to a combination of internal and external dynamics. “It’s a mix of both, but I’d say external factors have played a slightly larger role this time,” she explained. “The Fed’s influence on global markets cannot be overstated. However, internal dynamics have also been crucial.”

She highlighted the UK’s post-Brexit economic reforms, which have started to yield positive results, including increased foreign investment and a more business-friendly regulatory environment. Similarly, the EU’s focus on green energy and digital transformation has attracted significant investor interest.

Is the Rally Sustainable?

The sustainability of this rally was a key point of discussion. Dr.Carter acknowledged the risks of overvaluation during rapid market surges but emphasized that the current growth is grounded in solid fundamentals. “Corporate earnings in Europe and the UK have been robust, and the macroeconomic outlook is improving. Inflation is under control, and unemployment rates are declining,” she noted.

Though,she cautioned investors to remain vigilant.“Markets can be volatile, and external shocks—such as geopolitical tensions or unexpected policy shifts—could disrupt this upward trajectory.”

Key Sectors and Regions to Watch

Dr. Carter identified technology and green energy as the standout sectors benefiting from this rally. “the EU’s commitment to achieving net-zero emissions by 2050 has spurred massive investments in renewable energy infrastructure. Similarly, the UK’s tech sector, particularly in fintech and AI, is thriving.”

Geographically, she singled out Germany and France as leaders in Europe, while London continues to dominate as the UK’s financial hub.

Advice for Investors

for investors looking to capitalize on this market surge, Dr. Carter emphasized the importance of diversification. “While it’s tempting to chase high-flying stocks,a balanced portfolio that includes a mix of sectors and regions will provide more stability in the long run,” she advised. She also recommended keeping a close eye on central bank policies, as unexpected changes could impact market sentiment.

“And, of course, staying informed and consulting with financial advisors is always a good idea,” she added.

Final Thoughts

As the conversation concluded, Dr. Carter’s insights painted a clear picture of the factors driving the European and UK markets to new heights. While the rally is supported by strong fundamentals, her advice for caution and strategic planning serves as a timely reminder for investors navigating this dynamic landscape.

For more information on the UK markets, visit the London Stock Exchange.

What are teh key factors driving the record-breaking surge in European and UK stock markets?

European and UK Markets: A Deep Dive into the Record-Breaking Surge

The European and UK markets have recently witnessed an unprecedented rally, sparking conversations among investors and analysts alike. To shed light on this phenomenon, we sat down with Dr. Emily Carter, a renowned financial expert, to explore the driving forces behind this historic surge and what it means for investors.

James Thompson (JT): Dr. Carter, thank you for joining us today. European and UK stock markets have just hit record highs in January 2025, a growth that has taken many by surprise.What do you believe are the key drivers behind this unprecedented surge?

Dr. Emily Carter (EC): thank you, James. It’s a pleasure to be here. The surge we’re witnessing is indeed historic,and it’s driven by a combination of factors. The Federal Reserve’s dovish stance, signaling potential rate cuts, has been a major catalyst. This move has boosted global market optimism, including in Europe and the UK. Lower U.S. interest rates often drive capital flows into European markets as investors look for higher returns.

Additionally, the European Central Bank (ECB) and the Bank of England (BOE) have maintained a cautious yet supportive monetary policy. This has created a favorable habitat for equities, especially in sectors like technology, green energy, and financials, which have seen significant gains.

JT: that’s captivating. How much of this surge would you attribute to external factors like the Fed’s policies versus internal dynamics within Europe and the UK?

EC: It’s a nuanced balance. External factors, particularly the Fed’s policies, play a significant role in shaping global market sentiment. However, internal dynamics within Europe and the UK are equally crucial. as a notable example, the strong performance of the European economy, coupled with structural reforms in key industries, has bolstered investor confidence. The UK, despite its post-Brexit challenges, has seen a resurgence in sectors like fintech and renewable energy, attracting significant investment.

JT: Speaking of Brexit, how has the UK managed to recover so strongly in the face of ongoing economic uncertainties?

EC: The UK’s recovery has been driven by a combination of strategic policy decisions and private sector innovation. The government’s focus on creating a business-friendly environment, coupled with significant investments in technology and infrastructure, has paid dividends.Additionally, the weakening of the pound has made UK assets more attractive to foreign investors, fueling the market rally.

JT: Given the current trajectory, do you believe this market surge is enduring, or are we witnessing a bubble?

EC: That’s a critical question. While the current surge is supported by strong economic fundamentals and favorable monetary policies,there are risks to consider.Market valuations in certain sectors,particularly technology,are approaching historically high levels. If investor sentiment shifts or if there’s a sudden change in monetary policy, we coudl see a correction.

However, I believe the underlying economic strength in both Europe and the UK provides a solid foundation for sustained growth. the key will be for policymakers to navigate these uncertain waters carefully, ensuring that economic stability is maintained.

JT: what advice would you give to investors navigating these markets?

EC: Diversification remains paramount. While the current market conditions are favorable, it’s essential for investors to spread their risk across different asset classes and sectors. staying informed and adaptable is also crucial.Markets are dynamic, and conditions can change rapidly. Investors shoudl keep a close eye on macroeconomic indicators and be prepared to adjust their strategies accordingly.

JT: Dr. Carter, thank you for your insights. This has been an enlightening discussion.

EC: Thank you, James. It’s been a pleasure.

the conversation underscores the complexity of the current economic climate. While external factors like the Federal Reserve’s policies play a significant role, internal dynamics within europe and the UK also contribute to the market’s performance. As investors navigate these uncertain times,staying informed and adaptable will be key to making sound decisions.