2024-11-24 15:05:00

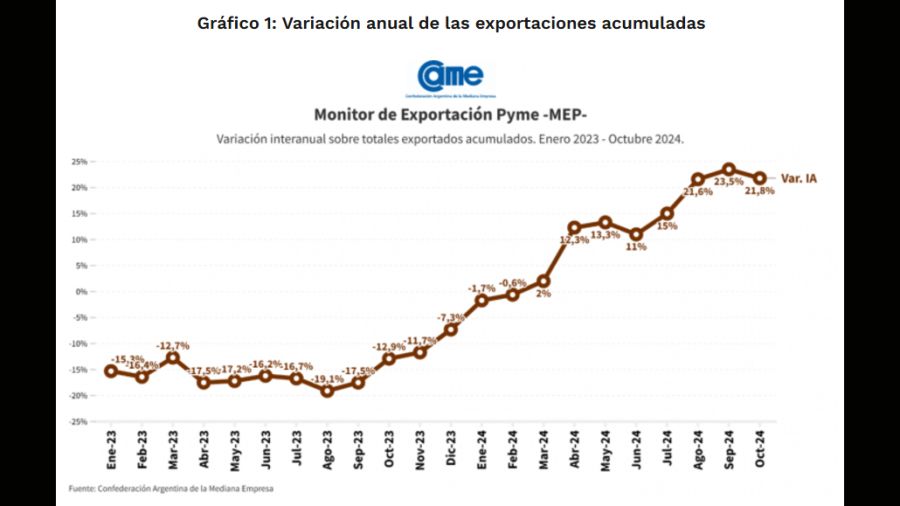

In the first 10 months of 2024, the export volume of small and medium-sized enterprises increased by 30%, and the US dollar increased by 21.8%, reaching US$8.367 billion. This figure accounts for 12.4% Percent of total Argentine exports between January and October 2024.

Based on details provided as usual Argentine Confederation of Medium Enterprises (CAME).the export volume of small and medium-sized enterprises as of the last day of October Reached 7.2 million tonswhich means That’s a 30% increase over the first 10 months of 2023. This huge increase in volume is a real increase in the total exports of SMEs and is the only number in the report published by the Business Center that does not leave a green color. The average price per ton is down 6.3% from last year and will be $1,161 in 2024.

According to CAME data, of the 7,264 companies exporting in the first 10 months of this year, 5,310 were small and medium-sized enterprises; This means that 73.1% of operators selling overseas are small and medium-sized enterprises.

Dictators don’t like this

The practice of professional and critical journalism is a fundamental pillar of democracy. That’s why it bothers those who think they have the truth.

same, SME Export Monitoring (MEP) When breaking down the analysis, he pointed out that in the first 10 months of this year, 4 of the 16 industries analyzed experienced declines. The tobacco and derivatives sector was the sector with the largest decline (-35.3%).

On the other hand, CAME revealed The largest improvement in dollar terms was miscellaneous manufacturing (+1,411.7%)at the same time tonThe largest increase occurred in Oil and fuels (+206.9%). The largest shrinkage also occurred in tobacco and its derivatives (-33.2%).

The main sectors for SME exports in the country are unprocessed food, represents Accounting for 50.1% of the total. In this regard, CAME said, “While the growth in volume is encouraging data, It can be inferred that the added value of exports will decrease as more value can be captured in the supply chain by locally produced or industrialized products.

The second most produced product is processed food (20.5%), followed by chemicals (9.2%).

At the same time, CAME pointed out that “if the complex SME exporters are broken down into their tariff status, it can be seen that the main export products are direct container fresh pears with a net content greater than 2.5 kilograms and less than or equal to 20 kilograms (0808.30. 00.920 Y), accounting for 2.7% of total SME exports, followed by squid, shrimp, soybeans and peanuts, all of which are not processed or industrialized.

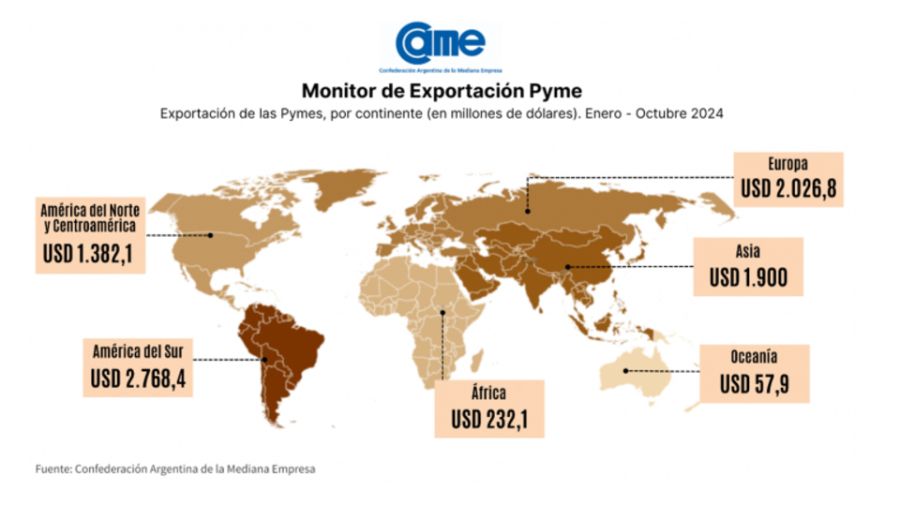

The main destination of 33.1% ($2.7684 billion) of Argentina’s SME exports is South Americastand out brazil and chile As a major partner ($1.752 billion). The second most relevant continent for local SMEs is Europa (24.2%), of which Netherlands, Spain and Italy They are the main trading partners ($931.1 million).

In this regard, the survey shows that of the more than 198 possible export destinations for Argentine SMEs, More than 79% of the business ($6,610.9 million) is concentrated in 20 countries.

Not applicable/HB

1732461270

#Small #mediumsized #enterprises #Exports #grow #strongly #ton #prices #fall #slightly

What factors have contributed to the 30% increase in export volume for SMEs in Argentina in 2024?

**Interview with Juan Torres, Economist at the Argentine Confederation of Medium Enterprises (CAME)**

**Interviewer:** Thank you for joining us today, Juan. Let’s dive right into the recent export data for small and medium-sized enterprises (SMEs) in Argentina. The report indicates a remarkable 30% increase in export volume. What do you attribute this growth to?

**Juan Torres:** Thank you for having me. The 30% increase in export volume that we’ve observed over the first ten months of 2024 can largely be attributed to a combination of favorable exchange rates and a robust market demand for high-quality Argentine products. SMEs have been particularly adept at adapting to these market conditions, which has significantly boosted their export capabilities.

**Interviewer:** That’s very insightful. Can you elaborate on the total export figures, particularly how they relate to the overall Argentine export landscape?

**Juan Torres:** Certainly! The export volume from SMEs reached approximately 8.367 billion US dollars, which accounted for 12.4% of Argentina’s total exports during the same period. This shows that SMEs are not just participating but are becoming a key component of our national economy. Notably, 5,310 out of 7,264 exporting companies are SMEs, which highlights their dominance in the export sector—making up about 73.1% of the exporters.

**Interviewer:** Interesting points! However, the report mentions a decline in average prices and certain sectors facing challenges. Can you provide us with more details on that?

**Juan Torres:** Yes, while the volume increase is promising, it’s also essential to highlight that the average price per ton decreased by 6.3%, now standing at $1,161. The tobacco sector, in particular, has faced significant challenges, experiencing a 35.3% decline. Conversely, sectors like miscellaneous manufacturing saw impressive growth in dollar terms, indicating a shift in the types of products that are thriving in the export market.

**Interviewer:** What should we take away from this mixed set of data regarding the future of SME exports in Argentina?

**Juan Torres:** The growth in export volumes is undeniably positive and reflects the resilience of our SMEs. However, it also serves as a call to action for stakeholders to support sectors under pressure, like tobacco, and to explore new export markets for products that are doing well. The overall landscape is evolving, and strategic decisions will be crucial to maintain and build upon this growth trajectory.

**Interviewer:** Thank you, Juan, for your insights into this important topic. It’s clear that while challenges exist, there are also significant opportunities for Argentine SMEs in the global marketplace.

**Juan Torres:** Thank you, it was a pleasure discussing these developments.