The Yield Curve Steepens Amidst Rate Cuts and Inflation Concerns

Table of Contents

Table of Contents

Understanding the Yield Curve

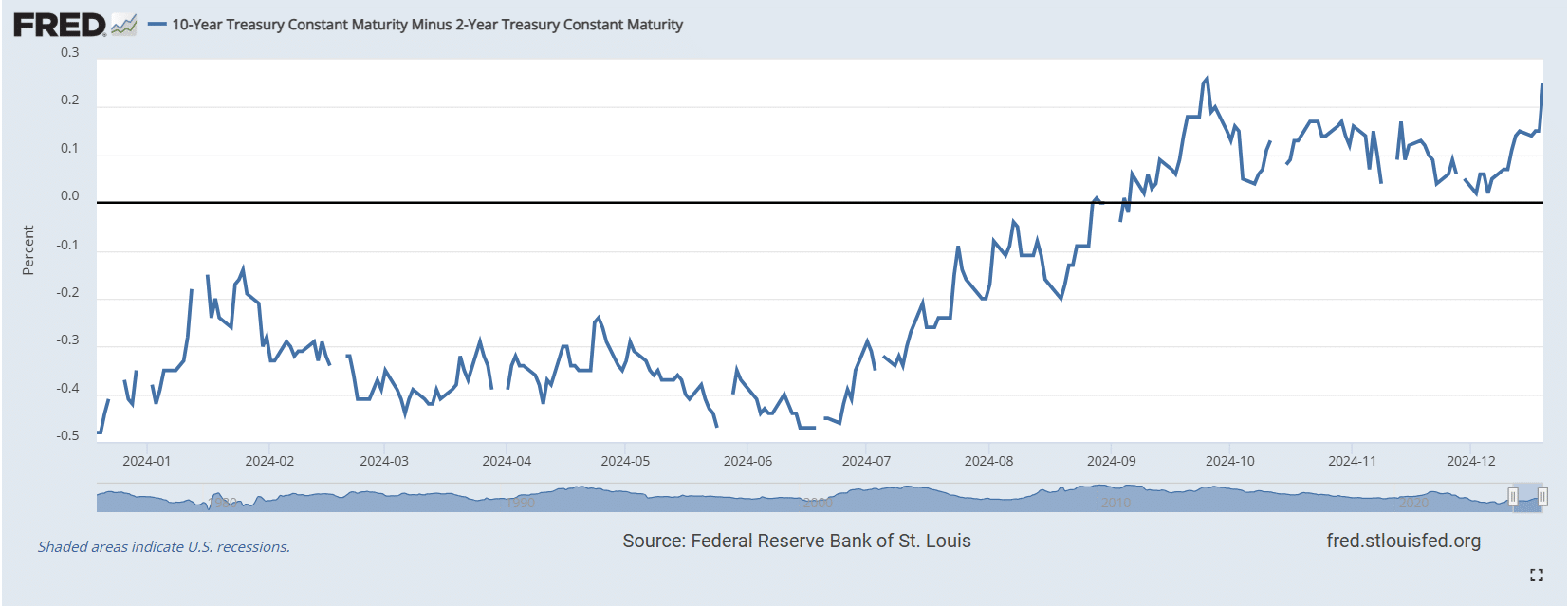

The yield curve typically slopes upwards, with longer-term bonds offering higher yields than shorter-term ones. This reflects the greater risk associated with locking in money for a longer period. However, for over two years, the curve had been inverted, with short-term rates exceeding long-term rates.This inversion was widely seen as a harbinger of an impending recession.Inflation Expectations on the Rise

The recent steepening of the yield curve suggests a change in market expectations. While the rate cuts were intended to stimulate the economy, they may also be fueling concerns about rising inflation. ” “[email protected]” Investors are now demanding higher yields on longer-term bonds to compensate for the potential erosion of their purchasing power due to inflation. This increased demand for long-term bonds has driven up their yields,resulting in a steeper yield curve.Trump’s Fiscal Policy and Trade Tensions

Adding to inflationary pressures are concerns over President trump’s expansionary fiscal policies and his threats to impose tariffs on goods from China, mexico, and canada. These measures could lead to higher import costs and further fuel inflation in the United States. As a result of these inflationary concerns, the market is now anticipating fewer rate cuts in the near future.Impact on Global Markets

The U.S. yield curve’s movements are having ripple effects on global markets. Bond yields in Europe, such as, have risen sharply in recent sessions, and the spread between U.S. and European bond yields has widened. These rising yields are putting pressure on stock markets, which have declined from their recent highs. Higher bond yields can make stocks less appealing to investors, as they offer a more attractive return on a lower-risk investment. If long-term U.S. Treasury yields continue to rise towards 5%, it could pose a significant threat to the stability of global stock markets.Quantitative Easing: A Potential Solution?

to mitigate these risks,the Federal Reserve may consider implementing a new round of quantitative easing (QE),a monetary policy tool designed to lower long-term interest rates. While QE could help to stabilize financial markets, it could also exacerbate inflationary pressures. The central bank faces a delicate balancing act as it seeks to stimulate economic growth while keeping inflation in check [ [1].## A Steeper Curve: Navigating the Paradox of Rate Cuts and Inflation Fears

**Archyde Interview: Dr. Emily Carter,Chief Economist at Veritas Capital**

**introduction:**

The Federal Reserve’s recent decision to reduce interest rates for the third consecutive time has sent ripples throughout financial markets. While lower interest rates typically stimulate economic activity, the yield curve has responded in an unusual way – it has steepened. This seemingly contradictory scenario raises vital questions about the current state of the economy and the effectiveness of monetary policy.

To help us navigate this complex landscape, we’re joined by Dr. Emily Carter, Chief Economist at Veritas Capital, a leading financial advisory firm. Dr. carter, welcome to Archyde.

**Dr. Carter:** Thank you for having me.

**Archyde:** Let’s start with the basics. Can you explain what the yield curve is and why its steepening is causing concern?

**Dr. Carter:** Certainly. The yield curve plots the interest rates of U.S. Treasury securities with different maturities, from short-term bills to long-term bonds.

Typically, a normal yield curve slopes upward, indicating that investors demand higher returns for lending

money for longer periods. However, when the curve steepens, it suggests that investors anticipate stronger economic growth and higher inflation in the future.

**Archyde:** But aren’t rate cuts meant to stimulate the economy and perhaps combat inflation fears?

**Dr. Carter:** Absolutely, that’s the intended effect. Though, the current context is unique. The fed’s rate cuts are primarily aimed at mitigating the potential slowdown caused by ongoing trade tensions and global economic uncertainty.

The market, on the other hand, seems to be expressing concern about the long-term inflationary implications of these rate cuts, particularly if they lead to excessive borrowing and spending.

**Archyde:** So, what are the potential implications of this steeper yield curve?

**Dr. Carter:**

A steeper yield curve can signal several things. First, it may indicate investors’ growing confidence in future economic growth, which could lead to increased investment and hiring.

However, it can also suggest expectations of higher inflation, which could erode purchasing power and potentially lead to tighter monetary policy down the road. The key will be gauging

the Fed’s ability to balance economic stimulation with inflation control.

**Archyde:** What should investors and policymakers be watching for in the coming months?

**Dr. Carter:** Several key indicators will shed light on the direction of the economy and the

effectiveness of the Fed’s policies. These include inflation data, employment figures, consumer spending, and manufacturing activity.

Furthermore, it will be crucial to monitor the global economic environment, especially developments in international trade and geopolitical tensions.

**Archyde:**

Dr. carter, thank you for providing such insightful perspective on this complex economic landscape.

**Dr. Carter:** My pleasure. It’s a challenging time, but understanding these nuances is crucial for navigating the markets and making informed decisions.

**Archyde:** For our viewers, we’ll be following this development closely and bring you further updates as they become available. Stay tuned.

Let’s dive into some interview questions based on the provided text:

**Archyde:** Could you explain, for our audience, what the yield curve is and why its recent steepening is causing concern amongst market observers?

**Dr. Carter:** The yield curve is essentially a graph plotting the interest rates of U.S. Treasury bonds against their maturity dates. typically, bonds with longer maturities have higher yields because investors demand more return for tying up their money for a longer period.

However, recently we’ve seen the yield curve steepen considerably. This means long-term interest rates are rising faster than short-term rates.

this is concerning because it usually signals investors are anticipating higher inflation in the future. They want higher yields on long-term bonds to offset the erosion of their purchasing power caused by rising prices.

**Archyde:** The Fed’s recent rate cuts were intended to stimulate the economy. Why, then, are we seeing this fear of inflation?

**Dr. Carter:** That’s a great question. In essence, the economy is walking a tightrope. While the rate cuts were aimed at boosting economic activity, they also increase the money supply. A flood of cheap money can sometimes lead to inflation if not carefully managed.

adding to those concerns are factors like President Trump’s fiscal policies, which are quite expansionary, meaning they also tend to increase spending and potentially drive up prices. The trade tensions are another wildcard, as tariffs can directly raise the cost of goods and contribute to inflation.

**Archyde:** Looking globally, how is this steepening yield curve affecting markets outside the U.S.?

**Dr. Carter:** The U.S. yield curve is incredibly influential. Its movements reverberate around the world.Countries that peg their currencies to the dollar or are heavily invested in U.S. Treasury bonds are feeling the effects directly.

For example, we’ve seen bond yields rise in Europe in tandem with the U.S. this puts pressure on their economies and can make it more expensive for them to borrow money. Global stock markets, which have already been volatile, could face further turbulence if long-term U.S. Treasury yields continue to climb.

**Archyde:** What potential solutions are being considered to address this situation?

**Dr. Carter:** The Federal Reserve is in a tricky position. They need to find a balance between stimulating growth and keeping inflation under control. One option on the table is a new round of quantitative easing (QE), which involves the Fed buying bonds to inject money into the system and push down long-term interest rates.

However, QE is a powerful tool and using it again could further fuel inflation fears. It’s a delicate balancing act, and the Fed will need to proceed with caution.

**Archyde:** Are there any silver linings in this situation?

**Dr. Carter:** Ultimately, the steepening yield curve is a signal, not a definitive outcome. It’s a warning sign that we need to be vigilant about inflation risks. If the Fed, along with governments worldwide, can take preemptive action and implement sound economic policies, we might potentially be able to avoid the worst-case scenarios.

The hope is that this serves as a catalyst for more thoughtful fiscal and monetary policies that promote sustainable, long-term growth without triggering runaway inflation.

**Archyde:** Dr. Carter, thank you for your insights today. This is a complex and rapidly evolving situation, and your analysis is invaluable.