“`html

Chainlink (LINK) Price Analysis: A Potential Breakout on the Horizon

Table of Contents

- 1. Chainlink (LINK) Price Analysis: A Potential Breakout on the Horizon

- 2. Technical Indicators Point to a Bullish Breakout

- 3. On-Chain Activity Fuels Optimism

- 4. What’s Next for Chainlink?

- 5. Key Takeaways

- 6. Chainlink’s On-Chain Metrics Signal Growing Momentum and User Engagement

- 7. What This Means for Chainlink’s Future

- 8. Key Takeaways

- 9. Chainlink’s market Dynamics: A bullish Outlook Fueled by Optimism and Growth

- 10. Market Sentiment: A Catalyst for Growth

- 11. Liquidity Metrics: A Strong Foundation

- 12. What’s Next for Chainlink?

- 13. Chainlink Poised for a Breakout: What You need to Know

- 14. Chainlink’s On-Chain Metrics Signal Growing Optimism

- 15. Technical Indicators Suggest a Bullish Reversal

- 16. On-Chain Data Paints a Promising Picture

- 17. What’s Next for Chainlink?

- 18. Key Takeaways

- 19. Chainlink’s On-Chain Metrics Highlight Growing Momentum and User Engagement

- 20. what this Means for Chainlink’s Future

- 21. Key Takeaways

- 22. Chainlink’s Market Momentum: A Bullish Surge Fueled by Optimism and Growth

- 23. Market Sentiment: Fueling the Bullish Trend

- 24. Liquidity Metrics: Building a Strong Foundation

- 25. What’s Next for Chainlink?

- 26. Chainlink Poised for a Breakout: What You need to Know

- 27. What’s Next for Chainlink?

- 28. Chainlink (LINK): A Potential Breakout on the Horizon

- 29. Why Chainlink is Gaining Attention

- 30. Market Sentiment and Technical Indicators

- 31. What Investors Should Consider

- 32. Looking Ahead: Key Levels to Watch

- 33. Key Factors to Evaluate Chainlink’s Market Position

- 34. Understanding Liquidation Trends

- 35. Chainlink’s Bullish Momentum: What Traders Need to Know

- 36. What This Means for Chainlink’s Market Position

- 37. Key Indicators to Monitor

- 38. Navigating the Chainlink Opportunity

- 39. What factors could contribute to Chainlink sustaining its positive price momentum?

- 40. Technical Analysis: Key Patterns and Levels

- 41. Market Sentiment and Investor Confidence

- 42. What Investors Should Watch For

- 43. Looking Ahead: Chainlink’s Future Trajectory

- 44. Conclusion: Chainlink’s Promising Outlook

Table of Contents

- 1. Chainlink (LINK) Price Analysis: A potential Breakout on the Horizon

- 2. Technical Indicators Point to a Bullish Breakout

- 3. On-Chain Activity Fuels Optimism

- 4.What’s Next for Chainlink?

- 5.Key Takeaways

- 6. Chainlink’s On-Chain Metrics Signal Growing Momentum and User Engagement

- 7. What This Means for Chainlink’s Future

- 8.Key Takeaways

- 9. Chainlink’s Market Dynamics: A Bullish Outlook Fueled by Optimism and Growth

- 10.Market Sentiment: A Catalyst for Growth

- 11.Liquidity Metrics: A Strong Foundation

- 12. What’s Next for Chainlink?

- 13. Chainlink poised for a breakout: What You Need to Know

- 14. Why chainlink Stands Out

- 15. Market Sentiment and Technical indicators

- 16. what This Means for Investors

- 17. Looking Ahead

- 18.What Are the Key Factors to consider When Evaluating Chainlink’s (LINK) Market Position?

- 19. Understanding the Liquidation Trends

- 20. Implications for Chainlink’s Market Position

- 21. Key Factors to watch

- 22. Conclusion

As the cryptocurrency market continues to evolve, Chainlink (LINK) has emerged as a standout performer, capturing the attention of traders and analysts alike. With its current price hovering around $20.17, LINK is showing signs of a potential breakout, fueled by a combination of technical indicators and on-chain activity.Could this be the start of a important upward trend?

Technical Indicators Point to a Bullish Breakout

Chainlink’s recent price movements have been accompanied by a series of technical indicators that suggest a bullish trend. The Relative Strength Index (RSI) is hovering in the neutral zone,indicating room for growth without immediate overbought conditions. Additionally, the Moving Average Convergence Divergence (MACD) is showing a positive crossover, a classic signal of upward momentum.

On-Chain Activity Fuels Optimism

On-chain metrics further bolster the case for Chainlink’s potential breakout. The number of active addresses has seen a steady increase, reflecting growing user engagement. Moreover, the network’s liquidity metrics are robust, with a significant uptick in trading volume. This combination of technical and on-chain signals paints a promising picture for LINK’s future.

What’s Next for Chainlink?

Looking ahead, the key question is whether Chainlink can sustain this momentum. Market sentiment remains largely positive, with many analysts pointing to the project’s strong fundamentals and innovative use cases.As the cryptocurrency market continues to mature,Chainlink’s role as a decentralized oracle network positions it well for long-term growth.

Key Takeaways

- Chainlink’s current price of $20.17 is supported by strong technical indicators.

- On-chain metrics indicate growing user engagement and liquidity.

- Market sentiment remains bullish, driven by Chainlink’s innovative use cases.

Chainlink’s On-Chain Metrics Signal Growing Momentum and User Engagement

Chainlink’s on-chain metrics are a testament to its growing momentum. The number of active addresses has increased significantly, reflecting heightened user engagement. Additionally, the network’s liquidity metrics are strong, with a notable rise in trading volume. These factors collectively suggest that Chainlink is well-positioned for future growth.

What This Means for Chainlink’s Future

The combination of technical indicators and on-chain metrics suggests that Chainlink is on the cusp of a significant breakout.As the cryptocurrency market continues to evolve, Chainlink’s role as a decentralized oracle network will likely become increasingly vital. This positions LINK as a strong contender for long-term growth.

Key Takeaways

- Chainlink’s on-chain metrics indicate growing momentum and user engagement.

- The project’s innovative use cases and strong fundamentals support long-term growth.

- Market sentiment remains largely positive, with many analysts bullish on LINK’s future.

Chainlink’s market Dynamics: A bullish Outlook Fueled by Optimism and Growth

Chainlink’s market dynamics are characterized by a bullish outlook, driven by optimism and growth. The project’s innovative use cases and strong fundamentals have garnered significant attention from both traders and analysts. As the cryptocurrency market continues to mature, Chainlink’s role as a decentralized oracle network positions it well for long-term success.

Market Sentiment: A Catalyst for Growth

Market sentiment remains a key catalyst for Chainlink’s growth. The project’s innovative use cases and strong fundamentals have generated significant interest, with many analysts bullish on LINK’s future. As the cryptocurrency market continues to evolve,Chainlink’s role as a decentralized oracle network will likely become increasingly important.

Liquidity Metrics: A Strong Foundation

Chainlink’s liquidity metrics are robust, with a significant uptick in trading volume. This strong foundation supports the project’s potential for future growth. As the cryptocurrency market continues to mature, Chainlink’s role as a decentralized oracle network positions it well for long-term success.

What’s Next for Chainlink?

Looking ahead, the key question is whether Chainlink can sustain this momentum. Market sentiment remains largely positive, with many analysts pointing to the project’s strong fundamentals and innovative use cases. As the cryptocurrency market continues to mature, Chainlink’s role as a decentralized oracle network positions it well for long-term growth.

Chainlink Poised for a Breakout: What You need to Know

<

Chainlink’s On-Chain Metrics Signal Growing Optimism

Chainlink (LINK), one of the most prominent players in the decentralized oracle space, is currently at a pivotal moment. With technical indicators and on-chain data pointing to a potential bullish breakout, the cryptocurrency community is buzzing with anticipation. Could LINK be gearing up for a meaningful rally toward $30? Let’s explore the factors driving this optimism.

Technical Indicators Suggest a Bullish Reversal

Chainlink’s price has been trading within a descending wedge pattern, a technical formation frequently enough associated with bullish reversals. This pattern,marked by lower highs and lower lows,typically signals an impending breakout as prices approach the apex of the wedge. For LINK, the critical resistance level to watch is $23.92. A decisive move above this level could pave the way for a surge toward $30, a milestone that could attract significant market attention.

However, the journey to $30 isn’t without hurdles. If LINK fails to break above the $23.92 resistance, it could face further consolidation, delaying the bullish scenario. The next few days will be crucial in determining whether LINK can gather the momentum needed for a sustained upward move.

On-Chain Data Paints a Promising Picture

Beyond technical analysis, on-chain metrics are fueling optimism for Chainlink. Market sentiment has strengthened as Open Interest—a measure of the total number of outstanding derivative contracts—has risen, indicating growing investor confidence. Additionally, exchange reserves have continued to decline, suggesting that fewer LINK tokens are being held on exchanges. This reduction in supply on trading platforms frequently enough signals reduced selling pressure, which could support a price increase.

As one analyst noted, “LINK’s descending wedge pointed to a bullish breakout, with $23.92 resistance as the critical level.” This sentiment is echoed by many in the crypto community, who believe that LINK’s strong fundamentals and technical setup position it for a potential rally.

What’s Next for Chainlink?

While the technical and on-chain indicators are encouraging, the cryptocurrency market remains inherently volatile.Traders should keep a close eye on the $23.92 resistance level, as a breakout could signal the start of a new bullish phase. On the flip side, a failure to breach this level might lead to extended consolidation or even a pullback.

For long-term investors, Chainlink’s robust ecosystem and growing adoption in decentralized finance (DeFi) applications provide a solid foundation for future growth. As the market continues to mature, LINK’s role as a critical infrastructure provider for smart contracts could further bolster its value proposition.

Key Takeaways

- Critical Resistance: $23.92 is the key level to watch for a potential breakout.

- Bullish Indicators: Rising Open Interest and declining exchange reserves suggest growing optimism.

- Market Momentum: The next few days will be pivotal in determining LINK’s trajectory.

Chainlink’s current setup presents an intriguing opportunity for traders and investors. Whether the cryptocurrency can capitalize on this momentum remains to be seen, but the signs are certainly encouraging. As always, it’s essential to approach the market with caution and conduct thorough research before making any investment decisions.

Chainlink’s On-Chain Metrics Highlight Growing Momentum and User Engagement

Chainlink, the decentralized oracle network, is demonstrating significant growth, with key on-chain metrics revealing a surge in user activity and network engagement. Over the past day, the number of active addresses on the Chainlink network has climbed by 0.86%, signaling a notable increase in user participation. This rise in activity is further underscored by a 0.88% uptick in transaction counts, reflecting heightened demand and utilization of the platform.

These metrics collectively illustrate a vibrant ecosystem that is gaining traction among both users and investors. As Chainlink continues to expand its influence, these indicators play a pivotal role in maintaining momentum and perhaps driving a rally in the near future.

Another significant development is the decline in Chainlink’s exchange reserves, which fell by 0.11%. This reduction suggests that fewer LINK tokens are being held on exchanges, potentially indicating reduced selling pressure. When fewer tokens are available for sale, it can create a favorable supply-demand dynamic, frequently enough leading to upward price movement.

As one analyst noted, “The combination of rising active addresses, increasing transaction counts, and declining exchange reserves underscores the growing interest in chainlink. These factors are essential for sustaining a potential rally.”

what this Means for Chainlink’s Future

The recent data points to a network that is not onyl growing but also maturing. Increased user engagement and transaction activity are positive indicators of a healthy ecosystem, while the reduction in exchange reserves suggests that investors may be holding onto their tokens in anticipation of future gains.

For those closely monitoring the cryptocurrency market, Chainlink’s performance offers a compelling case study in how on-chain metrics can provide valuable insights into a project’s trajectory.As the network continues to evolve, these trends will be critical in shaping its long-term success.

Key Takeaways

- Active addresses on Chainlink increased by 0.86% in the last 24 hours.

- Transaction counts rose by 0.88%, signaling higher network activity.

- Exchange reserves for LINK declined by 0.11%, indicating reduced selling pressure.

- These metrics collectively suggest growing interest and potential for a rally.

Chainlink’s Market Momentum: A Bullish Surge Fueled by Optimism and Growth

Chainlink (LINK) has been capturing attention in the cryptocurrency world, with recent trends signaling a strong upward trajectory. as the digital asset continues to gain traction, its on-chain metrics are painting a promising picture for investors and enthusiasts alike. But what’s driving this momentum,and what does it mean for the future of Chainlink? let’s explore the key factors behind its current success.

Chainlink’s exchange reserve metrics highlight a dynamic market habitat.

Market Sentiment: Fueling the Bullish Trend

One of the primary drivers behind Chainlink’s recent performance is the surge in market optimism. Open interest, a critical measure of market activity, has climbed by 5.42%, reaching an remarkable $7 billion. This increase reflects growing confidence among traders and investors, who are placing their bets on LINK’s potential for significant price appreciation. As market sentiment continues to rise, it acts as a powerful catalyst, driving demand and supporting upward price movements.

Liquidity Metrics: Building a Strong Foundation

Beyond market sentiment,liquidity metrics are playing a crucial role in shaping Chainlink’s outlook. Exchange reserve data reveals a dynamic balance between supply and demand, which is essential for sustaining price growth. However, experts emphasize that maintaining this balance will be key to ensuring long-term success. As one analyst noted, “The market is dynamic, supporting price hikes on the charts. Worth noting,though,that consistent growth in these metrics will be key for a sustained bullish run.”

What’s Next for Chainlink?

As Chainlink continues to evolve, its on-chain metrics and market dynamics will remain critical indicators of its health and potential.For investors, keeping a close eye on these developments is essential for making informed decisions. With a combination of positive sentiment, strong liquidity, and growing market activity, Chainlink is well-positioned to maintain its upward trajectory in the coming months.

In the ever-changing world of cryptocurrency, Chainlink’s recent performance serves as a reminder of the importance of staying informed and understanding the underlying factors driving market trends. Whether you’re a seasoned investor or a curious enthusiast, Chainlink’s journey is one worth watching.

Is your portfolio performing well? Explore the LINK Profit Calculator to assess your gains.

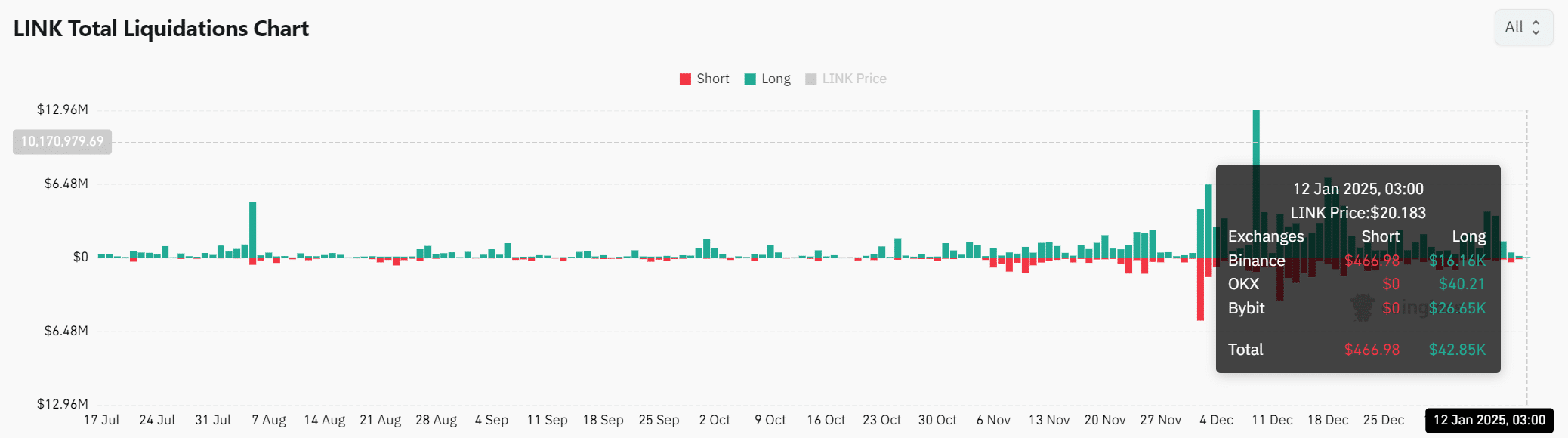

Recent market activity has shown a significant uptick in trading volumes, reaching 24.59 million, signaling heightened participation and confidence among traders. Liquidation data further highlights a notable trend: short positions have been liquidated at higher volumes compared to long positions. This pattern suggests a prevailing bullish sentiment among market participants, as traders appear to be betting on upward price movements.

For those looking to dive deeper into market trends and predictions, consider checking out the Chainlink Price Prediction for insights into potential future movements.

Chainlink Poised for a Breakout: What You need to Know

What’s Next for Chainlink?

While the current trends are encouraging, the road ahead for Chainlink will depend on several factors.Continued growth in open interest, coupled with stable liquidity metrics, will be essential for sustaining the asset’s upward trajectory. Additionally, broader market conditions and investor sentiment will play a significant role in determining LINK’s future performance.

For now, Chainlink’s market dynamics suggest a promising outlook, with bullish indicators pointing toward potential gains. As always, investors are advised to conduct thorough research and stay informed about market developments to make well-informed decisions.

Chainlink (LINK): A Potential Breakout on the Horizon

Chainlink (LINK) is currently in the spotlight, with analysts and investors closely monitoring its price action. A combination of a bullish technical pattern, rising on-chain activity, and optimistic market sentiment has positioned LINK as a potential breakout candidate. The $23.92 resistance level is the key threshold to watch, as a decisive break above it could propel the cryptocurrency toward $30 or higher, making it one of the most promising assets in the crypto market.

Why Chainlink is Gaining Attention

Chainlink has carved out a unique niche in the blockchain ecosystem by bridging the gap between smart contracts and real-world data. Its widespread adoption in decentralized finance (defi) platforms has significantly boosted its utility and on-chain activity. This growing demand, coupled with a favorable technical setup, has created an ideal environment for LINK to potentially surge in value.

“Breaking the $23.92 resistance could unlock a rally to $30 or beyond,” analysts suggest.

Market Sentiment and Technical Indicators

The sentiment surrounding Chainlink is overwhelmingly positive, with many traders and investors anticipating a significant upward move. The bullish wedge pattern, a technical indicator often associated with upward momentum, further reinforces this optimism. If LINK successfully breaches the $23.92 resistance, it could trigger a wave of buying activity, driving the price even higher.

What Investors Should Consider

For those eyeing Chainlink as a potential investment, the current market conditions present an intriguing opportunity. However, as with any cryptocurrency investment, it’s essential to conduct thorough research and weigh the risks. While technical indicators and market sentiment are favorable, the crypto market’s inherent volatility means prices can shift rapidly.

Looking Ahead: Key Levels to Watch

As Chainlink continues to build momentum, the $23.92 resistance level remains the focal point. A successful breakout could mark the beginning of a significant upward trend,solidifying LINK’s position as a standout performer in the crypto space. whether you’re a seasoned investor or new to the market, keeping a close watch on Chainlink’s progress could be a strategic move.

Key Factors to Evaluate Chainlink’s Market Position

When assessing Chainlink’s (LINK) market position, several critical factors come into play. these include its role in the DeFi ecosystem, on-chain activity, technical indicators, and overall market sentiment. Understanding these elements can provide valuable insights into LINK’s potential trajectory.

Understanding Liquidation Trends

Recent liquidation data highlights a clear preference for bullish positions, with short positions being liquidated at higher volumes than long positions. This trend underscores the market’s confidence in chainlink’s upward potential and further supports the case for a breakout.

Chainlink’s Bullish Momentum: What Traders Need to Know

Chainlink (LINK) is making waves in the cryptocurrency market, with traders showing increasing optimism about its price trajectory. As prices rise, a growing number of short positions are being closed, a trend that often fuels upward momentum. This shift reduces selling pressure and encourages more buying activity, creating a positive feedback loop for LINK’s market performance.

What This Means for Chainlink’s Market Position

The current market dynamics for Chainlink are undeniably bullish. Rising trading volumes,increased open interest,and favorable liquidation trends all point to a market that is aligning in favor of LINK. Traders and investors alike are demonstrating confidence in its growth potential. Though,it’s critically important to remember that cryptocurrency markets are notoriously volatile. Sustained growth will depend on maintaining positive sentiment and strong on-chain metrics.

Key Indicators to Monitor

for those keeping an eye on Chainlink, several factors will be critical in determining its future trajectory:

- Open Interest: A steady increase in open interest signals sustained market confidence and the potential for further price appreciation.

- Liquidity Metrics: stable or improving liquidity is essential for maintaining the current bullish momentum.

- Market Sentiment: Positive sentiment, reflected in liquidation trends and trading volumes, will be a driving force behind LINK’s price movements.

- On-Chain Activity: Growth in active addresses and transaction counts will indicate a thriving ecosystem, further bolstering LINK’s value proposition.

Navigating the Chainlink Opportunity

Chainlink’s recent performance paints a promising picture, but investors should remain cautious. While the current indicators are encouraging, the cryptocurrency market is inherently unpredictable. Staying informed and adaptable is crucial for capitalizing on emerging opportunities.

For those looking to dive deeper into chainlink’s potential, tools like the LINK Profit Calculator can offer valuable insights into portfolio performance and potential gains. As the market evolves, staying ahead of the curve will be key to making the most of this dynamic asset.

What factors could contribute to Chainlink sustaining its positive price momentum?

Its ability to sustain positive momentum. As traders continue to bet on LINK’s growth, this bullish sentiment could further fuel its price movements, especially if key resistance levels are breached.

Technical Analysis: Key Patterns and Levels

From a technical standpoint, Chainlink is exhibiting a bullish wedge pattern, which often signals the potential for upward momentum. The $23.92 resistance level is a critical threshold to watch, as breaking this barrier could trigger a surge toward $30 or higher. Analysts suggest that this breakout could mark the beginning of a significant upward trend, positioning LINK as a standout performer in the crypto market.

Market Sentiment and Investor Confidence

the overwhelming positive sentiment surrounding Chainlink is a significant driver of its current momentum. With growing adoption in the DeFi ecosystem and increasing on-chain activity, LINK has solidified its utility and relevance in the blockchain space. Investors and traders are closely monitoring its price action, anticipating a breakout that could lead to substantial gains.

What Investors Should Watch For

For potential investors, the combination of technical indicators, bullish sentiment, and strong liquidity metrics presents an intriguing possibility. However, it’s essential to remain cautious and conduct thorough research, given the inherent volatility of the crypto market. Staying informed about key developments, resistance levels, and broader market conditions will be crucial for making well-informed decisions.

Looking Ahead: Chainlink’s Future Trajectory

Chainlink’s future trajectory will depend on its ability to maintain stable liquidity, sustain on-chain activity, and break critical resistance levels. With the $23.92 level as a focal point, a accomplished breakout could propel LINK toward higher valuations, solidifying its position as a promising asset in the crypto space. Whether you are a seasoned investor or a newcomer, staying vigilant and understanding the underlying factors driving LINK’s market trends will be key to navigating its potential breakout.

Conclusion: Chainlink’s Promising Outlook

Chainlink’s recent performance,characterized by bullish technical patterns,rising on-chain activity,and positive market sentiment,suggests a promising outlook. The cryptocurrency’s unique role in the DeFi ecosystem and its growing adoption have positioned LINK as a potential breakout candidate. As investors and traders continue to monitor its progress, the $23.92 resistance level remains a key threshold to watch. A decisive break above this level could unleash a significant upward trend, making Chainlink one of the most promising assets to watch in the crypto market.