Europe’s 5G Standalone Rollout trails Behind Global Leaders, GSMA Report Reveals

Europe’s journey toward 5G dominance is progressing, but not without hurdles. According to a recent GSMA report,only about 15% of European operators with active 5G networks had launched 5G Standalone (5G SA) by the end of Q3 2024. this figure pales in comparison to regions like North America and Asia Pacific, where over 30% of operators have already embraced 5G SA technology.

The GSMA highlighted the challenges European operators face, stating, “This is indicative of the difficult operating conditions facing European operators.” While recent launches by EE in the UK and Free in France signal momentum, the pace of 5G SA deployments remains slower than industry expectations. “The speed of rollouts remains slower than many industry players anticipated a few years ago,” the report noted.

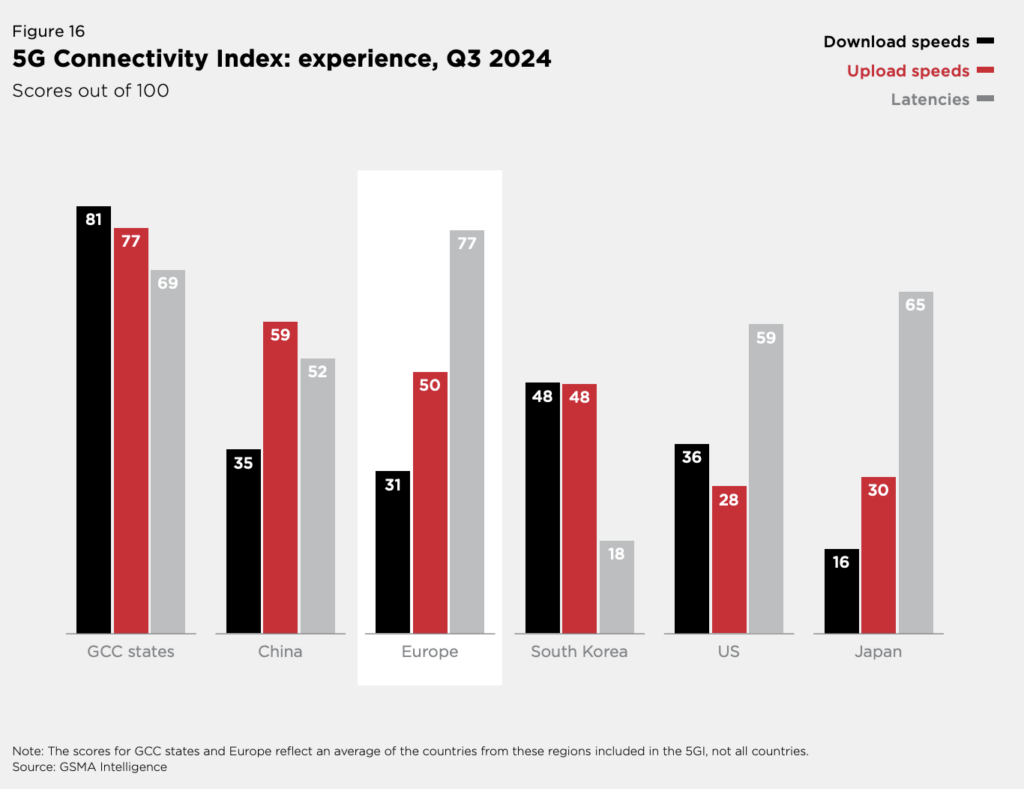

When it comes to 5G performance, Europe also lags behind. By the end of 2023, the region’s average 5G download speeds reached approximately 230 Mbps—a significant leap from the 44 Mbps of 4G.Though, this still trails behind the Gulf Cooperation Council (GCC) states and developed Asia Pacific markets, wich continue to set the benchmark for 5G speeds.

despite these challenges, 5G adoption in Europe is growing. By the close of 2023, 5G accounted for 30% of mobile connections across the continent, equating to 200 million connections. Countries like Denmark, Finland, Germany, Norway, Switzerland, and the UK are leading the charge, each boasting a 5G adoption rate exceeding 40%.

As the global race for 5G supremacy intensifies, Europe’s slower rollout of 5G SA and its lagging download speeds underscore the need for accelerated investment and innovation. While the continent has made strides, catching up to global leaders will require a concerted effort from operators, regulators, and policymakers alike.

The Future of Connectivity: 5G, IoT, and AI in Europe

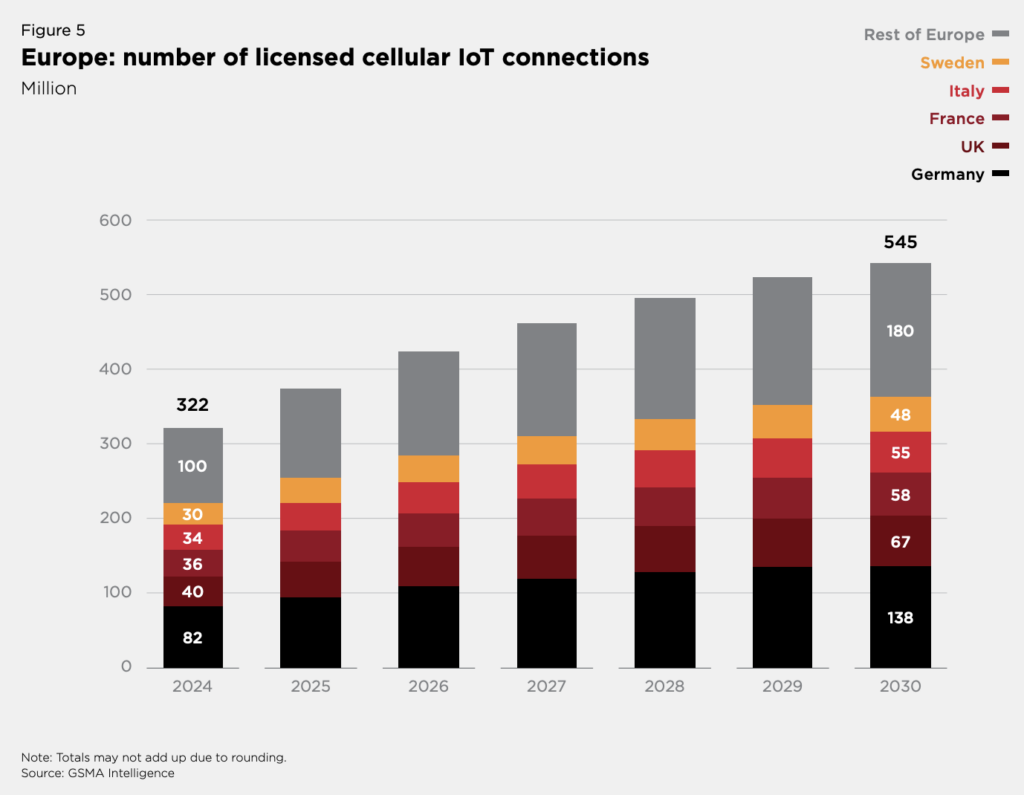

Europe is on the brink of a technological revolution, with 5G, IoT, and AI leading the charge. According to the GSMA, nearly 550 million licensed cellular IoT connections are expected across Europe by 2030.Germany is set to dominate, accounting for about 25% of these connections, while the UK, France, Italy, and sweden will each contribute around 10%. This surge in IoT adoption is a testament to the regionS commitment to innovation and digital change.

Artificial intelligence is also playing a pivotal role in shaping Europe’s tech landscape. Major telecom operators are investing heavily in AI to enhance their services. for instance, Orange has integrated network AI into its operations center, Deutsche Telekom is leveraging AI to bolster security, and EE is using AI to improve network reliability. These advancements highlight the growing synergy between AI and telecommunications, paving the way for smarter, more efficient networks.

Despite some challenges,the outlook for 5G in Europe remains promising. The GSMA predicts that 5G adoption will reach 80% by 2030,contributing an estimated €164 billion ($168.7 billion) to the economy. However, achieving this milestone will require significant policy reforms to ensure that telecom operators can secure the necessary investments for critical network infrastructure. “it can’t be done without policy reform,” the GSMA emphasized, underscoring the importance of regulatory support.

Globally, 5G has already made remarkable strides. In 2024, worldwide 5G connections surpassed 2 billion, a milestone achieved just five years after its introduction. This makes 5G the fastest-growing mobile broadband technology in history, a testament to its transformative potential.

As Europe continues to embrace these technologies, the region is poised to become a global leader in connectivity and innovation. The integration of 5G, IoT, and AI will not only drive economic growth but also enhance the quality of life for millions, creating a smarter, more connected future.

What are the biggest challenges facing Europe’s 5G and IoT deployment?

Interview wiht Dr. Elena Müller,chief Technology Officer at EuroConnect,on Europe’s 5G,IoT,and AI Landscape

By Archyde News Team

archyde: dr. Müller, thank you for joining us today. Europe is often described as being on the brink of a technological revolution, with 5G, IoT, and AI at the forefront. What’s your take on this?

Dr. Elena Müller: Thank you for having me. It’s an exciting time for Europe,but also a critical one. The GSMA’s projections of 550 million licensed cellular IoT connections by 2030 are ambitious, yet achievable. However, the real challenge lies in ensuring that Europe doesn’t just participate in this revolution but leads it. Right now, we’re seeing notable progress, but we’re also lagging behind global leaders in key areas like 5G Standalone (5G SA) deployment.

Archyde: Speaking of 5G SA, the GSMA report highlights that only 15% of European operators have launched 5G SA networks, compared to over 30% in North America and Asia Pacific. Why do you think Europe is trailing behind?

Dr. Müller: there are several factors at play. First,the regulatory environment in Europe is more fragmented compared to regions like North America or Asia Pacific. This creates challenges for operators who need to navigate different rules and standards across countries. Second, the investment required for 5G SA is significant, and many European operators are still grappling with the ROI from thier initial 5G non-standalone (NSA) deployments.there’s a lack of urgency in some markets, partly due to slower consumer adoption rates compared to other regions.

Archyde: The report also mentions that Europe’s average 5G download speeds are around 230 Mbps, which is notable compared to 4G but still behind regions like the GCC and Asia Pacific. What’s holding Europe back in terms of performance?

Dr. Müller: It’s a combination of infrastructure and spectrum availability. In Europe, we’ve been slower to allocate mid-band spectrum, which is crucial for achieving higher speeds and better coverage. Additionally, the density of our urban areas and the cost of deploying infrastructure in rural regions pose unique challenges. While we’ve made strides, we need to accelerate spectrum auctions and streamline permitting processes to catch up.

Archyde: Despite these challenges, 5G adoption in Europe is growing, with countries like Denmark, Finland, and Germany leading the way. What’s driving this growth?

Dr. Müller: It’s a mix of consumer demand and enterprise adoption. In countries like Germany and the UK, industries such as manufacturing, healthcare, and logistics are leveraging 5G to drive efficiency and innovation. For consumers, the appeal of faster speeds and lower latency is undeniable. However, we need to ensure that the benefits of 5G are accessible to all, not just in urban centers but across rural areas as well.

Archyde: Looking ahead, the GSMA predicts that germany will account for 25% of europe’s IoT connections by 2030, with the UK, France, italy, and Sweden each contributing around 10%. What does this mean for Europe’s IoT ecosystem?

Dr. Müller: It’s a promising sign of Europe’s potential, but it also highlights the need for collaboration. Germany’s leadership in IoT is driven by its strong industrial base, particularly in sectors like automotive and manufacturing. Though, for Europe to truly thrive, we need a more integrated approach. This means harmonizing standards, fostering cross-border partnerships, and investing in skills development to ensure that the workforce is ready for this conversion.

Archyde: what steps do you think Europe needs to take to catch up with global leaders in 5G and IoT?

Dr. Müller: First, we need a unified strategy at the EU level to streamline regulations and incentivize investment. Second, we must prioritize spectrum allocation and infrastructure deployment, particularly in underserved areas. Third, collaboration between operators, governments, and industries is crucial to drive innovation and adoption. And we need to focus on education and training to build a workforce that can support this technological shift.

Archyde: Dr. Müller, thank you for your insights. It’s clear that while Europe faces challenges, there’s also immense potential for growth and innovation in the years to come.

Dr.Müller: Thank you. I’m optimistic about Europe’s future, but we must act decisively and collaboratively to seize the opportunities ahead.

end of Interview